Asia-Pacific Plant-Based Protein Market Size (2024-2030)

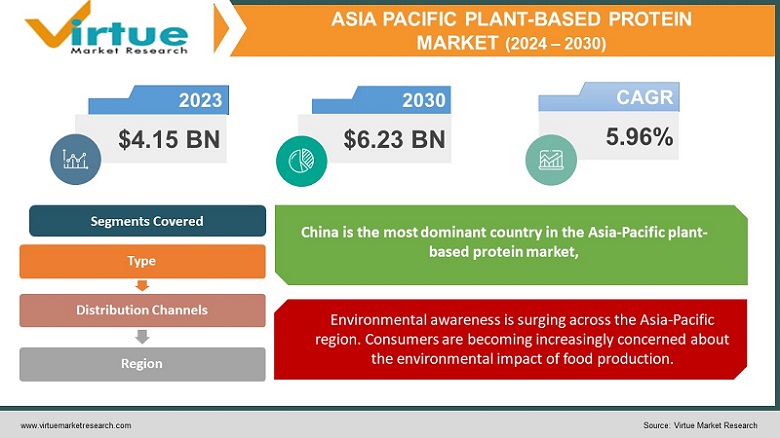

The Asia-Pacific Plant-Based Protein Market was valued at USD 4.15 Billion in 2023 and is projected to reach a market size of USD 6.23 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.96%.

There is a notable increase in demand for plant-based protein substitutes in the Asia-Pacific region. Many factors have combined to feed this trend, which has turned the once-niche business into a vibrant and exciting area. Everywhere in the region, consumers are looking for food options they believe would benefit their health. Since they may reduce cholesterol and saturated fat intake, plant-based proteins are frequently seen as a healthier option to animal-based proteins. In the Asia-Pacific region, environmental consciousness is growing. Concerns over resource consumption and greenhouse gas emissions from animal husbandry are shared by consumers. It's common to think of plant-based proteins as a more sustainable option. The prevalence of lactose intolerance and the rise of veganism further fuel the demand for plant-based protein options. These dietary restrictions create a need for alternative protein sources.

Key Market Insights:

Soy protein remains the dominant ingredient, accounting for an estimated 60.49% value share in 2023.

Pea protein, chickpea protein, and mung bean protein are gaining traction due to their unique functionalities and allergen-friendliness, expected to hold a combined share of over 7%.

Plant-based meat alternatives (burgers, sausages) hold the largest share at 41%, followed by plant-based dairy alternatives (milk, yogurt) at 32%.

Supermarkets and hypermarkets dominate with a 52% share, followed by online retailers with a growing presence at 18%.

The market for plant-based protein powders for athletes and fitness enthusiasts is projected to reach $1.2 billion USD by 2027.

Over 40% of consumers in Asia-Pacific are willing to pay a premium for plant-based protein products perceived as healthier and more sustainable.

Investment in the Asia-Pacific plant-based protein sector is expected to surpass $5 billion USD by 2030.

The number of vegetarians and vegans in the Asia-Pacific region is projected to reach 120 million by 2025, signifying a growing core consumer base for plant-based protein.

An estimated 20% of the population in the region experiences lactose intolerance, creating a demand for plant-based dairy alternatives.

Asia Pacific Plant-Based Protein Market Drivers:

Across the Asia-Pacific region, a significant shift is underway. Consumers are increasingly prioritizing their health and well-being, actively seeking out dietary options perceived as beneficial.

When compared to animal proteins, plant-based protein sources like soy, peas, and lentils are frequently thought to be lower in saturated fat and cholesterol and higher in fiber, vitamins, and minerals. This is exactly what the health-conscious consumer wants—nutritious substitutes. Plant-based proteins satisfy a range of dietary requirements, such as lactose intolerance, veganism, and vegetarianism. The market is expanding due to this larger customer base. Manufacturers are constantly innovating to create plant-based protein products fortified with additional nutrients, such as omega-3 fatty acids and vitamins. This caters to health-conscious consumers seeking complete nutritional profiles in their protein sources. When compared to conventional meat options, some consumers feel that plant-based protein products are blander and less satisfying to the taste. To appeal to consumers who are health-conscious, flavoring and texturizing methods must be continuously innovated.

Environmental awareness is surging across the Asia-Pacific region. Consumers are becoming increasingly concerned about the environmental impact of food production.

Customers actively seek out sustainable food options and are becoming more environmentally conscientious. The production of plant-based proteins typically uses less water and land than animal agriculture, which is in line with consumer demand for more ecologically friendly food options. The release of greenhouse gases is a serious issue. A big part of the problem is animal agriculture, and people are seeking solutions to lessen their environmental impact. Alternatives to meat that come from plants are thought to be a possible remedy. Animal welfare is a problem when it comes to factory farming techniques. Plant-based proteins are a good option for consumers looking to make more ethical dietary choices.

Asia Pacific Plant-Based Protein Market Restraints and Challenges:

A lingering perception exists that plant-based protein products lack the taste and texture of traditional meat options. While advancements in flavoring and texturizing techniques are ongoing, overcoming this perception gap remains crucial for wider adoption. Plant-based protein products can sometimes be perceived as more expensive than their animal-based counterparts. This is particularly concerning in budget-conscious cultures prevalent across the Asia-Pacific region. Manufacturers need to find ways to make these products more accessible without compromising quality. Continued investment in research and development to create plant-based protein products that mimic the sensory experience of meat is essential. This includes replicating textures and developing innovative flavor profiles that cater to regional palates. Regulations regarding labeling and terminology for plant-based protein products are constantly evolving. Manufacturers need to stay updated and compliant with these changes across different countries to avoid disruptions.

Asia Pacific Plant-Based Protein Market Opportunities:

While soy protein dominates the market, exploring alternative sources like pea, mung bean, and chickpea protein caters to growing allergen concerns and offers unique functionalities for product development. Plant-based protein powders and snacks fortified with essential vitamins, minerals, and omega-3 fatty acids cater to health-conscious consumers seeking complete nutrition. Innovation in plant-based dairy alternatives extends beyond milk to explore cheese, yogurt, and butter substitutes, catering to lactose-intolerant consumers and vegans. Continuous research and development efforts are crucial to creating innovative plant-based protein products with improved taste, texture, and functionality. Embracing technologies like 3D printing and fermentation can unlock new possibilities for creating plant-based protein products that mimic the sensory experience of meat. Online grocery platforms and direct-to-consumer sales offer convenient access for consumers and can be particularly effective for niche plant-based protein products. Building robust supply chains that ensure consistent access to high-quality plant-based protein ingredients is vital for meeting growing demand. Developing targeted marketing campaigns that promote the health, environmental, and ethical benefits of plant-based protein can resonate with specific consumer segments.

ASIA PACIFIC PLANT-BASED PROTEIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

5.96% |

||

|

Segments Covered |

By Type, Distribution Channel and Region |

||

|

Various Analyses Covered |

GRegional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Archer Daniels Midland (ADM) , Cargill, Ingredion, Beyond Meat , Oatly , Mengniu Dairy , VOW , Green Monday , Omni Meat, Ingredi , Turtle Tree Labs |

Asia Pacific Plant-Based Protein Market Segmentation:

Asia Pacific Plant-Based Protein Market Segmentation: By Type:

- Plant-Based Meat Alternatives

- Plant-Based Dairy Alternatives

- Plant-Based Protein Powders and Shakes

- Plant-Based Egg Alternatives

Currently, plant-based meat alternatives reign supreme in the Asia-Pacific market, accounting for roughly 55-60% of the total market share. Plant-based meat alternatives offer familiar formats like burgers, sausages, nuggets, and mince. Consumers can easily incorporate them into existing meals, making the transition from animal protein a smooth one. Advancements in flavoring and texturizing techniques are creating plant-based meat alternatives that increasingly resemble their animal-based counterparts in taste and texture, attracting a wider consumer base.

The fastest-growing segment in the Asia-Pacific plant-based protein market is plant-based dairy alternatives, boasting a projected growth rate of over 8%. A significant portion of the Asian population is lactose intolerant, creating a strong demand for plant-based milk, yogurt, and cheese alternatives. The rising number of vegans in the region drives the demand for plant-based dairy products that offer a complete dairy-free experience. Consumers perceive plant-based dairy alternatives as potentially healthier and more environmentally friendly options compared to traditional dairy products. Developing plant-based cheese alternatives that melt and shred like traditional cheese is essential for wider adoption in various culinary applications.

Asia Pacific Plant-Based Protein Market Segmentation: By Distribution Channel:

- Traditional Convenience Stores

- Supermarkets and Hypermarkets

- E-commerce Platforms

- Specialty Stores

- Other Channels

Supermarkets and Hypermarkets (55-60%) are the undisputed king of plant-based protein distribution in the Asia-Pacific region. Their extensive reach, brand recognition, and wider product selections make them a one-stop shop for many consumers. However, shelf space allocation for plant-based products can be limited, hindering brand visibility for smaller players. These retail giants have a widespread presence across urban and even some rural areas, making plant-based protein products accessible to a large consumer base. Additionally, established brand recognition fosters consumer trust and familiarity with specific products. Consumers can find a variety of plant-based protein options alongside other groceries during their regular shopping trips, offering a convenient way to integrate these products into their diets.

E-commerce platforms are witnessing phenomenal growth in the Asia-Pacific region, and the plant-based protein market is no exception. Unlike physical stores, e-commerce platforms offer a much wider selection of plant-based protein products, catering to niche dietary needs and preferences. Consumers can explore options from various brands and regions. Online shopping provides the ultimate convenience, allowing consumers to browse products, compare prices, and have them delivered to their doorstep, saving valuable time. E-commerce platforms are ideal for establishing subscription box services that offer curated selections of plant-based protein products, promoting brand discovery and repeat business.\

Asia Pacific Plant-Based Protein Market Segmentation: Regional Analysis:

- China

- Japan

- South Korea

- India

- Australia & New Zealand

- Rest of Asia-Pacific

China is the most dominant country in the Asia-Pacific plant-based protein market, owing to its vast population, growing demand for sustainable and healthy food options, and thriving plant-based food industry. Chinese cuisine has a rich history of incorporating plant-based ingredients, such as tofu, seitan, and various plant-based meat substitutes, which has contributed to the acceptance and popularity of plant-based protein products. The Chinese government has recognized the importance of developing a sustainable food system and has implemented policies and initiatives to promote plant-based diets and support the growth of the plant-based protein industry. Major Chinese companies, such as Nestle, Unilever, and Cargill, have invested heavily in plant-based protein product development, further driving innovation and increasing the variety of products available in the market.

India is emerging as the fastest-growing country in the Asia-Pacific plant-based protein market, driven by a combination of cultural traditions, health awareness, and economic factors. India has a rich cultural heritage of vegetarianism and plant-based diets, with a significant portion of the population adhering to these dietary practices for religious, cultural, or ethical reasons. With increasing disposable incomes, Indian consumers are more willing to explore and experiment with new food products, including plant-based protein alternatives. The urban population in India is rapidly increasing, and urbanites are more open to trying new food products, contributing to the demand for plant-based protein products. International and domestic companies are investing in the development of plant-based protein products specifically tailored to Indian palates and preferences, further fueling the market's growth.

COVID-19 Impact Analysis on the Asia Pacific Plant-Based Protein Market:

Global supply lines were interrupted by lockdowns and border restrictions, which resulted in a brief shortage of the raw materials and completed goods used in plant-based protein products. Both domestic production and imports were impacted by this. When health and immunity were top priorities, consumers first concentrated on stockpiling staple foods like rice and lentils. As a result, demand for non-essential products like plant-based substitutes temporarily decreased. The demand for the plant-based protein sources normally provided in these places was damaged by the closure of restaurants and cafes as well as a drop in the dine-out culture because of safety concerns. Movement restrictions and a preference for home-cooked meals contributed to a rise in demand for convenient and healthful food options. The focus on health and immunity during the pandemic led some consumers to explore plant-based protein as a potential source of essential nutrients. While the exact science behind this connection is still evolving, it sparked curiosity and willingness to experiment with plant-based options.

Latest Trends/ Developments:

Pea protein is gaining significant traction due to its allergen-friendliness, neutral taste profile (versatile for product development), and high protein content. This makes it ideal for applications beyond meat alternatives, like plant-based dairy substitutes. Mung bean protein is emerging as a promising option, particularly in Southeast Asia, due to its regional familiarity and complete amino acid profile. Its mild flavor and good gelling properties make it suitable for various plant-based products. Chickpea protein is finding its way into plant-based flours, snacks, and even pasta alternatives. Its high fiber content and unique texture add valuable functionalities to product development. Mycoprotein, derived from fungal fermentation, is gaining popularity due to its meat-like texture and potential health benefits. It's being used to create innovative plant-based meat alternatives with a satisfying bite. Precision fermentation, using genetically modified microbes, is on the horizon for producing specific plant-based proteins. This holds promise for replicating the taste and texture of animal proteins with even greater accuracy.

Key Players:

- Archer Daniels Midland (ADM)

- Cargill

- Ingredion

- Beyond Meat

- Oatly

- Mengniu Dairy

- VOW

- Green Monday

- Omni Meat

- Ingredi

- Turtle Tree Labs

Chapter 1. Asia Pacific Plant-Based Protein Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Plant-Based Protein Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Plant-Based Protein Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Plant-Based Protein Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Plant-Based Protein Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Plant-Based Protein Market– By Type

6.1. Introduction/Key Findings

6.2. Plant-Based Meat Alternatives

6.3. Plant-Based Dairy Alternatives

6.4. Plant-Based Protein Powders and Shakes

6.5. Plant-Based Egg Alternatives

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Asia Pacific Plant-Based Protein Market– By Distribution channel

7.1. Introduction/Key Findings

7.2. Traditional Convenience Stores

7.3. Supermarkets and Hypermarkets

7.4. E-commerce Platforms

7.5. Specialty Stores

7.6. Other Channels

7.7. Y-O-Y Growth trend Analysis By Distribution channel

7.8. Absolute $ Opportunity Analysis By Distribution channel, 2024-2030

Chapter 8. Asia Pacific Plant-Based Protein Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Plant-Based Protein Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland (ADM)

9.2. Cargill

9.3. Ingredion

9.4. Beyond Meat

9.5. Oatly

9.6. Mengniu Dairy

9.7. VOW

9.8. Green Monday

9.9. Omni Meat

9.10. Ingredi

9.11. Turtle Tree Labs

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Consumers in the Asia-Pacific region are increasingly health-conscious, seeking out protein sources perceived as healthier alternatives to traditional meat. Plant-based proteins are often viewed as lower in saturated fat and cholesterol, and potentially beneficial for heart health and weight management

The high sugar content in apple juice, even though naturally occurring, raises concerns about its impact on obesity, diabetes, and other health issues. This could lead to stricter regulations or changing consumer preferences towards lower-sugar alternatives

Archer Daniels Midland (ADM), Cargill, Ingredion, Beyond Meat, Oatly

Mengniu Dairy, VOW, Green Monday, Omni Meat, Ingredi, Turtle Tree Labs.

China has firmly established itself as the most dominant player in the Asia-Pacific market, commanding an impressive 40% market share

India emerges as the fastest-growing country in this sector. India's burgeoning population, rising disposable incomes, and rapid urbanization have fueled the demand.