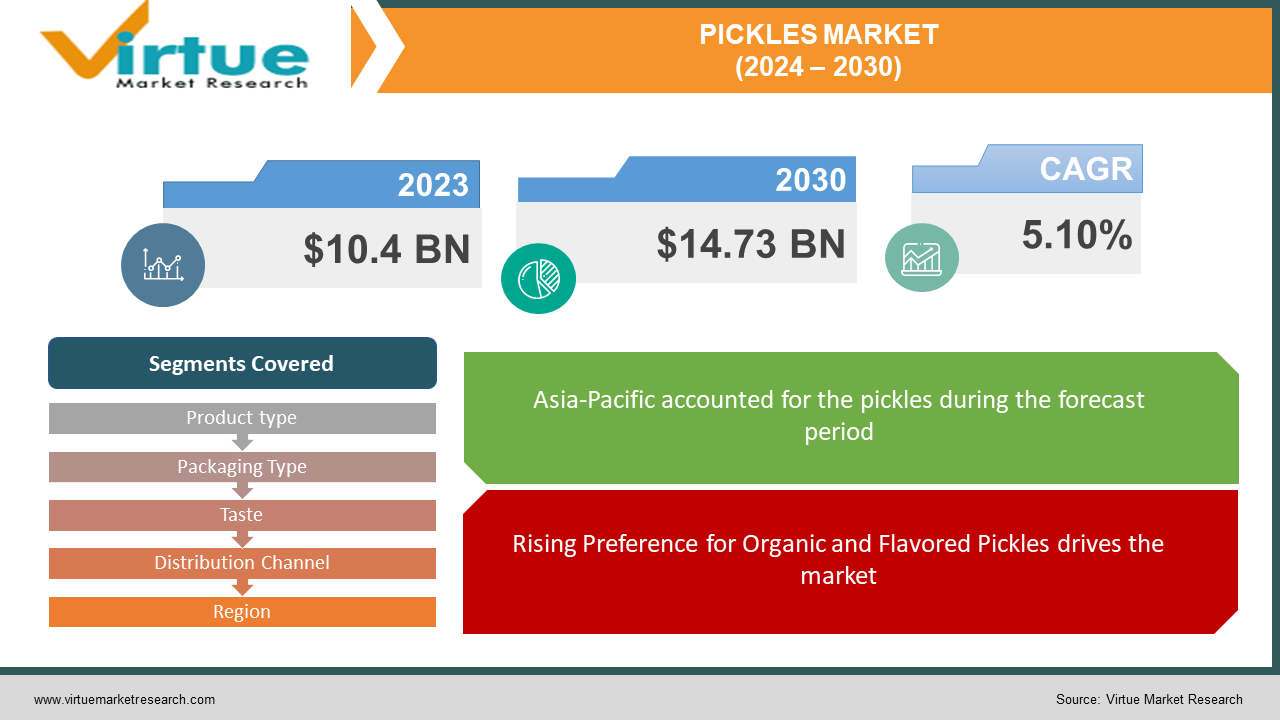

Pickles Market Size (2024 – 2030)

The Pickles Market was valued at USD 10.4 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 14.73 billion by 2030, growing at a CAGR of 5.10%.

Key Market Insights:

Pickles serve as a complimentary accompaniment in various countries, commonly paired with sandwiches, hot dogs, and various other food items. Consumers, recognizing the importance of their health and well-being, are now displaying a preference for non-GMO, organic, and natural products. This shift is contributing to the growth of the pickle market. Vinegar-based pickles, in particular, play a role in diabetes management by helping maintain hemoglobin levels in the body.

The escalating demand for vegan and gourmet pickles is noteworthy, driven by the increasing population of individuals embracing a vegan lifestyle. Moreover, the extended shelf life of pickles has captured consumer interest, as these products remain stable at room temperature for prolonged periods. In response to this trend, market participants are expanding their product distribution to encompass a broader international audience.

Prominent e-commerce platforms such as Amazon and India Mart are now featuring an expanded array of pickle products. The availability of discounts and special offers has prompted consumers to shift their purchasing preferences towards online platforms. Concurrently, market players are introducing new product categories as part of their strategy to diversify and enhance their portfolios within the market.

Pickles Market Drivers:

Rising Preference for Organic and Flavored Pickles drives the market.

In various nations, pickles are widely employed as a condiment to enhance taste and flavor, commonly applied to sandwiches, hamburgers, hot dogs, and various food items. The market dynamics are chiefly influenced by factors such as health benefits, flavor enhancement, and the desire for pickles as a complementary addition to main course meals. Additionally, there has been a notable surge in the demand for natural and organic food products, including pickles, driven by heightened consumer awareness regarding the adverse health effects associated with the consumption of synthetic food ingredients.

Moreover, the escalating popularity of the vegan lifestyle has contributed to a growing demand for gourmet pickles and pickle products. This trend aligns with the increasing consciousness among consumers regarding the sourcing and composition of their food choices.

Pickles Market Restraints and Challenges:

The pickle market faces a constraint in the form of fluctuating prices of raw materials and ingredients used in pickle manufacturing. This challenge is particularly pronounced in developing countries such as India. In response to this limitation, individuals in these regions exhibit a preference for homemade pickles produced by the unorganized pickle industry. The appeal lies in the perception that homemade pickles incorporate pure ingredients and offer customization options based on both materials and packaging preferences. This consumer choice reflects a desire for transparency and control over the quality and composition of the pickles they consume.

Pickles Market Opportunities:

Ethnic Cuisine is increasing in popularity in different countries, creating opportunities.

The market is experiencing the impact of globalization, introducing consumers to a diverse range of international cuisines. Within this context, pickles emerge as significant contributors, driving demand for authentic and culturally varied pickle options. Notably, Kimchi has gained popularity as a healthful and flavorful pickle in global markets. As a fermented cabbage or radish pickle, Kimchi offers a spicy profile and distinctive taste, coupled with probiotic health benefits.

Similarly, German sauerkraut and Indian achaar are making inroads into international markets, appealing to consumers seeking exploration of novel flavors. The allure of ethnic pickles extends beyond taste to encompass cultural significance. Consumers are increasingly drawn to the narratives surrounding these pickles, delving into traditional preparation methods and the roles they play in diverse culinary traditions. This cultural exploration through food is a key factor contributing to the growing popularity of pickles.

In response to this trend, manufacturers are diversifying their product offerings, introducing an expanded range of ethnic pickles to meet the rising demand. The globalization of flavors is enhancing the pickles market, creating a more inclusive landscape that reflects the rich and diverse culinary heritage across the globe.

PICKLES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.10% |

|

Segments Covered |

By Product type, Packaging Type, Taste, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

The Kraft Heinz Ltd, Pinnacle Foods Inc., Del Monte Foods Private Limited, Desai Foods Ltd,. Mt. Olive Pickle Company, Angel Camacho Alimentacion, Del Monte Foods, G.D Foods Pvt Ltd, Reitzel, Orkla ASA |

Pickles Market Segmentation: By Product Type

-

Fruit Pickle

-

Vegetable Pickle

-

Meat Pickle

-

Seafood Pickle

-

Relish

-

Other Product Types

The predominant share in the market is held by fruit pickles, encompassing a diverse array of fruit-based varieties, including mango, lemon, cherry, and exotic options such as dragon fruit and papaya. Noted for their sweet and tangy flavor profiles, fruit pickles have gained popularity among consumers seeking a delightful and refreshing enhancement to their meals. The distinctive appeal of fruit pickles lies in their adept balancing of sweet and sour notes, providing a unique flavor dimension that complements a wide range of dishes. The rising trend of fusion cuisine is a significant driver behind the increasing demand for fruit pickles, as they contribute to enhancing the flavor profiles of both traditional and contemporary culinary creations.

Concurrently, the fastest-growing segment within the market is vegetable pickles, comprising a diverse assortment of pickled vegetables. Common choices include cucumbers, carrots, and jalapeños. Known for their crisp texture and savory, often spicy, flavors, vegetable pickles serve as versatile ingredients utilized in sandwiches, salads, and as side dishes in various cuisines worldwide. This segment's growth underscores the expanding consumer preference for the diverse and savory attributes offered by vegetable pickles in culinary applications.

Pickles Market Segmentation: By Packaging Type

-

Glass Jars

-

Plastic Containers

-

Pouches

-

Cans

The glass and plastic jar segment has secured the largest market share, with glass being the predominant choice for pickle storage among manufacturers. Glass containers offer protection against microbes, sunlight, and air, thereby preventing the pickle from acquiring a bitter and rancid taste. Additionally, glass packaging is aesthetically appealing and serves as a barrier against the leaching of various chemicals into the pickle.

Concurrently, there is an expanding preference for plastic jars, driven by their ease of handling and storage owing to their lightweight nature. Plastic packaging, being more cost-effective, is gaining traction, and the durability of plastic jars, which are less prone to breakage, makes them a safer option for product storage.

However, the stand-up pouches segment is anticipated to be the fastest-growing sector. This growth can be attributed to the convenience of storage, flexibility, cost-effectiveness, and the lightweight nature of stand-up pouches. The increasing demand for these pouches underscores their appeal to consumers and manufacturers alike, positioning them as a rapidly growing choice within the market.

Pickles Market Segmentation: By Taste

-

Sweet

-

Salty

-

Sour

Sweet pickles currently dominate the industry, holding the largest market share. Renowned for their delightful blend of sweetness and mild tanginess, sweet pickles are typically crafted from cucumbers or other vegetables and preserved in a syrupy brine infused with ingredients such as sugar, vinegar, and spices. The sweet flavor profile of these pickles makes them a popular choice across age groups. Consumers often enjoy sweet pickles as standalone snacks, as garnishes for sandwiches, or paired with cheese and charcuterie boards. Their widespread appeal can be attributed to their capacity to offer a pleasing contrast to savory dishes, solidifying their status as a household and restaurant staple.

Concurrently, the fastest-growing segment in the industry is sour pickles. Typically produced through traditional fermentation methods, these pickles develop their characteristic sourness with the assistance of natural lactobacillus bacteria. While cucumbers are a common choice, sour pickles can be made from various vegetables. Their tangy flavor profile renders them a versatile addition to numerous dishes, including sandwiches, salads, and accompaniments to hearty meals. The increasing popularity of sour pickles underscores their versatility and appeal to consumers seeking bold and distinctive flavors.

Pickles Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Other Distribution Channels

Supermarkets and hypermarkets stand as the predominant market segment, offering consumers a comprehensive range of pickle brands and flavors under one roof. The allure of shopping for pickles in these establishments stems from the expansive shelf space dedicated to food products, facilitating a diverse selection for consumers. Retail giants in this segment often conduct promotions and discounts, attracting price-conscious consumers. Additionally, the shopping experience in supermarkets and hypermarkets is characterized by the convenience of browsing, comparing products, and accessing complementary items, making them a preferred choice for many pickle buyers.

Simultaneously, the online stores segment is experiencing notable popularity, propelled by the convenience of e-commerce and the accessibility of a broad assortment of pickle products from the comfort of one's home. Online stores present consumers with an extensive variety of pickle brands, flavors, and packaging sizes. The added convenience of doorstep delivery enhances the appeal of online shopping, making it an attractive option for busy individuals and those who prefer the ease of virtual transactions.

Pickles Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

Asia-Pacific remains at the forefront of the pickles and pickle products market, driven by heightened commercialization and industrialization in the pickle processing industry, particularly in developing nations like India. Aam ka achar, the mango pickle, stands out as a ubiquitous favorite among Indians, although regional variations in ingredients reflect the diverse array of indigenous fruits and vegetables found throughout the country. The rising consumption of a broad spectrum of pickled fruits, vegetables, seafood, and meat as meal accompaniments is expected to contribute significantly to the expanding growth of the pickles market in the Asia-Pacific region.

The future outlook for the global pickles market appears promising, driven by increasing consumer demand for pickles as flavorful products and food enhancers during the forecast period. In addition to the popular mango pickle, other varieties such as amla pickle, beetroot pickle, carrot pickle, and bitter gourd pickle, among others, cater to diverse regional preferences that may change seasonally. The influence of Western cuisines in India has also led to a notable demand for gourmet pickles in recent years. To meet this evolving demand, market players in India are actively introducing new products to the market, as exemplified by Indian Traditional Food's launch of Gujjuben and YO'S Kitchen Sandwich pickles at the Indus Food 2022, India's largest food expo, in January 2022.

In Latin America, the pickles market is displaying growing potential, propelled by an increasing emphasis on incorporating traditional ingredients in pickle production. This reflects a trend towards preserving and celebrating local culinary traditions in the region.

COVID-19 Pandemic: Impact Analysis

The pickles market underwent significant disruptions due to the COVID-19 pandemic. While there was initially a surge in demand for pickles in the early stages of the pandemic, this trend eventually reversed, leading to a decline in pickle consumption. The pandemic's impact was multifaceted, affecting both the demand and supply sides of the market.

On the demand side, the initial increase in pickle sales could be attributed to consumers stocking up on non-perishable items during periods of uncertainty. However, as the situation evolved and consumer behavior shifted, the demand for pickles experienced a subsequent decrease.

Simultaneously, the pandemic posed challenges to the supply chain, creating difficulties for manufacturers in securing raw materials and transporting their products. Disruptions in logistics, including restrictions on movement and changes in consumer purchasing patterns, contributed to the complexities faced by pickle manufacturers.

Latest Trends/ Developments:

November 2023: Kraft Heinz has introduced Pickle Ketchup, a novel condiment that seamlessly blends the tangy and savory flavors of pickles with the iconic taste of HEINZ Ketchup.

- October 2023: Conagra Brands, Inc. has collaborated with Frank’s RedHot to unveil three hot and spicy Kosher Dill Pickles, promising a harmonious fusion of flavor and heat suitable for sandwiches, burgers, or as a delectable straight-from-the-jar snack.

- September 2022: Opies, a brand under Bennett Opie Ltd., introduced a new line of pickles, featuring options such as Silverskin Onions with Turmeric & Mustard Seeds, Silverskin Onions with Red Wine Vinegar, and Pickled Pears.

- January 2022: Foster's Pickle Products, part of Columbia Valley Family Farms, launched Foster's Pickled Garlic, a unique pickle infused with red pepper for an added kick.

Key Players:

These are the top 10 players in the Pickles Market:-

-

The Kraft Heinz Ltd

-

Pinnacle Foods Inc.

-

Del Monte Foods Private Limited

-

Desai Foods Ltd

-

Mt. Olive Pickle Company

-

Angel Camacho Alimentacion

-

Del Monte Foods

-

G.D Foods Pvt Ltd

-

Reitzel

-

Orkla ASA

Chapter 1. PICKLES MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. PICKLES MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. PICKLES MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. PICKLES MARKET Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. PICKLES MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. PICKLES MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Fruit Pickle

6.3 Vegetable Pickle

6.4 Meat Pickle

6.5 Seafood Pickle

6.6 Relish

6.7 Other Product Types

6.8 Y-O-Y Growth trend Analysis By Product Type

6.9 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. PICKLES MARKET – By Packaging Type

7.1 Introduction/Key Findings

7.2 Glass Jars

7.3 Plastic Containers

7.4 Pouches

7.5 Cans

7.6 Y-O-Y Growth trend Analysis By Packaging Type

7.7 Absolute $ Opportunity Analysis By Packaging Type, 2024-2030

Chapter 8. PICKLES MARKET – By Distribution

8.1 Introduction/Key Findings

8.2 Supermarkets/Hypermarkets

8.3 Convenience Stores

8.4 Online Retailers

8.5 Other Distribution Channels

8.6 Y-O-Y Growth trend Analysis By Distribution

8.7 Absolute $ Opportunity Analysis By Distribution, 2024-2030

Chapter 9. PICKLES MARKET – By Taste

9.1 Introduction/Key Findings

9.2 Sweet

9.3 Salty

9.4 Sour

9.5 Y-O-Y Growth trend Analysis By Taste

9.6 Absolute $ Opportunity Analysis By Taste, 2024-2030

Chapter 10. PICKLES MARKET , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Product Type

10.1.2.1 By Packaging Type

10.1.3 By Distribution

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Product Type

10.2.3 By Packaging Type

10.2.4 By Distribution

10.2.5 By Taste

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Product Type

10.3.3 By Packaging Type

10.3.4 By Distribution

10.3.5 By Taste

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Product Type

10.4.3 By Packaging Type

10.4.4 By Distribution

10.4.5 By Taste

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Product Type

10.5.3 By Packaging Type

10.5.4 By Distribution

10.5.5 By Taste

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. PICKLES MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 The Kraft Heinz Ltd

11.2 Pinnacle Foods Inc.

11.3 Del Monte Foods Private Limited

11.4 Desai Foods Ltd

11.5 Mt. Olive Pickle Company

11.6 Angel Camacho Alimentacion

11.7 Del Monte Foods

11.8 G.D Foods Pvt Ltd

11.9 Reitzel

11.10 Orkla ASA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

In various nations, pickles are widely employed as a condiment to enhance taste and flavor, commonly applied to sandwiches, hamburgers, hot dogs, and various food items.

The top players operating in the Pickles Market are - Kraft Heinz Ltd, Pinnacle Foods Inc., Del Monte Foods Private Limited, Desai Foods Ltd, Mt. Olive Pickle Company, Angel Camacho Alimentacion, Del Monte Foods, G.D Foods Pvt Ltd, Reitzel, Orkla ASA.

The pickles market underwent significant disruptions due to the COVID-19 pandemic.

The globalization of flavors is enhancing the pickles market, creating a more inclusive landscape that reflects the rich and diverse culinary heritage across the globe.

In Latin America, the pickles market is displaying growing potential, propelled by an increasing emphasis on incorporating traditional ingredients in pickle production.