North America Pickles Market Size (2024-2030)

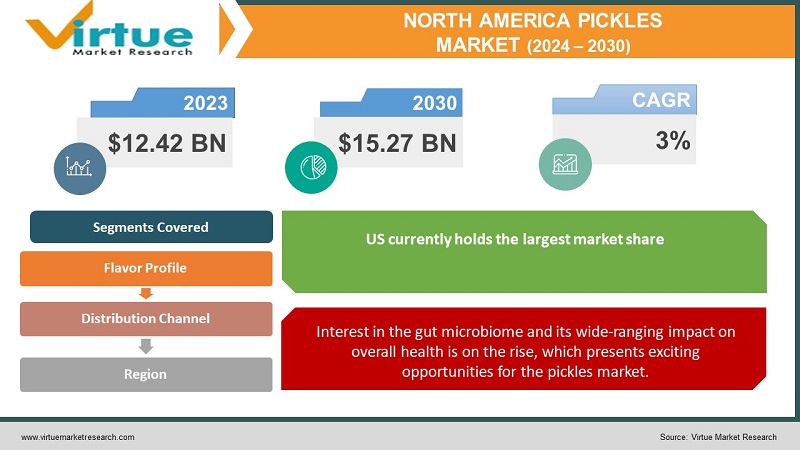

The North America Pickles Market was valued at USD 12.42 Billion in 2023 and is projected to reach a market size of USD 15.27 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3%.

The pickling process transforms vegetables, infusing them with a delicious interplay of salty, sour, sometimes sweet, and even spicy notes, creating flavor bombs that enhance everything from simple sandwiches to gourmet dishes. Pickles go beyond being a mere condiment. They're included in salads, used as appetizers, incorporated into recipes, and even inspire unusual snacks like fried pickle chips. The long shelf-life of pickles makes them a convenient pantry item, reducing food waste, and ensuring a flavorful ingredient is always on hand. Consumers crave adventurous tastes. Pickles deliver a punch of sour, spicy, or unusual flavor combinations that awaken otherwise simple meals. Naturally fermented pickles are gaining attention for their potential probiotic content, aligning with the gut-health focus. Even traditional pickles maintain a relatively healthy image compared to many processed snacks. Pickles are featured more prominently in restaurant dishes and food trends. This increased exposure inspires home cooks to get creative too.

Key Market Insights:

Innovation centers around different brines and flavor infusions. Garlic, dill, and spices are classics, but there's a move towards bolder, globally inspired profiles and even sweet or spicy pickle varieties. Naturally fermented pickles, offering probiotic benefits, are a growing niche with a distinct taste difference compared to solely vinegar-brined pickles. The market has both shelf-stable, vinegar-heavy options and a growing refrigerated section with fresher flavor profiles and often emphasizing natural fermentation. Pickles, especially smaller formats, fit perfectly into the demand for portable, flavorful snacks perceived as healthier than chips or candy. Consumers are open to adventurous flavors. Pickles offer a low-risk way to experiment, from spicy variations to globally inspired ones. While sodium content is a concern for some, many pickles promote their low-calorie, fat-free properties. Fermented pickles gain additional appeal due to potential gut health benefits. The rise of home cooking and exploring diverse cuisines drives interest in pickles as condiments, recipe additions, and as part of creative charcuterie boards. The high sodium content of many pickles is a barrier for some consumers with health concerns or dietary restrictions. The price of raw ingredients like cucumbers can be impacted by weather and crop yields, creating instability in production costs. Pickles need to become known as a versatile standalone snack and ingredient, not just alongside burgers. Pickles compete with a plethora of other snack options, both healthy and indulgent. While fermented foods are on the rise, consumer education is needed to explain the benefits and unique taste characteristics.

North America Pickles Market Drivers:

Busy schedules are eroding traditional mealtimes. Pickles, especially in portable formats (mini pickles, single-serve packs), fit the trend of frequent, smaller snacks throughout the day.

Snacking isn't just about grazing between meals anymore. It often replaces them. Busy lifestyles mean people seek quick, portable bites to provide energy boosts throughout the day. Snacks offer a space to explore adventurous tastes or make healthier choices with smaller commitments than a full meal. People feel more empowered to try the spicy habanero pickle when it's a snack, not a major side dish decision. The lines between what constitutes a snack are getting fuzzier. A handful of gourmet olives or a small jar of pickled veggies blurs the line between snack and light appetizer. The satisfying crunch of a pickle offers textural appeal often lacking in softer snack options, making them feel more substantial. From traditional dill to fiery variations, pickles deliver intense flavor in a small package, satisfying the desire for bold taste experiences. Naturally tangy, pickles offer a refreshing counterpoint to the sweet and salty snacks dominating the market. While sodium needs consideration, the low-calorie count and fat-free nature of many pickles allow them to be perceived as a "better for you" option compared to many processed snacks. Pickle chips offer a different textural experience, competing in the chip aisle and introducing the pickle flavor to a wider audience.

Interest in the gut microbiome and its wide-ranging impact on overall health is on the rise, which presents exciting opportunities for the pickles market.

The awareness that gut health influences immunity, mood, and even chronic disease risk has revolutionized how people view the bacteria residing within them. Consumers are actively looking for dietary ways to support their gut microbiome. The concept of "good" bacteria offering health benefits has gained widespread recognition, albeit with a need for deeper consumer education on specifics. While research is ongoing, the link between a healthy gut microbiome and overall well-being is increasingly accepted, driving consumer interest in gut-supportive foods. Unlike vinegar-based pickles, traditionally fermented pickles contain live and active cultures, the kind associated with probiotic benefits. The naturally sour flavor profile of fermented foods aligns with consumer expectations, making their unique taste more approachable. Pickles can introduce consumers to the wider world of fermented foods like kimchi, miso, etc., with their range of health associations. Fermented pickles can command a higher price due to their perceived health benefits and more complex flavor profiles. The refrigerated section grows, housing live-culture pickles with a focus on freshness and natural ingredients. Smaller businesses specializing in artisanal fermented pickles are entering the market, often targeting local distribution initially before potentially expanding.

North America Pickles Market Restraints and Challenges:

While some pickles benefit from a health-conscious consumer trend, sodium content poses a major challenge. Pickles often struggle to break free from deeply ingrained consumer perceptions.

Historically, the high salt content of pickles has been a crucial part of their preservation method, especially for long-term storage. Growing health concerns around excessive sodium intake create a barrier for many consumers, particularly those with hypertension or on salt-restricted diets. The sodium issue can overshadow messaging around the gut health benefits of fermented pickles, or the low-calorie, fat-free nature of many pickled vegetables. Many consumers primarily think of pickles as a condiment to add to sandwiches or burgers, not as a versatile and satisfying option on their own. The characteristic tangy, sour flavor of pickles, especially fermented ones, can be polarizing for some. Initial negative experiences can lead to lasting avoidance. Consumers might underestimate the range of flavors found in the pickle category. There's a need to showcase sweet, spicy, globally inspired, and herby options to broaden appeal. Fermented pickles often require refrigeration to maintain optimal quality and live cultures. This limits shelf space and distribution potential in stores without ample chilled sections. Short shelf-life, especially for fresh-pack pickles without heavy preservatives, can contribute to food waste if not managed efficiently. This impacts retailer profitability and potentially drives prices up. While trending, making fermented pickles at home is less common than canning jams. This limits market growth potential compared to products with a strong DIY element. Variations in freshness and quality, particularly in smaller-batch pickles, can lead to negative consumer experiences if not carefully controlled.

North America Pickles Market Opportunities:

Craft pickle makers focus on unique flavor combinations, often using unexpected spices, local ingredients, and heritage vegetable varieties. This taps into the desire for culinary adventure and exclusivity. Highlighting the maker, the ingredients' origin and traditional fermentation methods creates a compelling narrative that justifies a price premium and builds brand loyalty. High-end pickles find their way into gourmet gift baskets, specialty cheese pairings, or even curated pickle-of-the-month subscriptions. Chefs at innovative restaurants create signature pickles, sometimes even collaborating with local pickle makers to retail these unique creations, adding a halo of exclusivity. Reviving old-school pickling traditions or utilizing less-common vegetables like kohlrabi or Romanesco taps into the foodie trend of seeking the novel. Pickled fruits like strawberries, plums, or grapes offer a sweet-tart contrast and can be used innovatively in desserts, cocktails, or cheese pairings. Developing and promoting recipes where pickles are a central flavor component, not just an afterthought – think pickle-based sauces, soups, salads, or even unexpected baked goods. Pickle brands partner with spice companies for co-branded spice blends, or with hot sauce makers to create pickle-infused hot sauces, and expand their reach into new flavor territories. Chefs featuring pickles in innovative dishes can create trends that trickle down to the home cook, inspiring broader culinary use of pickles.

NORTH AMERICA PICKLES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3% |

|

Segments Covered |

By Flavor profile, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CNADA, MEXICO |

|

Key Companies Profiled |

Walmart, Kroger, Sysco, United Natural Foods Inc., McClure's Pickles, Bubbie's |

North America Pickles Market Segmentation:

North America Pickles Market Segmentation: By Flavor Profile -

- Classic Dill

- Sweet Pickles

- Spicy and Zesty

Classic Dill: The enduring leader, accounting for approximately 50-65% of the pickles market. Dill pickles are deeply ingrained in North American food culture. Their flavor evokes nostalgia and comfort for many consumers. Their tangy-savory profile works as a side for burgers and sandwiches, an addition to salads, or even as a snack on its own. Dill pickles are widely accessible, consistently available in supermarkets, and cater to a broad taste preference. Sweet Pickles: A significant force, holding around 20-30% of the market. Moving beyond the traditional bread and butter pickle, there's potential for sweet-tart pickled fruits (watermelon, grapes, plums) to capture attention as both snacks and unique dessert garnishes. Naturally fermented pickles, with their tangier, nuanced taste profile, are poised for further growth as consumer awareness of gut health and "live foods" increases. Spicy and Zesty: Growing in popularity, ranging from 10-20%. Spicy and zesty pickles pack a flavor punch, offering a welcome alternative to blander snack options, perfectly aligning with the quest for bolder snack experiences.

North America Pickles Market Segmentation: By Distribution Channel -

- Supermarkets and Grocery Stores

- Online Retailers

- Specialty Stores

- Farmer's Markets and Local Stores

- Restaurants and Foodservice

Supermarkets and Grocery Stores: The absolute powerhouse in pickle distribution. These offer the widest selection, from mass-market brands to smaller, more specialized players, as well as private-label options. Online Retailers: This sector is rapidly gaining ground, encompassing online giants like Amazon, grocery-specific online platforms, and the direct-to-consumer websites of pickle brands themselves. Specialty Stores: Gourmet food shops, delicatessens, and even some international markets often focus on unique pickle varieties, smaller-batch producers, imported options, or those with a focus on fermented pickles. Farmer's Markets and Local Stores: These provide a vital outlet for small, artisanal pickle producers as well as those with regionally focused flavor profiles or who specialize in seasonal pickled vegetables. Restaurants and Foodservice: While not a direct retail channel for consumers, restaurants, caterers, and other food service businesses utilize a significant volume of pickles, from garnishes to ingredients in dishes. Supermarkets and Grocery Stores dominate with an estimated 70-80% of the total market share. The online retail space is experiencing significant growth within the pickles market.

North America Pickles Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

The United States: Holds approximately 75-85% of the North American pickles market. Holds the dominant position, accounting for the largest share of the market due to its sizable population, diverse culinary influences, and established pickle consumption habits. Canada: Represents an estimated 10-20% of the market. While smaller than the U.S. market, Canada has a well-developed pickle sector, particularly strong in the production of cucumber-based pickles. Mexico: Holds the remaining estimated 5-10%. Mexico's contribution to the North American pickle market is primarily focused on pickled peppers and a growing presence in other pickled vegetables that align with its strong culinary traditions. The U.S. population embraces a huge range of cuisines. This fuels demand for both classic dill pickles and a growing appetite for pickles inspired by global flavors. While the U.S. dominates in terms of size, Mexico's pickle sector, particularly in the pickled pepper realm, is exhibiting noteworthy growth trends. The popularity of Mexican cuisine in the U.S. and Canada is growing rapidly. This increases demand for authentic pickled ingredients like jalapeños and other chili varieties.

COVID-19 Impact Analysis on the North America Pickles Market:

Border closures and disruptions in transportation networks caused temporary shortages of certain pickle varieties or ingredients, particularly for brands reliant on specific international suppliers. With lockdown restrictions and public health concerns, online grocery shopping gained significant traction. This presented an opportunity for pickle brands to reach consumers directly through these platforms. Consumers focused on stocking their pantries with shelf-stable items, and pickles, with their long shelf life and versatility, became a staple for many households. With restaurants largely closed, people rediscovered the joys of home cooking. This fueled a demand for pickles as a versatile condiment or even an ingredient in creative recipes. With economic uncertainty, consumers became more budget-conscious. This might benefit brands offering value packs or private-label pickle options. Single-serve, grab-and-go pickle options remained popular, catering to busy lifestyles and potential concerns about sharing communal condiments. The potential health benefits of fermented pickles resonated with a health-conscious consumer base, leading to growth in this segment. Smaller, artisanal pickle producers relying on farmers markets or specialty stores might have faced challenges due to social distancing measures and disruptions in these market channels. Larger pickle brands with established distribution networks were better positioned to weather the initial disruptions and adapt to changing consumer needs.

Latest Trends/ Developments:

Pickle brands are releasing small-batch, seasonal flavors, creating a sense of exclusivity and excitement – pickled ramps in spring, spicy pickled green beans in summer, etc. Increased consumer interest in fermented pickles is fuelling innovation in this segment, with brands highlighting specific probiotic strains and emphasizing digestive benefits. While sodium is inherent to pickling, brands are exploring lower sodium options through creative brines or fermentation techniques to broaden their appeal. Explicitly marketing pickles as a healthy snack option – highlighting their low-calorie, fat-free properties and bold flavors – taps into the snackification trend. Craft pickle makers focus on exceptional ingredients, heirloom vegetable varieties, and complex spice blends, justifying a higher price tag. Premium pickles find homes in gourmet gift baskets, specialty cheese pairings, or even as curated "pickle of the month" subscriptions. Chefs featuring signature house-made pickles add a halo effect, with some even partnering with local pickle makers to bring these creations to retail.

Key Players

- Walmart

- Kroger

- Sysco

- United Natural Foods Inc.

- McClure's Pickles

- Bubbie's

Chapter 1. North America Pickles Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Pickles Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Pickles Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Pickles Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Pickles Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Pickles Market– By Flavor Profile

6.1. Introduction/Key Findings

6.2. Classic Dill

6.3. Sweet Pickles

6.4. Spicy and Zesty

6.5. Y-O-Y Growth trend Analysis By Flavor Profile

6.6. Absolute $ Opportunity Analysis By Flavor Profile , 2024-2030

Chapter 7. North America Pickles Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Supermarkets and Grocery Stores

7.3. Online Retailers

7.4. Specialty Stores

7.5. Farmer's Markets and Local Stores

7.6. Restaurants and Foodservice

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. North America Pickles Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Distribution Channel

8.1.3. By Flavor Profile

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Pickles Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Walmart

9.2. Kroger

9.3. Sysco

9.4. United Natural Foods Inc.

9.5. McClure's Pickles

9.6. Bubbie's

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Pickles, especially in portable formats like single-serve pouches or mini jars, perfectly align with the demand for quick, convenient snacks that can be enjoyed anywhere

While offering flavor and preservation benefits, the high sodium content of many pickles is a major concern for health-conscious consumers. Excessive sodium intake is linked to high blood pressure and cardiovascular issues. This creates a barrier for some, especially those with dietary restrictions

Walmart, Kroger, Sysco, United Natural Foods Inc., McClure's Pickles

Bubbie's.

The US currently holds the largest market share, estimated at around 75%.

Mexico exhibits the fastest growth, driven by its increasing population, and expanding economy