Pet Supplements Market Size (2024 –2030)

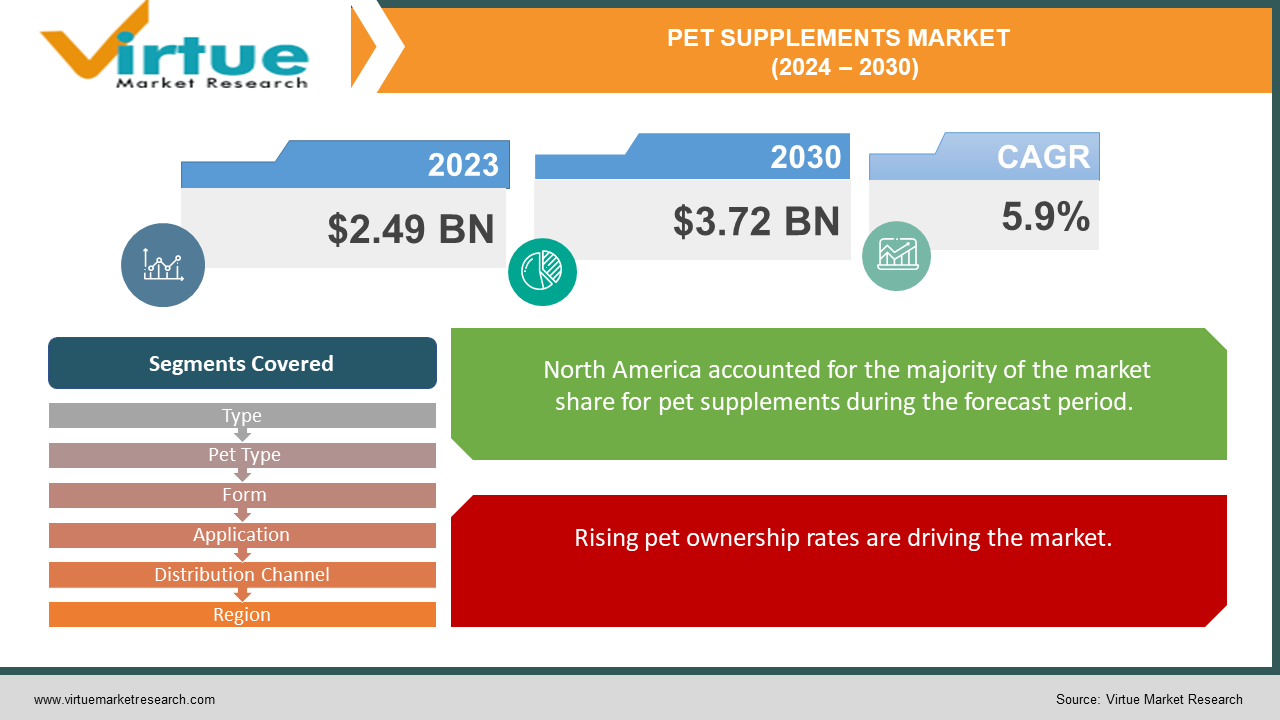

In 2023, the Global Pet Supplements Market was valued at USD 2.49 billion and is projected to reach a market size of USD 3.72 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

Pet supplements are specialized processed foods made from plant and animal raw materials that are intended to make up for nutritional deficiencies in animals such as dogs, cats, birds, horses, and reptiles. They contain concentrated sources of essential vitamins, minerals, and proteins. Over the course of the forecast period, the pet supplement market is anticipated to expand significantly due to rising pet adoption rates and growing concerns for animal welfare. Additionally, the trend of keeping low-maintenance, fur-free reptiles like anoles, bearded dragons, leopard geckos, tortoises, and turtles is growing, which is helping to expand the market. The growing inclination for organic pet food and increased consumer knowledge of the advantages of pet supplements are also driving industry growth. The US FDA has recently approved several new pet supplements that cater to different dog health needs. Apoquel Chewable tablets were introduced by Zoetis to treat atopic dermatitis and itching in dogs older than a year. Librela (bedinvetmab injectable), another Zoetis product, uses monthly injections to target nerve growth factor (NGF) and reduce osteoarthritis pain in dogs. Cobalequin, an oral cobalamin supplement containing active folate that is essential for dogs suffering from cobalamin deficiency, was created by Nutramax Laboratories Veterinary Sciences. To support joint health and mobility in dogs of all sizes and breeds, Purina Pro Plan Veterinary Supplements introduced Joint Care Soft Chews. Enriched with hyaluronic acid, collagen, chondroitin sulfate, glucosamine, and omega-3 fatty acids. These supplements address particular health issues and promote general well-being in pets, which is an advancement in pet healthcare.

Key Market Insights:

Joint health supplements account for approximately 30% of the pet supplements market share, driven by the increasing awareness of age-related joint issues in pets and the desire to improve mobility and quality of life for older animals.

The dog segment constitutes around 65% of the demand for pet supplements, reflecting the larger population of dogs as pets and the higher tendency of dog owners to provide supplementary nutrition.

In terms of distribution channels, online retail represents about 40% of the market share for pet supplements, attributed to the convenience of e-commerce and the wide variety of products available through online platforms.

The adoption of natural and organic pet supplements is growing at a rate of approximately 10% annually, driven by the increasing trend towards clean-label products and the perception that natural ingredients are healthier for pets.

Global Pet Supplements Market Drivers:

Rising pet ownership rates are driving the market.

The market for pet supplements is expected to grow significantly because pet adoption is becoming more and more commonplace worldwide. Pet ownership is becoming more and more common for a variety of reasons, including personal preferences and health benefits. For example, some people or couples who are medically unable to conceive naturally choose to adopt pets rather than have biological children. Furthermore, the therapeutic roles that pets play in providing companionship and emotional support are becoming more widely acknowledged. These roles are critical to the well-being of pet owners, particularly those who have specific medical conditions. Pet owners are becoming more and more willing to spend money on their pets' well-being, which is driving up demand for pet supplements.

The demand for pet supplements is being driven by the increased awareness of pet nutrition and health.

Since the start of this decade, there has been a noticeable increase in people's awareness of the nutrition and general health of their dogs. To guarantee that their pets are receiving the best care possible, pet owners are becoming increasingly watchful about the components and additives in pet meals and supplements. The use of natural and organic ingredients, along with more palatable formulations like soft chews and gels, to support pet health is becoming more and more popular. A global trend toward putting pet health and dietary awareness first is also evident in the rise in popularity of mixed products that combine essential fatty acids, herbs, nutrients, and vitamins. The global pet supplement industry is becoming more and more popular as a result of this raised awareness.

Pet Supplements Market Challenges and Restraints:

The fact that most pet owners are unaware of these products is one of the main obstacles impeding the pet supplement market's global expansion. Many people think that supplements are not necessary if their pets seem healthy, or they think that their pets' "complete and balanced" pet foods should be their only source of nutrition. A major obstacle to market expansion is this misconception. It also offers big pet supplement companies a great chance to fully inform pet owners about the advantages and significance of supplementation for their pets' health and well-being. By dispelling these myths through outreach and education initiatives, the pet supplement market may see significant expansion.

Pet Supplements Market Opportunities:

The growing popularity of e-commerce platforms is one of the main factors driving the substantial expansion of the pet supplement market. The growth of the internet pet supply market is a noteworthy development in the industry, as it enables pet supplement suppliers to expand their customer base and possibly increase revenue. In an attempt to expand their product lines and gain a larger share of the market, numerous pet supplement manufacturers are partnering with major online retailers. For instance, to draw more customers to their products, PetMed Express, Inc., also known as 1-800-PetMeds, has partnered with Amazon to increase the selection of pet supplements and provide competitive pricing. These collaborations demonstrate the increasing impact of e-commerce and its function in propelling market expansion in the pet supplement sector.

PET SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.9% |

|

Segments Covered |

By Type, Pet Type, Form, Application, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé, FOODSCIENCE, Ark Naturals, NOW Foods, Virbac, Zoetis, Bayer AG, Pet Honesty, Nutramax Laboratories, Zesty Paws |

Global Pet Supplements Market - By Type

-

Over-the-counter (OTC)

-

Prescription

With an 86.71% revenue share in 2022, over-the-counter (OTC) pet supplements dominated the market. These supplements are well-liked by pet owners because they are easily obtainable, address particular health concerns in pets, and provide particular nutrients. Their broad availability is facilitated by a variety of distribution channels, including supermarkets, pet stores, internet retailers, and others. OTC supplements that are frequently bought are joint, omega-3, multivitamins, and probiotic supplements. Prescription pet supplements are expected to expand between 2023 and 2030 at a compound annual growth rate (CAGR) of 6.4%. These supplements are made specifically to treat certain pet health issues, and their efficacy and safety are guaranteed by stringent quality control procedures and clinical research. Prominent players in the prescription pet supplement industry, such as Zoetis and Elanco, are fostering innovation and increasing acceptance among pet owners looking to provide their animals with specialized health solutions.

Global Pet Supplements Market - By Pet Type

-

Dogs

-

Cats

-

Others

With a 44.30% revenue share, dog supplements held the largest market share in 2022. According to the American Pet Products Association, 69.0 million households in the US own a dog, making them the most popular pet worldwide with a high adoption rate. New dog supplements like Greenies, which Mars and Affiliates released in October 2021, are anticipated to propel market expansion in the upcoming years. These premium ingredients-free supplements are free of artificial flavors, preservatives, and fillers, and they support the immune system while also promoting the health of the skin and coat and mobility. The market for cat supplements is anticipated to expand at a compound annual growth rate (CAGR) of 6.1% between 2023 and 2030. Because cats are loved for their company, there is a growing market for cat food products, including supplements. According to a CNN Health article from November 2021, 30% of Americans suffer from insomnia, and 25 million Americans have obstructive sleep apnea. Although there is evidence to suggest that sleeping with cats may exacerbate insomnia, owning a cat still provides comfort and companionship, which increases cat adoption rates and creates opportunities for the pet supplement industry.

Global Pet Supplements Market - By Form

-

Pills/ Tablets

-

Chewables

-

Powders

-

Others

Chewable supplements account for 73.88% of pet supplement sales globally in 2022 due to their widespread popularity. Dogs and cats, for example, frequently have difficulty swallowing pills or capsules, or they just don't enjoy the sensation. Since pets naturally chew on their food, chewable vitamins are a great solution because the supplements can be absorbed in the stomach just like regular food. Saliva mixes in during chewing, aiding in the supplement's breakdown for improved absorption. Powdered supplements are anticipated to grow at a compound annual growth rate (CAGR) of 6.5% between 2023 and 2030. Compared to tablets or pills, powdered supplements are easier to take, absorb more quickly, and can be added to a variety of foods and beverages. It is anticipated that their adaptability will make them more well-liked by pet owners. For instance, NOW Foods provides powdered vitamins for pets that help cats and dogs' cardiovascular health.

Global Pet Supplements Market - By Application

-

Skin & Coat

-

Hip & Joint

-

Digestive Health

-

Others

With more than 50.78% of revenue in 2022, hip and joint supplements led the pet supplement market, and this trend is anticipated to continue. For pets that have joint discomfort, which can cause stiffness, reluctance to move, limping, and general discomfort, these supplements are essential. Compounds like glucosamine and chondroitin, which shield joints from damage and aid in the prevention of arthritis, are found in many of these supplements. The market for joint health supplements is further enhanced by the inclusion of omega-3 fatty acids, which are frequently used for their anti-inflammatory qualities. The skin and coat supplement market is expected to expand at a compound annual growth rate (CAGR) of 6.2% between 2022 and 2030. More and more pet owners are noticing skin problems in their animals, like dryness, hair loss, inflammation, wounds from scratching, and dandruff from itching. Pets' skin can be nourished and soothed by nutrients such as zinc, omega-3 and omega-6 fatty acids, coconut oil, vitamins, minerals, and antioxidants found in supplements for skin and coat health. The market demand for these products is being driven by growing concerns about the general well-being of pets.

Global Pet Supplements Market - By Distribution Channel

-

Online

-

Offline

Pet supplement sales were primarily distributed offline in 2022, with 88.6% of sales occurring through outlets like neighborhood shops, convenience stores, and supermarkets/hypermarkets. These channels provide pet owners with a vast selection of skin and coat care products, including omega-3s and multivitamins. The collaboration between pet care company Noa and French retailer Carrefour, which launched a dedicated pet store in Paris in July 2020 and provides an extensive selection of pet health products, is an illustration of this trend. With a predicted compound annual growth rate (CAGR) of 8.6%, the online distribution channel is predicted to expand significantly between 2023 and 2030. The convenience and selection provided by internet merchants like Chewy, Petco Animal Supplies, Inc., BestVetCare.com, and Amazon will fuel this growth. In response to the growing demand from pet owners who prefer to shop online for their pets' needs, these platforms offer a large selection of supplements for pets, including those for fish, birds, dogs, and cats.

Global Pet Supplements Market - By Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America held a commanding 44.60% revenue share in 2023, dominating the pet supplement market. According to the National Pet Owners Survey, the growing number of pet owners, growing knowledge of pet health issues, and growing interest in improving digestion, immune systems, and skin allergy management are the main factors driving this leadership position. The percentage of American households with pets rose from 56% to 67% between 1988 and 2019, suggesting a consistent increase in pet ownership and the care requirements that go along with it. The Asia Pacific region is expected to grow at a compound annual growth rate (CAGR) of 6.6% between 2023 and 2030. Pet owners' increasing conviction that their pets' regular diets might not contain all the nutrients they need is driving this growth in the demand for supplements to close any nutritional gaps. The growing market in this region is also aided by the rising numbers of pets, such as dogs, cats, fish, birds, and poultry, especially in China and Australia. Europe, on the other hand, is anticipated to expand at a CAGR of 5.7% over the course of the forecast period, maintaining its significant market share of 25.91% in 2022. The area gains from a sizable pet owner population that places a high value on their animals' health, as well as from a strong infrastructure in the pet food sector that makes pet supplements more easily accessible. The pet supplement market in Europe is expanding as a result of these various factors coming together.

COVID-19 Impact on the Global Pet Supplements Market:

Pet food and supplement markets fared better during the COVID-19 pandemic than many other consumer product categories. Movement restrictions and closed borders had an immediate impact on the import, export, and manufacturing of pet supplements, upsetting the supply chain. But as more people and their pets stayed at home during lockdowns, the need for pet supplements rose. The pet supplement market is anticipated to rebound as COVID-19 vaccination campaigns advance and infection rates fall, taking advantage of a return to more typical consumer behavior and economic circumstances.

Latest Trend/Development:

There are several significant trends and advancements in the pet supplement industry. Pet owners are prioritizing healthier options free of artificial additives, which is driving up demand for products made with natural and organic ingredients. Specialized formulas designed for immune support, digestive health, skin and coat care, and joint health are becoming more and more well-liked. Providing supplements to pets is becoming simpler thanks to advancements in delivery formats like powders, soft chews, and chewable tablets. Also growing are customized supplements that cater to the specific health requirements of each pet. With its convenience and extensive product selection, e-commerce is growing in importance as a distribution channel. Global expansion is being driven by rising pet ownership and global awareness of pet health, while manufacturers are concentrating on scientific research and transparency to establish trust.

Key Players:

-

Nestlé

-

FOODSCIENCE

-

Ark Naturals

-

NOW Foods

-

Virbac

-

Zoetis

-

Bayer AG

-

Pet Honesty

-

Nutramax Laboratories

-

Zesty Paws

Market News:

-

The Purina division of Nestlé completed a $182 million expansion of its King William, Virginia, facility in July 2023. The goal of this expansion is to increase production capacity for new litter products while also satisfying North America's growing demand for cat litter solutions.

-

Zesty Paws debuted its first range of puppy supplies in August 2022. The products include vitamins, a milk substitute, and training treats. Training Bites, Puppy Milk Replacer, Puppy AllerImmune Bites, Calming Bites for Puppies, and Puppy 8-in-1 Multivitamin Bites are among the products in the lineup.

Chapter 1. Pet Supplements Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Pet Supplements Market– Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Pet Supplements Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Pet Supplements Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Pet Supplements Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Pet Supplements Market – By Type

6.1 Introduction/Key Findings

6.2 Over-the-counter (OTC)

6.3 Prescription

6.4 Y-O-Y Growth trend Analysis By Type

6.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Pet Supplements Market – By Pet Type

7.1 Introduction/Key Findings

7.2 Dogs

7.3 Cats

7.4 Others

7.5 Y-O-Y Growth trend Analysis By Pet Type

7.6 Absolute $ Opportunity Analysis By Pet Type, 2024-2030

Chapter 8. Pet Supplements Market – By Application

8.1 Introduction/Key Findings

8.2 Skin & Coat

8.3 Hip & Joint

8.4 Digestive Health

8.5 Others

8.6 Y-O-Y Growth trend Analysis By Application

8.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 9. Pet Supplements Market – By Form

9.1 Introduction/Key Findings

9.2 Pills/ Tablets

9.3 Chewables

9.4 Powders

9.5 Others

9.6 Y-O-Y Growth trend Analysis End-User

9.7 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Pet Supplements Market – By Distribution Channel

10.1 Introduction/Key Findings

10.2 Online

10.3 Offline

10.4 Y-O-Y Growth trend Analysis By Distribution Channel

10.5 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 11. Pet Supplements Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Type

11.1.2.1 By Pet Type

11.1.3 By Application

11.1.4 By Distribution Channel

11.1.5 Countries & Segments - Market Attractiveness Analysis

11.2 Europe

11.2.1 By Country

11.2.1.1 U.K

11.2.1.2 Germany

11.2.1.3 France

11.2.1.4 Italy

11.2.1.5 Spain

11.2.1.6 Rest of Europe

11.2.2 By Type

11.2.3 By Pet Type

11.2.4 By Application

11.2.5 By Form

11.2.6 By Distribution Channel

11.2.7 Countries & Segments - Market Attractiveness Analysis

11.3 Asia Pacific

11.3.1 By Country

11.3.1.1 China

11.3.1.2 Japan

11.3.1.3 South Korea

11.3.1.4 India

11.3.1.5 Australia & New Zealand

11.3.1.6 Rest of Asia-Pacific

11.3.2 By Type

11.3.3 By Pet Type

11.3.4 By Application

11.3.5 By Form

11.3.6 By Distribution Channel

11.3.7 Countries & Segments - Market Attractiveness Analysis

11.4 South America

11.4.1 By Country

11.4.1.1 Brazil

11.4.1.2 Argentina

11.4.1.3 Colombia

11.4.1.4 Chile

11.4.1.5 Rest of South America

11.4.2 By Type

11.4.3 By Pet Type

11.4.4 By Application

11.4.5 By Form

11.4.6 By Distribution Channel

11.4.7 Countries & Segments - Market Attractiveness Analysis

11.5 Middle East & Africa

11.5.1 By Country

11.5.1.1 United Arab Emirates (UAE)

11.5.1.2 Saudi Arabia

11.5.1.3 Qatar

11.5.1.4 Israel

11.5.1.5 South Africa

11.5.1.6 Nigeria

11.5.1.7 Kenya

11.5.1.8 Egypt

11.5.1.9 Rest of MEA

11.5.2 By Type

11.5.3 By Pet Type

11.5.4 By Application

11.5.5 By Form

11.5.6 By Distribution Channel

11.5.7 Countries & Segments - Market Attractiveness Analysis

Chapter 12. Pet Supplements Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Nestlé

12.2 FOODSCIENCE

12.3 Ark Naturals

12.4 NOW Foods

12.5 Virbac

12.6 Zoetis

12.7 Bayer AG

12.8 Pet Honesty

12.9 Nutramax Laboratories

12.10 Zesty Paws

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

In 2023, the Global Pet Supplements Market was valued at $2.49 billion and is projected to reach a market size of $3.72 billion by 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.9%.

The market is driven by the rising percentage of pet owners and The Growing Awareness of Pet Nutrition and Health are the factors driving the Global Pet Supplements Market.

The Growth of the Pet Supplement Market May Be Restricted by Lack of Knowledge.

Powder form is the fastest growing in the Global Pet Supplements Market.

Asia-Pacific region is the fastest growing in the Global Pet Supplements Market.