Global Orthopaedic Surgery Robots Market Size (2024 – 2030)

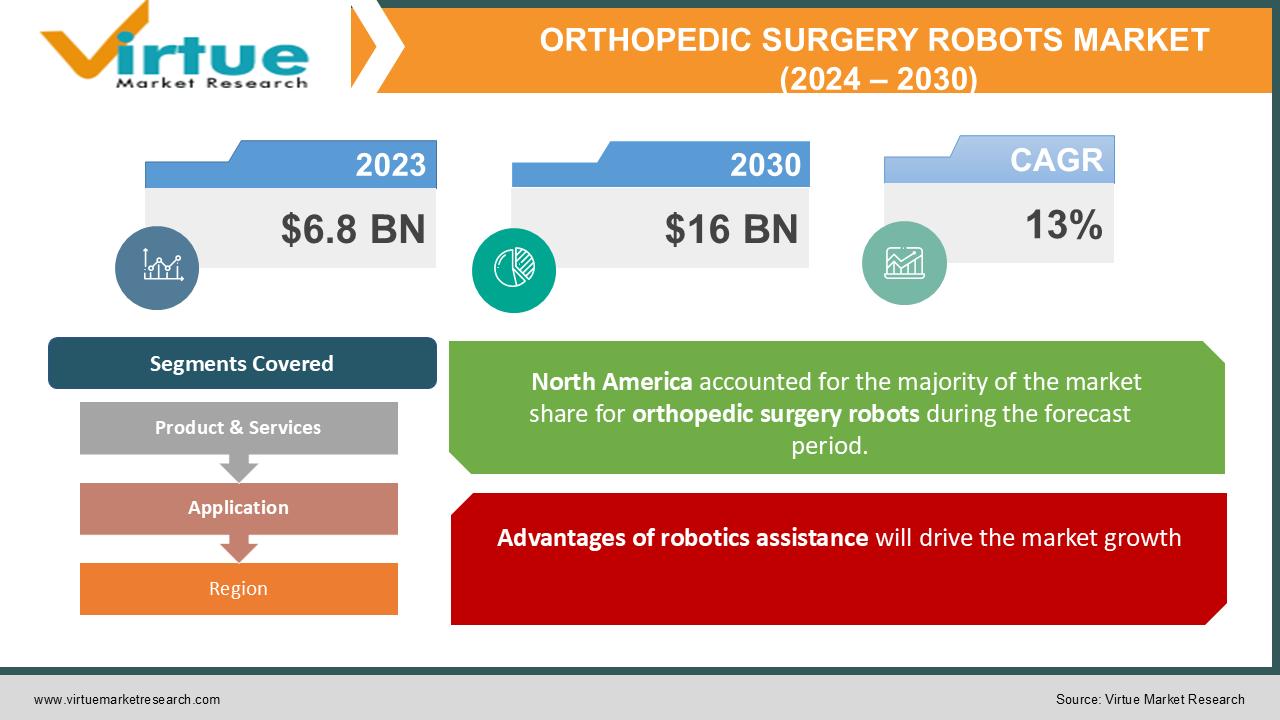

The Global Orthopedic Surgery Robots Market was valued at USD 6.8 billion in 2023 and is projected to reach a market size of USD 16 billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 13%.

Industry Overview

The global orthopedic surgical robots market is being boosted by rising cases of orthopedic diseases such as meniscus tear, tendon burst, knee, and hip break, rheumatoid joint inflammation, and osteoarthritis, as well as growing interest in digitization in the clinical business, combined with a moving example toward the use of surgical robots in orthopedic operations. In addition, trend-setting innovation and growing awareness among people about the benefits of less well-known orthopedic procedures for surgical applications are propelling the global orthopedic surgical robots market forward.

Orthopedic surgical robots are designed to aid orthopedic surgeons in performing medical procedures. Orthopedic sports may be conducted with more precision and accuracy with the help of these robots. These robots can perform bone-related scientific activities that aren't readily visible.

Orthopedic surgical robots are typically small in size and are operated scientifically by hospital therapy professionals. They aid in advancements that necessitate acceptable trends, such as scientific techniques for treating hip spoil, pelvic medical process, and pubic rami. The orthopedic department's surgical robots improve the medical system's aftereffects. It also makes scientific techniques repeatable, which is impossible with human fingertips.

Healthcare advancements have played a significant role in providing high-quality care and increasing success rates. Healthcare services have long depended on technology as a primary utility for fine-tuning many procedures and improving important results, and will continue to do so.

The convergence of "orthopedics" and "robotics" has breathed new life into process efficiency and patient recovery paradigms, and surgical robot penetration is emerging as a bright spot in the global orthopedics services landscape.

Market Drivers

Advantages of robotics assistance will drive the market growth

Minimally invasive surgeries (MIS) are becoming increasingly popular across the world, owing to the benefits they provide, such as smaller incisions, fewer cuts, reduced scarring, reduced discomfort, greater safety, shorter recovery times, and significant cost savings. By providing improved precision, repeatability, control, and efficiency, robotic minimally invasive surgery adds to these benefits.

The surgical success rate in the IRDG (integrated robotic distal gastrectomy) group was 98.0 percent, significantly higher than the CLDG (conventional laparoscopic distal gastrectomy) group, which accounted for 89.5 percent success rate, according to a 2020 article on the comparison of surgical outcomes between integrated robotic and conventional laparoscopic surgery for distal gastrectomy. Though both groups had comparable rates of in-patient and out-patient problems, the IRDG group's readmission rate (98.0 percent) was much lower than the CLDG group's (84.3 percent ).

Robotic surgery also has increased visualization capabilities that provide surgeons a better perspective of the working area and allow them to see minute features utilizing high-definition cameras. These devices have more dexterity than the human hand, and their ability to rotate 360 degrees and navigate better allows surgeons to reach difficult-to-reach places. These benefits of surgical robots, as well as the growing desire for better, faster healthcare services, are projected to propel the surgical robots market forward in the future years.

The rising penetration of surgical robotics in ASC will increase the consumer demand

Ambulatory surgery centers (ASCs) are outpatient surgical, diagnostic, and preventative treatments that do not need admission to a hospital. Governments, third-party payers, and patients all benefit from the cost-effectiveness of ASCs.

According to a study conducted by Healthcare BlueBook (a provider of healthcare data) and HealthSmart (a provider of health plans for self-funded employers), ASCs reduced the cost of outpatient surgery by USD 38 billion annually by providing a lower-cost site of care than hospital outpatient departments.

Each year, Medicare and its beneficiaries save more than USD 2.6 billion by paying much less for treatments performed in ASCs than for the identical procedures conducted in hospitals. When patients receive care in an ASC, their co-payments are also much lower. Because of the cost savings, the number of surgical operations performed in ASCs and outpatient settings has increased rapidly, while hospital in-patient stays have decreased.

According to a 2019 study published in the Ambulatory Surgery Center Association's ASC Focus journal, there has been a major transition from doing difficult surgical operations in inpatient settings to outpatient settings.

As a result, ASCs, particularly in the United States, are rapidly investing in sophisticated robots to treat complicated situations. Some ASCs that use the da Vinci Surgical System to do minimally invasive operations include Atlanta Minimally Invasive Gynecologic Surgery Center, Health East Ambulatory Surgical Center, and Hutchinson Ambulatory Surgery Center.

MAKOplasty, a robotic-arm guided surgery for orthopedic therapy, is also available at Midtown Surgery Center and San Francisco Surgery Center. As a result, the expanding number of ASCs offering robotic-assisted specialist operations presents a huge potential for surgical robot manufacturers.

Market Restraints

Installation of a robotics system requires a huge initial investment which will be a restraint on market growth

Minimally invasive operations are more costly than robot-assisted surgeries. Robotic hysterectomy is only recommended by the American Congress of Obstetricians and Gynecologists for unique and difficult clinical situations. The implementation of robotic surgery for all hysterectomies, according to the group, would add an estimated USD 960 million to the yearly cost of hysterectomy procedures in the United States. One of the most widely used robotic systems, the da Vinci, costs between USD 1.5 million and USD 2.5 million per unit, while the CyberKnife robotic system costs over USD 4 million per unit.

Furthermore, a robot's yearly maintenance costs are close to USD 125,000, adding to the already exorbitant expense of robotic surgery. The typical cost of a robotic surgical operation ranges from USD 3,000 to USD 6,000. As a result of the growing cost of procedures due to the usage of robotic systems, the medical robotics industry is predicted to slow down.

Hospital expenditures throughout the world have been shrinking in recent years, owing mostly to decreased federal appropriations. For example, the Florida government reduced USD 160 million from South Florida hospitals' budgets in 2017. In 2017, 44 Denver urban hospitals experienced budget cutbacks ranging from 0.1 million to $20 million.

Similarly, hospital funds in other European nations have been cut in recent years, with more cuts projected in the years ahead. Budget cuts have required cost-cutting measures in a variety of areas of hospital operations. Staff layoffs, facility upgrading delays, and capital equipment acquisitions such as high-cost robotic systems have all been halted due to cost-cutting.

The rise in adoption of traditional surgical methods will challenge the robotics market growth

The global traditional orthopedic surgery is projected to challenge the market growth of robotic orthopedic surgery. Many hospitals and research organizations are adopting traditional ways of surgery as the robotic surgery method are still under development. This makes the patients hesitant to opt for robotic surgery as they are still not aware of its benefits and precision.

Segmentation Analysis

Global Orthopedic Surgery Robots Market- By Product & Services

- Instruments and Accessories

- Robotic Systems

- Services

When it comes to hospital inpatient robotic system penetration in the United States, procedure claims data show that overall penetration of the robotic technique is still very low, implying that companies offering these advanced technologies at an early stage will see a significant upside opportunity.

While surgical robotic devices are becoming more popular across the world, usage varies by region. These robotic systems are being adopted at a slower pace as the technology is fairly new in the market and many patients and doctors are still skeptical about the precision and safety of the machine.

Global Orthopedic Surgery Robots Market- By Application

- General Surgery

- Gynecological Surgery

- Urological Surgery

- Neurosurgery

- Orthopedic Surgery

- Other Applications

Total hip and knee replacement, tunnel implantation for knee ligament restoration, and trauma and spinal surgeries are among the applications of robot-assisted orthopedic surgery now being studied. Although some short-term studies have demonstrated the possibility of robotic applications in orthopedics, no long-term data defining the usefulness of robot-assisted orthopedic surgery has been published.

Before robot-assisted orthopedic surgery becomes generally available, issues of cost, training, and safety must be solved. Although robotic-assisted orthopedic surgery is still in its early stages, technology has the potential to revolutionize the way orthopedic treatments are performed in the future. Robotic devices can be firmly attached to the bone thanks to the capacity to isolate and rigidly fix bones in predefined locations. As a result, the bone is viewed as a fixed object, simplifying the robotic system's computer control.

Global Orthopedic Surgery Robots Market- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

Because of the rising incidence of bone-related diseases and the growing need for automation in the medical business in the aforesaid area, North America dominates the worldwide orthopedic surgical robots market. Furthermore, due to an increasing trend towards the use of surgical robots in various types of procedures, Europe maintained the largest share of the worldwide market. It goes hand in hand with technological advancements in the robotics business.

Furthermore, the Asia Pacific region is booming in the orthopedic surgical robotics market, because of growing awareness of the advantages of minimally invasive orthopedic robotic surgery over traditional orthopedic surgery. In addition, the growing older population, as well as the worldwide population, are driving the growth of the global orthopedic surgical robots market.

NOTABLE HAPPENINGS IN THE GLOBAL ORTHOPEDIC SURGERY ROBOTS MARKET IN THE RECENT PAST.

- Business Acquisition: - In January 2021, OrthoSensor and its Verasense intraoperative sensor technology were acquired by Stryker to improve the Mako robots.

- Regulatory Approval: - In January 2021, TransEnterix's Intelligent Surgical Unit, which adds AI-based capabilities and allows machine vision capabilities to TransEnterix's Senhance robotic surgical system, has achieved CE Mark clearance.

- Regulatory Approval: - In January 2020, In Japan, Sytrker Corporation's Mako robotic surgical system got regulatory approval for partial knee indications.

Impact of Covid-19 on the Industry

The worldwide impact of the COVID-19 epidemic on the world's population and economy has been disastrous. Healthcare systems have been severely strained as a result of the epidemic. To reduce the risk of transmission and save healthcare resources for COVID-19 patients, healthcare institutions and providers have been told to halt elective surgical operations and medical tests. The epidemic has resulted in a temporary restriction on elective operations all over the world, resulting in the cancellation of elective procedures all over the world, having a detrimental impact on the global economy.

The government's imposition of lockdown and social distancing restrictions to combat the COVID-19 pandemic outbreak resulted in the suspension of various operations, supply chain disruptions, stifling business growth, technology event cancellations, and suspensions of new developments, all of which have had an impact on overall production and sales, limiting the industry's expansion. The epidemic has caused a temporary ban on elective operations throughout the world, resulting in the cancellation of procedures all over the world, putting a strain on the global economy. Healthcare institutions and providers have been ordered to suspend elective surgical operations and medical exams for COVID-19 patients to limit the risk of transmission and save healthcare resources. However, government limitations are projected to loosen, allowing the industry to see a minor increase following COVID-19, as producers focus on various breakthroughs and innovations, market trends, and other expansion initiatives. These characteristics will help the market develop at a rapid rate following COVID-19.

Chapter 1.Global Orthopedic Surgery Robots Market– Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2.Global Orthopedic Surgery Robots Market– Executive Summary

2.1. Market Size & Forecast – (2022 – 2026) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-16 Impact Analysis

2.3.1. Impact during 2022 - 2026

2.3.2. Impact on Supply – Demand

Chapter 3.Global Orthopedic Surgery Robots Market– Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4.Global Orthopedic Surgery Robots Market - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. Global Orthopedic Surgery Robots Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6.Global Orthopedic Surgery Robots Market– By Product & Services

6.1. Instruments and Accessories

6.2. Robotic Systems

6.3. Services

Chapter 7.Global Orthopedic Surgery Robots Market– By Application

7.1. General Surgery

7.2. Gynecological Surgery

7.3. Urological Surgery

7.4. Neurosurgery

7.5. Orthopedic Surgery

7.6. Other Applications

Chapter 8.Global Orthopedic Surgery Robots Market– By Region

8.1. North America

8.2. Europe

8.3. The Asia Pacific

8.4. Latin America

8.5. The Middle East

8.6. Africa

Download Sample

Choose License Type

2500

4250

5250

6900