Medical Robotics Market Size (2025 – 2030)

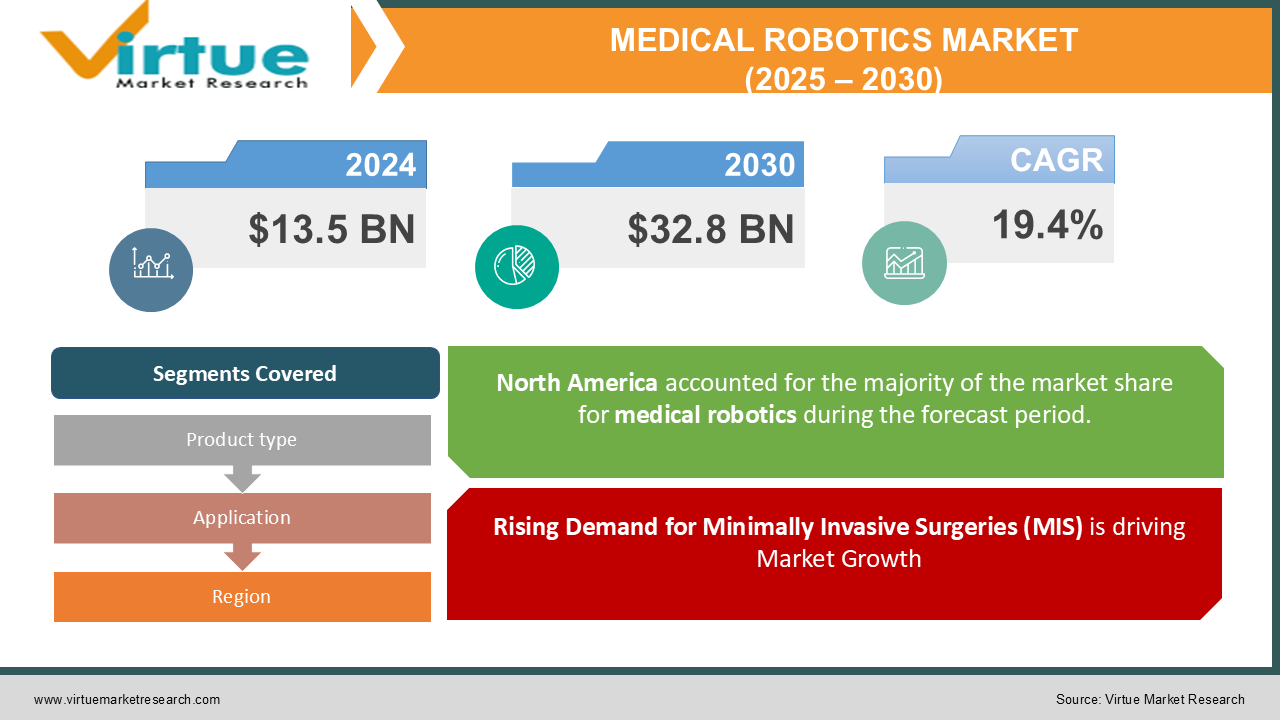

The Global Medical Robotics Market was valued at USD 13.5 billion in 2024 and is projected to reach USD 32.8 billion by 2030, growing at a CAGR of 19.4% during the forecast period.

The increasing demand for minimally invasive surgeries (MIS), advancements in robotic-assisted procedures, and the rising prevalence of chronic diseases are fueling market growth. Medical robots enhance surgical precision, reduce recovery times, and improve patient outcomes. The growing adoption of AI-powered robotic systems in diagnostics and surgery is further accelerating market expansion. Additionally, the integration of machine learning, data analytics, and 5G connectivity in medical robotics is revolutionizing healthcare delivery.

Key Market Insights

-

Surgical robots dominated the market in 2024, accounting for over 60% of revenue share, with widespread adoption in orthopedic and laparoscopic surgeries.

-

Rehabilitation robots are witnessing the fastest growth due to increased demand for robotic-assisted physiotherapy and stroke rehabilitation.

-

North America leads the market with a 40% share, driven by technological advancements, rising robotic-assisted surgeries, and strong regulatory approvals.

-

The Asia-Pacific region is the fastest-growing market due to increasing healthcare expenditure and robotic adoption in China and Japan.

-

Increasing hospital investments in robotic-assisted procedures and AI-driven automation is reshaping the healthcare sector.

-

Collaborative partnerships between medical device manufacturers and AI companies are enhancing robotic capabilities.

Global Medical Robotics Market Drivers

1. Rising Demand for Minimally Invasive Surgeries (MIS) is driving Market Growth

Minimally invasive surgeries (MIS) offer numerous benefits, such as reduced scarring, lower infection risks, faster recovery times, and improved surgical precision. Robotic-assisted systems provide higher accuracy and dexterity than traditional procedures, making them essential in complex surgeries like neurosurgery, orthopedics, and urology.

With increasing patient preference for minimally invasive procedures, hospitals and surgical centers are investing heavily in robotic-assisted surgery (RAS) platforms such as da Vinci Surgical System, ROSA Knee System, and Mako Robotic-Arm Assisted Surgery. This trend is expected to drive significant market expansion in the coming years.

2. Technological Advancements in AI and Machine Learning is driving Market Growth

The integration of artificial intelligence (AI), machine learning (ML), and real-time data analytics is transforming medical robotics. AI-powered robots can process vast amounts of medical data, enhance surgical accuracy, and assist in complex decision-making.

For instance, machine learning algorithms help robotic systems identify tumors with higher precision, predict patient outcomes, and improve surgical planning. Additionally, advancements in haptic feedback, voice-controlled robotics, and 5G connectivity are enhancing real-time surgical interactions, increasing adoption rates.

3. Growing Applications in Rehabilitation and Elderly Care is Boosting Market Growth

The demand for rehabilitation robots is increasing due to the rising number of stroke patients, aging populations, and neurological disorders. Robotic-assisted rehabilitation improves patient mobility and accelerates recovery by providing personalized physical therapy and movement assistance.

For example, exoskeleton robots like ReWalk and Ekso Bionics help paralyzed patients regain mobility, while robotic therapy systems assist in post-stroke motor recovery. As global life expectancy rises, demand for these assistive robotic solutions will continue to grow.

Global Medical Robotics Market Challenges and Restraints

1. High Cost of Robotic Systems and Maintenance Restricting Market Growth is restricting the market growth

One of the primary challenges in medical robotics is the high initial investment and maintenance costs. Robotic surgical systems, such as the da Vinci Surgical System, can cost between USD 1 million and USD 2.5 million, making it difficult for smaller hospitals to afford them.

Additionally, ongoing maintenance, training costs, and software upgrades further add to financial burdens. Limited reimbursement policies in several regions also hinder adoption, particularly in developing countries with budget constraints.

2. Regulatory and Safety Concerns Hindering Market Expansion is restricting the market growth

Stringent regulatory approvals and patient safety concerns pose significant challenges in medical robotics. Regulatory bodies such as the FDA, EMA, and ISO impose strict compliance requirements to ensure robotic systems meet quality, safety, and efficacy standards.

Moreover, cybersecurity risks associated with robotic-assisted procedures pose concerns about data breaches, hacking, and software malfunctions. Ensuring robust data encryption, cybersecurity protocols, and AI transparency will be crucial for market growth.

Market Opportunities

The global medical robotics market is on a trajectory of substantial growth, fueled by a confluence of factors including increasing investments in AI-driven robotic systems, rising adoption in emerging markets, and continuous innovations in smart automation. Emerging economies like China, India, and Brazil are experiencing particularly rapid expansion due to significant improvements in healthcare infrastructure and supportive government policies that encourage the adoption of robotic-assisted procedures. This growth isn't limited to major metropolitan hospitals; the increasing demand for affordable robotic-assisted surgery solutions in mid-sized hospitals and ambulatory surgical centers (ASCs) is creating new and lucrative market opportunities. Furthermore, the advent of tele-robotics and remote surgery capabilities is proving to be a game-changer, enabling specialists to conduct complex surgical procedures remotely using high-speed, low-latency 5G-enabled robotic systems. This technology has the potential to revolutionize access to specialized care, particularly for patients in remote or underserved areas. Beyond the operating room, the applications of medical robotics are expanding rapidly. Areas like pharmacy automation, drug dispensing, and remote patient monitoring are increasingly incorporating robotic technologies, further diversifying the market and driving its overall growth. This broader adoption across various healthcare settings promises to improve efficiency, accuracy, and patient outcomes, solidifying the role of medical robotics in the future of healthcare.

MEDICAL ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

19.4% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Intuitive Surgical, Inc., Medtronic plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., Smith & Nephew plc, Siemens Healthineers AG, Accuray Incorporated, Titan Medical Inc., Ekso Bionics Holdings, Inc., Renishaw plc |

Medical Robotics Market Segmentation - By Product Type

-

Surgical Robots

-

Rehabilitation Robots

-

Hospital & Pharmacy Robots

-

Others

Surgical robots constitute the largest segment of the medical robotics market, commanding a substantial revenue share exceeding 60% in 2024. This dominance stems from the widespread adoption of these sophisticated systems across a range of surgical specialties, including orthopedics, neurosurgery, and general surgery. The core value proposition of surgical robots lies in their ability to enhance precision, dexterity, and enable minimally invasive procedures, leading to improved patient outcomes such as reduced recovery times, smaller incisions, and less blood loss. These advantages have fueled their popularity among both surgeons and patients. Several key players contribute to this thriving segment. Intuitive Surgical's da Vinci Surgical System stands out as a global leader, renowned for its versatility and widespread use in various procedures. Medtronic's Hugo RAS system is another significant entrant, offering a modular and adaptable platform designed to meet the evolving needs of surgical teams. Smith & Nephew's CORI Surgical System has made significant inroads, particularly in orthopedic applications, highlighting the specialized nature of some robotic systems. The continued development and refinement of these technologies, coupled with the expansion of their applications, are expected to further solidify the surgical robots segment's leading position in the medical robotics market in the years to come.

Medical Robotics Market Segmentation - By Application

-

Orthopedics

-

Neurosurgery

-

Laparoscopy

-

Pharmacy Automation

-

Others

The medical robotics industry is experiencing a surge in innovation, with AI-driven automation, real-time data analytics, and remote robotic-assisted surgery at the forefront. AI-powered robotic assistants are revolutionizing surgical procedures, enhancing accuracy and precision beyond human capabilities. These robots can also automate repetitive hospital tasks, freeing up medical professionals to focus on more critical aspects of patient care. 5G connectivity is enabling the development of tele-surgery, where surgeons can perform procedures remotely using robotic systems, expanding access to specialized care for patients in remote areas. In addition to surgical applications, soft robotics, exoskeletons, and wearable robotic devices are gaining traction in rehabilitation and elderly care, enhancing patient mobility and independence. As the use of medical robots becomes more widespread, cybersecurity and data security are paramount. Increased investments in robust cybersecurity protocols and blockchain-based robotic networks are addressing these concerns, ensuring the safe and efficient delivery of robotic-assisted healthcare.

Medical Robotics Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America dominates the medical robotics market, holding a 40% market share in 2024, driven by high adoption rates, advanced healthcare infrastructure, and strong regulatory approvals. The U.S. leads the market due to increasing robotic-assisted surgeries and heavy investments in AI-driven robotic solutions. Asia-Pacific is the fastest-growing region, exhibiting a CAGR of 18.5%, fueled by rising healthcare investments in China, Japan, and India. Government initiatives promoting robotic surgery and increasing medical tourism are driving market expansion in this region.

COVID-19 Impact Analysis

The COVID-19 pandemic significantly impacted the medical robotics market, accelerating the shift toward robotic automation, remote surgery, and AI-driven healthcare solutions.

During the pandemic, hospitals prioritized non-contact robotic solutions for patient monitoring, drug delivery, and disinfection procedures. Surgeons also leveraged robotic-assisted surgery to minimize direct patient contact, reducing infection risks.

The post-pandemic era has witnessed continued adoption of AI-powered robotic systems, emphasizing remote healthcare, tele-robotics, and precision surgeries, further driving market growth.

Latest Trends/Developments

The medical robotics industry is experiencing a period of rapid innovation, driven by advancements in artificial intelligence (AI), real-time data analytics, and 5G connectivity. AI-powered robotic assistants are becoming increasingly sophisticated, capable of performing complex surgical procedures with greater accuracy and precision than humanly possible. These robots can also automate repetitive tasks in hospitals, freeing up medical professionals to focus on more critical aspects of patient care. 5G connectivity is enabling the development of tele-surgery, where surgeons can perform procedures remotely using robotic systems, expanding access to specialized care for patients in remote areas. In addition to surgical applications, soft robotics, exoskeletons, and wearable robotic devices are gaining traction in rehabilitation and elderly care. These technologies can help patients regain mobility and independence after injury or illness, and assist elderly individuals with daily tasks. As the use of medical robots becomes more widespread, cybersecurity and data security are paramount. Increased investments in robust cybersecurity protocols and blockchain-based robotic networks are addressing these concerns, ensuring the safe and efficient delivery of robotic-assisted healthcare.

Key Players

-

Intuitive Surgical, Inc.

-

Medtronic plc

-

Stryker Corporation

-

Zimmer Biomet Holdings, Inc.

-

Smith & Nephew plc

-

Siemens Healthineers AG

-

Accuray Incorporated

-

Titan Medical Inc.

-

Ekso Bionics Holdings, Inc.

-

Renishaw plc

Chapter 1. Medical Robotics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Medical Robotics Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Medical Robotics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Medical Robotics Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Medical Robotics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Medical Robotics Market – By Product Type

6.1 Introduction/Key Findings

6.2 Surgical Robots

6.3 Rehabilitation Robots

6.4 Hospital & Pharmacy Robots

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2025-2030

Chapter 7. Medical Robotics Market – By Application

7.1 Introduction/Key Findings

7.2 Orthopedics

7.3 Neurosurgery

7.4 Laparoscopy

7.5 Pharmacy Automation

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 8. Medical Robotics Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Medical Robotics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Intuitive Surgical, Inc.

9.2 Medtronic plc

9.3 Stryker Corporation

9.4 Zimmer Biomet Holdings, Inc.

9.5 Smith & Nephew plc

9.6 Siemens Healthineers AG

9.7 Accuray Incorporated

9.8 Titan Medical Inc.

9.9 Ekso Bionics Holdings, Inc.

9.10 Renishaw plc

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The market was valued at USD 13.5 billion in 2024 and is projected to reach USD 32.8 billion by 2030, growing at a CAGR of 19.4% during the forecast period.

Key drivers include the rising demand for minimally invasive surgeries (MIS), technological advancements in AI-powered robotics, increasing applications in rehabilitation and elderly care, and growing investments in healthcare automation.

The market is segmented by Product Type (Surgical Robots, Rehabilitation Robots, Hospital & Pharmacy Robots, Others) and by Application (Orthopedics, Neurosurgery, Laparoscopy, Pharmacy Automation, Others).

North America is the leading region, holding a 40% market share in 2024, driven by technological advancements, high adoption of robotic-assisted surgeries, and strong regulatory approvals.

Major players include Intuitive Surgical, Medtronic, Stryker, Zimmer Biomet, Smith & Nephew, Siemens Healthineers, Accuray, Titan Medical, Ekso Bionics, and Renishaw.