Surgical Robots Market Size (2025 – 2030)

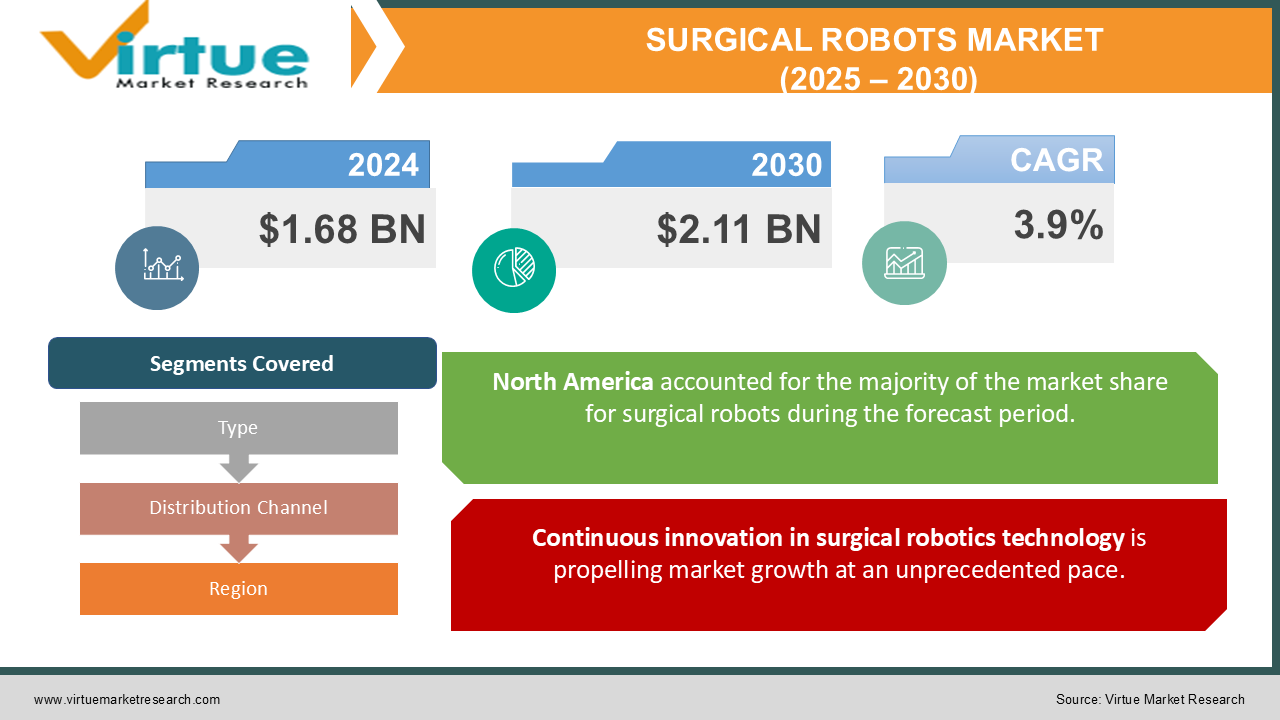

The Surgical Robots Market was valued at USD 1.68 Billion in 2024 and is projected to reach a market size of USD 2.11 Billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 3.9%.

The surgical robots market represents a transformative segment of the healthcare technology industry, revolutionizing the way surgeries are performed across various medical specialties. Surgical robots are sophisticated, computer-assisted systems that enhance the precision, flexibility, and control of surgeons during complex procedures. These machines bridge the gap between traditional surgical methods and the need for minimally invasive techniques. Their applications span a wide range of medical fields, including urology, gynaecology, orthopaedics, general surgery, and cardiology, enabling unprecedented surgical outcomes. The growing adoption of surgical robots is driven by their ability to minimize human error, reduce recovery times, and enhance patient safety. Unlike conventional surgery, robotic-assisted procedures allow for enhanced visualization, higher dexterity, and unparalleled accuracy These factors collectively make the surgical robots market a cornerstone of modern healthcare, with immense potential for continued growth and innovation.

Key Market Insights:

-

Over 200,000 robotic-assisted surgeries were performed worldwide in 2023.

-

Surgical robots accounted for 15% of all minimally invasive surgeries globally.

-

Approximately 12,000 surgical robots were operational across hospitals and surgical centers in 2023.

-

The average cost of a surgical robot in 2023 ranged from $1.5 million to $3 million.

-

Training surgeons on robotic systems required an average of 30 hours of specialized instruction.

-

The maintenance cost of surgical robots averaged $150,000 annually per system.

-

Robotic systems reduced surgical complication rates by 30% compared to traditional methods.

-

Robotic-assisted surgeries decreased hospital stays by an average of 2.5 days per patient.

-

General surgeries made up 40% of all robotic-assisted procedures in 2023.

-

Urological applications constituted 25% of surgical robot usage globally.

-

The use of surgical robots in gynaecology grew by 20% from the previous year.

-

Orthopaedic robotic systems contributed to 18% of all robotic-assisted surgeries.

-

Cardiothoracic applications accounted for 10% of the surgical robot market.

-

Over 75% of top-tier hospitals worldwide adopted robotic systems in their operating rooms.

-

An estimated 50,000 surgeons received certification for robotic surgery in 2023.

Market Drivers:

The growing preference for minimally invasive surgical procedures has become a significant driver for the surgical robot's market.

Traditional open surgeries often result in extended hospital stays, higher risks of complications, and prolonged recovery periods. However, robotic-assisted surgeries address these challenges by enabling smaller incisions, reduced blood loss, and faster healing. Patients and healthcare providers alike are gravitating toward these benefits, creating robust demand for surgical robots globally. Minimally invasive procedures performed using robotic systems enhance the surgeon's dexterity and precision, allowing access to hard-to-reach areas while reducing the risk of collateral damage to surrounding tissues. Similarly, robotic-assisted prostatectomies are now considered the gold standard in urological oncology due to superior outcomes, such as lower rates of incontinence and sexual dysfunction. Healthcare systems are increasingly prioritizing minimally invasive techniques to enhance patient satisfaction and reduce costs associated with extended hospitalization. Surgical robots play a critical role in achieving these objectives, leading to widespread adoption across hospitals, ambulatory surgical centers, and specialty clinics. The growing emphasis on patient-cantered care and precision medicine further fuels the demand for robotic systems in minimally invasive procedures.

Continuous innovation in surgical robotics technology is propelling market growth at an unprecedented pace.

The integration of artificial intelligence (AI), machine learning, and augmented reality (AR) into surgical robots has transformed the capabilities of these systems. Modern robotic platforms now offer enhanced visualization, real-time imaging, and autonomous assistance, allowing surgeons to perform complex procedures with unprecedented accuracy. For example, AI-powered surgical robots can analyse intraoperative data and provide surgeons with predictive insights, improving decision-making during critical phases of surgery. AR-enabled systems superimpose digital overlays onto real-time views of the surgical site, offering unparalleled guidance for navigation and precision. These advancements are particularly beneficial in fields like neurosurgery and orthopaedics, where millimetre-level accuracy is crucial. Another significant development is the emergence of haptic feedback technology in robotic systems. This feature allows surgeons to "feel" the tissue resistance during robotic-assisted procedures, replicating the tactile sensation of traditional surgery. Additionally, the miniaturization of robotic instruments has expanded their applicability to paediatric and micro-surgeries, addressing a broader range of medical needs. The technological sophistication of surgical robots has also opened doors for remote surgery and telemedicine. Surgeons can now perform procedures on patients located thousands of miles away using tele-operated robotic systems, breaking geographical barriers and enabling access to expert care in underserved regions.

Market Restraints and Challenges:

Despite the promising potential of surgical robots, the market faces several barriers that hinder widespread adoption. High costs remain one of the most significant challenges, as acquiring and maintaining robotic systems involves substantial financial investments. This limits their accessibility to well-funded hospitals and specialty clinics, leaving smaller healthcare providers and developing regions underserved. Additionally, the steep learning curve associated with operating robotic systems poses a challenge for surgeons and healthcare institutions. Mastery of robotic-assisted surgery requires extensive training and certification, which can be time-consuming and resource-intensive. The lack of adequately trained personnel in certain regions further exacerbates this issue, creating a bottleneck for market growth. Regulatory and ethical considerations also present obstacles to the proliferation of surgical robots. Stringent approval processes for new robotic systems can delay their commercialization, while concerns about data privacy and cybersecurity in AI-powered robots remain unresolved. Furthermore, the potential for machine errors or malfunctions raises questions about liability and patient safety.

Market Opportunities:

The surgical robot's market is teeming with opportunities, particularly in the areas of technological innovation and expanding applications. The development of cost-effective robotic systems tailored for specific medical specialties offers immense potential for market growth. For instance, introducing low-cost robotic platforms for general surgeries could democratize access to robotic-assisted procedures in resource-constrained settings. Emerging economies present another lucrative opportunity for market players. As healthcare infrastructure in these regions improves, the demand for advanced medical technologies, including surgical robots, is expected to surge. Governments and private investors are increasingly funding healthcare modernization projects, creating fertile ground for the adoption of robotic systems. The integration of AI and big data analytics into robotic surgery holds the promise of transformative advancements. Future surgical robots equipped with real-time data analysis capabilities could predict patient outcomes, recommend optimal surgical approaches, and adapt to unforeseen complications during procedures. These innovations could redefine surgical practices and establish new standards of care.

SURGICAL ROBOTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

3.9% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Intuitive Surgical, Medtronic, Stryker Corporation, Zimmer Biomet, Smith & Nephew, Johnson & Johnson, Siemens Healthineers, Globus Medical, Asensus Surgical, CMR Surgical |

Surgical Robots Market Segmentation: By Type

-

Laparoscopic Surgical Robots

-

Orthopaedic Surgical Robots

-

Neurological Surgical Robots

-

Robotic Catheters

-

Others

Most Dominant Type: Laparoscopic surgical robots hold the largest market share due to their wide applications in various medical fields and the ongoing preference for minimally invasive surgeries. Their high precision and ability to perform complex procedures with smaller incisions make them a leading choice in hospitals worldwide.

Fastest-Growing Type: The orthopaedic segment is experiencing rapid growth due to the increasing prevalence of musculoskeletal disorders such as arthritis and the rising number of orthopaedic surgeries. The precision offered by robotic systems in these surgeries is expected to significantly improve patient outcomes, making this segment particularly attractive to both hospitals and surgical centers.

Surgical Robots Market Segmentation: By Distribution Channel

-

Hospitals

-

Ambulatory Surgical Centers

-

Specialty Clinics

-

Others

Fastest-Growing Channel: ASCs are expected to experience the fastest growth in robotic surgery adoption. The increased demand for outpatient procedures, rising healthcare costs, and advancements in robotic technology that make these systems more affordable have contributed to this trend. Ambulatory centers offer cost-effective care, making them an attractive option for robot-assisted surgery.

Most Dominant Channel: Due to the broad range of applications, hospitals continue to dominate the market. They account for the majority of surgical robot purchases, as they are equipped to handle the ongoing maintenance and integration of these technologies into their surgical departments.

Surgical Robots Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East and Africa

Most Dominant Region: North America leads the market due to its well-established healthcare infrastructure, high healthcare expenditure, and a robust ecosystem of innovation in medical technology. Factors such as a high prevalence of chronic conditions like cancer, cardiovascular diseases, and orthopaedic disorders fuel demand for surgical robots.

Fastest-Growing Region: Asia-Pacific is witnessing rapid growth due to rising healthcare investments, growing medical tourism, and increasing awareness about robotic-assisted surgeries. Emerging economies like China, India, and South Korea are key contributors to the region's growth. The growing middle-class population, coupled with rising disposable incomes, is increasing the demand for advanced medical technologies. Governments in the region are emphasizing healthcare infrastructure development, further propelling market growth.

COVID-19 Impact Analysis on the Surgical Robots Market:

The COVID-19 pandemic disrupted the surgical robot's market in both positive and negative ways. Elective surgeries were postponed prioritizing resources for COVID-19 patients, leading to a temporary decline in the utilization of surgical robots. However, the crisis also underscored the importance of minimally invasive procedures that minimize patient recovery times and hospital stays, boosting the demand for robotic systems post-pandemic.

Latest Trends and Developments:

In 2023, the surgical robots market witnessed a surge in AI-driven innovation. Robotic systems integrated with machine learning algorithms demonstrated enhanced adaptability, allowing them to learn from each procedure and improve over time. The advent of portable and modular robotic systems also marked a significant trend, enabling greater flexibility in operating room setups. Moreover, partnerships between tech companies and healthcare providers accelerated the development of cutting-edge robotic platforms tailored for specific surgical applications.

Key Players in the Market:

-

Intuitive Surgical

-

Medtronic

-

Stryker Corporation

-

Zimmer Biomet

-

Smith & Nephew

-

Johnson & Johnson

-

Siemens Healthineers

-

Globus Medical

-

Asensus Surgical

-

CMR Surgical

Chapter 1. Surgical Robots Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Surgical Robots Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Surgical Robots Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Surgical Robots Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Surgical Robots Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Surgical Robots Market – By Type

6.1 Introduction/Key Findings

6.2 Laparoscopic Surgical Robots

6.3 Orthopaedic Surgical Robots

6.4 Neurological Surgical Robots

6.5 Robotic Catheters

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. Surgical Robots Market – By Distribution Channel

7.1 Introduction/Key Findings

7.2 Hospitals

7.3 Ambulatory Surgical Centers

7.4 Specialty Clinics

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Distribution Channel

7.7 Absolute $ Opportunity Analysis By Distribution Channel, 2025-2030

Chapter 8. Surgical Robots Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Distribution Channel

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Distribution Channel

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Distribution Channel

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Distribution Channel

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Distribution Channel

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Surgical Robots Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Intuitive Surgical

9.2 Medtronic

9.3 Stryker Corporation

9.4 Zimmer Biomet

9.5 Smith & Nephew

9.6 Johnson & Johnson

9.7 Siemens Healthineers

9.8 Globus Medical

9.9 Asensus Surgical

9.10 CMR Surgical

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Modern surgical robots are equipped with sophisticated sensors, advanced imaging systems, and real-time feedback mechanisms. These features enable surgeons to perform complex procedures with unparalleled accuracy.

Robotic systems can cost millions of dollars, making them a financial burden, particularly for smaller hospitals and clinics.

Key companies driving advancements in the sector include Intuitive Surgical, known for its da Vinci Surgical System, and Medtronic, which has pioneered various robotic solutions. Other notable players such as Stryker Corporation, Zimmer Biomet, and Smith & Nephew are leveraging technological innovation to expand their offerings. Johnson & Johnson, through its subsidiary Ethicon, continues to make strides in robotic-assisted surgeries.

North America currently holds the largest market share, estimated around 35%.

Asia Pacific has shown significant room for growth in specific segments.