GLOBAL ORGANIC LAMB MEAT MARKET SIZE (2023 - 2030)

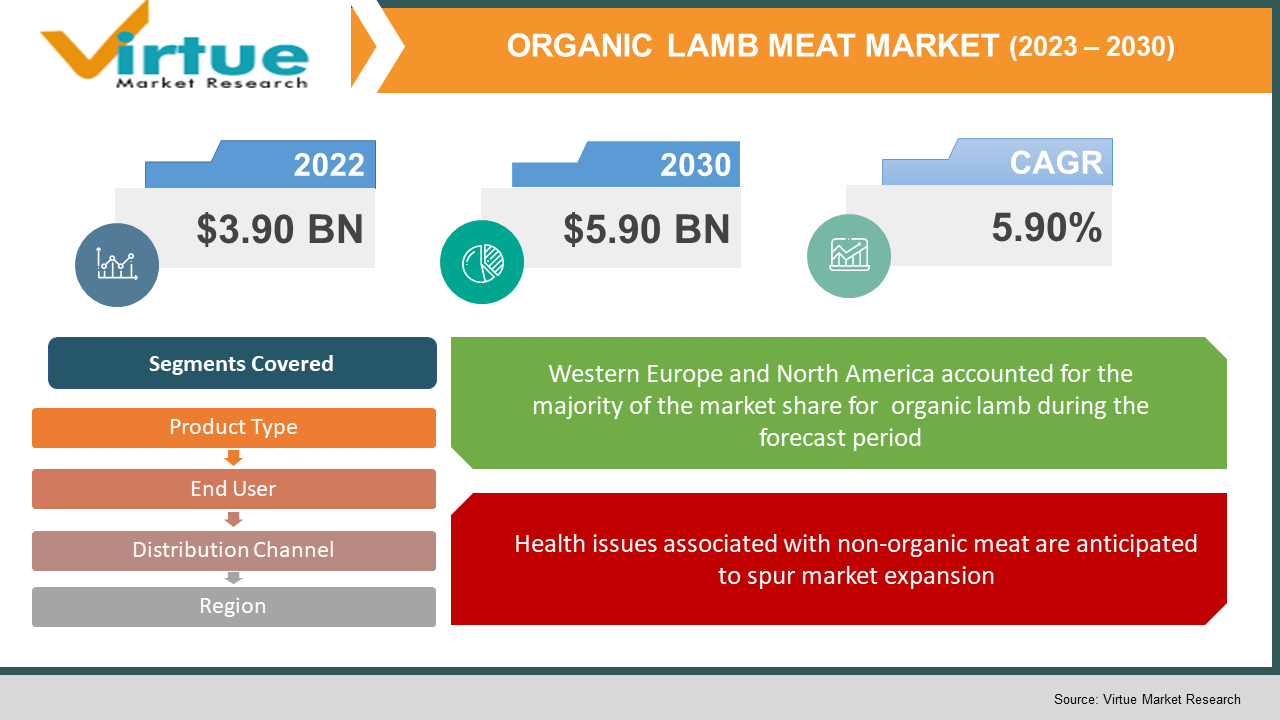

The Global Organic Lamb Meat Market valued at USD 3.90 Billion in 2022 and is projected to reach a market size of USD 5.90 Billion by the end of 2030. Over the forecast period of 2023-2030, the market is projected to grow at a CAGR of 5.3%.

Industry Overview:

Organic lamb is raised without the use of antibiotics to assure contamination-free meat. There are many different kinds of cattle feed, including grain-fed (soy, maize, and others), barley-fed, and grass-fed (forage), all of which typically include vitamins and minerals as supplements to improve the overall quality of the feed without the use of artificial substances. Compared to conventionally raised meat, organic lamb is a good source of omega-3 unsaturated fatty acids and antioxidants (flavonoids and anthocyanins), which have several health benefits like reducing cholesterol and fending off free radicals. It is advantageous for both environmental and human health. Additionally, organic lamb has caught the attention of meat connoisseurs all around the world due to its mild flavor and chewability. Numerous oversight organizations exist all over the world, such as the Australian Organic Standard (ACO) and the United States Department of Agriculture (USDA), that is in charge of periodically enforcing the laws and guidelines to guarantee the safety and caliber of organic meat. The prognosis for the organic lamb business is particularly alluring as consumer health consciousness continues to rise. Additionally, rising instances of meat contamination, rising disposable incomes, rising use of dietary vitamin and mineral supplements, and rising meat consumption are the factors estimated to propel the expansion of the organic lamb market. Rapid changes in consumer habits and an increase in the working population have led to a strong preference for convenience foods. To draw in more customers, producers in the organic lamb industry are increasingly providing ready-to-cook organic lamb products. To broaden their product offerings, several major participants in the organic lamb production industry provide specialty lamb cuts such as ground lamb, dried lamb, and others. E-Commerce facilitates the sale of goods and the direct delivery of those goods to customers, thereby addressing the convenience issue. The market for organic lamb is anticipated to grow over the next several years as manufacturers put more emphasis on providing convenience and health benefits.

COVID-19 pandemic impact on Organic Lamb Meat Market

The organic lamb meat market was significantly impacted by the COVID-19 outbreak. The majority of organic lamb is consumed in dining establishments. A slowdown in the food service sector brought on by COVID-19 has affected the development of the organic lamb market. The supply chain and distribution system for organic lamb has also been impacted as a result of the stoppage of commercial operations and production procedures. The majority of industries are advancing, nonetheless, as lockout limitations are being relaxed in numerous nations. As a result, in the post-COVID period, the organic lamb market is anticipated to experience a significant growth rate.

MARKET DRIVERS:

Health issues associated with non-organic meat are anticipated to spur market expansion

Meat from animals that have been given growth hormones and various antibiotics is associated with several health issues. As a result, consumers are becoming more conscious of their health and are demanding more organic foods. Organic meat extends various benefits as a great source of vital vitamins and antioxidants. Fresh food from the farm, which has health advantages and is pesticide-free, is more popular with consumers. Restaurants are including organic food on their menus more frequently as a result of the perception that organic food is more enticing than conventional cuisine.

The industry is expanding due to rising consumer preference for premium organic food products

Rising preferences for high-end organic products are also influenced by growing environmental concerns. Consumers are spending more money on organic food items nowadays because they place a high value on their health, which benefits the organic lamb industry. The popularity of organic food has grown as people are becoming more aware of the harm that chemicals in food can do to human health. The absence of toxic pesticides, fertilizers, and chemicals in organic food provides consumers with all-natural products and additional advantages. Consumers are interested in learning about the source, production process, and quality of the food they eat. Demand for transparency and traceability is increasing as a result of the prior attention given to food safety issues and the increased awareness of potential risks associated with the products that consumers consume.

MARKET RESTRAINTS:

High rearing costs may limit market growth for organic lamb meat

The organic lamb must be raised under very tight regulations that are determined by the nation's regulatory organizations. There can be no antibiotics or growth promoters provided to the cattle, and their diet must only consist of 100% organic feed. This makes it an expensive and time-consuming process because extra care must be taken of the cattle to follow these strict regulations, and suitable procedures must be in place. This expense is inevitably passed on to the consumer, driving up the price of organic lamb and impeding the market's potential for expansion.

Challenge of growing uncertainty in the organic lamb market

The health and well-being of the livestock are essential for the organic lamb's growth. The ban on some medications, such as antibiotics, can leave livestock extremely susceptible, and any sick or damaged sheep treated with such treatment cannot be sold in the organic lamb market. In the organic lamb market, some obstacles must be removed, like the high cost and limited supply of organically certified feedstuff and fodder. Customers in emerging economies are also skeptical of the authenticity and quality of organic lamb due to the inadequate infrastructure for organic certification. A factor posing a challenge to the market's growth is predicted to be the growing voices of animal welfare organizations like PETA, Animal Welfare Institute, and many others calling for an end to animal slaughter and the promotion of general well-being.

GLOBAL ORGANIC LAMB MEAT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2022 - 2030 |

|

Base Year |

2022 |

|

Forecast Period |

2023 - 2030 |

|

CAGR |

5.3 % |

|

Segments Covered |

By Product Type, Distribution Channel, End User and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Thomas Food International, Arcadian Organic & Natural Meat, Colin & Sally’s Organic Lamb & Beef, Mallow Farm & Cottage, Elliott Agriculture, Good Earth Farms, Tulip Ltd, Sunshine Coast Organic Meats, Swillington Organic Farm, Pitney Farm Shop. |

This research report on the Organic Lamb Meat market has been segmented based on product type, distribution channel, end-user, and region.

Organic Lamb Meat Market – By Product Type

-

Raw Lamb

-

Processed Lamb

Based on Product Type, the Organic Lamb Meat Market is categorized into Raw Lamb and Processed Lamb. Lambs that have been processed after being slaughtered provide meat items known as processed lambs. Typically, they take the shape of ground beef, minced lamb, roasted legs, racks with bones, or lamb sausage. Processed lamb is popular with individuals who don't want to cook an entire animal for one dinner because it has already been partially cooked by being grilled or roasted before processing, so there isn't much left to do other than make side dishes.

Organic Lamb Meat Market – By Distribution Channel

-

Direct Sales

-

Indirect Sales

-

Modern Trade

-

Convenience Stores

-

E-Retailers

-

Specialty Stores

-

Others

-

Based on Distribution Channel, the Organic Lamb Meat Market is categorized into Direct Sales and Indirect Sales. The offline Organic Lamb Meat Market held the highest share in 2021. The infrastructure in numerous developing nations and consumer tastes have undergone various changes as a result of widespread modernization. People now prefer to buy more items from modern retailers like supermarkets, hypermarkets, and convenience stores because they offer a variety of advantages to customers, including well-presented products, trolley support, standard-quality products, presence in prime locations close to PVRs, and convenience of shopping from one place. Therefore, active shoppers are willing to spend more to buy in such facilities. Therefore, active shoppers are willing to spend more to buy in such facilities. Additionally, the internet sector is anticipated to increase at the quickest rate between 2022 and 2030, with a CAGR of 6.8%. E-commerce enterprises can now easily offer their services in underdeveloped areas because of the conveniences of a better network, Google Maps support, and regenerating infrastructure. More favorable shopping offers, time-saving features, substantial savings, and 24-hour purchasing alternatives are extending unwavering opportunities.

Organic Lamb Meat Market – By End User

-

Household

-

Food Industry

-

Soups

-

Frozen Snacks

-

Ready Meals

-

Others

-

Based on End Users, the Organic Lamb Meat Market is categorized into Household and Food industries.

In 2021, the Household sector held the biggest proportion. In the household segment, organic lamb is becoming more popular. With no antibiotics, hormones, or chemical fertilizers utilized throughout the animal's growth, it offers consumers high-quality meat. Organic Lamb can be eaten raw for a quick meal, and stews, curries, and pasta sauces are other highly popular options. When cooked properly, the organic lamb has an aromatic quality that makes it stand out from other meats in flavor (e.g., beef). During the COVID-19 pandemic, customers stopped or restricted eating at food service establishments to avoid the risk of contracting the virus.

The food industry segment is anticipated to increase at the quickest rate from 2023 - 2030, with a CAGR of 7.1%. Several uses for organic lamb exist in the food business. It can be used to make high-quality meat dishes like sausages, burgers, and mincemeat, or it can be combined with other ingredients to make organic lamb patties or burger sliders that are served in restaurants and take-out food outlets all over the world. As an alternative, raw organic lamb can be used in stews, curries, and tagines; people in Asia Pacific nations like to eat it this way. The commercial sector can benefit from organic lamb since it can be used to produce healthier meat. Lamb that is grown organically has higher levels of Omega-6 fatty acids than conventional beef or pork, and it offers more protein and less fat (especially saturated fats) per serving than other meats.

Organic Lamb Meat Market - By Region:

-

North America

-

Europe

-

Asia-Pacific

-

Rest of the World

The organic lamb market is dominated by Western Europe and North America, and it is projected that these regions will continue to grow over the coming years. Geographically, the European organic lamb meat market accounted for the largest revenue share in 2021. The high production of lamb and related goods in nations like the United Kingdom, New Zealand, and others is one reason for this market's rise. Additionally, these nations have a higher concentration of organic farms than other regions of the world, which is enabling the organic lamb industry to soar. Additionally, improved organic production regulations in the European Union guarantee the great quality of lamb, which draws many customers to it. The U.S. is one of the major markets for consumer sales due to rising demand from consumers seeking products with better nutritional value and increased demand for organic lamb meat.

Asia-Pacific is estimated to develop at the quickest CAGR over the forecast period. The population is expanding, and meat consumption is rising. People have incorporated nutrient-dense food as an essential component of their diets as a result of the rising number of health issues. The two main factors influencing the growth of the organic lamb market are shifting consumer tastes and preferences and rising health consciousness.

Latin America's organic lamb meat market growth is driven by strong consumer demand from households and the rising awareness of the health advantages of consuming more natural food products. It is anticipated that during the projected period, demand for processed meats in restaurants and other commercial settings will rise.

Major Key Players in the Market

-

Thomas Food International

-

Arcadian Organic & Natural Meat

-

Colin & Sally’s Organic Lamb & Beef

-

Mallow Farm & Cottage

-

Elliott Agriculture

-

Good Earth Farms

-

Tulip Ltd

-

Sunshine Coast Organic Meats

-

Swillington Organic Farm

-

Pitney Farm Shop.

Notable happenings in the Organic Lamb Meat Market in the recent past:

-

Acquisition- In May 2020, The well-known Australian meat processing company "Thomas Food International" announced that it has purchased a 50% ownership stake in the sheep meat business "Frew International" in Victoria, Australia.

-

Product Launch- In September 2020, the Purely grass-fed lamb was successfully introduced into the US market by Pre Brands LLC, a food processing company with US roots that is well known for its organic product offerings. Since Pre Brands raises all of its lambs in New Zealand, where they are let to graze on lush meadows all year long, the product is estimated to become popular right away due to the great quality of the meat.

-

Acquisition- In October 2019, The meat business Tulip Ltd. in the United Kingdom has been successfully acquired by Pilgrim's Pride Corporation, a food firm based in the United States. To complete the acquisition, Pilgrim has made a payment of USD 354. The deal has strengthened Pilgrim's portfolio of UK-focused investments.

Chapter 1. ORGANIC LAMB MEAT MARKET – Scope & Methodology

1.1. Market Segmentation

1.2. Assumptions

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. ORGANIC LAMB MEAT MARKET – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.3. COVID-19 Impact Analysis

2.3.1. Impact during 2024 - 2030

2.3.2. Impact on Supply – Demand

Chapter 3. ORGANIC LAMB MEAT MARKET – Competition Scenario

3.1. Market Share Analysis

3.2. Product Benchmarking

3.3. Competitive Strategy & Development Scenario

3.4. Competitive Pricing Analysis

3.5. Supplier - Distributor Analysis

Chapter 4. ORGANIC LAMB MEAT MARKET - Entry Scenario

4.1. Case Studies – Start-up/Thriving Companies

4.2. Regulatory Scenario - By Region

4.3 Customer Analysis

4.4. Porter's Five Force Model

4.4.1. Bargaining Power of Suppliers

4.4.2. Bargaining Powers of Customers

4.4.3. Threat of New Entrants

4.4.4. Rivalry among Existing Players

4.4.5. Threat of Substitutes

Chapter 5. ORGANIC LAMB MEAT MARKET - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. ORGANIC LAMB MEAT MARKET – By Product Type

6.1. Raw Lamb

6.2. Processed Lamb

Chapter 7. ORGANIC LAMB MEAT MARKET – By Distribution Channel

7.1. Direct Sales

7.2. Indirect Sales

7.2.1. Modern Trade

7.2.2 Covienience Stores

7.2.3. E- Retailers

7.2.4. Speciality Stores

7.2.5. Others

Chapter 8. ORGANIC LAMB MEAT MARKET – By End User

8.1. Household

8.2. Food Industry

8.2.1. Soups

8.2.2. frozen Snacks

8.2.3. Ready Meals

8.2.4. Others

Chapter 9. ORGANIC LAMB MEAT MARKET – By Region

9.1. North America

9.2. Europe

9.3. Asia-Pacific

9.4. Latin America

9.5. The Middle East

9.6. Africa

Chapter 10. ORGANIC LAMB MEAT MARKET – By Companies

10.1. Thomas Food International

10.2. Arcadian Organic & Natural Meat

10.3. Colin & Sallys Organic Lamb & Beef

10.4. Mallow Farm & Cottages

10.5. Elliot Agriculture

10.6. Good Earth Farms

10.7. Tulip Ltd

10.8. Sunshine Coast Organic Meats

10.9. Swillington Farms Inc

10.10. Pitney Farm Shop

Download Sample

Choose License Type

2500

4250

5250

6900