Open Finance Market Size (2024 – 2030)

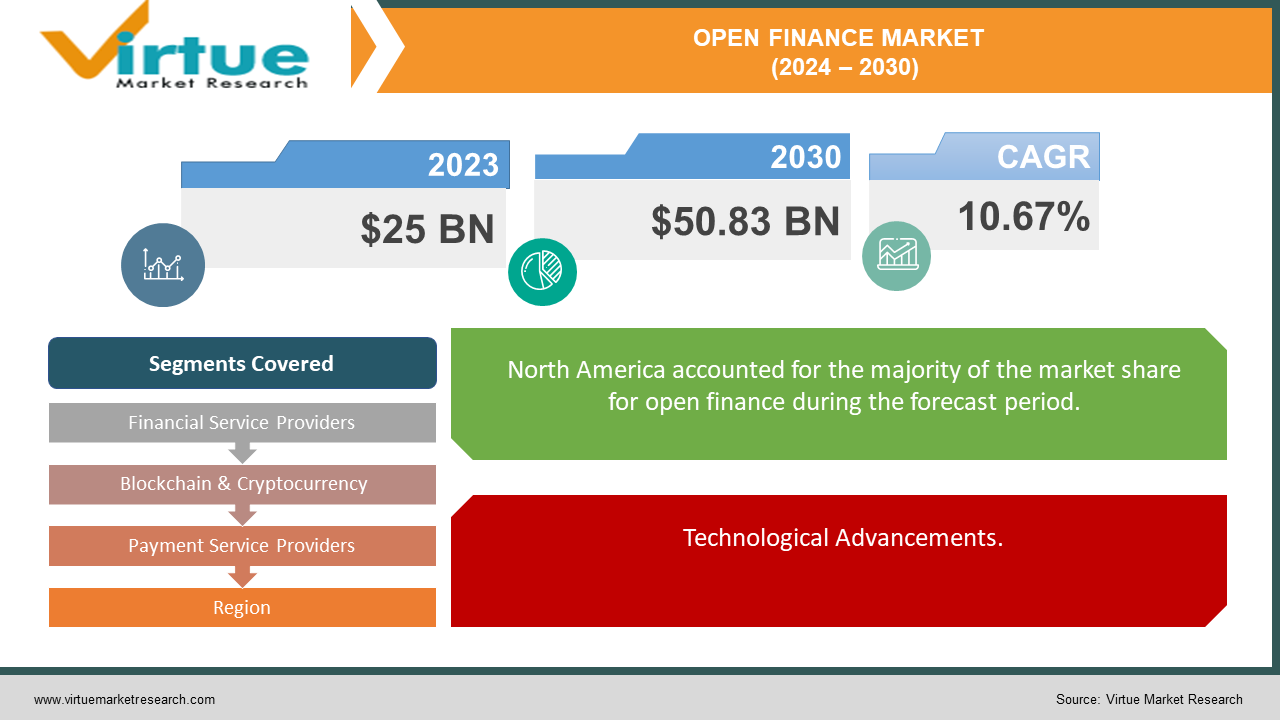

The global open finance market is projected to grow from an estimated USD 25 billion in 2023 to USD 50.83 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 10.67% over the forecast period of 2024-2030.

The open finance market expansion is fueled by increasing adoption of digital financial services, including mobile payments, peer-to-peer lending, and blockchain-based solutions, which enhance accessibility and efficiency in financial transactions. Regulatory developments supporting open banking initiatives globally further accelerate innovation, fostering a competitive landscape where traditional financial institutions and agile fintech firms collaborate and compete.

With a focus on enhancing financial inclusion, transparency, and customer-centricity, the open finance market promises to reshape how individuals and businesses interact with financial services, driving economic empowerment and technological integration across diverse markets worldwide.

Key Insights:

-

Fintech companies are projected to capture over 35% of the open finance market share by 2025, up from 15% in 2020, showcasing rapid adoption and market expansion.

-

By 2025, open banking initiatives are estimated to be implemented in over 80 countries worldwide, up from 40 countries in 2020, indicating widespread regulatory support and market penetration.

-

Over 60% of consumers surveyed express a preference for digital banking services over traditional banking methods, underscoring the growing demand for convenient and accessible financial solutions.

Global Open Finance Market Drivers:

Technological Advancements.

Rapid advancements in financial technology (fintech) are driving the evolution of the global open finance market. Innovations such as blockchain, artificial intelligence, and machine learning are revolutionizing financial services, enabling faster and more secure transactions, personalized customer experiences, and efficient risk management strategies.

Regulatory Initiatives.

Increasing regulatory support for open banking and open finance initiatives worldwide is a significant driver. Governments and regulatory bodies are mandating greater data transparency and interoperability among financial institutions, fostering competition, innovation, and consumer choice. Regulatory frameworks are evolving to ensure security, privacy, and fair competition in the open finance landscape.

Consumer Demand for Convenience.

Growing consumer preference for seamless digital experiences and personalized financial services is another critical driver. Customers increasingly seek convenient access to their financial data and services through mobile apps, digital wallets, and integrated platforms. This demand is prompting financial institutions and fintech firms to innovate rapidly to meet customer expectations and enhance user engagement.

Global Open Finance Market Restraints and Challenges:

Regulatory Complexity: Navigating a Patchwork of Laws.

The global open finance market grapples with a labyrinth of regulatory frameworks across different jurisdictions, presenting a significant barrier to seamless implementation. Varied data protection laws, differing standards of security protocols, and disparate rules on interoperability complicate compliance efforts for financial institutions and fintech firms alike. Harmonizing regulatory requirements and fostering international cooperation are critical steps to streamline operations and enhance market confidence.

Data Privacy Challenges: Safeguarding Consumer Trust.

Data privacy concerns loom large as consumers demand greater transparency and control over their financial information in open finance ecosystems. The need to uphold stringent data protection standards while ensuring seamless data sharing poses a delicate balance. Implementing robust encryption measures, transparent data handling practices, and empowering consumers with consent management tools are pivotal in building and maintaining trust amidst evolving regulatory expectations and growing cyber threats.

Legacy Systems Overhaul: Modernizing Infrastructure for Digital Transformation.

The integration of open finance solutions faces hurdles due to legacy systems prevalent in traditional financial institutions. These systems, designed for closed environments, often lack the agility and compatibility needed to support open APIs and real-time data sharing. Investing in comprehensive digital transformation strategies, including system upgrades, cloud adoption, and agile development methodologies, is essential to unlock the full potential of open finance innovations.

Global Open Finance Market Opportunities:

Expansion of Fintech Innovation: Pioneering New Financial Services.

The global open finance market presents a fertile ground for fintech innovation, offering opportunities to develop and deploy cutting-edge solutions. Fintech startups are leveraging open APIs and data-sharing capabilities to create novel financial products and services, including personalized banking experiences, automated wealth management solutions, and seamless cross-border payments. These innovations not only cater to evolving consumer preferences but also drive industry-wide disruption by enhancing efficiency, accessibility, and financial inclusion.

Enhanced Customer Engagement: Empowering Consumer Choice.

Open finance initiatives empower consumers with greater control over their financial data, enabling them to access a wider range of personalized services. By integrating multiple financial accounts and services into unified platforms, such as digital wallets and financial management apps, customers benefit from streamlined experiences and enhanced convenience. This shift towards customer-centric solutions fosters deeper engagement, loyalty, and satisfaction, driving market growth and expanding opportunities for fintech firms and financial institutions alike.

Collaborative Ecosystems: Fostering Partnerships and Innovation.

The open finance landscape encourages collaboration among diverse stakeholders, including banks, fintech startups, regulatory bodies, and technology providers. Partnerships facilitate the development of interoperable solutions, enabling seamless data exchange and enhancing service delivery. Collaborative ecosystems foster innovation by leveraging collective expertise and resources to address industry challenges, explore new market opportunities, and set standards for best practices. Embracing a collaborative approach is pivotal in unlocking the full potential of open finance and driving sustainable growth in the global financial ecosystem.

OPEN FINANCE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.67% |

|

Segments Covered |

By Financial Service Providers, Blockchain & Cryptocurrency, Payment Service Providers, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Coinbase, Binance, Square, Inc., Robinhood, Kraken, Gemini, Stripe, Revolut Celsius Network, Aave, Compound, Uniswap |

SEGMENTATION ANALYSIS

Open Finance Market Segmentation: By Financial Service Providers:

-

Loans

-

Savings accounts

-

Investment services

In the realm of open finance market segmentation by financial service providers, investment services emerge as pivotal due to their ability to offer personalized financial management solutions through digital platforms. These services, encompassing robo-advisors, brokerage options, and wealth management tools, leverage data analytics and AI to deliver tailored investment strategies and real-time market insights. The transparency facilitated by open APIs enhances accessibility across various financial accounts, fostering seamless integration and operational efficiency. With increasing demand for customized financial solutions, investment services are positioned to drive significant growth and innovation within the global open finance landscape.

Open Finance Market Segmentation: By Blockchain & Cryptocurrency:

-

Decentralized finance (DeFi)

-

Cryptocurrency exchanges

-

Blockchain-based financial services

Among the segments in blockchain and cryptocurrency within the open finance market, decentralized finance (DeFi) stands out as the most effective in reshaping financial ecosystems globally. DeFi platforms utilize blockchain technology to offer decentralized lending, borrowing, trading, and yield farming services, all without intermediaries. This approach democratizes financial services, providing users worldwide with access to financial products traditionally limited to institutional investors. DeFi's efficiency, transparency, and low transaction costs attract a growing user base seeking alternatives to traditional banking and finance. Furthermore, its interoperability across different blockchain networks fosters a vibrant ecosystem of innovative applications and protocols, driving continuous development and expanding opportunities for financial inclusion on a global scale. As regulatory frameworks evolve to accommodate DeFi's rapid growth, its potential to transform the financial landscape remains significant, offering a decentralized alternative to traditional financial systems.

Open Finance Market Segmentation: By Payment Service Providers:

-

Credit card issuer

-

Payment processors

-

Digital wallet

Among payment service providers in the open finance market, digital wallets stand out as the most effective segment, revolutionizing financial transactions with their versatility and convenience. These wallets, accessible through mobile apps or online platforms, securely store and manage various digital currencies and fiat money, facilitating seamless payments across diverse merchants and services. Beyond transactions, they integrate features like loyalty programs and financial management tools, enhancing user engagement and utility. With robust security measures such as biometric authentication and blockchain technology, digital wallets ensure safe and efficient peer-to-peer transfers and international remittances, catering to the increasing global demand for mobile and digital payment solutions. Their role in driving financial inclusion and transforming consumer behavior makes digital wallets pivotal in shaping the future of the open finance landscape.

Open Financial Services Market: By Region:

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

In the global market for [insert specific market], regional distribution reflects a diverse landscape of economic activity and consumer demand. North America commands the largest share with 40%, driven by robust technological infrastructure and high consumer spending. Europe follows with 20%, characterized by a mix of mature markets and emerging fintech innovations. The Asia-Pacific region accounts for 25%, showcasing rapid urbanization, expanding middle-class populations, and significant investments in digital financial services. South America and the Middle East and Africa each contribute 10%, influenced by varying levels of economic development and increasing adoption of mobile and digital payment solutions. This regional breakdown underscores the dynamic nature of the market, where regional strengths and evolving consumer preferences shape the trajectory of global market trends.

COVID-19 Impact Analysis on the Global Open Finance Market:

The COVID-19 pandemic has profoundly impacted the global open finance market, triggering both challenges and opportunities across the industry. Initially, the pandemic disrupted traditional financial services and accelerated the shift towards digital solutions. Fintech companies offering digital payments, blockchain-based financial services, and decentralized finance (DeFi) platforms experienced increased demand as consumers sought contactless and remote financial solutions. However, the economic uncertainties and regulatory changes brought by the pandemic posed challenges, particularly in areas of market volatility and cybersecurity risks. Despite these challenges, the pandemic underscored the resilience of open finance technologies in adapting to new norms and driving innovation. Looking forward, the market is poised for continued growth, driven by ongoing digital transformation trends and the evolving regulatory landscape that supports broader adoption of open finance solutions globally.

Latest Trends/ Developments:

In recent years, the global open finance market has witnessed transformative trends and rapid developments shaping the future of financial services. Key trends include the proliferation of decentralized finance (DeFi) platforms, which leverage blockchain technology to offer transparent, peer-to-peer financial services such as lending, borrowing, and trading without intermediaries. Additionally, the rise of digital assets and cryptocurrencies has gained momentum, with increasing institutional adoption and regulatory recognition reshaping the investment landscape. Innovations in artificial intelligence and machine learning are enhancing personalized financial advice and risk management, while open banking initiatives continue to promote data sharing and interoperability among financial institutions. These trends underscore a shift towards democratizing financial services, improving accessibility, and fostering innovation in the global open finance ecosystem. As technology continues to evolve and regulatory frameworks adapt, the market is poised for further expansion and disruption, offering new opportunities and challenges for stakeholders across the financial industry.

Key Players:

-

Coinbase

-

Binance

-

Square, Inc.

-

Robinhood

-

Kraken

-

Gemini

-

Stripe

-

Revolut

-

Celsius Network

-

Aave

-

Compound

-

Uniswap

Chapter 1. Open Finance Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Open Finance Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Open Finance Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Open Finance Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Open Finance Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Open Finance Market – By Financial Service Providers

6.1 Introduction/Key Findings

6.2 Loans

6.3 Savings accounts

6.4 Investment services

6.5 Y-O-Y Growth trend Analysis By Financial Service Providers

6.6 Absolute $ Opportunity Analysis By Financial Service Providers, 2024-2030

Chapter 7. Open Finance Market – By Blockchain & Cryptocurrency

7.1 Introduction/Key Findings

7.2 Decentralized finance (DeFi)

7.3 Cryptocurrency exchanges

7.4 Blockchain-based financial services

7.5 Y-O-Y Growth trend Analysis By Blockchain & Cryptocurrency

7.6 Absolute $ Opportunity Analysis By Blockchain & Cryptocurrency, 2024-2030

Chapter 8. Open Finance Market – By Payment Service Providers

8.1 Introduction/Key Findings

8.2 Credit card issuers

8.3 Payment processors

8.4 Digital wallet

8.5 Y-O-Y Growth trend Analysis By Payment Service Providers

8.6 Absolute $ Opportunity Analysis By Payment Service Providers, 2024-2030

Chapter 9. Open Finance Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Financial Service Providers

9.1.3 By Blockchain & Cryptocurrency

9.1.4 By By Payment Service Providers

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Financial Service Providers

9.2.3 By Blockchain & Cryptocurrency

9.2.4 By Payment Service Providers

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Financial Service Providers

9.3.3 By Blockchain & Cryptocurrency

9.3.4 By Payment Service Providers

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Financial Service Providers

9.4.3 By Blockchain & Cryptocurrency

9.4.4 By Payment Service Providers

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Financial Service Providers

9.5.3 By Blockchain & Cryptocurrency

9.5.4 By Payment Service Providers

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Open Finance Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Coinbase

10.2 Binance

10.3 Square, Inc.

10.4 Robinhood

10.5 Kraken

10.6 Gemini

10.7 Stripe

10.8 Revolut

10.9 Celsius Network

10.10 Aave

10.11 Compound

10.12 Uniswap

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global open financial market is projected to grow from an estimated USD 25 billion in 2023 to USD 50.83 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 10.67% over the forecast period of 2024-2030.

The primary driver of the global open finance market is the increasing demand for decentralized and accessible financial services enabled by blockchain technology and fintech innovations.

The key challenge facing the global open finance market is navigating regulatory complexities and ensuring compliance across various jurisdictions.

In 2023, North America held the largest share of the global open finance market.

Coinbase, Binance, Square, Inc., Robinhood, Kraken, Gemini, Stripe, Revolut, Celsius Network, Aave, Compound, Uniswap are the main players.