Open Banking Market Size (2024 – 2030)

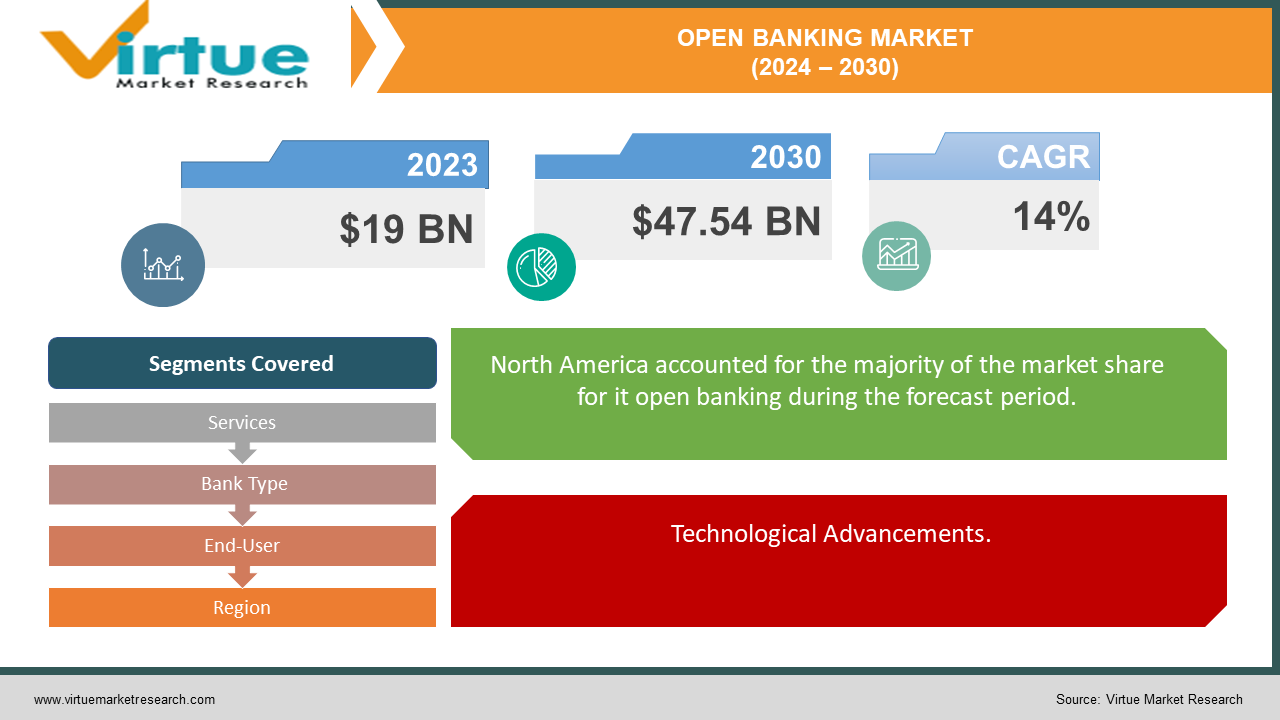

The global open banking market is projected to grow from an estimated USD 19 billion in 2023 to USD 47.54 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 14% over the forecast period of 2024-2030.

The Open Banking market is poised for robust growth, driven by regulatory initiatives, technological advancements, and evolving consumer expectations. As of 2023, the market is valued at approximately USD 19 billion and is projected to reach USD 48 billion by 2030, growing at a Compound Annual Growth Rate (CAGR) of around 14%. This growth is underpinned by the increasing adoption of API technology, artificial intelligence, and blockchain, which enhance the security and efficiency of financial services. Regulatory frameworks, such as PSD2 in Europe, mandate financial institutions to share customer data with third-party providers, fostering innovation and competition. Consumers are increasingly demanding seamless, personalized banking experiences, prompting traditional banks to collaborate with fintech companies. However, challenges such as data security, privacy concerns, and regulatory compliance remain critical considerations for market participants. Overall, the Open Banking market presents significant opportunities for growth and innovation, transforming the financial services landscape.

Key Insights:

Over 70% of major banks worldwide have integrated Open Banking solutions as of 2023, significantly enhancing customer engagement and service personalization.

In 2023, 50% of consumers reported using at least one Open Banking service, with this figure projected to reach 80% by 2027.

The total transaction volume via Open Banking platforms is forecasted to exceed USD 1.5 trillion by 2030, up from USD 500 billion in 2023.

Global Open Banking Market Drivers:

Driving Innovation Through Regulation.

Regulatory frameworks such as the Revised Payment Services Directive (PSD2) in Europe and similar initiatives globally have been pivotal in driving the Open Banking market. These regulations mandate financial institutions to share customer data with third-party providers, fostering competition and innovation. By opening up access to financial data, regulators aim to create a more transparent and efficient financial ecosystem, ultimately benefiting consumers with more choices and better services.

Rising Consumer Expectations for Customized Services.

As digital natives increasingly dominate the consumer base, there is a growing demand for personalized banking experiences. Open Banking enables financial institutions to offer tailored products and services by leveraging comprehensive customer data. This shift towards personalization not only enhances customer satisfaction but also drives customer loyalty, as consumers prefer banking solutions that cater specifically to their unique financial needs and behaviors.

Technological Advancements.

The rapid advancement in technologies such as APIs, artificial intelligence (AI), and blockchain is significantly propelling the Open Banking market forward. APIs facilitate seamless data sharing between banks and third-party providers, while AI and machine learning algorithms enable sophisticated data analysis and predictive insights. Blockchain technology further enhances security and transparency in transactions. These technological innovations collectively contribute to a more secure, efficient, and user-friendly banking environment, attracting both consumers and financial institutions to adopt Open Banking solutions.

Global Open Banking Market Restraints and Challenges:

Ensuring Consumer Trust Amidst Data Sharing.

One of the primary challenges facing the Open Banking market is the concern over data security and privacy. Consumers are increasingly wary of sharing their financial data with multiple entities due to the risk of data breaches and misuse. Despite advancements in encryption and cybersecurity, ensuring robust data protection and maintaining consumer trust remain significant hurdles. Financial institutions and third-party providers must implement stringent security measures and comply with regulatory standards to mitigate these concerns and safeguard consumer information.

Navigating a Fragmented Regulatory Landscape.

The diverse and evolving regulatory environment across different regions poses a significant challenge for the Open Banking market. Financial institutions and fintech companies must navigate varying regulations, such as PSD2 in Europe, CDR in Australia, and other region-specific mandates. This complexity can lead to increased compliance costs and operational challenges, particularly for organizations operating in multiple jurisdictions. Harmonizing regulatory requirements and fostering international collaboration are essential steps to streamline compliance and support global market growth.

Global Open Banking Market Opportunities:

Tapping into Underbanked Regions.

The expansion of Open Banking into emerging markets presents a significant growth opportunity. Many regions in Africa, Asia, and Latin America have large underbanked populations that can benefit from increased access to financial services. By leveraging mobile technology and innovative banking solutions, Open Banking can help bridge the financial inclusion gap, providing these populations with access to essential financial products and services, thereby driving economic growth and improving living standards.

Driving Innovation Through Strategic Partnerships.

Collaborations between traditional banks and fintech startups offer substantial opportunities for innovation within the Open Banking market. Fintech companies bring agility, cutting-edge technology, and innovative solutions that can complement the established infrastructure and customer base of traditional banks. By partnering with fintech startups, banks can accelerate their digital transformation, enhance their service offerings, and improve customer experiences, thereby staying competitive in the rapidly evolving financial landscape.

OPEN BANKING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

14% |

|

Segments Covered |

By Services, Bank Type, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Plaid, Yodlee, Tink, TrueLayer, Token, Figo, OpenWrks Salt Edge, Mbanq, Finicity, BBVA Open Platform, Railsbank |

Open Banking Market Segmentation: By Services

-

Banking and Payment Services

-

Data Services

-

Other Services

Banking and Payment Services represent the most effective segment within the Open Banking market, significantly transforming the financial landscape by enhancing accessibility and efficiency. These services encompass a range of functionalities such as account aggregation, payment initiation, fund transfers, and bill payments. By enabling seamless, real-time transactions and providing customers with a consolidated view of their financial data, these services improve financial management and decision-making. Furthermore, they foster financial inclusion by providing unbanked and underbanked populations with easier access to banking services through digital platforms. The convenience and improved user experience offered by these services drive higher adoption rates among consumers and businesses, making Banking and Payment Services a pivotal driver of growth and innovation in the Open Banking ecosystem.

Open Banking Market Segmentation: By Bank Type

-

Retail Banks

-

Corporate Banks

-

Investment Banks

-

Challenger Banks

Retail banks stand out as the most effective segment within the Open Banking market, primarily due to their direct interaction with a vast consumer base. By embracing Open Banking, retail banks can significantly enhance their service offerings, providing personalized financial products, real-time account information, and seamless payment solutions. These banks are in a prime position to leverage customer data to offer tailored financial advice, budgeting tools, and innovative payment methods, thereby empowering consumers with greater control over their finances. Additionally, the integration of Open Banking can streamline processes such as loan approvals and account management, improving operational efficiency and customer satisfaction. The widespread reach and frequent daily interactions of retail banks make them a crucial driver in the mass adoption of Open Banking, fostering a more inclusive and customer-centric financial ecosystem.

Open Banking Market Segmentation: By End-User

-

Individuals

-

Small and Medium Enterprises (SMEs)

-

Large Enterprises

Small and Medium Enterprises (SMEs) emerge as the most effective segment within the Open Banking market due to their pivotal role in the global economy and their growing demand for innovative financial solutions. Open Banking provides SMEs with enhanced access to financing, streamlined payment processes, and sophisticated financial management tools that were traditionally available only to larger enterprises. These services enable SMEs to optimize cash flow management, reduce operational costs, and improve financial planning. Additionally, SMEs can benefit from real-time financial insights and personalized banking services, which can help them make more informed business decisions and drive growth. By catering to the unique needs of SMEs, Open Banking fosters a more dynamic and competitive business environment, supporting the expansion and success of this critical sector.

Open Banking Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East & Africa

The global open banking market exhibits a diverse distribution of market share across various regions. North America leads with a dominant share of 35%, driven by robust regulatory frameworks encouraging financial institutions to adopt open banking practices. Europe closely follows with 30%, spearheading the movement with progressive regulations like PSD2, fostering a competitive landscape for fintech innovation. In the Asia-Pacific region, comprising 20% of the market, rapid digitalization, and a burgeoning fintech ecosystem contribute to significant growth opportunities in open banking. South America commands a notable 9%, buoyed by increasing digital penetration and evolving regulatory frameworks. Finally, the Middle East and Africa region holds a smaller yet emerging share of 6%, where nascent regulatory initiatives are paving the way for future open banking expansion. This distribution underscores a global trend toward embracing open banking as a catalyst for financial inclusivity, innovation, and competitive advantage across varied regional landscapes.

COVID-19 Impact Analysis on the Global Open Banking Market:

The COVID-19 pandemic has significantly influenced the global open banking market, catalyzing both challenges and opportunities. Initially, the crisis accelerated the adoption of digital financial services as lockdowns and social distancing measures restricted traditional banking activities. This surge in digital transactions highlighted the resilience and convenience of open banking solutions, spurring greater interest and investment in fintech innovation. However, the pandemic also underscored vulnerabilities in cybersecurity and data privacy, prompting intensified regulatory scrutiny and necessitating robust security measures within open banking frameworks. Looking ahead, the pandemic's impact is expected to drive continued evolution in consumer behavior towards digital channels, fostering a more robust and adaptive open banking ecosystem worldwide.

Latest Trends/ Developments:

The global open banking sector is currently experiencing transformative shifts driven by customer-centric approaches, evolving regulatory landscapes, technological advancements like blockchain and decentralized finance (DeFi), and increasing collaborations across financial institutions and fintech entities. These trends underscore a pivotal moment where innovation, regulatory compliance, and strategic partnerships converge to redefine financial services, emphasizing personalized experiences, enhanced security, and broader financial inclusion on a global scale.

Key Players:

-

Plaid

-

Yodlee

-

Tink

-

TrueLayer

-

Token

-

Figo

-

OpenWrks

-

Salt Edge

-

Mbanq

-

Finicity

-

BBVA Open Platform

-

Railsbank

Chapter 1. Open Banking Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Open Banking Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Open Banking Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Open Banking Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Open Banking Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Open Banking Market – By Services

6.1 Introduction/Key Findings

6.2 Banking and Payment Services

6.3 Data Services

6.4 Other Services

6.5 Y-O-Y Growth trend Analysis By Services

6.6 Absolute $ Opportunity Analysis By Services, 2024-2030

Chapter 7. Open Banking Market – By Bank Type

7.1 Introduction/Key Findings

7.2 Retail Banks

7.3 Corporate Banks

7.4 Investment Banks

7.5 Challenger Banks

7.6 Y-O-Y Growth trend Analysis By Bank Type

7.7 Absolute $ Opportunity Analysis By Bank Type, 2024-2030

Chapter 8. Open Banking Market – By End-User

8.1 Introduction/Key Findings

8.2 Individuals

8.3 Small and Medium Enterprises (SMEs)

8.4 Large Enterprises

8.5 Y-O-Y Growth trend Analysis By End-User

8.6 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 9. Open Banking Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Services

9.1.3 By Bank Type

9.1.4 By By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Services

9.2.3 By Bank Type

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Services

9.3.3 By Bank Type

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Services

9.4.3 By Bank Type

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Services

9.5.3 By Bank Type

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Open Banking Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Plaid

10.2 Yodlee

10.3 Tink

10.4 TrueLayer

10.5 Token

10.6 Figo

10.7 OpenWrks

10.8 Salt Edge

10.9 Mbanq

10.10 Finicity

10.11 BBVA Open Platform

10.12 Railsbank

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global open banking market is projected to grow from an estimated USD 19 billion in 2023 to USD 47.54 billion by 2030, reflecting a compound annual growth rate (CAGR) of approximately 14% over the forecast period of 2024-2030.

The primary drivers of the global open banking market are regulatory mandates promoting competition and innovation, technological advancements in API connectivity, and increasing consumer demand for personalized financial services.

The key challenges facing the global open banking market include concerns over data privacy and security, regulatory compliance complexities, and interoperability issues between financial institutions and fintech providers.

In 2023, North America held the largest share of the global open banking market.

Plaid, Yodlee, Tink, TrueLayer, Token, Figo, OpenWrks, Salt Edge, Mbanq, Finicity, BBVA Open Platform, and Railsbank are the main players.