Nutritional Premixes Market Size (2024 – 2030)

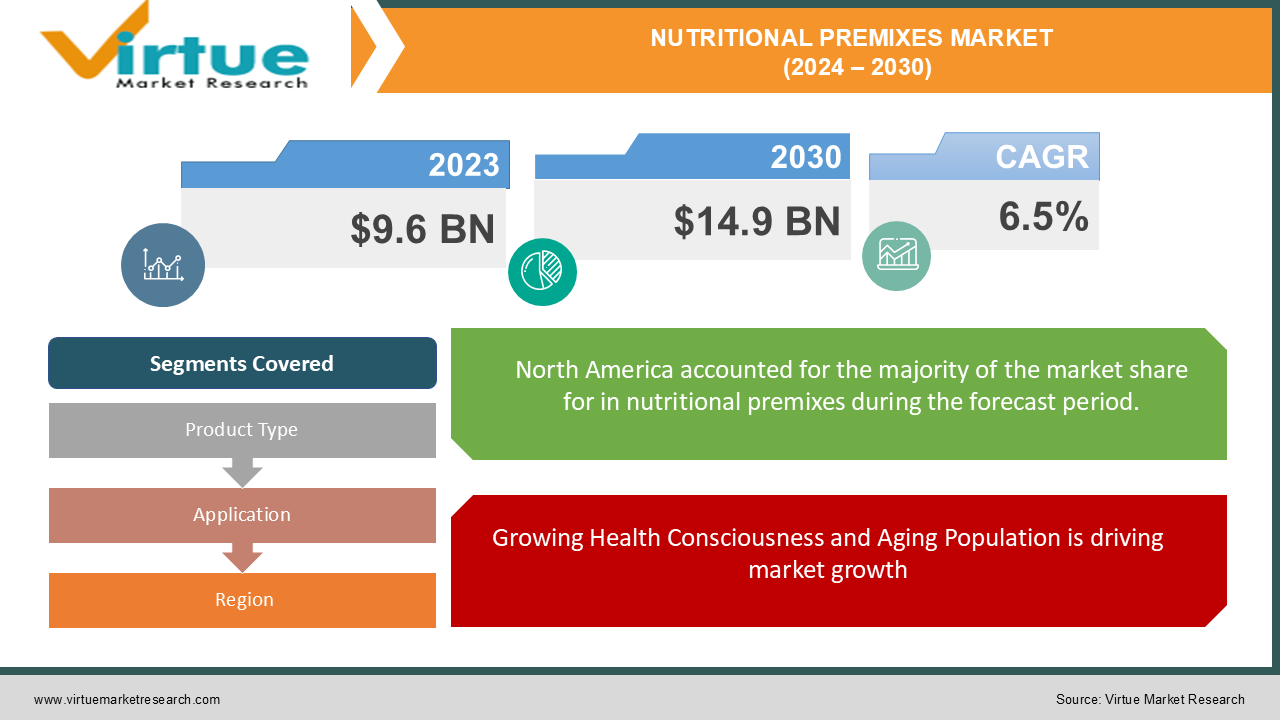

The Global Nutritional Premixes Market was valued at USD 9.6 billion in 2023 and is projected to grow at a CAGR of 6.5% from 2024 to 2030. The market is expected to reach USD 14.9 billion by 2030.

Nutritional premixes are blends of essential nutrients such as vitamins, minerals, amino acids, nucleotides, and other functional ingredients, used to enhance the nutritional content of food, beverages, and dietary supplements. This market has seen consistent growth due to rising health awareness, the aging population, and the growing demand for fortified food and beverages. Nutritional premixes are a preferred choice among manufacturers for creating tailored nutritional profiles that meet consumer needs for specific health outcomes, such as improved immunity, energy, and mental health.

Key Market Insights:

The food and beverage industry accounts for over 35% of the global nutritional premixes market revenue in 2023, driven by the demand for fortified products targeting functional health benefits.

Asia-Pacific is expected to be the fastest-growing region for nutritional premixes, with a CAGR of 7.5% from 2024 to 2030, fueled by rapid urbanization and increasing disposable incomes in countries like China and India.

The global market for infant nutrition is experiencing increased incorporation of premixes, accounting for nearly 20% of the overall demand in the nutritional premixes market.

Global Nutritional Premixes Market Drivers:

Growing Health Consciousness and Aging Population is driving market growth: One of the primary drivers of the global nutritional premixes market is the increasing health consciousness among consumers, particularly in developed and developing countries. As consumers become more aware of the importance of nutrition in maintaining long-term health, the demand for fortified foods and dietary supplements has surged. Aging populations in regions like North America, Europe, and parts of Asia are looking for products that promote healthy aging, leading to a rise in products containing nutritional premixes designed to improve immunity, cardiovascular health, and bone strength. Furthermore, the growing prevalence of lifestyle-related diseases, such as diabetes and obesity, has also contributed to the demand for health-centric products, with nutritional premixes becoming a go-to solution for product formulators.

Government Initiatives and Food Fortification Programs is driving market growth: Many governments and international organizations are launching initiatives to combat malnutrition and nutrient deficiencies, especially in developing countries. Fortification of staple foods such as rice, flour, and milk with essential nutrients like vitamins, minerals, and amino acids is being encouraged to address these deficiencies. For instance, several countries in Africa and Asia have implemented mandatory fortification policies for basic foods, leading to a substantial increase in the demand for nutritional premixes. Additionally, partnerships between public health organizations and private companies are promoting fortified products that meet specific nutritional needs, boosting the market for premixes in regions facing malnutrition challenges.

Advances in Nutritional Science and Personalized Nutrition Trends is driving market growth: As nutritional science evolves, there is a growing understanding of the role specific nutrients play in improving overall health and well-being. Advances in research are enabling the development of more targeted nutritional premixes that cater to individual needs, such as enhancing mental performance, supporting gut health, or improving energy levels. Personalized nutrition is a growing trend, where consumers seek products that cater to their unique dietary needs, fitness goals, or genetic makeup. This trend is creating significant opportunities for premix manufacturers to offer customizable solutions, especially in sectors like sports nutrition, dietary supplements, and medical nutrition.

Global Nutritional Premixes Market Challenges and Restraints:

Stringent Regulatory Standards and Complex Formulation Challenges is restricting market growth: One of the major challenges faced by the nutritional premixes market is adhering to the stringent regulatory requirements imposed by various governments and international bodies. Nutritional premix manufacturers must ensure that their products meet safety and quality standards, which can vary widely by region. The complexity of formulating premixes with multiple ingredients while maintaining stability, efficacy, and taste also poses a significant technical challenge. In addition, the need for accurate labeling and testing of nutritional claims adds another layer of complexity for manufacturers. These regulatory and formulation challenges can increase the cost of production, making it difficult for smaller companies to compete in the global market.

High Costs and Supply Chain Issues is restricting market growth: The production of high-quality nutritional premixes requires the sourcing of specific, often expensive, ingredients such as bioactive compounds, amino acids, and specialized minerals. The fluctuating costs of these raw materials, driven by factors such as environmental conditions, supply chain disruptions, or geopolitical tensions, can significantly impact the profitability of manufacturers. For instance, the global supply chain disruptions experienced during the COVID-19 pandemic led to delays and increased costs in raw material procurement. Additionally, sourcing natural or organic ingredients for clean-label products can further escalate costs, creating challenges for manufacturers trying to meet the increasing demand for affordable and high-quality premixes.

Market Opportunities:

The growing demand for customized nutritional solutions represents a significant opportunity for the nutritional premixes market. Consumers are increasingly looking for products tailored to their specific health needs, creating space for innovation in premix formulations. For example, the rise of sports nutrition products has led to a surge in premixes that support energy, recovery, and muscle growth, while the increasing focus on mental health has driven the demand for premixes containing ingredients that support cognitive function. Furthermore, the expansion of e-commerce platforms has allowed manufacturers to reach a broader audience, making it easier to introduce niche products to the market. Another area of opportunity lies in the growing preference for natural, organic, and clean-label ingredients. As consumers become more health-conscious and environmentally aware, the demand for nutritional premixes that align with these values is expected to increase. Companies that can offer sustainable and transparent supply chains for their premix ingredients will likely gain a competitive edge in the market. Additionally, the fortification of food products for specific populations, such as the elderly or infants, continues to grow, providing ample opportunities for market expansion.

NUTRITIONAL PREMIXES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

DSM, Glanbia Nutritionals, BASF SE, ADM, Jubilant Life Sciences, SternVitamin, Prinova Group, Nutreco, Farbest Brands, Barentz |

Nutritional Premixes Market Segmentation: By Product Type

-

Vitamins

-

Minerals

-

Amino Acids

-

Nucleotides

-

Other Functional Ingredients

The vitamins segment is the most dominant, holding over 40% of the market share, as they are widely used for fortifying a broad range of food and beverage products. The clean-label movement is driving manufacturers to source natural and organic premix ingredients, responding to consumer preferences for transparency and sustainability. New product innovations, such as all-in-one sports nutrition premixes, are expanding market opportunities in the fitness and wellness industry.

Nutritional Premixes Market Segmentation: By Application

-

Food and Beverages

-

Dietary Supplements

-

Pharmaceuticals

-

Infant Nutrition

-

Clinical Nutrition

The food and beverages segment is the largest in terms of application, accounting for more than 35% of the market due to the growing consumer interest in fortified and functional food products.

Nutritional Premixes Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America remains the dominant region in the global nutritional premixes market, primarily due to high consumer demand for fortified food and supplements, a well-established health and wellness industry, and strong government support for food fortification programs.

COVID-19 Impact Analysis on the Nutritional Premixes Market:

The COVID-19 pandemic had a significant impact on the global nutritional premixes market, with both positive and negative effects. On the positive side, the heightened awareness of health and wellness during the pandemic led to a surge in demand for products that boost immunity and overall health, such as fortified foods, dietary supplements, and functional beverages. Consumers became more focused on preventative health measures, driving up demand for premixes that included vitamins, minerals, and immune-boosting ingredients. However, the pandemic also caused disruptions in the supply chain, leading to delays in the procurement of raw materials and increased costs. Manufacturers faced challenges in maintaining production levels due to labor shortages and logistical issues. Despite these challenges, the market has recovered and is expected to grow as consumers continue prioritizing health and nutrition in the post-pandemic world.

Latest Trends/Developments:

A key trend in the nutritional premixes market is the rising consumer demand for plant-based and clean-label products. Increasingly, consumers are prioritizing natural, non-GMO, and organic ingredients that align with both their health goals and environmental values. This has driven manufacturers to develop innovative premixes that incorporate plant-based vitamins, minerals, and functional ingredients. Alongside this, the growing interest in personalized nutrition is reshaping the market, as consumers seek custom blends tailored to specific health needs like weight management, mental health, or sports performance. Additionally, sustainability is becoming a critical focus, with companies aiming to reduce their environmental impact by adopting more transparent and eco-friendly sourcing practices. Traceability across supply chains is gaining importance as consumers demand greater visibility into the origins of the ingredients used in premixes. This convergence of health-consciousness, personalization, and sustainability is reshaping the nutritional premixes market, creating opportunities for manufacturers to offer more customized, environmentally responsible, and high-quality products to meet evolving consumer expectations.

Key Players:

-

DSM

-

Glanbia Nutritionals

-

BASF SE

-

ADM

-

Jubilant Life Sciences

-

SternVitamin

-

Prinova Group

-

Nutreco

-

Farbest Brands

-

Barentz

Chapter 1. Nutritional Premixes Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Nutritional Premixes Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Nutritional Premixes Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Nutritional Premixes Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Nutritional Premixes Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Nutritional Premixes Market – By Product

6.1 Introduction/Key Findings

6.2 Vitamins

6.3 Minerals

6.4 Amino Acids

6.5 Nucleotides

6.6 Other Functional Ingredients

6.7 Y-O-Y Growth trend Analysis By Product

6.8 Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Nutritional Premixes Market – By Application

7.1 Introduction/Key Findings

7.2 Food and Beverages

7.3 Dietary Supplements

7.4 Pharmaceuticals

7.5 Infant Nutrition

7.6 Clinical Nutrition

7.7 Y-O-Y Growth trend Analysis By Application

7.8 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Nutritional Premixes Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Nutritional Premixes Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 DSM

9.2 Glanbia Nutritionals

9.3 BASF SE

9.4 ADM

9.5 Jubilant Life Sciences

9.6 SternVitamin

9.7 Prinova Group

9.8 Nutreco

9.9 Farbest Brands

9.10 Barentz

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Nutritional Premixes Market was valued at USD 9.6 billion in 2023 and is projected to reach USD 14.9 billion by 2030, growing at a CAGR of 6.5% during the forecast period.

Key drivers include growing health consciousness, government food fortification initiatives, and advances in nutritional science, which are boosting demand for fortified foods and dietary supplements.

The market is segmented by product type (Vitamins, Minerals, Amino Acids, Nucleotides, and other functional ingredients) and by application (Food and Beverages, Dietary Supplements, Pharmaceuticals, Infant Nutrition, and Clinical Nutrition).

North America is the most dominant region, driven by high consumer demand for fortified food, government support for food fortification, and a well-established health and wellness industry.

Leading players include DSM, Glanbia Nutritionals, BASF SE, ADM, Jubilant Life Sciences, SternVitamin, Prinova Group, Nutreco, Farbest Brands, and Barentz.