Nutritional Supplements Market Size (2025-2030)

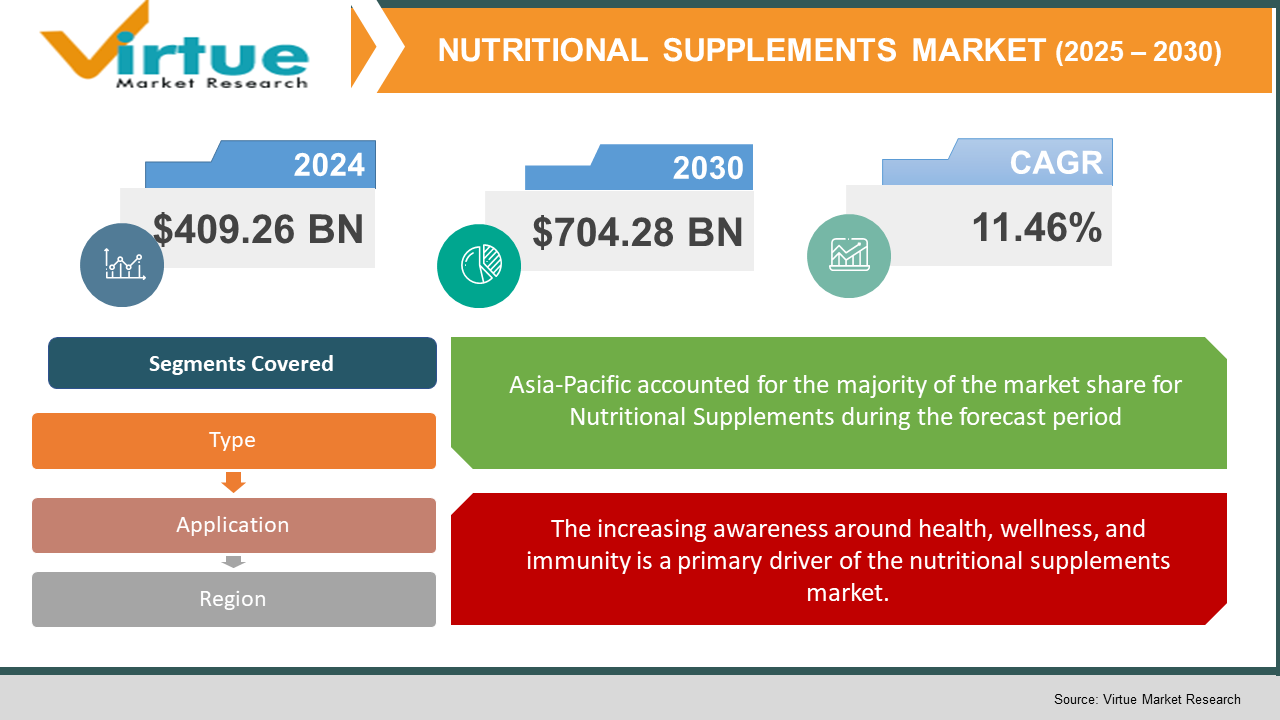

The Global Nutritional Supplements Market was valued at USD 409.26 billion in 2024 and is projected to reach a market size of USD 704.28 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.46%.

The Global Nutritional Supplements Market involves a broad category of products aimed at complementing dietary requirements and improving general well-being, such as vitamins, minerals, proteins, botanicals, amino acids, and specialty nutrients. The market has evolved into a vibrant and consumer-centric industry driven by growing awareness of preventive health, rising lifestyle-based health conditions, and the world's overall shift towards wellness and self-care. From aging populations and fitness enthusiasts to convenience-seeking professionals, consumers across various demographics are making supplements part of their lifestyle.

Key Market Insights:

- Over 70% of consumers globally now consider supplements part of their daily wellness routine. Vitamin D and Omega-3 remain among the top 5 most consumed supplements worldwide.

- Online supplement sales increased by over 60% post-COVID, driven by convenience and health awareness. Millennials and Gen Z make up more than 45% of new supplement users, with a focus on immunity and energy. The demand for plant-based and clean-label supplements has risen by 35% in the last two years.

- Asia-Pacific leads in growth due to rapid urbanization and rising disposable incomes. Sustainability and ethical sourcing are influencing purchase decisions for over 40% of global consumers.

Global Nutritional Supplements Market Drivers:

The increasing awareness around health, wellness, and immunity is a primary driver of the nutritional supplements market.

Growing awareness about health, wellness, and immunity is one of the key drivers for the nutritional supplements industry. Customers now are more educated and empowered, looking to prevent disease rather than just treat illness. This change in thinking has contributed to the popularity of daily vitamins, minerals, and immunity enhancers, particularly during the COVID-19 pandemic. Individuals in all age ranges are adding supplements to their lifestyle to maintain energy, digestion, mental acuity, and well-being. Urban areas, with their busy lifestyle and bad diets, are feeling the need heavily, making supplementing a fast and easy alternative to fill nutrition gaps. The masses are being educated, not just by conventional medical professionals but also by celebrities, medical specialists, and even online channels and social media outlets, along with a shift to a "food as medicine" philosophy. As this trend keeps on growing, firms are concentrating on creating clean-label, organic, and convenient-to-consume forms such as gummies, powders, and beverages.

Another major force propelling the market is the growing elderly population and their increasing reliance on nutritional supplements to support healthy aging.

Another key driver of the market is the aging population and their greater dependence on nutritional supplements to ensure healthy aging. With increasing life expectancy across the world, more individuals are looking for products that can ensure bone strength, joint mobility, cardiovascular health, and mental performance. Elderly people commonly experience nutrient malabsorption and are more prone to deficiencies in calcium, vitamin B12, D3, and omega-3 fatty acids propelling the demand for age-targeted forms. The necessity to live independently and lead active lives is inspiring the elderly to embrace supplements as a part of their daily routine. Moreover, healthcare organizations and caregivers are promoting preventive nutrition in order to decrease long-term healthcare expenditures. This demographic pattern is not exclusive to developed countries; even developing markets are seeing an increase in supplement use among aging populations. Consequently, companies are innovating to develop senior-friendly products with easy-to-swallow formulations and health benefits targeting specific needs.

Global Nutritional Supplements Market Restraints and Challenges:

One of the major challenges facing the global nutritional supplements market is the lack of uniform regulatory standards across regions, which often leads to inconsistencies in product quality, safety, and labeling.

One of the biggest problems confronting the international nutritional supplements market is that there are not standardized regulatory standards on a regional basis, tending to create differences in the quality, safety, and labeling of products. Supplements are classified differently in many countries whether as food, drugs, or natural health products creating a patchwork legal environment that makes international trade difficult and approval of products even more so. This loophole has enabled certain subpar or falsely labeled products to make their way into the market, eroding consumer confidence and sparking concerns regarding negative health impacts. Misdeclared ingredients, hidden additives, and contamination have been found in a number of cases, especially among online unregulated sites. As consumers gain more knowledge, they are also becoming increasingly wary, requiring openness and accountability. This setting provides both an entry barrier for new players and a dilemma for incumbent players seeking to uphold credibility and compliance while innovating. Resolution of these regulatory and trust concerns is critical to the long-term growth of the market and consumer trust.

Global Nutritional Supplements Market Opportunities:

The worldwide market for nutritional supplements offers tremendous opportunities, fueled by changing lifestyles among consumers and an increasing need for customized wellness solutions. With the fast pace of digital health technology and wearables, consumers can now monitor their nutritional requirements in real time, driving demand for customized supplement products. Delivery format innovations such as gummies, effervescent tablets, functional drinks, and nano-capsules are making supplements convenient and attractive, particularly among the younger population. Moreover, growing demand for clean-label, vegan, and plant-based products presents new opportunities in health-focused and environmentally conscious consumer bases. New economies in the Asia-Pacific region and Latin America present high-growth opportunities due to rising disposable incomes, rising awareness, and growing access to e-commerce. In addition, strategic collaborations between supplement companies and health, healthcare, and fitness industries are producing interconnected health environments that drive more consumer engagement. All these trends combined are an open field to innovation, growth, and future market sustainability.

NUTRITIONAL SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11.46% |

|

Segments Covered |

By Type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Sun Pharmaceuticals Industries Ltd, Himalaya Wellness Company, Unilever, Cipla Health Limited, Dabur India Ltd |

Global Nutritional Supplements Market Segmentation:

Nutritional Supplements Market Segmentation: By Type

- Vitamins

- Botanicals

- Minerals

- Proteins & Amino Acid

- Fibers & Specialty Carbohydrates

- Omega Fatty Acids

- Others

The market for nutritional supplements is widely divided by type, with each segment serving particular health objectives and consumer tastes. Vitamins are the most commonly consumed supplements, particularly Vitamin D, B-complex, and multivitamins, due to their contribution to immunity, energy, and general well-being. Botanicals, such as herbal extracts ashwagandha, ginseng, and turmeric, are increasingly popular as a result of the growing demand for natural and plant-based products. Minerals like calcium, magnesium, zinc, and iron are essential for bone health and metabolic processes, while proteins & amino acids reign supreme in the sports nutrition market for muscle repair and growth. Fibers and specialty carbohydrates are focused on digestive health and weight management, increasingly important in functional food formats. While that's happening, omega fatty acids, including omega-3s, are vital to heart, brain, and skin health and tend to be obtained through fish oil or plant-based ingredients. The "Others" category consists of antioxidants, enzymes, and specialty products, which fill specific health niches and new trends in wellness.

Nutritional Supplements Market Segmentation: By Application

- Energy & Weight Management General Health

- Bone & Joint Health

- Gastrointestinal Health

- Immunity

- Cardiac Health

- Diabetes

- Anti-cancer

- Others

By usage, the market caters to a wide range of health needs and lifestyle aspirations. Energy and weight management supplements are witnessing robust demand from gym goers and people with sedentary lives looking for metabolism-enhancing assistance. Overall health supplements, such as multivitamins and adaptogens, are universally used for everyday wellness practices among all ages. Bone and joint health products are necessary for aging and osteoarthritis or osteoporosis risk populations. Supplements supporting gastrointestinal health, such as prebiotics and probiotics, have grown significantly in popularity because of increasing interest in gut health and its connection to immunity. Immune-supporting supplements continue to be highly sought post-pandemic, with customers actively looking for natural protection against infection. Cardiovascular health supplements like omega-3s and CoQ10 are utilized to control cholesterol and blood pressure. As diabetes incidence increases, demand for diabetes control supplements like chromium, magnesium, and fiber is increasing consistently. A niche but developing market also exists for anti-cancer supportive supplements, which are frequently adopted as adjunct therapies. The "Others" category encompasses beauty supplements, brain health supplements, and stress-management supplements.

Nutritional Supplements Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East & Africa

The Global Nutritional Supplements Market demonstrates uneven growth across geographical regions, with Asia-Pacific leading due to rising health awareness and wellness trends in nations such as China and India. North America comes next with a well-established base for consumers of dietary, sports, and lifestyle supplements, backed by high expenditure on health and fitness. In Europe, demand is centered primarily on immunity-supporting products and overall wellness, as consumers choose clean-label and plant-based options. South America is seeing increasing traction as fitness consciousness is on the rise and nutrition awareness becomes more prevalent. The Middle East and Africa are newer markets, where urbanization and growing disposable income are promoting the use of health supplements, particularly among urban and younger demographics. All share distinct consumer culture, but are indicative of one global trend away from reactive and toward preventive care and nutrition-led lifestyles.

COVID-19 Impact Analysis on the Global Nutritional Supplements Market:

The COVID-19 pandemic directly affected the international market for nutritional supplements, chiefly through increasing consumers' emphasis on immunity and health. This heightened sense of concern produced a substantial spike in the demand for dietary supplements, notably products thought to improve immune functions like vitamins C and D, zinc, and probiotics. For example, in the United States, the first six weeks of the pandemic saw a 44% surge in sales of supplements, which earned an extra $435 million. At the same time, web searches for nutritional supplements increased throughout the world, indicating that the public is more interested in taking preventive health actions. Nevertheless, because of this heightened usage, scientific proof of the effectiveness of these supplements for preventing and treating COVID-19 is still inconclusive. This situation highlights the need for consumers to be careful and seek advice from medical practitioners when contemplating supplement consumption during health emergencies.

Latest Trends/ Developments:

The international market for nutritional supplements is undergoing profound changes fueled by changing consumer trends and technological innovation. One of the trends is the rise in personalized nutrition, where firms provide tailored supplements based on individual health requirements and genetic makeup, increasing effectiveness and customer satisfaction. This change is supported by increasing demand for clean-label products, as consumers prefer supplements with clear ingredient labels and fewer additives, as part of a wider trend towards natural and organic products. Sustainability has also come into the spotlight, as manufacturers have taken to using eco-friendly sourcing and packaging methods in order to meet the demands of environmentally aware purchasers. In addition, the market is also experiencing an explosion of new delivery formats, including gummies, chewable tablets, and liquid concentrates, that are making supplementation more convenient and attractive, especially among younger consumers. The convergence of digital health technologies, such as wearable devices and health apps, is also individualizing supplement regimens by offering real-time health information, thus increasing user engagement and compliance. These trends combined highlight a vibrant marketplace environment that is more consumer-driven, health-conscious, and environmentally conscious.

Key Players:

- Sun Pharmaceuticals Industries Ltd.

- Himalaya Wellness Company

- Unilever

- Cipla Health Limited

- Dabur India Ltd

- GSK plc

- Amway India Enterprises Pvt. Ltd

- MuscleBlaze

- Britannia Industries

- Abbott Laboratories

- Pfizer

- GlaxoSmithKline

- Nu Skin Enterprises

Chapter 1. NUTRITIONAL SUPPLEMENTS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. NUTRITIONAL SUPPLEMENTS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. NUTRITIONAL SUPPLEMENTS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. NUTRITIONAL SUPPLEMENTS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. NUTRITIONAL SUPPLEMENTS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. NUTRITIONAL SUPPLEMENTS MARKET – By Type

6.1 Introduction/Key Findings

6.2 Vitamins

6.3 Botanicals

6.4 Minerals

6.5 Proteins & Amino Acid

6.6 Fibers & Specialty Carbohydrates

6.7 Omega Fatty Acids

6.8 Others

6.9 Y-O-Y Growth trend Analysis By Type

6.10 Absolute $ Opportunity Analysis By Type , 2025-2030

Chapter 7. NUTRITIONAL SUPPLEMENTS MARKET – By Application

7.1 Introduction/Key Findings

7.2 Energy & Weight Management General Health

7.3 Bone & Joint Health

7.4 Gastrointestinal Health

7.5 Immunity

7.6 Cardiac Health

7.7 Diabetes

7.8 Anti-cancer

7.9 Others

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. NUTRITIONAL SUPPLEMENTS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Type

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Type

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Type

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Type

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. NUTRITIONAL SUPPLEMENTS MARKET – Company Profiles – (Overview, Packaging Product, Portfolio, Financials, Strategies & Developments)

9.1 Sun Pharmaceuticals Industries Ltd.

9.2 Himalaya Wellness Company

9.3 Unilever

9.4 Cipla Health Limited

9.5 Dabur India Ltd

9.6 GSK plc

9.7 Amway India Enterprises Pvt. Ltd

9.8 MuscleBlaze

9.9 Britannia Industries

9.10 Abbott Laboratories

9.11 Pfizer

9.12 GlaxoSmithKline

9.13 Nu Skin Enterprises

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Nutritional Supplements Market was valued at USD 409.26 billion in 2024 and is projected to reach a market size of USD 704.28 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 11.46%.

Rising health awareness and focus on preventive healthcare and growing fitness trends and demand for personalized nutrition boost market growth

Based on Service Provider, the Global Nutritional Supplements Market is segmented in-to material manufacturers, Raw Material Suppliers, Lab information management systems, Distributors & Wholesalers, End-to-End Solution Providers

Asia Pacific is the most dominant region for the Global Nutritional Supplements Market.

Sun Pharmaceuticals Industries Ltd, Himalaya Wellness Company, Unilever, Cipla Health Limited, Dabur India Ltd are the key players in the Global Nutritional Supplements Market.