Nutraceuticals Market size (2025 – 2030)

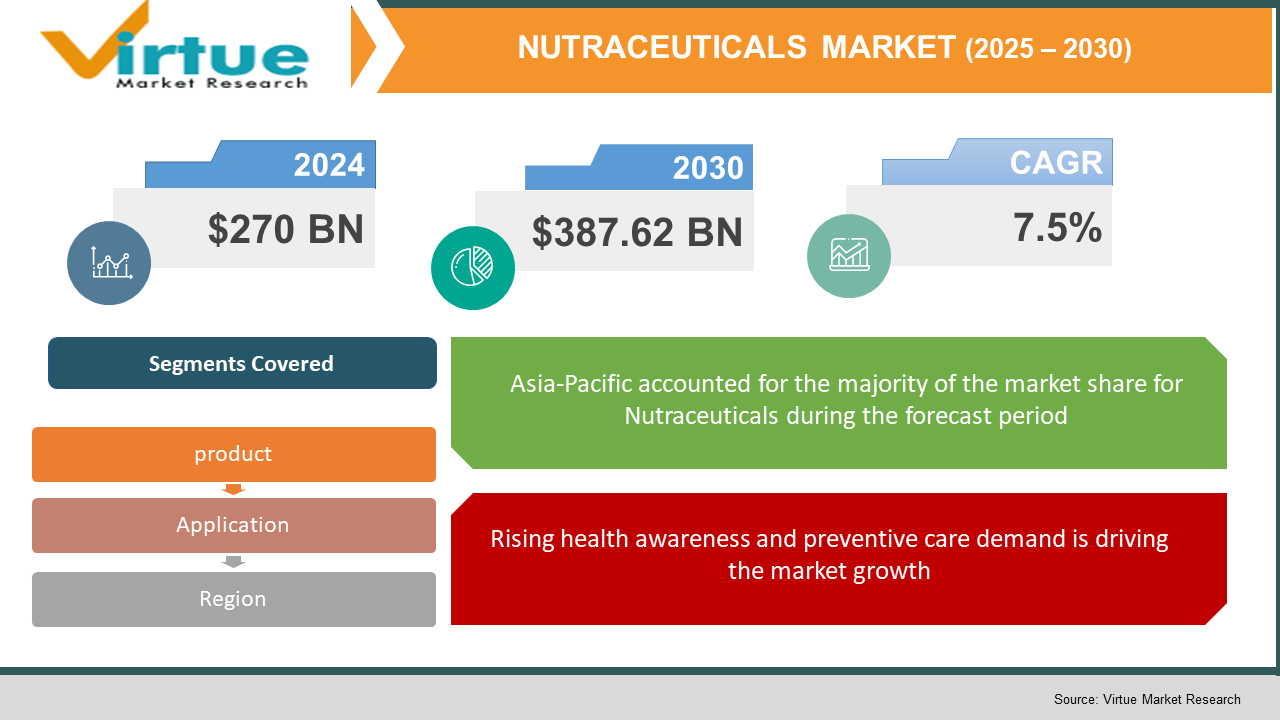

The Global Nutraceuticals Market was valued at USD 270 billion in 2024 and will grow at a CAGR of 7.5% from 2025 to 2030. The market is expected to reach USD 387.62 billion by 2030.

The Nutraceuticals Market revolves around functional food, dietary supplements, and beverages that provide medical or health benefits, including the prevention and treatment of disease. The increasing focus on health and wellness among consumers, combined with a rising aging population and a surge in lifestyle-related disorders, is driving the demand for nutraceuticals worldwide. With an increased inclination toward preventive healthcare and natural remedies, nutraceuticals are gaining momentum as an essential element in daily diets. This market benefits from growing research and innovation in product formulation, improving bioavailability and delivery mechanisms.

Key market insights:

- The dietary supplements segment accounted for more than 35% of the total revenue in 2024, driven by increasing awareness of nutrition and fitness among younger demographics and the aging population.

- Functional foods such as fortified cereals, dairy, and snacks held a market share of around 30% in 2024 and are growing steadily due to rising consumer preference for convenient and health-enhancing foods.

- The Asia-Pacific region contributed over 34% of global revenue in 2024, with rapid urbanization, expanding middle-class population, and increasing disposable incomes influencing spending on wellness products.

- In North America, the U.S. nutraceutical market led with more than USD 90 billion in sales in 2024, supported by strong demand for personalized nutrition and sports supplements.

- The probiotic-based nutraceuticals segment is witnessing a CAGR of 9.2%, with growing scientific backing for gut health and immunity support playing a key role in its growth.

- Online retail channels accounted for more than 25% of global nutraceutical sales in 2024 due to convenience, broader reach, and consumer trust in digital platforms for wellness products.

- Vitamin and mineral supplements remained the most popular sub-category in 2024, making up nearly 40% of the dietary supplement revenue worldwide.

- Clean label and organic nutraceuticals are gaining prominence, with over 45% of new product launches in 2024 claiming natural origin, non-GMO, or chemical-free formulations.

Global Nutraceuticals Market Drivers

Rising health awareness and preventive care demand is driving the market growth

As global awareness about personal health and wellness continues to rise, consumers are increasingly turning toward preventive healthcare practices. Nutraceuticals are being embraced as a proactive approach to maintain well-being and prevent the onset of chronic conditions such as obesity, diabetes, and cardiovascular diseases. The prevalence of these conditions, often linked to poor diet and sedentary lifestyles, has elevated the importance of dietary interventions. People are now more willing to invest in health-enhancing foods and supplements, especially those that are natural, non-synthetic, and free from harmful additives. The pandemic further emphasized the necessity of strong immunity and overall health, which caused a substantial uptick in sales of immunity-boosting nutraceuticals. In developed economies, healthcare systems are strained with the costs of treating lifestyle-related diseases, and this encourages both governments and healthcare providers to recommend preventive alternatives. Similarly, developing nations are witnessing shifts in lifestyle and diet, which presents opportunities for nutraceutical growth. Preventive care is no longer viewed as optional but as an essential lifestyle choice, and nutraceuticals are at the core of this transformation.

Aging population and age-related health conditions is driving the market growth

Globally, the aging population is growing at a significant pace. According to the United Nations, people aged 60 years and older are projected to double in number by 2050, reaching over 2 billion. This demographic shift has profound implications for the healthcare and wellness industries. Older adults typically have specific dietary needs, including increased intake of calcium, vitamin D, omega-3 fatty acids, and antioxidants to support bone health, cognitive function, and immune resilience. Nutraceuticals are tailored to address these needs through products like anti-aging supplements, bone and joint health formulations, and memory support capsules. With age, the risk of chronic ailments such as arthritis, osteoporosis, diabetes, and cardiovascular issues also increases. Nutraceuticals offer a non-pharmaceutical solution to manage these conditions or delay their progression, making them highly attractive to older consumers. Furthermore, many seniors prefer nutraceuticals because they are seen as more natural and carry fewer side effects compared to traditional medications. This growing demand for healthy aging products is one of the most significant drivers of market expansion and innovation.

Technological innovation and product diversification is driving the market growth

The nutraceutical industry is witnessing rapid advancements in formulation technologies, delivery systems, and ingredient innovation. Companies are investing heavily in R&D to develop products with enhanced bioavailability, targeted delivery, and better taste profiles. Nanotechnology, liposomal encapsulation, and time-release capsules are transforming how active ingredients are absorbed and utilized by the body. These innovations are improving the efficacy of nutraceuticals, making them more appealing to health-conscious consumers. Additionally, the market is experiencing diversification with the introduction of personalized nutrition—products tailored to an individual's genetic makeup, microbiome, lifestyle, and health goals. Artificial intelligence and data analytics are also being integrated to deliver custom recommendations. Moreover, companies are expanding into unconventional product formats such as gummies, functional beverages, and fortified snacks, which appeal to younger audiences and busy professionals. This diversity in offerings and formats not only meets the varying preferences of consumers but also boosts market penetration across demographics. Innovation remains a cornerstone of competitiveness in the nutraceutical space and a vital force shaping the future of the industry.

Global Nutraceuticals Market Challenges and Restraints

Lack of regulatory standardization globally is restricting the market growth

One of the significant challenges faced by the global nutraceuticals market is the lack of a unified regulatory framework across countries. While some nations treat nutraceuticals as food products, others classify them as pharmaceutical items, leading to substantial differences in quality control, labelling, and marketing practices. This inconsistency creates confusion for both manufacturers and consumers. Companies that operate across multiple regions must navigate a maze of varying guidelines, leading to increased costs in testing, certification, and compliance. Furthermore, in many emerging economies, the lack of stringent regulation may result in substandard or counterfeit products entering the market, which can undermine consumer trust and negatively impact the reputation of reputable brands. The absence of harmonized international standards also hinders trade and expansion, as businesses must adapt their formulations and packaging to fit local legal requirements. This fragmentation not only restricts the scalability of global operations but can also limit innovation, as companies may be reluctant to invest in new products that might not pass regulatory scrutiny in certain regions. A more standardized approach would help level the playing field and increase transparency and trust in the industry.

High cost of nutraceuticals limiting mass adoption is restricting the market growth

Despite growing awareness and demand, the cost of nutraceutical products remains a barrier to mass market adoption, particularly in price-sensitive regions. High-quality raw materials, advanced formulation technologies, and strict manufacturing standards contribute to the premium pricing of nutraceuticals. While affluent consumers in developed markets may not hesitate to pay more for wellness benefits, the same is not true in developing regions, where a large section of the population cannot afford these products. Furthermore, personalized nutrition and specialized supplements tailored to specific health needs are even more expensive, limiting their reach to niche markets. The cost factor also restricts government or insurance-backed wellness initiatives that could otherwise help promote preventive healthcare through nutraceuticals. Additionally, consumers often perceive nutraceuticals as optional add-ons rather than essential parts of their diet, making them vulnerable to budget cuts during economic downturns. Until manufacturers can scale production effectively or develop cost-effective alternatives without compromising on efficacy and quality, the broader adoption of nutraceuticals will remain constrained.

Market Opportunities

The global nutraceuticals market is poised for significant growth over the coming years, driven by a convergence of health trends, demographic changes, and scientific advancements. One of the biggest opportunities lies in expanding into untapped markets in developing regions such as Africa, Southeast Asia, and Latin America. These areas are witnessing rising disposable incomes and urbanization, which is shifting consumer preferences toward health-oriented products. With strategic investments and partnerships, nutraceutical companies can localize offerings and make products more accessible and affordable. Another opportunity exists in personalized nutrition, where brands can cater to individuals based on DNA, lifestyle, and health conditions. This level of customization not only enhances effectiveness but also creates brand loyalty. The growing interest in plant-based and vegan products opens new avenues, as consumers demand cruelty-free and sustainable alternatives. Nutraceuticals that incorporate ingredients like ashwagandha, turmeric, spirulina, and chia seeds appeal to this eco-conscious segment. Moreover, the integration of technology such as mobile health apps, smart packaging, and online consultations provides an interactive user experience that can enhance engagement and adherence. Functional beverages and on-the-go formats offer convenience to the modern consumer, blending health benefits with lifestyle needs. Clinical research continues to strengthen the credibility of nutraceuticals, encouraging healthcare professionals to recommend them as part of preventive care strategies. With the right combination of innovation, accessibility, and scientific validation, the nutraceuticals market can transition from a niche to a mainstream pillar of global wellness.

NUTRACEUTICALS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Product, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nestlé, Amway, Herbalife, PepsiCo, and Glanbia |

Nutraceuticals Market segmentation

Nutraceuticals Market segmentation By product:

• Dietary Supplements

• Functional Foods

• Functional Beverages

• Medicinal Foods

• Sports Nutrition

• Probiotics

Dietary supplements are the most dominant product category, contributing over 35% of global revenue in 2024. Their widespread usage for general health, immunity, and specific deficiencies makes them a core part of daily wellness routines. The category includes multivitamins, minerals, herbs, and proteins, addressing a wide range of consumer needs. With increased awareness around self-care, many individuals opt for supplements even without medical prescriptions, further strengthening their market share.

Nutraceuticals Market segmentation By application:

• General Health

• Immunity

• Digestive Health

• Cardiovascular Health

• Bone & Joint Health

• Weight Management

• Diabetes Management

• Anti-Aging

General health leads in the application segment, driven by consumer preference for products that offer overall wellness benefits. This category includes multivitamins, essential fatty acids, and mineral blends aimed at improving energy, endurance, and vitality. Products in this segment have mass appeal across age groups and are often used preventively, making it the most accessible and widely adopted category in the market.

Nutraceuticals Market Regional segmentation

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Asia-Pacific emerged as the dominant region in the global nutraceuticals market in 2024, accounting for more than 34% of total revenue. The region's growth is propelled by increasing health consciousness among the population, rapidly rising disposable incomes, and a shift toward preventive healthcare. Countries like India, China, and Japan are at the forefront due to a strong tradition of herbal and natural remedies combined with modern nutritional science. The widespread adoption of functional foods, fortified beverages, and dietary supplements reflects growing consumer awareness and demand for holistic wellness solutions. Government initiatives to reduce the burden of non-communicable diseases have also helped promote the use of nutraceuticals. Furthermore, local manufacturers are increasingly innovating to cater to regional preferences, including products based on traditional ingredients like turmeric, ginseng, and green tea. E-commerce platforms in this region have further enabled access and convenience, especially in urban areas. The growing penetration of multinational brands, alongside a robust domestic manufacturing base, makes Asia-Pacific a hotbed for expansion and innovation in nutraceuticals. With continued investments in health infrastructure and regulatory advancements, the region is likely to maintain its dominance in the coming years.

COVID-19 Impact Analysis on the Nutraceuticals Market

The COVID-19 pandemic significantly accelerated the growth of the global nutraceuticals market, reshaping consumer priorities and purchasing behaviors. During the crisis, individuals became increasingly focused on immunity and disease prevention, leading to a surge in demand for products that support overall health. Supplements containing vitamin C, zinc, elderberry, and probiotics witnessed a sharp rise in sales, especially during the first and second waves of the pandemic. Lockdowns and mobility restrictions also encouraged online purchases of nutraceuticals, with e-commerce platforms reporting record-breaking figures. Many first-time users tried supplements and functional foods during this period, leading to higher market penetration. At the same time, the industry faced disruptions in the supply chain, especially for raw materials and imported ingredients. Manufacturers responded with innovation in local sourcing and reformulation to meet demand. The pandemic also encouraged stronger collaboration between nutraceutical companies and research institutions, resulting in new product launches backed by clinical studies. Consumer behavior experienced a long-term shift, with people now valuing health more than ever and integrating nutraceuticals into their daily routines. As a result, the market expanded beyond its traditional boundaries and reached new consumer segments, including the younger population and those previously unaware of such products. Post-pandemic, the momentum continues, with wellness becoming a lifestyle rather than a temporary phase. Overall, COVID-19 served as a catalyst that reinforced the relevance and need for preventive health solutions, giving the nutraceuticals market a lasting boost.

Latest trends/Developments

The global nutraceuticals market is experiencing dynamic shifts in trends and developments driven by technological innovation, changing consumer preferences, and sustainability demands. One major trend is the rise of personalized nutrition, with companies using genetic and biometric data to offer customized supplements and dietary advice. This personalized approach is improving customer satisfaction and fostering brand loyalty. Another trend is the growing popularity of plant-based and vegan nutraceuticals. With the increase in environmentally conscious consumers, formulations featuring ingredients like pea protein, spirulina, and turmeric are gaining traction. Sustainable packaging and carbon-neutral production are also becoming key differentiators for leading brands. Moreover, new delivery formats such as gummies, shots, powders, and effervescent tablets are reshaping how supplements are consumed, making them more appealing to younger audiences. Functional beverages like kombucha, probiotic drinks, and fortified waters are replacing traditional sodas, offering health benefits along with refreshment. Digital health integration is another notable development, with mobile apps providing supplement tracking, dosage reminders, and even virtual nutritionist consultations. In terms of innovation, AI and big data are being leveraged to predict market demand and develop better formulations. There is also a stronger focus on clean label and transparency, with consumers demanding to know the origin and function of each ingredient. Scientific validation and clinical trials are becoming increasingly essential for gaining trust, especially among healthcare professionals. Overall, the nutraceuticals market is becoming more intelligent, interactive, and health-focused, aligning closely with the evolving needs of modern consumers.

Key Players:

- Herbalife

- Amway

- Nestlé Health Science

- DSM

- Glanbia

- Bayer AG

- Pfizer

- Abbott Nutrition

- BASF

- GNC Holdings

Chapter 1. NUTRACEUTICALS MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. NUTRACEUTICALS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. NUTRACEUTICALS MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. NUTRACEUTICALS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. NUTRACEUTICALS MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. NUTRACEUTICALS MARKET – By Product

6.1 Introduction/Key Findings

6.2 Dietary Supplements

6.3 Functional Foods

6.4 Functional Beverages

6.5 Medicinal Foods

6.6 Sports Nutrition

6.7 Probiotics

6.8 Y-O-Y Growth trend Analysis By Product

6.9 Absolute $ Opportunity Analysis By Product , 2025-2030

Chapter 7. NUTRACEUTICALS MARKET – By Application

7.1 Introduction/Key Findings

7.2 General Health

7.3 Immunity

7.4 Digestive Health

7.5 Cardiovascular Health

7.6 Bone & Joint Health

7.7 Weight Management

7.8 Diabetes Management

7.9 Anti-Aging

7.10 Y-O-Y Growth trend Analysis By Application

7.11 Absolute $ Opportunity Analysis By Application , 2025-2030

Chapter 8. NUTRACEUTICALS MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By Application

8.1.3. By Product

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product

8.2.3. By Application

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product

8.3.3. By Application

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product

8.4.3. By Application

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product

8.5.3. By Application

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. NUTRACEUTICALS MARKET – Company Profiles – (Overview, Packaging Product, Portfolio, Financials, Strategies & Developments)

9.1 Herbalife

9.2 Amway

9.3 Nestlé Health Science

9.4 DSM

9.5 Glanbia

9.6 Bayer AG

9.7 Pfizer

9.8 Abbott Nutrition

9.9 BASF

9.10 GNC Holdings

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Global Nutraceuticals Market was valued at USD 270 billion in 2024 and is expected to reach USD 387.62 billion by 2030.

Drivers include rising health awareness, preventive healthcare demand, and aging populations seeking functional foods.

Segments include functional food, functional beverages, and dietary supplements; applications cover immunity, digestive health, and more.

Asia-Pacific is the most dominant region due to growing disposable incomes and increased consumer health consciousness.

Key players include Nestlé, Amway, Herbalife, PepsiCo, and Glanbia.