Specialty Food Ingredients Market Size (2024 – 2030)

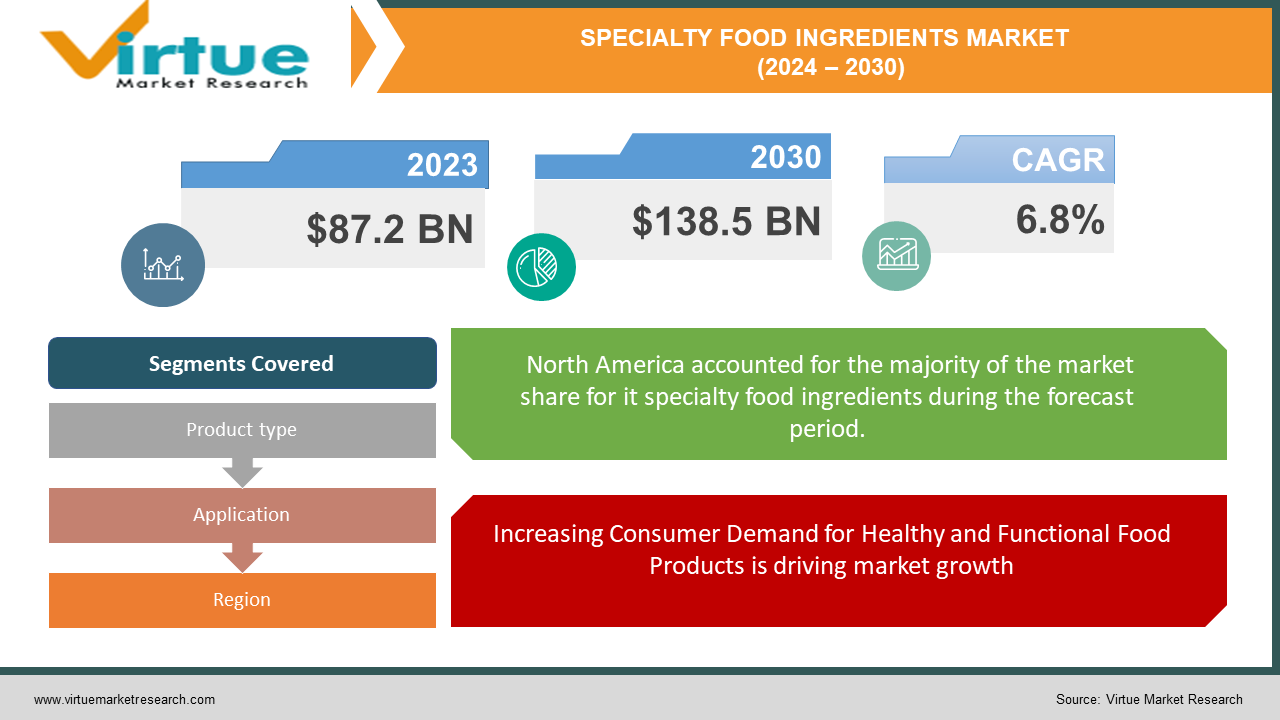

The Global Specialty Food Ingredients Market was valued at USD 87.2 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2030. The market is expected to reach USD 138.5 billion by 2030.

The specialty food ingredients market caters to the growing demand for natural and functional food additives. These minimally processed ingredients, like natural sweeteners, colors, and flavors, are gaining traction as consumers seek healthier and more transparent alternatives. They also encompass a wide range of functional ingredients like emulsifiers, texturants, and probiotics that enhance the taste, texture, and shelf life of convenient processed foods, making them essential for our busy lifestyles. This market is booming as food manufacturers strive to meet the evolving preferences of health-conscious consumers in a world dominated by convenience.

Key Market Insights:

Increasing consumer demand for healthy and functional food products is driving market growth. The growing adoption of natural and clean-label ingredients is boosting market demand. The rise in the consumption of convenience and ready-to-eat food products is fueling market expansion.

Technological advancements in food processing techniques are supporting market growth.

North America with a market share of 29.5% is the most dominant region in the Specialty Food Ingredients Market.

Expansion of the food and beverage industry, especially in developing regions, is contributing to market growth.

Global Specialty Food Ingredients Market Drivers:

Increasing Consumer Demand for Healthy and Functional Food Products is driving market growth

The wellness movement is a powerful driver in the specialty food ingredients market. As health awareness climbs, consumers are actively seeking food products that go beyond basic nutrition and deliver functional benefits. This translates to a growing preference for specialty ingredients that address specific health concerns. Prebiotics and probiotics, for example, are gaining significant traction due to their gut health-promoting properties. These ingredients are believed to support a healthy microbiome, which is increasingly linked to overall well-being and immune function. Plant-based proteins are another area witnessing a surge in popularity. Driven by concerns about animal welfare, environmental impact, and potential health benefits of plant-based diets, consumers are embracing these alternatives to traditional animal proteins. This has led to a surge in demand for specialty ingredients like pea protein, soy protein, and lentil protein as manufacturers look to formulate innovative and delicious plant-based options. Overall, the focus on proactive health management is propelling the specialty food ingredients market, with consumers actively seeking out functional ingredients that can enhance their well-being.

Growing Adoption of Natural and Clean Label Ingredients is driving the market growth

The tide is turning towards natural ingredients in the specialty food market, fueled by consumer concerns about artificial additives and preservatives. This shift is driven by a perception that "natural" equals "safer" and "healthier." Consumers are increasingly wary of unfamiliar chemical names on ingredient lists, opting for products with natural flavors, colors, and sweeteners they can recognize. This focus on clean labels goes beyond just avoiding artificial ingredients; it's linked to a belief that natural options are inherently better for you. As a result, specialty food producers are experiencing a surge in demand for these clean-label ingredients. This trend presents a significant opportunity for manufacturers to develop innovative and functional natural flavors, colors, and sweeteners that can compete with their artificial counterparts, ultimately shaping the future of the specialty food market.

Rise in the Consumption of Convenience and Ready-to-Eat Food Products is driving the market growth

Our fast-paced lives and growing cities are fueling a demand for convenient, ready-to-eat options. This, in turn, is driving the specialty food ingredients market. Manufacturers rely on these specialty ingredients to ensure their convenience foods taste great, hold their shape, and stay fresh on the shelf. Emulsifiers help blend ingredients that wouldn't normally mix, like oil and water in salad dressings. Stabilizers prevent separation and ensure a smooth texture in yogurt. Texturants mimic the mouthfeel we expect from traditional foods, even in low-fat or gluten-free options. By creating delicious, convenient, and shelf-stable options, specialty food ingredients are playing a key role in keeping up with our busy lifestyles and urban environments. This growing demand for convenience is expected to continue propelling the specialty food ingredients market forward.

Global Specialty Food Ingredients Market Challenges and Restraints:

High Cost of Specialty Food Ingredients is restricting the market growth

One of the major challenges faced by the market is the high cost associated with specialty food ingredients. Specialty ingredients often require complex manufacturing processes and are sourced from unique raw materials, which increases their production costs. This high cost can limit their adoption, especially in price-sensitive markets.

Stringent Regulatory Requirements are restricting the market growth

The specialty food ingredients market is subject to stringent regulatory requirements, particularly regarding food safety, labeling, and health claims. Compliance with these regulations adds complexity and cost to the manufacturing and marketing of specialty food products, posing a challenge for market players.

Market Opportunities:

The Specialty Food Ingredients Market presents several growth opportunities. The increasing consumer demand for organic and natural specialty food ingredients is a major opportunity. Consumers are becoming more conscious of their health and are actively seeking products that are free from artificial ingredients and chemicals. This trend is driving the demand for clean label ingredients, including natural flavors, colors, and sweeteners. Another significant opportunity lies in the expansion of the clean label market. Clean label products are gaining popularity due to their transparency and simplicity in ingredient lists. Manufacturers are responding by reformulating their products to eliminate artificial additives and preservatives, thus meeting consumer preferences for healthier options. Additionally, the rising popularity of plant-based ingredients presents a growth opportunity in the specialty food ingredients market. Plant-based proteins, dairy alternatives, and plant-derived sweeteners are increasingly being used to cater to the growing vegan and flexitarian consumer base. Manufacturers are also focusing on innovation and product diversification to capitalize on these opportunities. New product developments in functional food ingredients, such as probiotics for gut health and antioxidants for immune support, are expected to drive market growth.

SPECIALTY FOOD INGREDIENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.8% |

|

Segments Covered |

By Product type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Kerry Group PLC, DuPont de Nemours, Inc., DSM Nutritional Products AG, Sensient Technologies Corporation, Symrise AG, Givaudan SA |

Specialty Food Ingredients Market Segmentation - by Product Type

-

Liquid Ingredients

-

Powdered Ingredients

-

Specialty Sweeteners

-

Specialty Flavors

When it comes to the dominant form of specialty food ingredients, it's a close call between powdered ingredients and specialty sweeteners. Powdered ingredients offer versatility and ease of use in various food production processes. They encompass a wide range of starches for thickening, enzymes for specific functionalities, and even colors derived from natural sources. However, specialty sweeteners are experiencing explosive growth due to the rising demand for sugar reduction and healthier alternatives

Specialty Food Ingredients Market Segmentation - By Application

-

Food & Beverages

-

Nutraceuticals

-

Cosmetics & Personal Care

-

Pharmaceuticals

The most dominant application for specialty food ingredients is by far the Food & Beverages sector. This encompasses a vast array of categories including baked goods, sweet treats, dairy products, beverages, and more. The sheer volume of food and beverages consumed globally makes this the leading application. Additionally, consumer trends within this sector heavily favor the use of specialty ingredients. The rise of health-conscious consumers seeking functional and fortified products creates a strong demand for specialty ingredients like vitamins, probiotics, and natural sweeteners. This focus on clean and clear labeling also makes the Food & Beverage industry a prime target for specialty ingredients, as they can enhance taste, texture, and functionality while adhering to consumer preferences for natural and recognizable ingredients.

Specialty Food Ingredients Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

North America is the most dominant region in the Specialty Food Ingredients Market due to its advanced food processing industry and high consumer demand for healthy and functional food products.

COVID-19 Impact Analysis on the Specialty Food Ingredients Market

The COVID-19 pandemic delivered a rollercoaster ride to the Specialty Food Ingredients Market. Initial lockdowns caused disruptions in global supply chains, creating temporary shortages of crucial ingredients. However, this hurdle was soon overshadowed by a surge in consumer interest in health-focused products. The pandemic heightened health consciousness, driving demand for specialty ingredients that promote immunity and well-being. This shift in consumer behavior benefitted the market as manufacturers scrambled to incorporate ingredients like vitamins, antioxidants, and prebiotics into their offerings. Furthermore, the pandemic acted as a catalyst for the e-commerce boom. Restricted movement and social distancing measures propelled a significant portion of food sales online. This shift in purchasing behavior presented both challenges and opportunities for the Specialty Food Ingredients Market. Online platforms required adjustments to product information and marketing strategies to effectively reach consumers accustomed to in-person inspection. However, the ease and convenience of online retail also opened new avenues for reaching a wider customer base. Looking ahead, the Specialty Food Ingredients Market is expected to experience continued growth as health and wellness remain at the forefront of consumer priorities. Manufacturers who can innovate and adapt to meet evolving dietary needs will be well-positioned to capitalize on this long-term trend.

Latest Trends/Developments

The Clean Label Ingredients Market is brimming with exciting advancements driven by consumer demand for natural and transparent food options. One key trend is the rising popularity of plant-based ingredients. Consumers are seeking alternatives to animal-derived products for various reasons, including health, environmental concerns, and ethical considerations. This has fueled innovation in plant-based proteins like peas, soy, and lentils, along with plant-based alternatives for dairy (think nut milk and vegan cheese) and even meat (plant-based burgers and sausages). Another hot trend is the focus on functional ingredients. These ingredients not only provide basic functionality like texture or sweetness, but also boast additional health benefits like gut health support, improved digestion, or immune system enhancement. Prebiotics, probiotics, and botanical extracts are some examples gaining traction. Furthermore, clean label claims are evolving beyond simply avoiding artificial ingredients. Transparency is key, with consumers increasingly interested in the source and sustainability practices behind the ingredients. This has led to a rise in certifications like organic and fair trade gaining prominence in the clean label space. Manufacturers are also looking to technology for solutions. Fermentation techniques and novel processing methods are being explored to create clean label ingredients with improved functionality and consistent quality. Overall, the Clean Label Ingredients Market is a dynamic space fueled by innovation and consumer preferences for natural, healthy, and transparent food options.

Key Players:

-

Archer Daniels Midland Company

-

Cargill, Incorporated

-

Ingredion Incorporated

-

Tate & Lyle PLC

-

Kerry Group PLC

-

DuPont de Nemours, Inc.

-

DSM Nutritional Products AG

-

Sensient Technologies Corporation

-

Symrise AG

-

Givaudan SA

Chapter 1. Specialty Food Ingredients Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Specialty Food Ingredients Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Specialty Food Ingredients Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Specialty Food Ingredients Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Specialty Food Ingredients Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Specialty Food Ingredients Market – By Product Type

6.1 Introduction/Key Findings

6.2 Liquid Ingredients

6.3 Powdered Ingredients

6.4 Specialty Sweeteners

6.5 Specialty Flavors

6.6 Y-O-Y Growth trend Analysis By Product Type

6.7 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. Specialty Food Ingredients Market – By Application

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Nutraceuticals

7.4 Cosmetics & Personal Care

7.5 Pharmaceuticals

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Specialty Food Ingredients Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Product Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Product Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Product Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Product Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Product Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Specialty Food Ingredients Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Archer Daniels Midland Company

9.2 Cargill, Incorporated

9.3 Ingredion Incorporated

9.4 Tate & Lyle PLC

9.5 Kerry Group PLC

9.6 DuPont de Nemours, Inc.

9.7 DSM Nutritional Products AG

9.8 Sensient Technologies Corporation

9.9 Symrise AG

9.10 Givaudan SA

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Specialty Food Ingredients Market was valued at USD 87.2 billion in 2023 and will grow at a CAGR of 6.8% from 2024 to 2030. The market is expected to reach USD 132.5 billion by 2030.

The market is driven by increasing consumer demand for healthy and functional food products, growing adoption of natural and clean label ingredients, and a rise in the consumption of convenience and ready-to-eat food products.

Based on product type, the market is divided into Liquid Ingredients, Powdered Ingredients, Specialty Sweeteners, Specialty Flavors

North America is the most dominant region for the Specialty Food Ingredients Market.

The leading players include Archer Daniels Midland Company, Cargill, Incorporated, Ingredion Incorporated, Tate & Lyle PLC, Kerry Group PLC, DuPont de Nemours, Inc., DSM Nutritional Products AG, Sensient Technologies Corporation, Symrise AG, and Givaudan SA.