Novel Drug Delivery Systems Market Size (2025 – 2030)

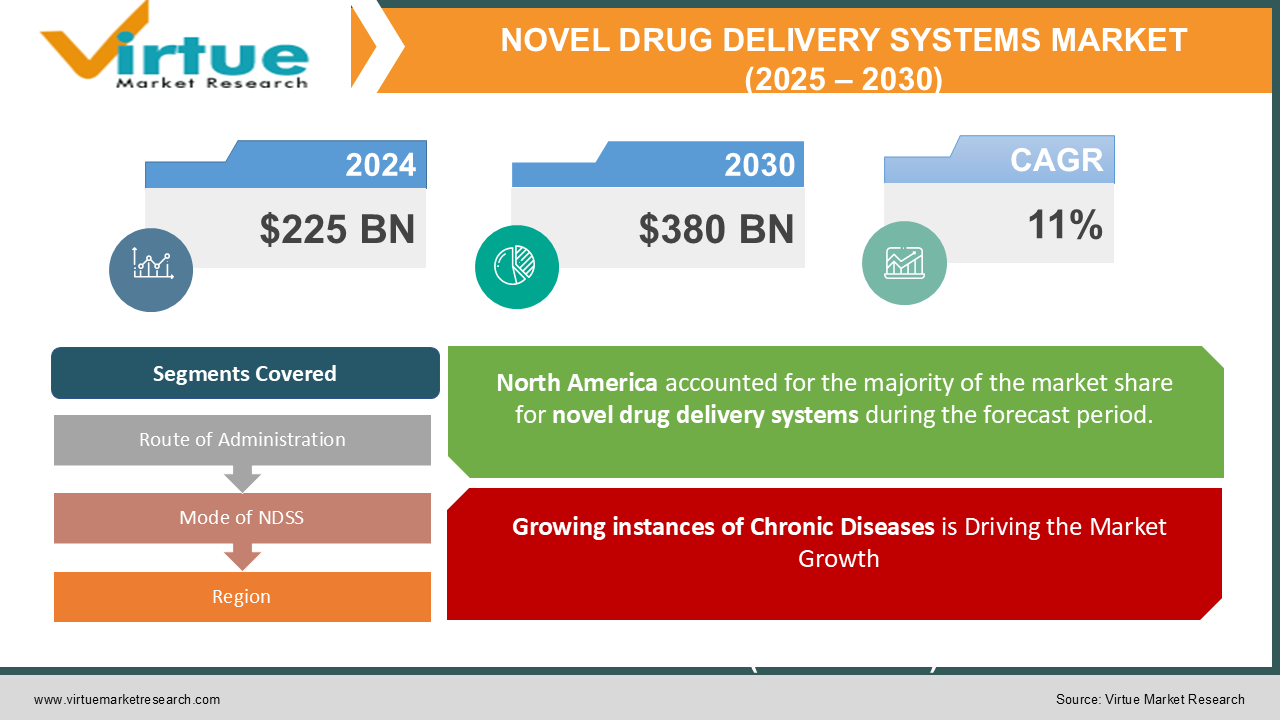

The Novel Drug Delivery Systems Market was valued at USD 225 billion and is projected to reach a Market size of USD 380 billion by the end of 2030. Over the forecast period of 2025-2030, the Market is projected to grow at a CAGR of 11%.

The Novel Drug Delivery Systems (NDDS) market is growing rapidly, due to the advancements in biotechnology and the increasing demand for more efficient, targeted, and personalised therapies. NDDS refers to innovative methods used to deliver drugs more precisely to specific areas of the body, improving the therapeutic effect while minimizing side effects. Some of the technologies employed in these systems include liposomes, nanoparticles, micelles, and transdermal patches designed to enhance bioavailability and the efficacy of drugs. Increasing numbers of patients have chronic diseases like cancer, diabetes, and cardiovascular disorders, all of which are demanding better solutions for drug delivery than oral administrations. The rise of biologics, which need special delivery techniques, adds fuel to the demand for novel drug delivery technologies. Moreover, the emergence of personalized medicine, wherein treatments are tailored according to the specific requirements of patients, is boosting the growth of this market. Significant regulatory clearances and innovations in the field are also gaining momentum due to attempts by pharmaceutical companies to create safer and more effective drugs. As the healthcare industry continues to focus on improving patient outcomes, the NDDS market is going to experience a lot of growth in the coming years with significant advancements being expected in the drug formulation and delivery technologies.

Key Market Insights:

-

Nanotechnology is significantly increasing in the NDDS market, as it has enabled drug delivery systems with the development of high precision and targeting. Nanoparticles, including liposomes, dendrimers, and micelles, provide enhanced bioavailability with reduced toxicity and targeted drug delivery, especially in cancer and chronic disease treatments.

-

The role of biologics and biosimilars in the growing NDDS market is highly significant, as most of these therapeutical agents require special delivery methods. According to a study, over 60% of biologic drugs approved in the last decade require advanced delivery systems that include injection or infusion pumps.

-

One of the major drivers in the NDDS market is personalized medicine. This is because systems can be developed to tailor each patient's specific needs. In 2024, a scientific study revealed that personalized drug delivery systems have helped improve the results in the oncology and rare genetic disorders spaces. The continued growth of novel drug delivery platforms will be driven by the potential to offer custom drug regimens as genetic testing becomes more affordable.

-

The FDA and EMA are just some of the regulatory bodies that are increasingly appreciating NDDS, resulting in more approval for novel drug delivery platforms.

-

Injectable drug delivery systems are rapidly gaining momentum with biologic and high-potency drugs.

Novel Drug Delivery Systems Market Drivers:

Growing instances of Chronic Diseases is Driving the Market Growth

The NDDS market is primarily driven by the rising incidence of chronic diseases, such as cancer, diabetes, cardiovascular diseases, and neurological disorders. Such diseases are mostly treated for a long time or require complex treatment that necessitates more efficient and precise drug delivery systems. For instance, most cancer treatments require biologics and chemotherapeutic agents that need to be delivered at specific doses and locations, thus requiring advanced drug delivery systems. As the global population ages and lifestyle diseases increase, the demand for innovative delivery solutions continues to grow.

Advancements in Biologics and Biosimilars.

The increasing demand for biologics, such as monoclonal antibodies, gene therapies, and vaccines, is creating a demand for more specific drug delivery methods. Most biological drugs are hard to administer orally and thus need alternative methods, such as injections or infusions. Novel drug delivery systems can improve the stability, bioavailability, and controlled release of biologics, thereby enhancing their effectiveness and patient adherence. With biologics forming a growing part of the pharmaceutical pipeline, the requirement for advanced delivery systems is also expected to continue rising.

Increasing Focus on Personalized Medicine.

With the healthcare industry shifting toward more personalized approaches to treatment, the need for drug delivery systems that can be tailored to individual patients becomes more critical. Personalized medicine involves adjusting treatments based on genetic, environmental, and lifestyle factors to optimize efficacy and minimize side effects. Drug delivery technologies that are novel and innovative, such as nanoparticle delivery or smart drug carriers that deliver drugs directly to specific cells or tissues, can be utilized for more accurate and effective treatments. This shift toward individualized care leads to an increase in demand for innovative delivery technologies to accommodate a wide array of patient-specific needs.

Novel Drug Delivery Systems Market Restraints and Challenges:

High Development and Production Costs.

The development of novel drug delivery systems involves significant investment in research, technology, and infrastructure. Many of these systems, such as those based on nanotechnology or biologics, require specialized manufacturing processes and materials, which can drive up costs. Additionally, regulatory hurdles related to the approval of new delivery technologies, including rigorous clinical trials, further increase development expenses. This can limit the accessibility and adoption of these systems, especially for smaller pharmaceutical companies or in emerging markets where cost is a critical factor.

Regulatory and Approval Challenges.

The approval process for novel drug delivery systems can be lengthy and complex, posing a significant challenge for companies in the market. Regulatory agencies like the FDA and EMA have strict requirements for the safety, efficacy, and manufacturing consistency of these systems, which can lead to delays. Furthermore, many novel delivery systems involve innovative technologies, such as nanomaterials or gene therapies, which may not fit neatly into existing regulatory frameworks. This uncertainty can slow down market entry and innovation, as companies must navigate evolving regulatory landscapes to gain approval.

Risk of Long-Term Safety and Efficacy Issues

While novel drug delivery systems offer substantial benefits, they also carry inherent risks, particularly related to long-term safety and efficacy. As many of these systems are relatively new, there may be limited long-term clinical data available to assess their effectiveness and potential side effects. Additionally, the complexity of these systems, such as nanoparticle-based carriers or implantable devices, can raise concerns about immune responses, toxicity, and drug accumulation over time. These uncertainties can hinder widespread adoption and confidence in these systems, both among healthcare professionals and patients.

NOVEL DRUG DELIVERY SYSTEMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

11% |

|

Segments Covered |

By Route of Administration, Mode of NDSS, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Johnson & Johnson, Novartis AG, Pfizer Inc., AbbVie Inc., Bayer AG, Medtronic PLC, Sanofi S.A., Mylan N.V. (Viatris), Gerresheimer AG, GlaxoSmithKline PLC |

Novel Drug Delivery Systems Market Segmentation: By Route of Administration

-

Oral Drug

-

Injectable Drug

-

Pulmonary Drug

-

Transdermal Drug

-

Others

The most popular approach to drug delivery is oral, particularly for tablets and capsules, although some medications have limited bioavailability. Its 35% to 40% market share is fueled by targeted and controlled-release formulations.

Thanks to advancements like autoinjectors and self-administration devices, injectable systems—which are used for biologics and vaccines—are becoming more and more popular. With the growth of biologic medicines and chronic illness treatments, this market segment holds 30% to 35% of the market.

Inhalers are frequently used for pulmonary delivery of respiratory diseases. Its rise has been driven by advancements in inhalation technologies for the treatment of COPD and asthma, and it currently accounts for 10% to 15% of the market.

Patches and other transdermal methods offer prolonged medication release, particularly for hormone and pain treatments. Thanks to advancements in skin permeability, this market segment accounts for 10% to 12% of the total.

The other segment comprises routes such as implanted devices, sublingual, and ocular. With growth in specialized sectors like eye illnesses and targeted medicine delivery, it accounts for roughly 5% to 10% of the market.

Novel Drug Delivery Systems Market Segmentation: By Mode of NDSS

-

Targeted

-

Controlled

-

Modulated

Targeted delivery focuses on the specific delivery of drugs to cells or specific tissues, which will minimize side effects and improve efficacy. This method is especially important for cancer and other "real-time target" conditions. Targeted delivery systems make up around 40% to 45% of the market, fueled by nanotechnology and biologics advances.

Controlled drug delivery systems deliver drugs in a controlled release manner over a long period. This results in better patient compliance and reduced side effects. Controlled delivery is an important method of chronic disease management, including the management of diabetes and pain relief. Controlled delivery accounts for approximately 30% to 35% of the NDDS market and is increasing due to the trend of long-acting treatments and increased patient convenience.

It is possible to adjust the drug release by physiological conditions or with the help of external stimuli within modulated drug delivery systems. This approach is helpful in developing an adaptive system that meets patient needs for hormone therapy or responsive formulations of drugs. Modulated systems represent about 15% to 20% of the market and are found to grow on the basis of smart drug delivery development and personalized medicine.

Novel Drug Delivery Systems Market Segmentation: Regional Analysis

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

North America stands at the helm of the market, influenced by advanced healthcare systems, heavy investment in R&D, and the high prevalence of chronic diseases. It constitutes about 40% of the market share due to the high demand for biologics and new drug delivery technologies.

Europe also comes second, with robust healthcare infrastructure and an increasing trend of personalized medicine. It shares 25% of the market, which is further fueled by the prevalence of chronic diseases and innovations in drug delivery.

The Asia-Pacific region is growing rapidly due to large populations, expanding healthcare access, and increasing chronic diseases. It holds 20% of the market share, with significant growth potential in emerging markets like China and India.

Latin America is growing steadily, mainly in Brazil and Mexico, with 10% of the market share. The growth is driven by increased adoption of advanced drug delivery systems.

The MEA region holds 5% of the market share, growing as healthcare infrastructure improves in countries like Saudi Arabia and the UAE, with a rising focus on chronic disease management.

COVID-19 Impact Analysis on the Novel Drug Delivery Systems Market:

The COVID-19 pandemic triggered a strong surge in advanced drug delivery systems, especially for vaccines, biologics, and therapeutics. In particular, the delivery of vaccines, especially mRNA vaccines like Pfizer-BioNTech and Moderna, calls for innovative delivery systems that account for temperature sensitivity and specialized injectables. Increased focus on effective and scalable drug delivery systems further fueled market growth during the pandemic. The adoption of self-administered injectables (e.g., for diabetes and chronic conditions) and remote healthcare monitoring solutions surged as healthcare systems shifted toward telemedicine. At the same time, the COVID-19 pandemic caused disruptions in manufacturing and logistics, affecting the production and delivery of drug delivery devices and materials. The pandemic diverted attention and resources away from the approval processes of new drug delivery systems, causing delays in regulatory reviews and approvals for some NDDS innovations. Regulatory bodies like the FDA and EMA had to prioritize COVID-related therapies, leading to slower timelines for other drug delivery systems.

Latest Trends/ Developments in the Novel Drug Delivery Systems Market:

Recent trends in the Novel Drug Delivery Systems (NDDS) market reflect significant advancements in technology and increasing demand for personalized and efficient treatments. There is a growing shift towards nanotechnology-based drug delivery, enabling more precise targeting and controlled release, particularly for cancer and chronic diseases.

Smart drug delivery systems, incorporating sensors and digital health integration, are gaining popularity, allowing for real-time monitoring and personalized treatment adjustments. The rise of biologics and biosimilars is driving demand for injectable systems and innovative delivery methods, such as wearable injectors.

Additionally, biodegradable drug delivery systems are gaining traction due to their environmental benefits. The COVID-19 pandemic has also accelerated the adoption of self-administered injectables and remote monitoring solutions while increasing attention to vaccine delivery technologies. As patient-centric approaches become more prominent, there is a growing focus on personalized medicine and the development of targeted delivery systems that reduce side effects and improve therapeutic outcomes.

Key Players:

-

Johnson & Johnson

-

Novartis AG

-

Pfizer Inc.

-

AbbVie Inc.

-

Bayer AG

-

Medtronic PLC

-

Sanofi S.A.

-

Mylan N.V. (Viatris)

-

Gerresheimer AG

-

GlaxoSmithKline PLC

Chapter 1. Novel Drug Delivery Systems Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Novel Drug Delivery Systems Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Novel Drug Delivery Systems Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Novel Drug Delivery Systems Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Novel Drug Delivery Systems Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Novel Drug Delivery Systems Market – By Route of Administration

6.1 Introduction/Key Findings

6.2 Oral Drug

6.3 Injectable Drug

6.4 Pulmonary Drug

6.5 Transdermal Drug

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Route of Administration

6.8 Absolute $ Opportunity Analysis By Route of Administration, 2025-2030

Chapter 7. Novel Drug Delivery Systems Market – By Mode of NDSS

7.1 Introduction/Key Findings

7.2 Targeted

7.3 Controlled

7.4 Modulated

7.5 Y-O-Y Growth trend Analysis By Mode of NDSS

7.6 Absolute $ Opportunity Analysis By Mode of NDSS, 2025-2030

Chapter 8. Novel Drug Delivery Systems Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Route of Administration

8.1.3 By Mode of NDSS

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Route of Administration

8.2.3 By Mode of NDSS

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Route of Administration

8.3.3 By Mode of NDSS

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Route of Administration

8.4.3 By Mode of NDSS

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Route of Administration

8.5.3 By Mode of NDSS

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Novel Drug Delivery Systems Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Johnson & Johnson

9.2 Novartis AG

9.3 Pfizer Inc.

9.4 AbbVie Inc.

9.5 Bayer AG

9.6 Medtronic PLC

9.7 Sanofi S.A.

9.8 Mylan N.V. (Viatris)

9.9 Gerresheimer AG

9.10 GlaxoSmithKline PLC

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Novel Drug Delivery Systems Market was valued at USD 225 billion and is projected to reach a Market size of USD 380 billion by the end of 2030. Over the forecast period of 2025-2030, the Market is projected to grow at a CAGR of 11%.

Growing occurrences of critical and fatal diseases, the urgency of researching treatments, technological advancements in manufacturing and delivery of advanced drugs, increasing need for tailored and personalized treatment options are the key drivers for this market.

By Mode of NDSS, Targeted, Controlled, and Modulated are the segments under the Novel Drug Delivery Systems Market.

North America is the most dominant region for the Slickline Services Market.

Johnson & Johnson, Novartis AG, Pfizer Inc., AbbVie Inc., Bayer AG, Medtronic PLC, Sanofi S.A., Mylan N.V. (Viatris), Gerresheimer AG, GlaxoSmithKline PLC