Drug Delivery Devices Market Size (2025 – 2030)

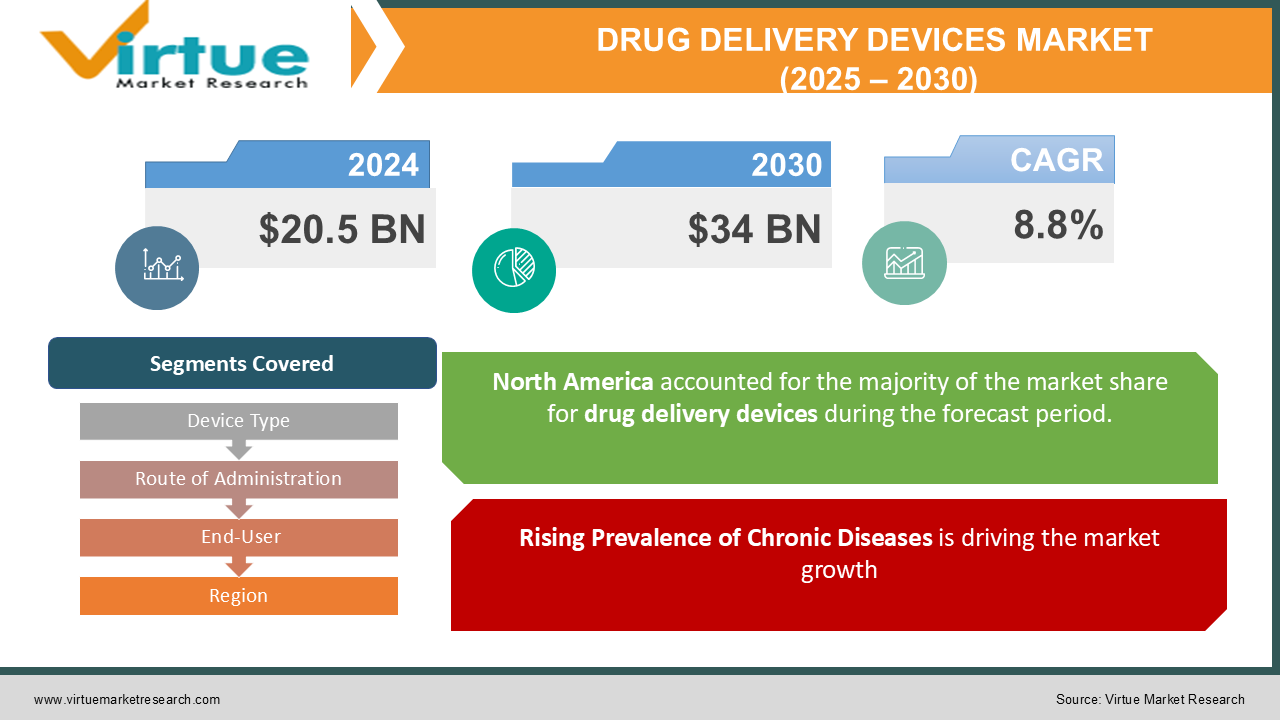

The Global Drug Delivery Devices Market was valued at USD 20.5 billion in 2024 and is projected to reach USD 34 billion by 2030, growing at a CAGR of 8.8% during the forecast period of 2025–2030.

These devices play a pivotal role in administering medications effectively, ensuring accurate dosage, and improving patient outcomes.

With the increasing prevalence of chronic diseases such as diabetes, asthma, and cardiovascular disorders, the demand for innovative drug delivery systems has surged. Additionally, advancements in personalized medicine and biopharmaceuticals have further fueled the adoption of cutting-edge drug delivery technologies.

Key Market Insights

Injectable drug delivery devices dominate the market, accounting for over 45% of total revenue in 2024, driven by the widespread adoption of prefilled syringes and autoinjectors.

The oral route of administration remains the most preferred method, contributing approximately 40% of the market share, owing to its ease of use and patient compliance.

The homecare segment is the fastest-growing end-user category, registering a CAGR of 10.2%, supported by the rising trend of self-administered therapies.

North America holds the largest market share, accounting for 38% of total revenue, followed by Europe, due to advanced healthcare systems and high adoption rates of novel therapies.

Global Drug Delivery Devices Market Drivers

Rising Prevalence of Chronic Diseases is driving the market growth

The increasing global burden of chronic diseases, including diabetes, cancer, asthma, and cardiovascular disorders, is a significant driver for the drug delivery devices market. Injectable and inhalable drug delivery systems, such as insulin pens and nebulizers, are critical for managing these conditions.

For example, the International Diabetes Federation estimates that approximately 537 million adults were living with diabetes in 2021, a number expected to rise significantly by 2030. This surge necessitates the adoption of advanced drug delivery devices to enhance treatment efficiency and patient compliance.

Advancements in Biopharmaceuticals and Personalized Medicine is driving the market growth

The growing adoption of biologics and personalized medicines is driving the development of specialized drug delivery devices. Biopharmaceuticals, including monoclonal antibodies, vaccines, and cell and gene therapies, require precise and efficient delivery systems to maintain efficacy.

Devices such as autoinjectors, prefilled syringes, and transdermal patches are increasingly used to deliver biologics, providing targeted and controlled medication delivery. Innovations like smart drug delivery systems are further enhancing the market's potential by integrating real-time monitoring and feedback capabilities.

Increased Focus on Patient-Centric Healthcare is driving the market growth

There is a growing emphasis on patient-centric healthcare solutions, which prioritize convenience, safety, and compliance. Homecare drug delivery devices, such as wearable infusion pumps and auto-injectors, enable patients to self-administer medications, reducing hospital visits and associated costs.

The demand for such devices is supported by the rising aging population and the shift toward outpatient care. According to the World Health Organization, the global population aged 60 years or older is expected to reach 2.1 billion by 2050, driving the need for user-friendly drug delivery solutions.

Global Drug Delivery Devices Market Challenges and Restraints

High Costs of Advanced Drug Delivery Systems is restricting the market growth

The high cost of innovative drug delivery devices poses a challenge, particularly in low- and middle-income countries. Devices such as implantable pumps and wearable injectors involve substantial manufacturing costs due to complex technologies and materials.

In addition, the integration of smart features like connectivity and AI in drug delivery devices further escalates their cost, limiting accessibility for a significant patient population. Governments and healthcare providers are working to address this issue, but affordability remains a critical restraint.

Regulatory and Safety Concerns is restricting the market growth

Drug delivery devices are subject to stringent regulatory requirements to ensure safety and efficacy. Meeting these standards involves extensive testing and validation, which can delay product approvals and market entry.

Furthermore, safety concerns related to device malfunctions or adverse reactions can impact consumer confidence. For example, issues such as syringe leakage, needle stick injuries, or pump failures can lead to complications, hindering the adoption of advanced systems.

Market Opportunities

The growing focus on personalized medicine and biologics presents significant opportunities for the drug delivery devices market. Biopharmaceuticals require sophisticated delivery systems for effective administration, creating demand for innovative devices such as smart autoinjectors, implantable drug delivery systems, and wearable patches.

Emerging markets in Asia-Pacific and Latin America offer untapped potential due to improving healthcare infrastructure, rising disposable incomes, and increasing awareness of advanced medical technologies. Manufacturers are investing in these regions to expand their market presence and cater to the growing demand for efficient drug delivery solutions.

The integration of digital health technologies with drug delivery devices is another key opportunity. Smart devices equipped with connectivity features allow real-time monitoring, dosage adjustments, and improved treatment adherence, aligning with the shift toward value-based care models.

DRUG DELIVERY DEVICES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

8.8% |

|

Segments Covered |

By Device Type, Route of Administration, End-User, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Becton, Dickinson and Company, Novartis AG, Medtronic plc, Johnson & Johnson Services, Inc., 3M Company, Pfizer Inc., Roche Holding AG, West Pharmaceutical Services, Inc., Gerresheimer AG, Baxter International Inc. |

Drug Delivery Devices Market Segmentation - By Device Type

-

Injectable

-

Inhalable

-

Transdermal

-

Others

Injectable devices dominate the drug delivery segment due to their widespread use in chronic disease management and biologic therapies. These devices offer several advantages, including precise dosing, rapid onset of action, and bypass of first-pass metabolism. They are particularly suitable for delivering complex drugs, such as biologics, which often require parenteral administration

Drug Delivery Devices Market Segmentation - By Route of Administration

-

Oral

-

Pulmonary

-

Injectable

-

Transdermal

-

Others

The oral route remains the most popular method of drug administration due to its ease of use, high patient compliance, and cost-effectiveness. It is a non-invasive method that does not require specialized medical personnel, making it suitable for self-administration. Oral dosage forms, such as tablets, capsules, and liquids, are widely available and can be easily incorporated into daily routines. Additionally, the oral route offers flexibility in terms of dosing regimens, allowing for both immediate-release and extended-release formulations. However, the oral route has certain limitations, including first-pass metabolism, which can significantly reduce the bioavailability of certain drugs. To overcome these challenges, researchers and pharmaceutical companies are continuously developing innovative oral drug delivery systems, such as nanoparticles and microparticles, to enhance drug absorption and improve therapeutic efficacy.

Drug Delivery Devices Market Segmentation - By End-User

-

Hospitals

-

Homecare

-

Clinics

-

Others

The homecare segment is experiencing rapid growth, driven by the increasing preference for self-administration and remote patient monitoring. As healthcare systems worldwide strive to reduce costs and improve patient outcomes, home-based care has emerged as a viable and effective alternative to traditional hospital settings. Patients can now administer medications, monitor their vital signs, and receive virtual consultations from the comfort of their own homes. This shift towards home-based care is particularly beneficial for chronic disease patients, who often require long-term therapy. By empowering patients to take control of their health, homecare solutions enhance patient satisfaction, improve adherence to treatment plans, and reduce the burden on healthcare providers. Additionally, advancements in technology, such as wearable devices and telehealth platforms, are further driving the growth of the homecare segment. These technologies enable real-time monitoring of patient data, early detection of adverse events, and timely intervention by healthcare professionals. As the demand for convenient and accessible healthcare continues to rise, the homecare segment is poised for significant growth in the coming years.

Drug Delivery Devices Market Segmentation - By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America leads the market, driven by advanced healthcare systems, high adoption of biologics, and the presence of key market players. The United States accounts for the largest share, supported by robust R&D activities and favorable reimbursement policies.

Asia-Pacific is the fastest-growing region, propelled by rising healthcare investments, a growing elderly population, and increasing prevalence of chronic diseases. Countries like China, India, and Japan are key contributors to this growth.

COVID-19 Impact Analysis

The COVID-19 pandemic had a mixed impact on the drug delivery devices market. While the initial phase saw disruptions in supply chains and manufacturing, the demand for drug delivery systems surged for COVID-19 treatments and vaccines. Injectable devices, such as prefilled syringes, played a crucial role in the mass vaccination efforts.

The pandemic also accelerated the adoption of homecare solutions, as patients sought to avoid hospital visits. This trend has created long-term growth opportunities for wearable and self-administered drug delivery systems.

Latest Trends/Developments

Integration of IoT and AI in drug delivery devices is enabling real-time monitoring, dosage personalization, and improved patient compliance. By incorporating sensors and wireless connectivity, these devices can track drug administration, measure patient vital signs, and transmit data to healthcare providers. AI algorithms can analyze this data to optimize dosing regimens, identify potential adverse effects, and provide personalized treatment plans. This level of precision and control enhances patient safety and efficacy, particularly for complex therapies like chronic diseases and cancer treatments. Manufacturers are adopting eco-friendly practices, such as reusable devices and biodegradable materials, to reduce environmental impact. By minimizing waste, conserving energy, and reducing the use of harmful chemicals, these companies are contributing to a more sustainable healthcare industry. Additionally, some manufacturers are developing innovative packaging solutions that reduce the amount of plastic and other non-biodegradable materials used in drug delivery devices. Companies are targeting emerging economies with cost-effective and innovative solutions to meet the rising healthcare demands. As these markets experience rapid economic growth and an aging population, there is a growing need for accessible and affordable drug delivery technologies. By offering tailored solutions that address the specific needs of these markets, companies can expand their market reach and improve patient access to essential medications.

Key Players

-

Becton, Dickinson and Company

-

Novartis AG

-

Medtronic plc

-

Johnson & Johnson Services, Inc.

-

3M Company

-

Pfizer Inc.

-

Roche Holding AG

-

West Pharmaceutical Services, Inc.

-

Gerresheimer AG

-

Baxter International Inc.

Chapter 1. Drug Delivery Devices Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Drug Delivery Devices Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Drug Delivery Devices Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Drug Delivery Devices Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Drug Delivery Devices Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Drug Delivery Devices Market – By Device Type

6.1 Introduction/Key Findings

6.2 Injectable

6.3 Inhalable

6.4 Transdermal

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Device Type

6.7 Absolute $ Opportunity Analysis By Device Type, 2025-2030

Chapter 7. Drug Delivery Devices Market – By Route of Administration

7.1 Introduction/Key Findings

7.2 Oral

7.3 Pulmonary

7.4 Injectable

7.5 Transdermal

7.6 Others

7.7 Y-O-Y Growth trend Analysis By Route of Administration

7.8 Absolute $ Opportunity Analysis By Route of Administration, 2025-2030

Chapter 8. Drug Delivery Devices Market – By End-User

8.1 Introduction/Key Findings

8.2 Hospitals

8.3 Homecare

8.4 Clinics

8.5 Others

8.6 Y-O-Y Growth trend Analysis By End-User

8.7 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 9. Drug Delivery Devices Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Device Type

9.1.3 By Route of Administration

9.1.4 By End-User

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Device Type

9.2.3 By Route of Administration

9.2.4 By End-User

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Device Type

9.3.3 By Route of Administration

9.3.4 By End-User

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Device Type

9.4.3 By Route of Administration

9.4.4 By End-User

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Device Type

9.5.3 By Route of Administration

9.5.4 By End-User

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Drug Delivery Devices Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Becton, Dickinson and Company

10.2 Novartis AG

10.3 Medtronic plc

10.4 Johnson & Johnson Services, Inc.

10.5 3M Company

10.6 Pfizer Inc.

10.7 Roche Holding AG

10.8 West Pharmaceutical Services, Inc.

10.9 Gerresheimer AG

10.10 Baxter International Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Drug Delivery Devices Market was valued at USD 20.5 billion in 2024 and is projected to reach USD 34 billion by 2030, growing at a CAGR of 8.8% during the forecast period of 2025–2030.

Key drivers include the rising prevalence of chronic diseases, advancements in biopharmaceuticals, and increased focus on patient-centric healthcare.

Segments include Device Type (Injectable, Inhalable, Transdermal), Route of Administration (Oral, Pulmonary, Injectable), and End-User (Hospitals, Homecare, Clinics).

North America dominates the market, accounting for 38% of total revenue in 2024, driven by advanced healthcare systems and high adoption of biologics.

Key players include Becton, Dickinson and Company, Novartis AG, Medtronic plc, Johnson & Johnson, and others.