North America Wine Market Size (2024 – 2030)

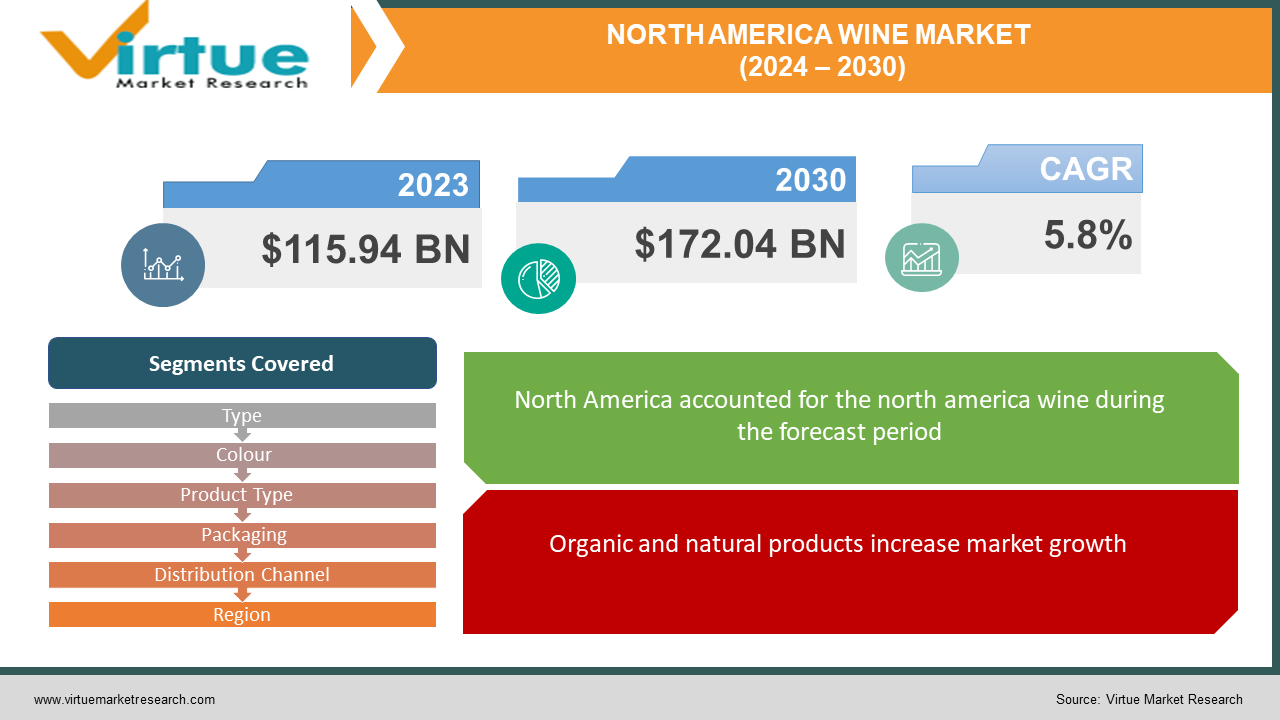

The North America Wine Market was valued at USD 115.94 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 172.04 billion by 2030, growing at a CAGR of 5.8%.

An alcoholic beverage known as wine is crafted through the fermentation process of various sources, including rice, fruits, cherries, berries, pomegranates, and grapes. Notably, the preparation excludes the addition of acids, enzymes, sugars, water, and additional nutrients. Historical evidence reveals the existence of wines in ancient cultures such as China, Iran, and Georgia. The consumption of wine is associated with numerous advantages, including the mitigation of heart disease risks and the reduction of cholesterol levels.

Key Market Insights:

The urban areas are witnessing an increasing preference for exotic wine, coupled with a surge in the overall demand for alcoholic beverages, thereby serving as pivotal factors driving market growth. The market is further propelled by shifts in lifestyle patterns, the expanding reach of e-commerce platforms, particularly in developing economies, a rising count of supermarkets and departmental stores, and heightened awareness among the populace regarding the advantageous aspects of wine consumption. Additionally, the escalating number of restaurants, lounges, and recreational clubs contributes significantly to the overall growth dynamics of the market. The global market is experiencing a notable trend of premiumization in wine products, which is anticipated to contribute significantly to the increased market value.

The expansion of the food and beverages industry, coupled with a continuously growing global population, amplifies the momentum of the wine market. Key drivers include heightened consumer awareness of high-quality, healthy, and nutritional wine options, a burgeoning community of young wine enthusiasts, and the augmented personal disposable income facilitated by major companies. Collectively, these factors play a crucial role in fostering growth and expansion within the wine market.

North America Wine Market Drivers:

Organic and natural products increase market growth.

A prevalent strategy among manufacturers is the acquisition of grapes in significant quantities from local vineyards to facilitate the production of wine at a lower cost. Moreover, there is a growing preference for locally produced wine in the U.S., driven by consumer demand for organic and natural products. Although organic wine remains a niche segment within the broader wine category, its production and consumption have witnessed an upward trajectory in recent years, fueled by increasing consumer awareness of health and wellness considerations. Additionally, certain manufacturers perceive the adoption of organic practices as imperative for achieving business growth.

North America Wine Market Restraints and Challenges:

High costs hinder the market growth.

The market faces a significant challenge in the form of elevated wine prices attributed to high production costs, which may impede overall growth. The growth rate of the market is further hindered by stringent government regulations and substantial tax burdens. Additionally, the increasing availability of alternative substitutes and the health risks associated with excessive consumption pose additional obstacles, potentially derailing the market's growth trajectory.

Harmful pesticides can restrain market growth.

The escalating wine production, coupled with the expanding cultivation of grapes, has the potential to exert detrimental effects on the environment, raising questions about its sustainability. The global concern over the environmental impact of wine production is notably attributed to the prevalent monoculture practices in vineyards, which heavily rely on the extensive application of herbicides, fungicides, and pesticides as preventive measures against diseases and pests. The widespread use of pesticides has contributed to the decline in insect and bird populations, while the intensive application of herbicides and fungicides has led to groundwater contamination and soil degradation, necessitating increased dependence on fertilizers. These environmental issues pose a potential constraint to the growth of the market.

North America Wine Market Opportunities:

The United States, accounting for approximately 17.50% of the global wine market in 2023, is significantly influenced by the preferences of millennials and the impact of social media. The dynamics of the wine market in the country have been molded, in part, by the preferences of the younger generation, particularly millennials. This demographic places a high value on authenticity, sustainability, and experiential aspects, aligning with certain facets of the wine industry.

NORTH AMERICA WINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Type, Colour, Product Type Packaging, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Casella Family Brands, E. & J. Gallo Winery, Pernod Ricard, Deutsch Family Wine & Spirits, Accolade Wine, Trinchero Family Estates, Bronco Wine Company, Constellation Brands, Inc., The Wine Group |

North America Wine Market Segmentation: By Type

-

Still Wines

-

Sparkling Wines

-

Fortified Wines

-

Others

The segment of sparkling wine is poised for rapid expansion, expected to achieve the fastest Compound Annual Growth Rate (CAGR). The market's growth is primarily attributed to an increase in the consumption of champagne and prosecco. Manufacturers have contributed to this trend by offering a diverse range of affordable products within this category, playing a pivotal role in propelling the segment forward. Additionally, the anticipated growth of sparkling wine is fueled by its perceived benefits, including positive effects on heart and skin health. Furthermore, the presence of polyphenols from red grapes in sparkling wine is associated with improvements in gut health and digestion, promoting the growth of beneficial gut bacteria.

North America Wine Market Segmentation: By Colour

-

Red Wine

-

White Wine

-

Rose Wine

-

Others

Red wine commands a significant market share, representing nearly 41.50% of the global wine market. The appeal of red wines lies in their diverse flavor characteristics, stemming from a range of grape varieties, terroirs, and winemaking techniques.

The extensive variety of red wines caters to diverse tastes, offering options such as the fruit-forward qualities of Merlot and the robust, complex structure of Cabernet Sauvignon. This diversity allows consumers to easily find red wines that align with their preferences, contributing to the enduring popularity of this market category.

North America Wine Market Segmentation: By Product Type

-

Unflavoured

-

Flavored

The flavored product type stands as both the largest and fastest-growing segment of the market.

North America Wine Market Segmentation: By Packaging

-

Bottles

-

Can

-

Others

The fastest-growing segment within the market is cans. Cans exhibit notable advantages, being lighter and more easily recyclable compared to glass bottles. The departure from the traditional concept of wine exclusively packaged in bottles reflects a significant shift in the industry's approach, demonstrating a willingness to experiment with various packaging formats to better appeal to consumers.

North America Wine Market Segmentation: By Distribution Channel

-

Supermarkets/Hypermarkets

-

Convenience Stores

-

Online Retailers

-

Other Distribution Channels

The wine market is predominantly dominated by the retail sales channel. The distribution of wine and other alcoholic beverages has conventionally and consistently been conducted through retail channels. The enduring legacy infrastructure of the retail sector has played a key role in sustaining its dominance within the market.

North America Wine Market Segmentation- by Region

-

U.S.

-

Canada

-

Mexico

The United States, situated in the North American region, holds a commanding position in the wine market and is expected to maintain its dominance throughout the forecast period. This leadership is attributed to robust demand for diverse wine varieties, an increasing inclination toward alcoholic beverages, and a rise in personal disposable income.

Within the United States, the wine market has experienced significant growth, establishing itself as a major player in the global wine industry. California, with notable regions such as Napa Valley and Sonoma County, serves as the heartland of the American wine industry, renowned for its production of high-quality wines. Other states, including Oregon, Washington, and New York, contribute significantly to the nation's overall wine production.

The U.S. wine market is characterized by its diversity, creativity, and large-scale production, catering to both domestic and international consumers. California, in particular, plays a pivotal role, accounting for approximately 90% of the total wine production in the country. The state's varied climate and terrain provide optimal conditions for cultivating a wide array of grape varietals. California is particularly acclaimed for its premium wine production, including varieties such as Cabernet Sauvignon, Chardonnay, and Zinfandel.

In addition to California's prominence, other regions contribute to the richness of the North American wine market. The Finger Lakes region in New York is renowned for its exceptional Riesling wines, while Oregon's Willamette Valley has emerged as a notable wine region, especially celebrated for its high-quality Pinot Noir wines.

Canada, with its wine industry concentrated in the Niagara Peninsula and British Columbia regions, has garnered recognition for producing ice wines, distinguished by their intense sweetness and distinctive flavors. Overall, the North American wine market, spearheaded by the United States, remains a dynamic and influential force in the global wine industry.

COVID-19 Pandemic: Impact Analysis

The wine industry experienced significant repercussions from the COVID-19 pandemic, primarily stemming from the mandated closure of on-trade wineries in various countries as a measure to control the virus's spread. Presently, there is an opportunity for the wine industry to regain consumer attention with the evolving situation. However, uncertainties loom regarding the sustainability of the current market surge in both on-trade and off-trade channels. Factors contributing to this uncertainty include the potential depletion of pantry loading, the gradual reopening of on-trade establishments, and the normalization of consumption behavior to pre-COVID-19 levels.

Key Players:

These are the top 10 players in the North America Wine Market: -

-

Casella Family Brands

-

E. & J. Gallo Winery

-

Pernod Ricard

-

Deutsch Family Wine & Spirits

-

Accolade Wine

-

Trinchero Family Estates

-

Bronco Wine Company

-

Constellation Brands, Inc.

-

The Wine Group

Chapter 1. North America Wine Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. North America Wine Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. North America Wine Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. North America Wine Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. North America Wine Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. North America Wine Market – By Type

6.1 Introduction/Key Findings

6.2 Still Wines

6.3 Sparkling Wines

6.4 Fortified Wines

6.5 Others

6.6 Y-O-Y Growth trend Analysis By Type

6.7 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. North America Wine Market – By Colour

7.1 Introduction/Key Findings

7.2 Red Wine

7.3 White Wine

7.4 Rose Wine

7.5 Others

7.6 Y-O-Y Growth trend Analysis By Colour

7.7 Absolute $ Opportunity Analysis By Colour, 2024-2030

Chapter 8. North America Wine Market – By Product Type

8.1 Introduction/Key Findings

8.2 Unflavoured

8.3 Flavored

8.4 Y-O-Y Growth trend Analysis By Product Type

8.5 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 9. North America Wine Market – By Packaging

9.1 Introduction/Key Findings

9.2 Bottles

9.3 Can

9.4 Others

9.5 Y-O-Y Growth trend Analysis End-User

9.6 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. North America Wine Market – By Distribution Channel

10.1 Introduction/Key Findings

10.2 Supermarkets/Hypermarkets

10.3 Convenience Stores

10.4 Online Retailers

10.5 Other Distribution Channels

10.6 Y-O-Y Growth trend Analysis By Distribution Channel

10.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 11. North America Wine Market, By Geography – Market Size, Forecast, Trends & Insights

11.1 North America

11.1.1 By Country

11.1.1.1 U.S.A.

11.1.1.2 Canada

11.1.1.3 Mexico

11.1.2 By Type

11.1.2.1 By Colour

11.1.3 By Product Type

11.1.4 By Distribution Channel

11.1.5 Countries & Segments - Market Attractiveness Analysis

Chapter 12. North America Wine Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1 Casella Family Brands

12.2 E. & J. Gallo Winery

12.3 Pernod Ricard

12.4 Deutsch Family Wine & Spirits

12.5 Accolade Wine

12.6 Trinchero Family Estates

12.7 Bronco Wine Company

12.8 Constellation Brands, Inc.

12.9 The Wine Group

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

There is a growing preference for locally produced wine in the U.S., driven by consumer demand for organic and natural products.

The top players operating in the North America Wine Market are - Casella Family Brands, E. & J. Gallo Winery, Pernod Ricard, Deutsch Family Wine & Spirits, Accolade Wine, Trinchero Family Estates, Bronco Wine Company, Constellation Brands, Inc., The Wine Group, Castel Frères.

The wine industry experienced significant repercussions from the COVID-19 pandemic, primarily stemming from the mandated closure of on-trade wineries in various countries as a measure to control the virus's spread.

The dynamics of the wine market in the country have been molded, in part, by the preferences of the younger generation, particularly millennials. This demographic places a high value on authenticity, sustainability, and experiential aspects, aligning with certain facets of the wine industry.

In the United States, the wine market has experienced significant growth, establishing itself as a major player in the global wine industry.