Middle East and Africa Wine Market Size (2024-2030)

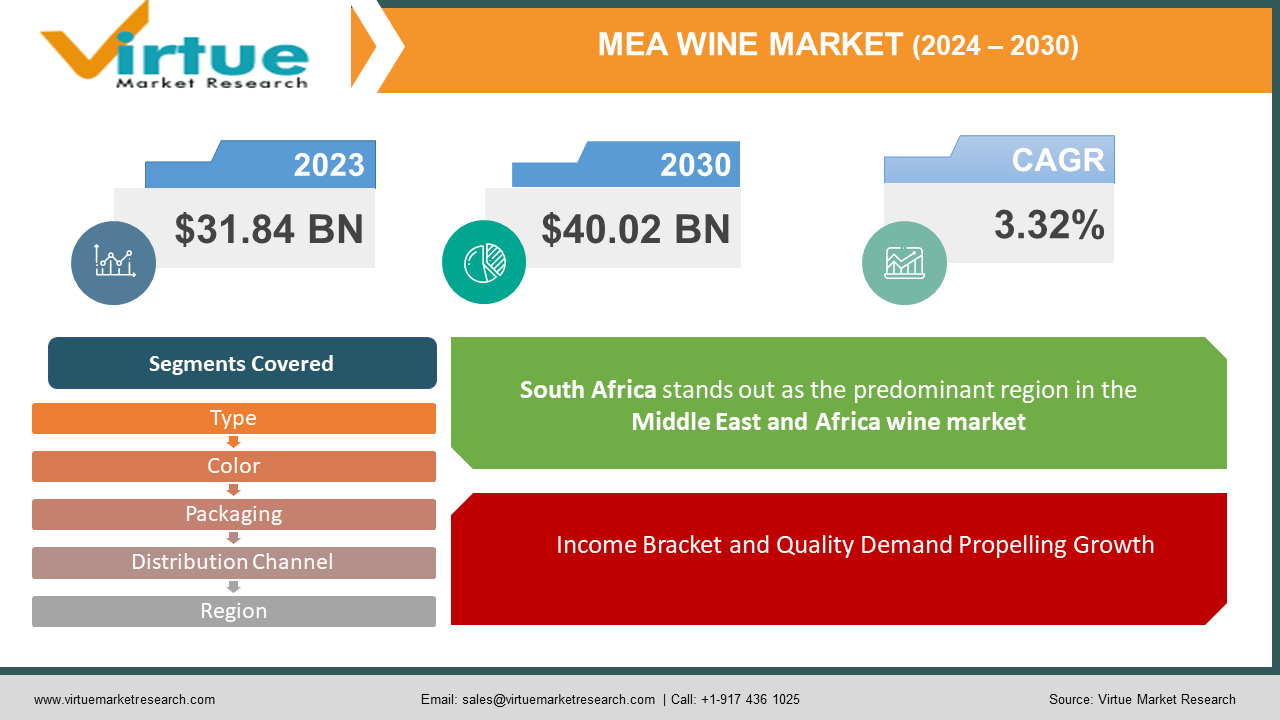

The Middle East and Africa Wine Market was valued at USD 31.84 billion in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 40.02 billion by 2030, growing at a CAGR of 3.32%.

Wine is a fascinating and diverse beverage that has been enjoyed by people around the world for centuries. Table wine, also known as still or regular wine, is the most common type. It is typically consumed with meals and has a lower alcohol content compared to other types of wine. Table wines generally have an alcohol content ranging from 8% to 14%, with the most common falling between 12% and 14%.

Sparkling wine is characterized by its effervescence, or the presence of bubbles. The carbonation is a result of natural fermentation or carbon dioxide injection. The traditional method involves a secondary fermentation in the bottle, while the tank method involves fermentation in large tanks before bottling. Champagne is a well-known type of sparkling wine, hailing from the Champagne region of France. Prosecco and Cava are popular alternatives.

Fortified wine is wine that has had a distilled spirit, such as brandy, added to it. This process increases the alcohol content and often results in a sweeter and more robust flavor. Port wine, Sherry, and Madeira are examples of fortified wines. They are often enjoyed as dessert wines or aperitifs. The fermentation process typically yields a wine with an alcohol content of around 15%, though it can vary depending on factors such as grape variety, climate, and winemaking techniques.

Wine holds a significant place in the global beverage market, with diverse varieties originating from various wine-producing regions worldwide. Wine has cultural and social significance, often associated with celebrations, rituals, and gatherings. Different regions have unique winemaking traditions and styles. Overall, the world of wine is rich and multifaceted, offering a wide array of flavors, styles, and experiences for enthusiasts and connoisseurs alike.

Key Market Insights:

- The wine market's substantial expansion, driven by the increasing demand for wines with distinct and invigorating flavors, reflects changing consumer preferences and trends. Consumers are increasingly seeking unique and diverse flavor profiles in their wine choices. This demand has led to the production and popularity of wines with distinct and innovative taste experiences.

- The growing preference for premium white wines suggests a shift in consumer taste towards lighter and crisper options. This trend may be influenced by factors such as food pairing preferences and a desire for refreshing beverages. The consumption of wine has evolved beyond being a simple beverage choice; it has become a symbol of social status. People often associate certain types of wine with sophistication and cultural experiences, driving the demand for high-quality and premium offerings.

- The rise of low-alcoholic or non-alcoholic wine reflects a broader trend towards healthier lifestyles and moderation in alcohol consumption. This category has gained popularity among millennials and young adults who appreciate the refreshing qualities and lower Alcohol By Volume (ABV) content. Low-alcoholic and non-alcoholic wines are commonly associated with various occasions, contributing to their popularity. These beverages are often served as table wines alongside regular meals, especially in developing countries, where they may be embraced as part of cultural and social practices. The escalating demand for low-alcoholic and non-alcoholic wines serves as a catalyst for manufacturers to introduce innovative products. This includes the development of new flavors, packaging, and marketing strategies to meet the evolving preferences of consumers.

- The increasing consumer interest in diverse wine options, including low-alcoholic and non-alcoholic alternatives, signals potential growth opportunities for manufacturers. This trend encourages the industry to adapt and expand its product offerings to cater to a broader customer base.

Middle East and Africa Wine Market Drivers:

Cultural and Religious Influences is boosting market growth.

Wine holds a distinctive status in many nations, playing a fundamental role in dietary practices. However, certain countries, like those in the Middle East and Africa, discourage wine consumption due to reasons rooted in religion or health considerations. The World Health Organization notes that in the United Arab Emirates and Africa, spirits are the predominant alcoholic choice, with wine closely following. The increasing influence of Western culture in these regions, where wine is often perceived as a premium beverage, presents opportunities for growth in the wine market. The younger demographic, in particular, exhibits a fervent embrace of sparkling wines, including prosecco, surpassing the popularity of champagne. This trend aligns with the global expansion of sparkling wine varieties.

Income Bracket and Quality Demand Propelling Growth:

The majority of the populace in regions where wine is embraced falls within the high-income bracket. This demographic trend fosters a demand for quality wine unhampered by price constraints, contributing significantly to market growth. Additionally, wine is recognized for its medicinal attributes, with an increasing demand driven by therapeutic properties. These properties include the alleviation of symptoms associated with depression, pain, and stress. The perceived health benefits, along with the appealing taste and refreshing qualities, contribute to market growth.

Middle East and Africa Wine Market Restraints and Challenges:

Global trends of increasing modernization have influenced consumer preferences, leading to a departure from traditional choices. Consumers are more open to experimenting with new and diverse alcoholic beverages. The overall rise in alcohol consumption worldwide has created a demand for a variety of alcoholic options. Consumers seek novel and unique experiences, encouraging producers to innovate in response to changing tastes.

Producers in the alcohol industry are responding to consumer demands by introducing inventive and daring variations in alcoholic beverages. This includes the development of new flavors, combinations, and types of drinks beyond traditional offerings.

To stay competitive and meet evolving consumer preferences, alcohol producers are diversifying their product offerings. This includes the creation of new brands, variations, and marketing strategies to capture different segments of the market.

Some consumers are becoming more health-conscious, leading to a demand for alcoholic beverages that align with wellness trends. This includes options with lower alcohol content, natural ingredients, and perceived health benefits. The rise of the craft and artisanal movement has influenced the alcohol industry. Consumers are drawn to unique and handcrafted beverages, contributing to the popularity of artisanal spirits, craft beers, and small-batch productions.

Middle East and Africa Wine Market Opportunities:

Prominent enterprises are engaging in mergers and acquisitions to strengthen their market positions. These strategic moves allow companies to acquire new capabilities, access new markets, and diversify their product portfolios. Additionally, companies are investing significantly in research and development (R&D) to drive product innovations. This includes the development of new wine varieties, flavors, and packaging to meet the evolving preferences of consumers and stay ahead of market trends.

Substantial investments in marketing are being made to build brand awareness, promote new products, and connect with consumers. Effective marketing strategies are essential for creating a strong brand presence in a competitive market.

Companies are expanding their distribution channels to ensure that their products reach a wider audience. This may involve entering new markets, strengthening relationships with existing distributors, and exploring e-commerce platforms to tap into online sales channels.

The significant portion of the population falling within the high-income bracket has contributed to the demand for premium-quality wine. The younger generation, in particular, is driving substantial market growth as they express a keen interest in wine, including sparkling varieties like champagne.

The discernible demand for premium-quality wine, coupled with the financial capacity of a substantial portion of the population, is shaping the market landscape. Consumers are willing to invest in higher-priced, high-quality wine without financial constraints.

MIDDLE EAST AND AFRICA WINE MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023- 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

3.32% |

||

|

Segments Covered |

By Type, Color, Packaging, Distribution Channel and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Accolade Wines, Treasury Wine Estates, Birthmark of Africa Wines , Pernod Ricard , Suntory Holdings Limited., Davide Campari-Milano S.p.A., Sula Vineyards Pvt. Ltd., Castel Group, Caviro, Miguel Torres S. A. |

Middle East and Africa Wine Market Segmentation:

Middle East and Africa Wine Market By Type:

- Still Wines

- Sparkling Wines

- Fortified Wines

- Others

The preference for sparkling white wine among Arabians, especially during Friday brunch events, reflects the influence of cultural traditions on beverage choices. Additionally, the response of major premium liquor distributors, Maritime and Mercantile International (MMI) and African + Eastern, to the growing demand for wine in the United Arab Emirates (UAE) through the introduction of a home delivery service is a strategic move to meet consumer needs. The preference for sparkling white wine among Arabians is linked to cultural practices, particularly the popularity of Friday brunch events. The cultural significance of these events has contributed to the increased consumption of sparkling white wine in the region. The acknowledgment of the escalating demand for wine in the UAE highlights the evolving consumer preferences in the region. The distributors, MMI and African + Eastern, are proactive in addressing this demand to maintain their market relevance.

Middle East and Africa Wine Market By Color:

- Red Wine

- White Wine

- Rose Wine

- Others

The dynamics of the wine market, with a predominant focus on white wine varieties, notably Chenin Blanc, and a significant share held by red wines, highlight the diversity and richness of the region's winemaking. A substantial majority, accounting for 66% of the overall wine grapes cultivated in South Africa, is attributed to white wine varieties. This prevalence signifies a strong presence and focus on white wine production within the South African wine industry. Despite the dominance of white wine grapes, the wine market features a substantial share held by red wines, occupying nearly 41.50% of the overall market. This dual emphasis on both white and red wines showcases the diversity and completeness of South Africa's winemaking.

Middle East and Africa Wine Market By Packaging:

- Bottles

- Can

- Others

In many retail establishments, the bottled wine available is sourced in bulk from producers who use large containers. Subsequently, the wine is filled into retail bottles. This process allows for flexibility in packaging, enabling wine to be warehoused in various types of bottles, including glass, plastics, and even wooden barrels. Can segment is the fastest growing segment in the market. As can be easily available and are carried around easily.

Middle East and Africa Wine Market By Distribution Channel:

- Off Trade

- On Trade

The off-trade sector is gaining dominance in the wine market, and it includes diverse establishments such as restaurants, clubs, and venues where consumers gather for social gatherings and celebrations. This shift reflects changing consumer preferences in how they access and enjoy wine. The supermarkets/hypermarkets segment is pivotal in the off-trade sector, capturing a substantial market share. These retail channels offer a wide selection of wines, spanning various types, brands, and price ranges, catering to a diverse consumer base. Supermarkets and hypermarkets contribute significantly to the off-trade sector's dominance by providing an extensive selection of wines. The availability of various types and brands, coupled with attractive promotional offers, enhances product sales through these channels. Dedicated shelf space for wines in supermarkets/hypermarkets facilitates consumer engagement. Shoppers can compare wine origins, review critics' ratings, and make informed choices based on their preferences. This approach empowers consumers to explore and select wines that align with their tastes.

Middle East and Africa Wine Market Segmentation- by Region

|

|

|

|

|

|

|

|

|

South Africa stands out as the predominant region in the Middle East and Africa wine market. It is the largest wine producer on the African continent and ranks ninth globally. Despite historical challenges, particularly during the era of apartheid, the South African wine industry has rebounded, contributing substantially to the global wine market. South Africa, also known as Mzansi, contributes half of the total wine tonnage produced in Africa. The region is recognized for delivering wines of notable quality, showcasing the resilience and growth of its wine industry. Wine tourism is gaining traction in the Middle East and Africa regions, with South Africa leading the way. The country has become a notable destination for wine enthusiasts, attracting tourists who play a pivotal role in propelling the wine consumption market.

Tourists contribute significantly to the wine consumption market in the Middle East and Africa. Countries like the UAE and Saudi Arabia have emerged as notable importers of wines, and the influx of tourists has led to an increase in popularity of wine-related events and festivals. Notable examples include the Cape Winelands Stellenbosch Wine Festival in South Africa and the Wine & Olive Festival in Marrakech, Morocco. These events serve as platforms to showcase the diverse offerings of the wine industry and attract both locals and tourists. Wine festivals and cultural events not only highlight the diversity of the wine industry but also serve as cultural attractions. They draw people to celebrate and appreciate the rich heritage of wine in these regions, contributing to the overall cultural and tourism experience.

COVID-19 Pandemic: Impact Analysis

The global wine distribution channel faced significant disruptions during the pandemic, primarily attributed to widespread restrictions on hotels and restaurants. These measures had profound consequences for businesses within the wine supply chain. Despite challenges, the wine industry managed to proceed with the wine grape harvest in 2020. This highlights the resilience and adaptability of the industry to continue essential processes even amid challenging circumstances. South Africa's lockdown measures, affecting both local and international sales, had a substantial impact on the wine industry. The restrictions had far-reaching consequences for businesses across the supply chain.

Key Players:

These are top 10 players in the Middle East and Africa Wine Market:-

- Accolade Wines

- Treasury Wine Estates

- Birthmark of Africa Wines

- Pernod Ricard

- Suntory Holdings Limited.

- Davide Campari-Milano S.p.A.

- Sula Vineyards Pvt. Ltd.

- Castel Group

- Caviro

- Miguel Torres S. A.

Chapter 1. Middle East and Africa Wine Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Wine Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Wine Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Wine Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Wine Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Wine Market– By Type

6.1. Introduction/Key Findings

6.2. Still Wines

6.3. Sparkling Wines

6.4. Fortified Wines

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Wine Market– By Color

7.1. Introduction/Key Findings

7.2. Red Wine

7.3. White Wine

7.4. Rose Wine

7.5. Others

7.6. Y-O-Y Growth trend Analysis By Color

7.7. Absolute $ Opportunity Analysis By Color, 2024-2030

Chapter 8. Middle East and Africa Wine Market– By Packaging

8.1. Introduction/Key Findings

8.2. Bottles

8.3. Can

8.4. Others

8.5. Y-O-Y Growth trend Analysis By Packaging

8.6. Absolute $ Opportunity Analysis By Packaging , 2024-2030

Chapter 9. Middle East and Africa Wine Market– By Distribution Channel

9.1. Introduction/Key Findings

9.2. Off Trade

9.3. On Trade

9.4. Y-O-Y Growth trend Analysis By Distribution Channel

9.5. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 10 . Middle East and Africa Wine Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Distribution Channel

9.1.3. By Color

9.1.4. Packaging

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Middle East and Africa Wine Market– Company Profiles – (Overview, Type Portfolio, Financials, Strategies & Developments)

11.1. Accolade Wines

11.2. Treasury Wine Estates

11.3. Birthmark of Africa Wines

11.4. Pernod Ricard

11.5. Suntory Holdings Limited.

11.6. Davide Campari-Milano S.p.A.

11.7. Sula Vineyards Pvt. Ltd.

11.8. Castel Group

11.9. Caviro

11.10. Miguel Torres S. A.

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The wine market's substantial expansion, driven by the increasing demand for wines with distinct and invigorating flavors, reflects changing consumer preferences and trends.

The top players operating in the Middle East and Africa Wine Market are - Accolade Wines, Treasury Wine Estate, Birthmark of Africa Wines, and Pernod Ricard

The global wine distribution channel faced significant disruptions during the pandemic, primarily attributed to widespread restrictions on hotels and restaurants

Nigerian Wine Brands Launch: In December 2021, Nigerian pharmacists entered the wine market by introducing new wine brands in collaboration with leading French winemakers.

Countries like the UAE and Saudi Arabia have emerged as notable importers of wines, and the influx of tourists has led to an increase in popularity of wine-related events and festivals