North America Refrigerant Market Size (2024-2030)

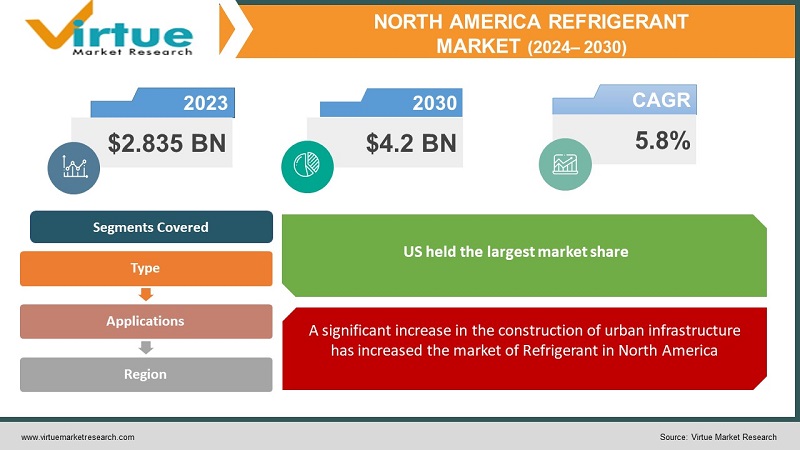

The North America Refrigerant Market was valued at USD 2.835 Billion and is projected to reach a market size of USD 4.2 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.8%.

In North America, compounds called refrigerants are essential to cooling systems like air conditioners and freezers. These substances help with heat transmission by collecting heat in one phase and releasing it in another to produce cooling effects. They can also change from liquid to gas and back. Environmental concerns are driving the replacement of common refrigerants like HFCs and HCFCs with more environmentally friendly options like HFOs. By lowering greenhouse gas emissions and ozone depletion, this change seeks to encourage more environmentally friendly cooling techniques across North America.

A chemical mixture of fluids used as cooling agents in heat pump and refrigeration cycles is called a refrigerant. Its application as prime working fluids in absorption refrigeration systems or as secondary fluids for transferring thermal energy between media is based on the phase transition principle. Several factors, including rising living standards and the increased use of refrigerants in cars and food goods, are driving the expansion of the refrigerant industry. These are the key elements propelling the market for refrigerants to rapid expansion. It is also expected that mobile air conditioners and chillers will become widely used in commercial refrigeration very quickly. Nonetheless, the environment is seriously harmed by using halons like hydrochlorofluorocarbons (HCFC) and chlorofluorocarbons (CFC). As a result, over the past few years, innovative environmentally friendly refrigerant compounds including R-410A, R-404A, and R-407C have been produced.

There are two segments in the refrigerant market: type and application. The market is divided into several types, including propane, ammonia, isobutane, CO2, HFC (hydrofluorocarbons), HFO (hydrofluoro-olefins), and HCFC (hydrochlorofluorocarbons). Over the past ten years, hydrocarbons have held a significant portion of the market, which can be linked to the increased demand for hydrocarbons brought on by the growing use of AC and refrigeration equipment. However, due to worries about the environment, it is anticipated that fluorocarbon and hydrochlorofluorocarbon will be phased out by 2040, creating chances for new refrigerants. The market is divided into segments based on application, including heat pumps, air conditioners, refrigerators, freezers, and large-scale refrigerators.

Key Market Insights:

Refrigerants are important to many different sectors since they are essential to contemporary cooling systems like refrigerators and air conditioners. Since the Montreal Protocol, hydrofluorocarbons (HFCs) have dominated the market as the preferred refrigerant, displacing ozone-depleting chlorofluorocarbons (CFCs). The industry is impacted by macroeconomic variables such as rapidly expanding economies and changing weather patterns, with the growing consumer electronics sector and the rise of less developed economies being the main drivers of growth. Due to their low global warming potential and low Ozone Depletion Potential (ODP), inorganic refrigerants are widely used in residential, commercial, and industrial settings since they are both economically and environmentally viable. The growing global data center industry, the growing cold storage sector, and the rising use of air conditioning all contribute to the rising need for refrigerants. The rise in refrigerant uses is partly due to the cold chain logistics trend, which addresses the requirement for temperature-controlled storage and transportation. This movement is fueled by the expansion of international trade in food and healthcare. Strategic deals, regional expansions, and continuous attempts by global firms to improve efficiency in manufacturing, resource allocation, and emissions reduction are characteristics of the industry.

North America Refrigerant Market Drivers:

A significant increase in the construction of urban infrastructure has increased the market of Refrigerant in North America

The industry is also being driven by the global urbanization trend, which is a major component. Buildings, both residential and commercial, are being built at an increasing rate as cities grow. For ventilation and temperature management, integrated cooling systems are typically needed for each of these buildings. Not only are residential areas but also shopping centers, office buildings, and transit hubs in need of dependable and efficient cooling systems. The market is under tremendous pressure to provide safe and efficient cooling agents due to this combined necessity. The need for scalable, effective, and eco-friendly cooling systems grows along with the expansion of metropolitan regions. The ongoing development of urban networks has a cascading influence on several other industries, including retail, electrical systems, and construction, opening up new opportunities for market expansion.

Constant innovation in supply chain networks and retail has increased the demand for Refrigerant in North America

A key factor in the market's advancement is the growth of the supply chain and retail networks. The majority of these cooling agents purchased have been completely transformed by developments in e-commerce platforms and inventory management system innovations. Previously, a difficult procurement procedure and restricted accessibility prevented the purchasing of these drugs. But a wider spectrum of customers may now easily obtain these products thanks to the upgrading of supply networks. In addition, advanced inventory management systems guarantee continuous supply, avoiding any possible bottlenecks that may otherwise hinder market expansion. Modern retail and supply chain technologies' increased accessibility and efficiency thereby draw in a wider range of clients, whether they are businesses or individual customers, and this makes a substantial contribution to the growing market in North America.

North America Refrigerant Market Restraints and Challenges:

The cost of making the switch from conventional to environmentally friendly refrigerants is a barrier to the expansion of the refrigerant market in North America. Companies face significant up-front costs, which include replacing or modifying current equipment and providing necessary staff retraining. Companies, especially small and medium-sized businesses, face a challenge in navigating the financial consequences of adopting eco-friendly solutions because of this financial investment. Despite the long-term advantages, the transition costs serve as a barrier, delaying the general adoption of environmentally friendly refrigerants. To ensure that the refrigerant market in North America can effectively navigate the challenges posed by evolving environmental standards, efforts to alleviate this constraint will need to involve strategic planning, financial incentives, and industry collaboration. This will facilitate a smoother and more cost-effective transition. In the market, safety concerns about some new refrigerants pose a significant issue. These alternatives' possible flammability or toxicity makes them subject to high safety standards compliance, intense testing, and significant research—all of which impede their quick acceptance. Complete risk assessments and the creation of strong safety measures are essential if end users and the environment's safety are to be guaranteed. As a result, the time and money needed to resolve safety concerns because the adoption process to stall. To address these worries, industry players need to put a high priority on teamwork and invest in cutting-edge technologies and safety precautions. Maintaining a healthy balance between innovation and safety is essential to building market trust and accelerating the use of safer, more environmentally friendly refrigerants in North America.

North America Market Opportunities:

The refrigerant market has grown significantly in recent years. Its reduced ability to cause global warming in comparison to other refrigerants can be the reason behind this. The increasing need for environmentally friendly air conditioning systems is likely to fuel the market's upward trend in the upcoming years. R32, which is one of the energy-efficient solutions in refrigerant is well-liked by both manufacturers and customers because it provides superior cooling performance and increased energy efficiency. The gradual elimination of ozone-depleting compounds and stringent environmental restrictions are also driving up demand for R32. With rising use in industrial, commercial, and residential settings, the refrigerant R32 market looks to have a bright future.

NORTH AMERICA REFRIGERANT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.8% |

|

Segments Covered |

By Product, Type, Consumption, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, Canada, Mexico |

|

Key Companies Profiled |

The Linde Group, Daikin Industries, Ltd., Arkema S.A., Honeywell International Inc., Chemours Company, Mexichem S.A.B. de C.V. (now Orbia), Arkema Inc., Airgas, Inc. (Part of Air Liquide), Gas Americas, National Refrigerants, Inc. |

North America Refrigerant Market Segmentation:

North America Refrigerant Market Segmentation By Type:

- HCFC

- HFC

- HFO

- Propane

- Ammonia

- Isobutane

- CO2

The North America Refrigerant Market Segmented by Types, Hydrocarbon held the largest market share. The market for refrigerants is divided into types. The market is divided into several types, including propane, ammonia, isobutane, CO2, HFC, HFO, and HCFC Over the past ten years, hydrocarbons have held a significant portion of the market, which can be linked to the increased demand for hydrocarbons brought on by the growing use of AC and refrigeration equipment. However, due to concerns about the environment, it is anticipated that fluorocarbon and hydrochlorofluorocarbon will be phased out after two to three decades, creating chances for new refrigerants.

North America Refrigerant Market Segmentation By Applications:

- Large-scale Refrigerators

- Chillers

- Heat Pumps

- Air Conditioners

- Refrigerators

The North America Refrigerant Market Segmented by Applications, Air Conditioners held the largest market share and is poised to maintain its dominance throughout the forecast period. Based on application, the market is segmented into areas for heat pumps, air conditioners, refrigerators, chillers, and large-scale refrigerators. Estimates indicate that the sector selling air conditioners generates the most money, and this pattern is not expected to change anytime soon. The growing use of refrigerants in automobiles and food items, together with rising living standards, are some of the factors driving the growth of the refrigerant industry. These are the main factors driving the refrigerant market's explosive growth. Additionally, it is anticipated that transportable air conditioners and chillers will swiftly gain widespread usage in commercial refrigeration.

North America Refrigerant Market Segmentation By Regional Analysis:

- USA

- Canada

- Mexico

The North America Market for Refrigerant markets segmented by region, US held the largest market share. The refrigerant market in North America is primarily driven by the United States, which holds a significant market share and influence. Technological innovation, a strong HVAC&R sector, and a regulatory environment that influences refrigerant use are the main forces behind the supremacy. The types of refrigerants that are used change as a result of policies like the Environmental Protection Agency's (EPA) SNAP program, which directs the shift to environmentally friendly alternatives. Canada has its own unique set of market characteristics and is a significant player in the North American refrigerant market. The need for heating and cooling solutions is influenced by the variety of climate conditions experienced by Canada. Objectives for energy efficiency and the demand for sustainable solutions in a range of end-use applications are other variables that affect the Canadian industry.

COVID-19 Impact Analysis on Africa and the Middle East Market for Refrigerant the Market:

The COVID-19 pandemic has presented opportunities as well as obstacles for the refrigerant market in North America. The supply chain for several refrigerants was disrupted in the sector, which resulted in shortages and higher costs. Restrictions and lockdowns affected building and manufacturing activities, causing installations and projects to be delayed. Furthermore, market expansion was hampered by investors' cautious approach as a result of economic uncertainty. Nevertheless, amid these difficulties, the pandemic highlighted the significance of ventilation and indoor air quality, leading to an increased emphasis on HVAC and R systems. Energy-efficient and environmentally friendly refrigerants became more in demand as consumers and businesses looked to create healthier indoor environments. This offered market participants a chance to adapt to shifting priorities and support sustainable solutions during the post-pandemic recovery.

Latest Trends/ Developments:

Natural refrigerants are gaining market share rapidly because of their remarkable energy efficiency and cooling capabilities. A considerable growth rate is expected in the commercial refrigeration and mobile air conditioning sectors in the United States throughout the projection period due to the phase-out of HFCs and the transition to more environmentally friendly natural and sustainable refrigerants like ammonia and carbon dioxide. In recent years, there has been a surge in the establishment of supermarkets and a rise in the demand for frozen items, which has led to an increase in the market for cooling equipment and supermarket retail chains.

Since environmentally friendly is coming into the market, inorganic refrigerants are also widely used substitutes in the refrigerant business. They are used in commercial, industrial, and residential applications because of their nearly zero global warming potential (GWP) and ozone depletion potential (ODP), non-toxicity, and economic viability.

Key Players:

- The Linde Group

- Daikin Industries, Ltd.

- Arkema S.A.

- Honeywell International Inc.

- Chemours Company

- Mexichem S.A.B. de C.V. (now Orbia)

- Arkema Inc.

- Airgas, Inc. (Part of Air Liquide)

- Gas Americas

- National Refrigerants, Inc.

Chapter 1. North America Refrigerant Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Refrigerant Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Refrigerant Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Refrigerant Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Refrigerant Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Refrigerant Market– By Type

6.1. Introduction/Key Findings

6.2. HCFC

6.3. HFC

6.4. HFO

6.5. Propane

6.6. Ammonia

6.7. Isobutane

6.8. CO2

6.9. Y-O-Y Growth trend Analysis By Type

6.10. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. North America Refrigerant Market– By Applications

7.1. Introduction/Key Findings

7.2. Large-scale Refrigerators

7.3. Chillers

7.4. Heat Pumps

7.5. Air Conditioners

7.6. Refrigerators

7.7. Y-O-Y Growth trend Analysis By Applications

7.8. Absolute $ Opportunity Analysis By Applications , 2024-2030

Chapter 8. North America Refrigerant Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Type

8.1.3. By Applications

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Refrigerant Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. The Linde Group

9.2. Daikin Industries, Ltd.

9.3. Arkema S.A.

9.4. Honeywell International Inc.

9.5. Chemours Company

9.6. Mexichem S.A.B. de C.V. (now Orbia)

9.7. Arkema Inc.

9.8. Airgas, Inc. (Part of Air Liquide)

9.9. Gas Americas

9.10. National Refrigerants, Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North America Refrigerant Market was valued at USD 2.835 Billion and is projected to reach a market size of USD 4.2 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.8%.

The Linde Group, Daikin Industries, Ltd., Arkema S.A., Honeywell International Inc., Chemours Company, Mexichem S.A.B. de C.V. (now Orbia), Arkema Inc., Airgas, Inc. (Part of Air Liquide), A-Gas Americas, National Refrigerants, Inc. are the key players in North America

The USA has the largest market for Refrigerant.

The market is expanding at an impressive rate, propelled by using modern techniques of environment-friendly and emerging variances of energy-efficient variations like R32

The Refrigerants are used in the Air conditioners the most. The maximum business comes from this sector in North America