Asia Pacific Refrigerant Market Size (2024-2030)

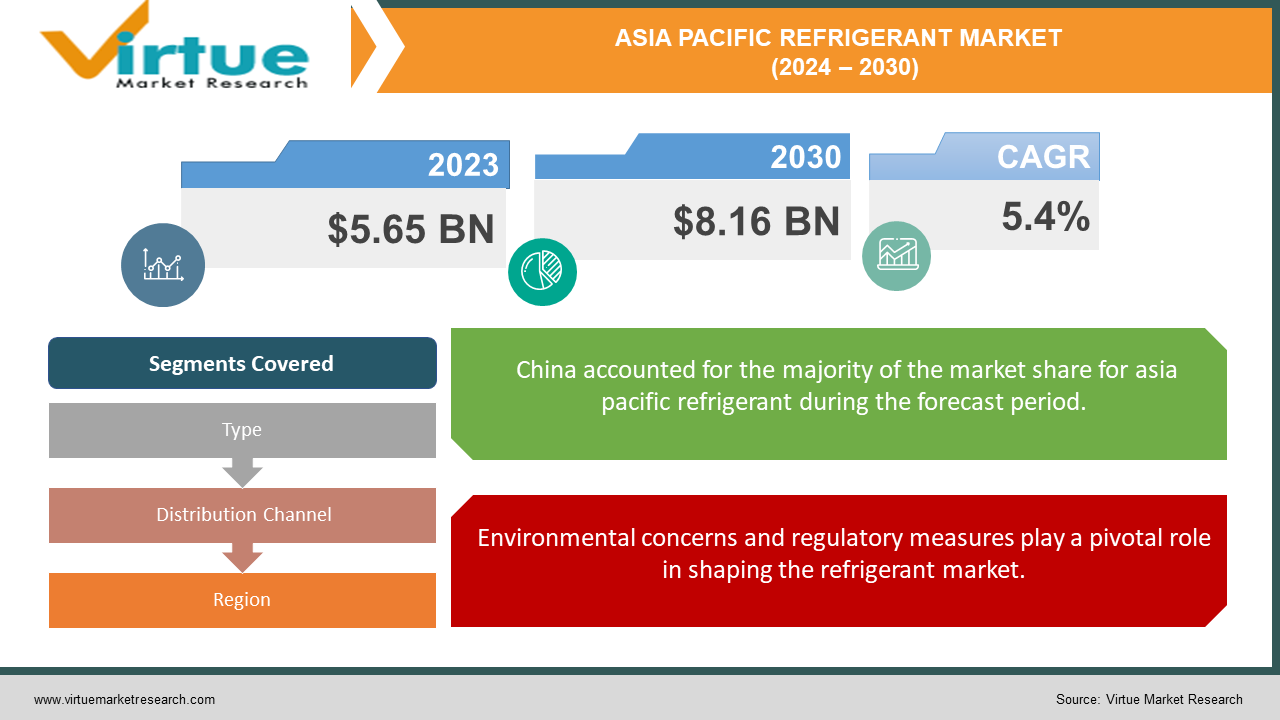

The Asia Pacific Refrigerant Market was valued at USD 5.65 Billion in 2023 and is projected to reach a market size of USD 8.16 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.4%.

The Asia-Pacific refrigerant market is witnessing substantial growth, driven by increasing demand in various end-use sectors such as automotive, residential, and commercial air conditioning, and industrial refrigeration. Refrigerants, which are chemical compounds used in air conditioning and refrigeration systems, play a critical role in the cooling and heating processes. The Asia-Pacific region, with its rapidly growing industrial base and rising living standards, presents a fertile ground for the expansion of the refrigerant market. Because of its large population and quick economic growth, the Asia Pacific area is a significant participant in the worldwide refrigerant industry. High demand is seen in the market from the refrigeration and HVAC (heating, ventilation, and air conditioning) industries. Leading contributors include China, India, Japan, and South Korea, which are propelled by thriving trade and manufacturing sectors.

Key Market Insights:

By 2027, low-GWP HFO blends are expected to increase at the quickest pace in the industry, with a compound annual growth rate (CAGR) of more than 10%.

Due to their extremely low GWP, natural refrigerants such as CO2 and ammonia, which will make up less than 5% of the market in 2023, are expected to increase at a compound annual growth rate (CAGR) of 8%.

It is estimated that a commercial refrigeration system has an average life cycle of fifteen years. The cost of retrofitting current systems to use low-GWP refrigerants might hinder market acceptance.

The Asia-Pacific region's refrigerant disposal services market is anticipated to develop rapidly, surpassing USD 1.5 billion in value by 2027.

Over 2 million service technicians working in the Asia-Pacific region require training and skill development to handle and service equipment using low-GWP refrigerants.

Leakage rates of refrigerants during equipment operation and servicing can be as high as 20%, necessitating improved leak detection and management practices.

Over 60% of consumers in major Asian economies like China and India are willing to pay a premium for eco-friendly air conditioners that utilize low-GWP refrigerants.

E-commerce platforms are offering refrigerant sales and service booking options, with over 15% of refrigerant purchases in China happening online by 2023.

Asia Pacific Refrigerant Market Drivers:

The Asia Pacific region is experiencing rapid urbanization and industrialization, driving the demand for refrigeration and air conditioning systems.

Large cities are growing quickly in nations like China, India, and Indonesia, which is increasing demand for both residential and commercial real estate. Modern cooling systems are needed because of this urban development to maintain comfort and preserve perishable items. The growth of urban areas has resulted in a rise in the development of commercial, industrial, and residential buildings, all of which need effective cooling systems. Urbanization raises the need for HVAC systems in all of these building types: homes, shops, offices, and industrial complexes. The refrigerant industry has been boosted as a result of the increase in air conditioning and refrigeration system installations. As consumers seek comfort and convenience in their living and working environments, the expanding middle-class population and rising disposable incomes further drive this desire.

Environmental concerns and regulatory measures play a pivotal role in shaping the refrigerant market.

Restrictions and policies that promote sustainable and environmentally friendly alternatives have become necessary due to the influence of refrigerants on global warming and ozone layer depletion. Manufacturers are spending money on R&D to create alternative refrigerants that adhere to environmental regulations in response to regulatory pressure. Novelties like hydrofluoroolefins, or HFOs, and natural refrigerants like ammonia and CO2 are becoming more and more well-liked. These solutions have the combined benefit of improving energy efficiency while also lessening their impact on the environment.

Asia Pacific Refrigerant Market Restraints and Challenges:

The high cost of alternative refrigerants is one of the main issues facing the Asia Pacific refrigerant business. Although switching to natural and low-GWP refrigerants is crucial for environmental sustainability, these alternatives frequently have greater implementation and production costs. There are substantial financial costs associated with manufacturers switching to new refrigerants. Research & development, retooling production facilities, and adhering to regulatory norms can come at a high cost. Because customers frequently pay for these costs, eco-friendly refrigerants are more expensive than conventional ones. The introduction of novel refrigerants presents a number of technical difficulties. The unique characteristics of each type of refrigerant necessitate modifications to handling, maintenance, and system design practices.

Asia Pacific Refrigerant Market Opportunities:

The Asia Pacific refrigerant industry has a lot of room to develop because of technological improvements. Developing more economical, ecologically friendly, and efficient refrigerants requires constant innovation. The goal of refrigerant mix research & development is to combine the greatest qualities of various materials to provide ideal solutions. Better performance, a reduced GWP, and increased energy efficiency are possible with certain mixes. To get the required balance of qualities, for example, novel combinations of HFOs and conventional refrigerants are being investigated. Improved performance and efficiency are possible when IoT (Internet of Things) and AI (Artificial Intelligence) are combined with refrigeration systems. In line with the rising need for sustainable solutions, smart refrigeration systems may minimize energy usage, forecast maintenance requirements, and optimize cooling cycles.

ASIA PACIFIC REFRIGERANT MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

|

Market Size Available |

2023 - 2030 |

|

|

Base Year |

2023 |

|

|

Forecast Period |

2024 - 2030 |

|

|

CAGR |

5.4% |

|

|

Segments Covered |

By Type, Distribution Channel and Region |

|

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

|

Regional Scope |

|

|

|

Key Companies Profiled |

The Chemours Company (US), Honeywell International Inc. (US), Arkema SA (France), Dongyue Group Co., Ltd. (China), Zhejiang Fotech International Co., Ltd. (China), Linde plc (Ireland), Air Liquide SA (France), Daikin Industries Ltd. (Japan), SRF Limited (India), Changshu 3F (China) |

Asia Pacific Refrigerant Market Segmentation:

Asia Pacific Refrigerant Market Segmentation: By Types:

- CFCs

- HCFCs

- HFC

- natural refrigerants

- HFOs

Despite regulatory pressures, HFCs remain the dominant sub-type in the market due to their widespread use and established infrastructure. HFCs are commonly used in residential and commercial air conditioning, refrigeration, and automotive applications. However, their dominance is gradually being challenged by the rise of eco-friendly alternatives.

The use of natural refrigerants—like ammonia (NH3), carbon dioxide (CO2), and hydrocarbons—like propane—is expanding quickly because of their minimal environmental effect and regulatory compliance. In industrial and commercial settings where efficiency and sustainability are top priorities, these refrigerants are being employed more and more.

Asia Pacific Refrigerant Market Segmentation: By Distribution Channel:

- Direct Sales

- Online Platforms

- Retail stores

The major distribution channels are still wholesalers and distributors because of their well-established networks and capacity to offer large volumes at reasonable costs. These middlemen are essential in guaranteeing that refrigerants are available in different areas to meet the demands of producers, suppliers, and consumers.

Due to the growing popularity of e-commerce platforms, online retail is becoming the distribution channel with the quickest rate of growth. A large selection of items, affordable prices, and the ease of online shopping are the main causes of this expansion. Online platforms are becoming increasingly popular with consumers and companies, especially in metropolitan areas, for their refrigerant demands.

Asia Pacific Refrigerant Market Segmentation: Regional Analysis:

- China

- India

- Japan

- South Korea

- Australia & New Zealand

- Rest of Asia-Pacific

The Asia Pacific refrigerant market is dominated by China, which commands a market share of around 40%. The nation's enormous industrial base, broad manufacturing capabilities, and large expenditures in infrastructure and technology are all major contributors to its supremacy. China's strong industrial sector is a major factor in the country's leadership in the refrigerant industry. There are several industrial businesses in the nation, such as consumer products, electronics, and automotive, all of which need sophisticated refrigeration and cooling systems. Refrigerants are required because of the accelerating urbanization and ongoing infrastructure development, which increase the requirement for air conditioning and refrigeration systems.

With a market share of about 10%, India is the nation in the Asia Pacific refrigerant industry that is expanding the quickest. The nation's need for refrigerants is expanding due in large part to the country's strong economic expansion, growing urbanization, and rising disposable incomes. India's economy has been expanding steadily, which has accelerated urbanization and industrialization. The demand for consumer durables like refrigerators and air conditioners is being driven by the growing middle class, which has more discretionary cash. Consequently, there is a greater need for refrigerants.

COVID-19 Impact Analysis on the Asia Pacific Refrigerant Market:

A direct consequence of COVID-19 was the interruption of worldwide supply networks. Cross-border transportation of finished refrigerants and raw materials was impeded by travel bans and lockdowns. The Asia-Pacific area, which is strongly dependent on international commerce, was notably impacted by this interruption in terms of the import and export of refrigerants. Among the most damaged industries was the hotel industry. Foot traffic at restaurants and hotel occupancy rates fell precipitously as a result of travel restrictions, lockdowns, and social distancing tactics. The need for refrigerants in commercial refrigeration systems for food storage and display therefore decreased. In order to preserve the integrity of perishable items after delivery, cold chain logistics became more important as e-commerce grew during the pandemic. The focus on public health during the pandemic has heightened awareness of environmental issues. This can potentially drive a shift towards more eco-friendly refrigerants like ammonia and carbon dioxide, which offer lower global warming potential (GWP) compared to traditional options like hydrofluorocarbons (HFCs). With increased reliance on cold chain logistics for e-commerce deliveries, the demand for after-sales services like refrigerant maintenance and leak detection is likely to rise. This presents a potential growth avenue for companies specializing in refrigerant servicing and repair.

Latest Trends/ Developments:

HFCs initially emerged as replacements for HCFCs, offering similar cooling efficiency without ozone depletion. However, HFCs are potent greenhouse gases, and their use is being regulated under the Kigali Amendment to the Montreal Protocol. The adoption of low-GWP refrigerants presents challenges. Some have lower energy efficiency, potentially impacting equipment performance and energy consumption. Additionally, retrofitting existing equipment for these refrigerants might not always be feasible or cost-effective. Collaboration between refrigerant manufacturers, equipment producers, and research institutions is vital to accelerate innovation and ensure the development of safe, efficient, and environmentally friendly cooling solutions. Industry bodies establish standards for refrigerant safety, handling, and equipment compatibility. These standards guide manufacturers, service providers, and end-users in ensuring safe and responsible refrigerant practices. Products using low-GWP refrigerants can qualify for eco-labels like "Energy Star" or regional equivalents. These labels help consumers identify environmentally conscious choices. Conducting life cycle assessments allows manufacturers to quantify the environmental impact of their refrigerants throughout their entire life cycle, from production to disposal. This transparency builds consumer trust.

Key Players:

- The Chemours Company (US)

- Honeywell International Inc. (US)

- Arkema SA (France)

- Dongyue Group Co., Ltd. (China)

- Zhejiang Fotech International Co., Ltd. (China)

- Linde plc (Ireland)

- Air Liquide SA (France)

- Daikin Industries Ltd. (Japan)

- SRF Limited (India)

- Changshu 3F (China)

Chapter 1. Asia Pacific Refrigerant Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Asia Pacific Refrigerant Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Asia Pacific Refrigerant Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Asia Pacific Refrigerant Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Asia Pacific Refrigerant Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Asia Pacific Refrigerant Market– By Types

6.1. Introduction/Key Findings

6.2. CFCs

6.3. HCFCs

6.4. HFC

6.5. natural refrigerants

6.6. HFOs

6.7. Y-O-Y Growth trend Analysis By Types

6.7. Absolute $ Opportunity Analysis By Types, 2024-2030

Chapter 7. Asia Pacific Refrigerant Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Direct Sales

7.3. Online Platforms

7.4. Retail stores

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Asia Pacific Refrigerant Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Asia-Pacific

8.1.1. By Country

8.1.1.1. India

8.1.1.2. china

8.1.1.3. Japan

8.1.1.4. South korea

8.1.1.5. Australia

8.1.1.6. Rest of MEA

8.1.2. By Types

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Asia Pacific Refrigerant Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 The Chemours Company (US)

9.2. Honeywell International Inc. (US)

9.3. Arkema SA (France)

9.4. Dongyue Group Co., Ltd. (China)

9.5. Zhejiang Fotech International Co., Ltd. (China)

9.6. Linde plc (Ireland)

9.7. Air Liquide SA (France)

9.8. Daikin Industries Ltd. (Japan)

9.9. SRF Limited (India)

9.10. Changshu 3F (China)

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Asia-Pacific region is witnessing a rapid rise in disposable incomes, urbanization, and infrastructure development. This translates into a growing demand for air conditioning in homes, offices, and commercial establishments

Low-GWP refrigerants often have a higher initial cost compared to traditional HFCs. This can be a barrier for some consumers and businesses, hindering widespread adoption.

The Chemours Company (US), Honeywell International Inc. (US), Arkema SA (France), Dongyue Group Co., Ltd. (China), Zhejiang Fotech International Co., Ltd. (China), Linde plc (Ireland), Air Liquide SA (France), Daikin Industries Ltd. (Japan), SRF Limited (India), Changshu 3F (China), Tazzetti S. p. A. (Italy), Sinochem Corporation (China), Mitsui Chemicals, Inc. (Japan).

The Asia Pacific refrigerant market is dominated by China, which commands a market share of around 40%.

With a market share of about 10%, India is the nation in the Asia Pacific refrigerant industry that is expanding the quickest.