North American Prenatal Vitamin Supplement Market Size (2024-2030)

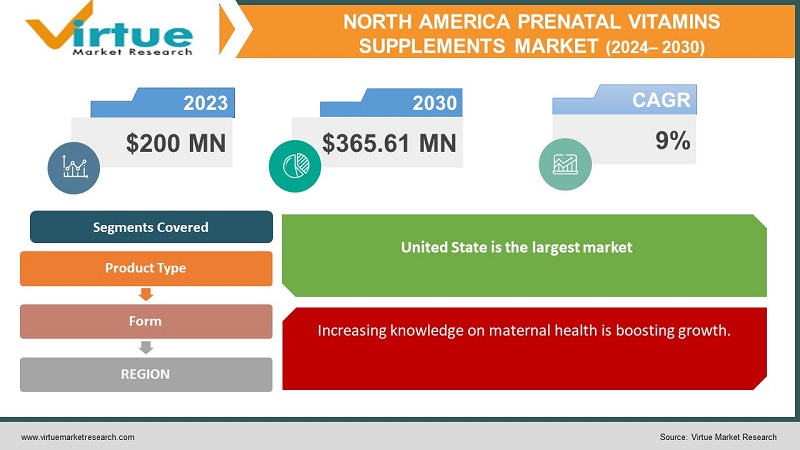

The North American prenatal vitamin supplement market was valued at USD 200 million and is projected to reach a market size of USD 365.61 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9%.

The growing emphasis on and knowledge of maternal health is driving a dynamic and expanding market for prenatal vitamin supplements in North America. This market offers a broad range of products made to meet the nutritional needs of pregnant moms, which is crucial for fostering the health of the mother and the growing baby. Multivitamins, folic acid supplements, iron, and calcium formulations are some of the key product kinds that cater to the specific needs of pregnant moms. The distribution channels provide accessibility and convenience to a broad spectrum of consumers; these channels include traditional pharmacies, supermarkets, and the quickly expanding Internet retail sector. On the market, substitute forms such as powders and candies are growing in popularity, giving those who have

Key Market Insights:

Growing awareness of the importance of maternal nutrition and rising demand for prenatal vitamins are driving market expansion. The market is characterized by a wide array of products, including multivitamins, folic acid supplements, and tailored formulations that address the unique needs of pregnant moms. The inclination for alternative formats like gummies and powders shows how the market is changing to meet consumer needs and preferences. Moreover, the increasing popularity of organic and specialist prenatal vitamins points to a broader movement towards healthier choices. The market is anticipated to rise from 200 million in 2023 to 365.61 million by 2030, demonstrating both its resilience and importance in boosting maternal and fetal health. These noteworthy findings present a picture of a market primed for gradual transformation, driven by a combination of consumer awareness, product innovation, and a commitment to improving the health of expectant mothers.

North America Prenatal Vitamins Supplements Market Drivers:

Increasing knowledge on maternal health is boosting growth.

The prenatal vitamin supplement market in North America is primarily driven by the increased public awareness of maternal health issues. Prenatal vitamins are becoming more and more crucial for protecting the health of the mother and the baby as people become more health-conscious. This is visible to both medical experts and expectant women. When more people become aware of the link between a good pregnancy and appropriate nutrition, there is a tendency for prenatal care regimens to include nutritional supplements. This increased awareness highlights both the increasing demand for maternal healthcare in North America and how it is changing.

Convenience and accessibility via online retail channels are contributing to the success.

Online shopping platforms' widespread accessibility and convenience are major drivers of the sector. Due to the rise of e-commerce, expectant mothers may now conveniently access a wide choice of prenatal vitamin products, weigh their options, and make informed decisions from the comfort of their homes. The ease of online shopping and doorstep delivery choices have contributed significantly to the market's expansion. This trend reflects a fundamental shift in consumer behavior, whereby the digital landscape is having a big impact on the prenatal supplement industry in North America.

Developments in technology for supplement formulations are expanding the market.

Formulations using new technologies are driving innovation in the prenatal supplement sector. Continuous research and development aims to make formulations better by making essential nutrients more effective and bioavailable. Alternative delivery techniques like powders and sweets are gaining popularity to satisfy clients who have trouble taking conventional tablets or have dietary constraints. Using natural and organic ingredients also aligns with the broader trend of customers choosing healthier options. This technological innovation in supplement manufacture not only meets a wide range of consumer needs but also demonstrates a commitment to staying at the forefront of nutritional science in the prenatal vitamin market in North America.

North America Prenatal Vitamin Supplements Market Restraints and Challenges:

The challenges of compliance and the stringency of regulations are barriers.

The market encounters difficulties with compliance and regulatory obligations. Manufacturers may have difficulties due to strict laws governing the formulation, labeling, and marketing of prenatal vitamins. Limitations may arise from the need for market participants to constantly change to comply with changing regulatory regimes. It is difficult to retain product effectiveness and client appeal while adhering to the strict regulations in the North American market.

Customer doubt and false information can hinder growth.

Some consumers may still be skeptical about the worth and efficacy of prenatal vitamins, despite their increasing understanding. The benefits of these supplements may not be fully understood by expectant mothers because of disinformation or conflicting advice from various sources. Market players need to use effective communication strategies and educational initiatives to dispel myths and convince potential customers of the benefits of prenatal vitamins.

Price sensitivity and concerns about affordability create obstacles.

Prenatal vitamin cost sensitivity and affordability are problems, particularly for some populations. Specialty and premium formulas satisfy specific needs, but the price may be too high for some customers. Reaching a balance between offering high-quality supplements and ensuring affordability is crucial to meeting a variety of customer needs. Market players need to get around this barrier to ensure that a variety of people can keep getting prenatal vitamins.

North American Prenatal Vitamin Supplement Market Opportunities:

Novel compounds for a range of medical needs have been beneficial.

There are plenty of chances for companies to take the lead in creating innovative formulations that meet a variety of health needs in the North American market for prenatal vitamin supplements. Customized prenatal vitamins that treat specific conditions like gestational diabetes or dietary deficits in vegetarian diets might cater to a more affluent clientele. Companies can differentiate themselves as leaders in providing comprehensive and tailored solutions for maternal nutrition by tailoring formulas to meet a variety of health requirements, in addition to capitalizing on specialized markets.

Eco-friendly solutions and sustainable practices are providing the market with an ample number of possibilities.

The burgeoning emphasis on sustainability presents a feasible prospect for industry players to employ ecologically sustainable techniques in the production and packaging of prenatal vitamins. Using sustainable sourcing, biodegradable packaging, and little environmental impact can win over environmentally conscious clients. Prioritizing sustainability not only contributes to environmental preservation but also makes firms stand out as morally and responsibly chosen by socially conscious consumers.

Combining digital and telehealth platforms is accelerating the growth rate.

The integration of digital platforms and telehealth services presents a strategic opportunity for industry players to revolutionize the availability and delivery of prenatal vitamins. The entire client experience can be enhanced by creating interactive tools, online consultations, and user-friendly mobile applications. Companies in the quickly evolving sector of digital health and wellness may employ technology to provide personalized nutritional recommendations, facilitate patient-physician communication, and ultimately cultivate a more informed and engaged clientele.

NORTH AMERICA PRENETAL VITAMINS SUPPLEMENTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9% |

|

Segments Covered |

By Product Type, Form, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, Canada, Rest of North America |

|

Key Companies Profiled |

Kikkoman Corporation, Direct Relief, Church & Dwight Co., Inc, Procter & Gamble, Nestle SA, Rainbow Light, Biotech Research Corporation, Megafood, Nutramark, Pharmawhite & Twinmark |

North America Prenatal Vitamins Supplements Market Segmentation:

North America Prenatal Vitamins Supplements Market Segmentation: By Product Type:

- Multivitamins

- Folic Acid

- Iron Supplements

- Calcium

Among the product categories, multivitamins have the largest market share in 2023. They are particularly helpful in providing comprehensive nutritional support throughout pregnancy. A variety of vitamins and minerals, including calcium, iron, and folic acid, are combined in multivitamins to address the intricate dietary requirements of expectant mothers. This all-inclusive approach ensures that pregnant moms receive a balanced blend of essential nutrients that are essential for both the mother's and the fetus's growth. Multivitamins provide pregnant women with an easy and efficient way to meet their nutritional demands since they reduce the stress of juggling many supplement regimens. Folic acid supplements are the fastest-growing category. They help prevent neural tube defects in developing fetuses, which addresses a specific and important aspect of prenatal care. The demand for folic acid supplements is anticipated to rise quickly as pregnant women and medical professionals become more aware of the advantages of taking supplements.

North America Prenatal Vitamins Supplements Market Segmentation: By Form:

- Gummies

- Capsules

- Powder

Capsules have the largest share in the market. This is explained by the fact that doctors prefer to prescribe capsules because of their extended shelf life, which in turn drives up demand for the product. Furthermore, manufacturers favor it because of how much easier it is to fill capsules due to technological improvements. Moreover, it is expected that the capsule's ability to readily dissolve in stomach fluids will increase customer demand for these prenatal vitamin supplements. Gummies are the fastest-growing segment. They are a popular choice because of their tasty flavor and chewable texture, especially for people who might find it difficult to take regular capsules or who would just like a more enjoyable supplement experience. Gummies work well to ensure constant and enjoyable prenatal supplement intake, which in turn supports the health of both the mother and the fetus. This is partly due to their accessibility. In addition to being tasty, gummies also provide pregnant women with a fun and easy way to get the nutrients they need without having to drink water or have other accompaniments.

North America Prenatal Vitamins Supplements Market Segmentation: By Region:

- USA

- Canada

- Mexico

Geographically, the prenatal vitamin supplement market in North America is distributed, with varying market shares originating from the US, Canada, and Mexico. The United States commands a significant 50% market share and dominates the world due to its massive population, robust healthcare system, and high level of maternal health awareness. Canada is the fastest-growing, with a 29% stake, indicating the large market presence and importance of prenatal nutrition in the nation's healthcare system. Mexico, on the other hand, holds a 21% market share, indicating the growing need and awareness for prenatal vitamins in the region.

COVID-19 Impact on the North American Prenatal Vitamin Supplement Market:

The industry for prenatal vitamin supplements in North America has seen both possibilities and challenges as a result of the COVID-19 epidemic. The market demonstrated resilience by adapting to the shifting circumstances, despite the early phases of the pandemic causing production and supply chain delays, which in turn generated short-term shortages and logistical challenges. Because of the pandemic, there is a greater need for supplements due to the increased awareness of health and welfare, as well as the importance of prenatal nutrition. Moreover, lockdowns and social distancing strategies have accelerated the transition to online retail platforms and e-commerce, providing consumers with a simple means of obtaining prenatal vitamins. Even if the need for healthcare has increased, the pandemic has highlighted the vital role that prenatal vitamins play in maintaining the health of both mothers and fetuses. Companies are looking into contactless delivery methods, telemedicine consultations, and digital health solutions, showcasing the adaptability and creativity of the sector. The North American Prenatal Vitamin Supplements Market is well-positioned to exploit the knowledge learned from the pandemic to establish a more robust and adaptable sector in the wake of the COVID-19 epidemic, even though there are still challenges to be addressed.

Latest Trends/Developments:

Notably, individualized nutrition is becoming more and more crucial, and prenatal supplementation is becoming more tailored to each person's needs based on lifestyle and genetics. Consumer desires for natural and healthier solutions are shown in the rising popularity of organic and clean-label products. While e-commerce continues to be the industry leader, there has been a noticeable shift in favor of online retail platforms for easy and diverse product access. The industry also sees constant innovation in formulas, including alternative delivery forms like gummies, to satisfy the diverse needs of pregnant moms. Furthermore, the use of telehealth services and digital platforms in prenatal care signifies a more significant change in how clients seek guidance and information.

A few government recommendations that have impacted the market for prenatal vitamins in North America are the 400–800 mcg of folic acid per day suggestion made by the U.S. Preventive Services Task Force to women who wish to get pregnant. Even though 70% of Americans take supplements, over 10% of pregnant women in the nation do not receive enough essential nutrients, according to NHANES data. This highlights the need for targeted treatments to address nutritional deficiencies and provide the best possible health for both mothers and fetuses. It also highlights market potential, particularly among the thirty percent of individuals who do not take supplements.

Key Players:

- Kikkoman Corporation

- Direct Relief

- Church & Dwight Co., Inc

- Procter & Gamble

- Nestle SA

- Rainbow Light

- Biotech Research Corporation

- Megafood

- Nutramark

- Pharmawhite & Twinmark

Chapter 1. North America prenatal vitamin supplement Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America prenatal vitamin supplement Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America prenatal vitamin supplement Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America prenatal vitamin supplement Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America prenatal vitamin supplement Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America prenatal vitamin supplement Market– By Product Type

6.1. Introduction/Key Findings

6.2. Multivitamins

6.3. Folic Acid

6.4. Iron Supplements

6.5. Calcium

6.8. Y-O-Y Growth trend Analysis By Product Type

6.9. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America prenatal vitamin supplement Market– By Form

7.1. Introduction/Key Findings

7.2. Gummies

7.3. Capsules

7.4. Powder

7.5. Y-O-Y Growth trend Analysis By Form

7.6. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 8. North America prenatal vitamin supplement Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Form

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America prenatal vitamin supplement Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Kikkoman Corporation

9.2. Direct Relief

9.3. Church & Dwight Co., Inc

9.4. Procter & Gamble

9.5. Nestle SA

9.6. Rainbow Light

9.7. Biotech Research Corporation

9.8. Megafood

9.9. Nutramark

9.10. Pharmawhite & Twinmark

9.11. SoFresh

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North American prenatal vitamin supplement market was valued at USD 200 million and is projected to reach a market size of USD 365.61 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 9%.

The primary reasons propelling the prenatal vitamin supplements market in North America are the increasing number of women reaching reproductive age, the increasing incidence of pregnancy-related health issues, and the growing awareness of maternal health

Notable developments in the North American prenatal vitamin supplement market have improved the health of expectant mothers and fetuses, increased product innovation, and increased accessibility for a larger spectrum of consumers

The USA is the dominant region, driven by its experimentation and progress factors

The major players include Kikkoman Corporation, Direct Relief, Procter & Gamble, Nestle SA, Rainbow Light, Biotech Research Corporation, Megafood, Nutramark, Pharmawhite, and Twinmark