Europe Prenatal Vitamins Supplements Market Size (2024-2030)

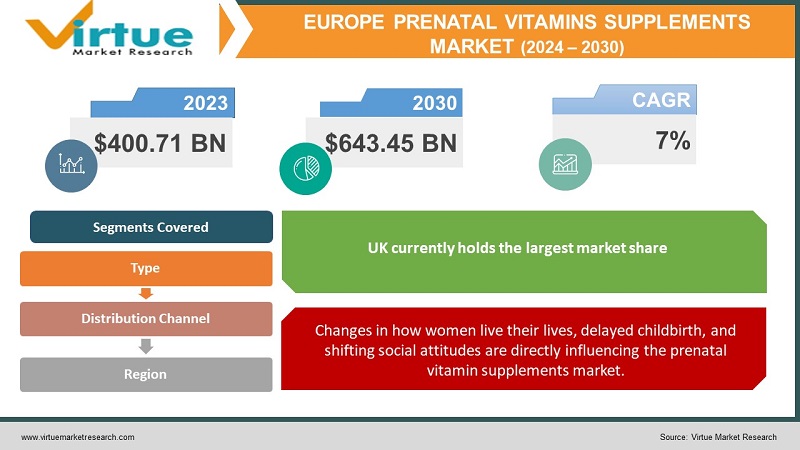

Europe Prenatal Vitamins Supplements Market was valued at USD 400.71 Billion in 2023 and is projected to reach a market size of USD 643.45 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7%.

The European prenatal vitamins and supplements market is propelled by a confluence of factors, making it an area of steady growth and innovation. Women are more informed than ever about the crucial role of specific vitamins and minerals (folic acid, iron, iodine, etc.) for both healthy fetal development and maternal well-being. Even with balanced diets, certain nutrient gaps are common, especially in specific populations. Prenatal supplements fill this need. The recognition of prenatal care's impact on long-term health outcomes for both mother and child drives supplement usage. The trend towards later pregnancies increases prenatal supplement usage, as women are more proactive about creating an optimal nutritional environment for conception. Pregnancies with multiple, medical conditions, dietary restrictions (veganism), and concerns like nausea create a need for specialized prenatal supplements. Consumers scrutinize ingredients, desiring prenatal supplements free from artificial additives, allergens, and potential GMOs.

Key Market Insights:

The European market for prenatal supplements exhibits healthy growth, fueled by greater awareness of the importance of nutrition during pregnancy and pre-conception periods. Women are more proactive about supplementing their diets to support both their health and their developing baby's development. Folic acid (and its bioavailable form, folate) is the star of prenatal supplements, crucial for preventing neural tube defects. Many European countries have public health campaigns or even recommendations around folate supplementation for all women of childbearing age. While iron, calcium, and iodine are staples in prenatal formulas, the market is seeing innovation towards a more comprehensive approach. Gummy vitamins are gaining popularity in the prenatal segment, appealing to women who experience nausea or have difficulty swallowing pills. Consumers are scrutinizing labels. Prenatal vitamins with plant-based ingredients, free-from additives, and organic certifications are sought after. This drives a focus on ingredient sourcing and supply chain transparency. Brands highlighting research partnerships and clinical studies to support their formulations gain trust in a health-conscious market. Regulations on fortification of staple foods with folic acid vary across Europe. This could lead to a reduced need for supplementation in certain regions. Additionally, potential subsidies for prenatal vitamins in some countries could increase access and drive market growth. Increasing focus on the impact of pre-conception nutrition for both potential parents opens growth opportunities for specialized supplements with a longer-term view of reproductive health.

Europe Prenatal Vitamins Supplements Market Drivers:

A significant driver of the European prenatal vitamin supplements market lies in the rising awareness and prioritization of both maternal and infant health during pregnancy and the crucial postpartum period.

Women today have greater access to reliable health information through online resources, healthcare providers, and public health campaigns. This empowers them to be more proactive about supplementing their nutritional needs during a time of increased demands. There's an increased understanding of the role prenatal vitamins play in preventing complications. Folic acid's impact on reducing the risk of neural tube defects is widely known, but awareness is growing around the potential benefits of other vitamins and minerals (Iron for healthy oxygen transport, DHA for fetal brain development, etc.). Women and their families often see prenatal vitamins as an investment in the long-term health of both mother and child. This mindset fuels a willingness to pay for premium, high-quality supplements. Obstetricians, midwives, and even general practitioners proactively recommend prenatal vitamin supplementation, emphasizing their crucial role in a healthy pregnancy. This expert guidance reinforces the importance of these supplements.

Changes in how women live their lives, delayed childbirth, and shifting social attitudes are directly influencing the prenatal vitamin supplements market.

Modern women often juggle demanding careers and personal lives. Pre-packaged prenatal vitamin supplements offer a convenient, targeted way to fill potential nutritional gaps that might arise from hectic lifestyles and less-than-ideal eating habits. The trend towards delaying pregnancy into one's 30s or beyond is evident in Europe. This increases the appeal of prenatal vitamins, as nutritional needs can shift with age and as fertility may become a greater concern. Women today are generally more proactive about their healthcare choices. This translates to seeking out specific prenatal vitamin formulations tailored to their individual needs (e.g., vegan options, probiotic-enhanced supplements, addressing pre-existing deficiencies). There's a decreasing stigma around taking dietary supplements in general. Prenatal vitamins are now often seen as a normal, responsible part of pregnancy care rather than a sign of 'weakness' or a less-than-perfect diet. The intensity of these drivers can differ across European countries. Nations with robust public health education or stricter food fortification regulations might see different supplementation patterns compared to others. There's a lack of absolute standardization regarding dosages and specific formulations recommended during pregnancy. This creates a market where diverse products compete, and women need to consult with their healthcare providers for guidance. While awareness is growing, access to affordable prenatal vitamins remains an issue, especially for economically disadvantaged women. Government programs and non-profit initiatives play a role in some European countries to address this gap.

Europe Prenatal Vitamins Supplements Market Restraints and Challenges:

Concerns about artificial additives, fillers, and unnecessary ingredients in supplements are on the rise. Prenatal vitamins targeted at this market niche need rigorous sourcing and transparent labelling.

Unlike a single, unified market like the USA with its FDA, Europe presents a patchwork of national regulations regarding prenatal vitamins. This creates complexity for manufacturers, as a formulation legal in one country might require changes for another. What's considered 'optimal' in prenatal vitamin composition changes as research progresses. For example, the amount of folic acid recommended differs across countries, and emerging science on nutrients like choline could lead to future reformulation needs. Prenatal vitamins fall into a less strictly controlled category than prescription medications. This can lead to inconsistent quality standards, and aggressive, sometimes misleading, marketing claims by some brands. While ideally, women consult their doctor before starting any supplement regimen, this doesn't always happen. Self-purchase of prenatal vitamins is common, making consumer education paramount. Healthcare professionals themselves might hold differing opinions on the necessity of prenatal supplements for everyone. Some advocate a 'food first' approach, emphasizing getting nutrients through diet, and only using supplements to address identified deficiencies. The level of prenatal care and availability of consultations with nutritionists varies across Europe. In regions with less access, women may have limited guidance in choosing the right prenatal supplement.

Europe Prenatal Vitamins Supplements Market Opportunities:

Going beyond a blanket 'pregnancy' supplement. Products tailored to pre-conception, first-trimester needs, later trimesters, and even the postpartum period will gain traction. While a nascent field, the potential for prenatal vitamins customized based on the mother's genetic profile holds appeal for those seeking highly personalized health optimization. Pills are just the beginning. Expect innovations in gummies with flavor profiles catering to pregnancy taste changes, time-release formulas to combat nausea or even liquid supplements for those who struggle with swallowing. Where ingredients come from matters. Traceability back to their origin and emphasizing sustainable practices will resonate with a growing consumer segment. Going beyond basics like non-GMO. Expect the market to be flooded with supplements boasting of 'free-from' artificial dyes, sweeteners, common allergens, etc. Buzzwords like "natural" aren't enough. Brands partnering with doctors or midwives to communicate the science behind their formulations, and potentially even undergoing small-scale studies, will see this as a competitive advantage.

EUROPE PRENATAL VITAMINS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.1% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

United Kingdom, France, Spain, Germany, Italy, Russia, Sweden, Denmark, Switzerland, Netherlands, and Rest of Europe |

|

Key Companies Profiled |

Bayer, Procter & Gamble (P&G), Church & Dwight Co. Inc., Pfizer, Solgar, Thorne Research, Rainbow Light, Garden of Life, Metagenics |

Europe Prenatal Vitamins Supplements Market Segmentation:

Europe Prenatal Vitamins Supplements Market Segmentation: By Type -

- Multivitamins

- Folic acid

- Iron

- Vitamin D

- Calcium

- Omega-3 Fatty acids

Multivitamins: These have the biggest market share and offer a "one-stop-shop" for all the nutritional requirements that arise during pregnancy and the preconception period. Iron, folic acid, iodine, calcium, vitamin D, several B vitamins, and frequently other vital minerals are among them. Folic acid: It is probably the most crucial dietary supplement during the early stages of pregnancy and preconception. It is essential to avoid neural tube abnormalities. frequently offered as a supplement on its own and as an essential part of multivitamins. Iron: Even before becoming pregnant, many women have low iron levels. The need for iron is significantly enhanced during pregnancy due to the increased blood volume. Individuals with anemia frequently take standalone iron supplements or them in addition to multivitamins. Vitamin D: Essential for both mother and child's bone health and calcium absorption. Due to the high prevalence of deficiencies, particularly in Northern Europe, supplementation is frequently advised. Calcium: Essential for both the mother's own bone health and bone development. usually, a significant ingredient in prenatal multivitamins, however it is less common as a supplement on its alone. Omega-3 fatty acids: DHA and EPA, or omega-3 fatty acids, are crucial for the developing fetus's brain and eyes.

Europe Prenatal Vitamins Supplements Market Segmentation: By Distribution Channel -

- Pharmacies and Drugstores

- Supermarkets and Hypermarkets

- Online Retailers

- Specialty Health Stores

- Direct-to-Consumer (D2C) Brands

Pharmacies and Drugstores: Traditionally considered the primary source of prenatal vitamins. Pharmacies offer access to in-house pharmacists who can provide valuable advice and guidance to pregnant women. Consumers often perceive a greater degree of trust and reliability with pharmacy-sourced supplements. Supermarkets and Hypermarkets: These large retail outlets provide broad consumer reach with convenient access to a range of prenatal vitamin brands. Dedicated health and wellness sections within stores improve visibility and offer the ease of purchasing supplements alongside regular grocery shopping. Online Retailers: E-commerce platforms are rising rapidly in the prenatal vitamins market. The convenience of home delivery, a wide selection across brands and price points, and ease of comparing product information draw a considerable consumer segment. Specialty Health Stores: These niche stores catering to natural and organic products often carry prenatal supplements. Their focus aligns well with the trend of consumers seeking 'cleaner' formulations with plant-based or naturally derived ingredients. Direct-to-Consumer (D2C) Brands: Certain prenatal vitamin manufacturers establish their online presence, selling directly to consumers through their websites. This allows greater control over brand messaging and creates opportunities for personalized subscription models. Pharmacies and Drugstores retain their position with strong consumer associations with in-person advice, product legitimacy, and a broader tradition of health-related purchases. Online Retailers boast significant growth potential driven by convenience, competitive pricing, and the vast selection available through e-commerce platforms.

Europe Prenatal Vitamins Supplements Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

UK: 25% - High awareness and proactive public health campaigns make it a market leader. The UK's well-established public health campaigns emphasizing the importance of folic acid, particularly for neural tube defect prevention, have a long history. This translates to high consumer awareness and drives demand. Germany: 20% - A robust economy and growing health consciousness support the market. Germany's strong economy grants consumers the discretionary income to prioritize investments in health and wellness, including prenatal supplements. France: 15% - Strong healthcare system and decent birth rates contribute to steady demand. France's advanced healthcare system promotes public awareness about prenatal health. Doctors often recommend prenatal vitamins, and driving consumption. Italy: 12% - Improving health infrastructure and evolving attitudes toward supplements. Recent developments in Italy's healthcare system are boosting accessibility to health-related information and resources, including prenatal care recommendations. Spain: 10% - Moderate market size with potential for further growth. Though not experiencing rapid expansion, Spain exhibits a dependable market for prenatal vitamins. Awareness is growing among expecting mothers, creating space for further growth. Rest of Europe: 18% - A diverse mix of emerging markets and established economies. This segment encompasses a mix of smaller Western European nations, Nordic countries, and rapidly developing economies in Eastern Europe. Emerging Eastern European markets show promise due to rising incomes and healthcare access, making supplements more affordable for expectant mothers.

COVID-19 Impact Analysis on the Europe Prenatal Vitamins Supplements Market:

The early stages of the pandemic triggered disruptions across various sectors. Lockdowns and supply chain constraints caused temporary stock shortages or delays in certain prenatal vitamin brands. Pregnant women, already navigating heightened anxieties during a crucial time, expressed concerns about potential deficiencies and the impact on their unborn babies. However, the pandemic also triggered a greater emphasis on overall health and immune system support. This shift in focus positively impacted the prenatal vitamin supplement market. Expectant mothers, acutely aware of their vulnerability and the potential risks of COVID-19 complications, viewed prenatal vitamins as a crucial line of defense for themselves and their developing babies. The focus on immune system support during the pandemic fueled a rise in demand for prenatal vitamins fortified with additional immune-boosting ingredients such as Vitamin C, Vitamin D, and Zinc. Manufacturers responded by introducing new product lines catering to this growing demand, offering a wider range of options for expectant mothers seeking extra protection. The pandemic has placed a spotlight on the importance of prenatal health. This heightened awareness is likely to translate into a long-term increase in the use of prenatal vitamin supplements among expectant mothers across Europe. The surge in online shopping habits established during the pandemic is likely to persist. Consumers accustomed to the convenience of e-commerce platforms will continue to utilize them for purchasing prenatal vitamins, shaping a more digital future for the market. The pandemic's emphasis on immune health is expected to influence the continued popularity of prenatal vitamins fortified with additional immune-boosting ingredients. Manufacturers will likely cater to this trend by offering products formulated to address this specific need.

Latest Trends/ Developments:

The traditional approach of a standard prenatal vitamin for all is shifting towards more tailored offerings. This trend considers individual needs, potential deficiencies, and unique dietary requirements of expectant mothers. Genetic analysis services are emerging, assessing a woman's DNA for predispositions to certain vitamin or mineral deficiencies. Results contribute to personalized supplement recommendations for optimized prenatal health. Manufacturers are creating prenatal vitamins with varying compositions for different trimesters of pregnancy, as nutritional requirements fluctuate. Some companies design formulas based on dietary preferences like vegan or vegetarian, or those catering to specific genetic profile needs. Research highlighting the interplay between a mother's gut microbiome and the baby's developing immune system is driving innovation in prenatal supplements. Select prenatal vitamin brands are incorporating specific probiotic strains known for supporting digestion, immune function, and potentially reducing risks of allergies in children. Prebiotics, which nourish beneficial gut bacteria, are also finding their way into select prenatal formulas for a holistic approach to maternal gut health. Expectant mothers are increasingly focused on the ingredients in their prenatal supplements. They seek products free from artificial colors, flavors, sweeteners, and unnecessary fillers.

Key Players

- Bayer

- Procter & Gamble (P&G)

- Church & Dwight Co. Inc.

- Pfizer

- Solgar

- Thorne Research

- Rainbow Light

- Garden of Life

- Metagenics

Chapter 1. Europe Prenatal Vitamins Supplements Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Product Type

1.5. Secondary Product Type

Chapter 2. Europe Prenatal Vitamins Supplements Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Prenatal Vitamins Supplements Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Prenatal Vitamins Supplements Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Prenatal Vitamins Supplements Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Prenatal Vitamins Supplements Market– By Type

6.1. Introduction/Key Findings

6.2. Multivitamins

6.3. Folic acid

6.4. Iron

6.5. Vitamin D

6.6. Calcium

6.7. Omega-3 Fatty acids

6.8. Y-O-Y Growth trend Analysis By Type

6.9. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Prenatal Vitamins Supplements Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Pharmacies and Drugstores

7.3. Supermarkets and Hypermarkets

7.4. Online Retailers

7.5. Specialty Health Stores

7.6. Direct-to-Consumer (D2C) Brands

7.7. Y-O-Y Growth trend Analysis By Distribution Channel

7.8. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Europe Prenatal Vitamins Supplements Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Prenatal Vitamins Supplements Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Bayer

9.2. Procter & Gamble (P&G)

9.3. Church & Dwight Co. Inc.

9.4. Pfizer

9.5. Solgar

9.6. Thorne Research

9.7. Rainbow Light

9.8. Garden of Life

9.9. Metagenics

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Proactive public health campaigns across many European countries emphasize the critical role of prenatal vitamins, specifically folic acid, in preventing birth defects. These efforts often include partnerships with healthcare providers and widespread education programs.

While prenatal vitamins are widely available, financial constraints remain a barrier for some women, particularly in less affluent regions or those without robust health insurance coverage. This raises concerns about inequity in access to crucial prenatal care support.

Bayer, Procter & Gamble (P&G), Church & Dwight Co. Inc., Pfizer, Solgar, Thorne Research, Rainbow Light, Garden of Life, Metagenics

UK currently holds the largest market share, estimated at around 25%.

As economies in countries like Poland, Romania, or the Czech Republic develop, there's substantial growth potential in the Prenatal Vitamins Supplements Market.