North America Peanut Oil Market Size (2024-2030)

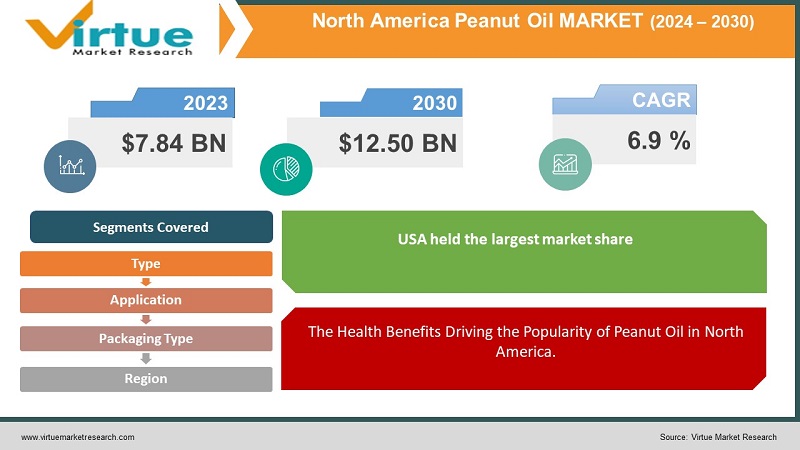

The North America Peanut Oil Market was valued at USD 7.84 billion and is projected to reach a market size of USD 12.50 billion by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 6.9 % between 2024 and 2030.

Groundnut oil, sometimes called arachis oil or peanut oil, is a mild-flavored vegetable oil highly valued for its distinct peanut flavor and scent similar to sesame oil. It is especially recommended for frying meals because it has a higher smoke point than other cooking oils. Antioxidants like vitamin E are frequently added to increase the shelf life of products. For the forecast period, peanut oil demand is expected to stay flat despite not having any special functionality compared to other oils. Its practical qualities, such as its capacity to deep fry without overpowering the underlying dish with flavor, keep people using it. Furthermore, peanuts' ongoing popularity can be attributed to their nutty essence. However obstacles still stand in the way of the North American peanut oil market's expansion, chief among them being the high cost of peanut oil and the rising demand for soybean oil. Notwithstanding these obstacles, the unique properties of peanut oil guarantee its continued use in culinary applications.

Key Market Insights:

Peanut oil has a high smoke point and many uses in home kitchens and food processing plants, its popularity among health-conscious customers looking for healthier cooking options is growing in North America. Its market growth is further supported by the rising popularity of Latin American and Asian cuisines, which use peanut oil as a basic ingredient. However, the frequency of peanut allergies and competition from other vegetable oils pose serious obstacles. While peanut allergies require strict labeling and allergen management techniques, other oils such as olive, avocado, and coconut oils compete for consumer attention with their supposed health benefits and unique flavor profiles. Notwithstanding these obstacles, the natural properties of peanut oil continue to draw consumers looking for flavor and health, calling for creativity and adaptability.

North America Peanut Oil Market Drivers:

The Health Benefits Driving the Popularity of Peanut Oil in North America.

The health advantages of peanut oil are becoming more and more popular as health consciousness grows. Peanut oil is particularly well-known for its ability to lower the chance of arrhythmias, or irregular heartbeats, which lessens the possibility of unexpected cardiac events. Furthermore, eating it lowers blood pressure, slows the rate at which atherosclerotic plaque grows, and lowers triglyceride levels—all vital components of heart health maintenance. The nutritional profile of peanut oil is becoming more and more appealing as consumers place a higher priority on preventative care as a necessary part of living a healthier lifestyle. Peanut oil, which is high in vitamins, proteins, and minerals, is thought to be a natural remedy for several conditions, such as depression, asthma, and cancer. Due to its many health benefits, peanut oil is becoming more and more popular in the market as health-conscious consumers looking for real wellness benefits as well as culinary diversity choose it.

Strategic Marketing and Endorsements Drive the North America Peanut Oil Industry.

In the highly competitive peanut oil business, consumer engagement and market growth are largely dependent on strategic marketing campaigns and endorsements. It is imperative to have a robust brand presence by utilizing brand names that effectively communicate trust, quality, and dependability to consumers. Businesses can make use of peanut oil's nutritional value by emphasizing its heart-healthy qualities, which include lowering triglyceride levels, promoting general well-being, and lowering the risk of heart disease. Furthermore, highlighting the safety of the product through strict quality control procedures and certifications builds customer trust and loyalty. Within the food sector, partnerships, mergers, acquisitions, and collaborations all help to increase the market by opening up new channels of distribution, diversifying product offerings, and encouraging innovation. Furthermore, a significant investment in marketing initiatives, such as advertising campaigns, influencer marketing on social media, and experiential marketing events, raises consumer awareness and brand visibility. Companies may effectively promote peanut oil as a preferred choice among health-conscious consumers and drive sustained market growth by developing thorough marketing strategies and getting endorsements from reliable sources.

North America Peanut Oil Market Restraints and Challenges:

Alternative vegetable oils like canola and soybean oil, which frequently have lower costs and appeal to consumers on a tight budget, compete fiercely with peanut oil. The market is further complicated by the high frequency of peanut allergies, especially in youngsters, which discourages families from buying peanut oil at all. Due to consumer preference for safer options, the potential market expansion for peanut oil is constrained by the serious worry about allergic responses. Expanding market share in the vegetable oil business is significantly hampered by the impact of peanut allergies, despite the nutritional advantages and culinary diversity of peanut oil.

North America Peanut Oil Market Opportunities:

To navigate the competitive landscape and expand market share, peanut oil producers can adopt a multifaceted approach focused on premiumization, sustainability, product innovation, targeted marketing, and strategic partnerships. Capitalizing on the trend towards healthier eating habits, offering premium varieties like cold-pressed or organic peanut oils appeals to health-conscious consumers seeking minimally processed options. Highlighting sustainable sourcing practices and eco-friendly packaging addresses the growing demand for environmentally responsible products while emphasizing traceability and fair-trade certifications to enhance consumer trust. Moreover, continuous product innovation, such as introducing new blends or flavored varieties with added health benefits or ethnic-inspired flavors, caters to diverse culinary preferences and fosters consumer interest. Strategic marketing efforts should focus on educating consumers about peanut oil's health benefits, versatility, and unique smoke points compared to other oils, targeting health-conscious cooks and enthusiasts of specific cuisines. Additionally, forging partnerships with chefs and food businesses that advocate for healthy cooking or specialize in ethnic cuisines amplifies brand visibility and showcases peanut oil's culinary applications, ultimately driving market growth and consumer adoption.

NORTH AMERICA PEANUT OIL MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.9% |

|

Segments Covered |

By Type, Application, packaging type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CANADA, MEXICO |

|

Key Companies Profiled |

Archer Daniels Midland Company , Bunge Limited , Cargill, Incorporated, Louis Dreyfus Company , ACH Food Companies, Inc. , Fuji Oil Corporation (US), Inc., Wilmar International Limited , The J.M. Smucker Company , Hormel Foods Corporation , Spectrum Naturals Products, Inc. |

North America Peanut Oil Market Segmentation:

North America Peanut Oil Market Segmentation By Type:

- Refined Peanut Oil

- Unrefined Peanut Oil

The North American peanut Oil Market is Segmented by Type, Refined Peanut held the largest market share last year and is poised to maintain its dominance throughout the forecast period .peanut oil dominates the North American market due to its neutral taste and high smoke making it a versatile choice for various cooking methods like frying and stir-frying. The refining process removes impurities and peanut flavor, ensuring that it doesn't overpower other ingredients in dishes. While both refined and unrefined peanut oils offer health benefits, refined versions may appeal more to health-conscious consumers due to lower saturated fat content. Moreover, refined peanut oil is generally more cost-effective than unrefined options, making it accessible to a broader range of consumers. Its wider availability in most grocery stores further solidifies its market dominance, despite unrefined peanut oil offering a richer peanut flavor and potentially more antioxidants. Ultimately, the combination of neutral taste, high smoke point, affordability, and wider availability cements refined peanut oil's position as the preferred choice for many home cooks and culinary professionals in North America.

North America Peanut Oil Market Segmentation By Application:

- Cooking

- Food Processing

- Cosmetics

- Pharmaceuticals

The North America Peanut Oil Market is Segmented by Application, Cooking held the largest market share last year and is poised to maintain its dominance throughout the forecast period. In the North American Peanut Oil Market, the "Cooking" application segment reigns supreme, and it's likely to stay that way. This dominance stems from several factors. Firstly, peanut oil's high smoke point makes it a favorite for frying, stir-frying, and searing, techniques prevalent in many cuisines. Home cooks and restaurants alike rely on peanut oil for its ability to deliver crispy textures without burning. Secondly, its neutral taste complements various dishes – from Asian stir-fries to Southern fried chicken – without overpowering other ingredients. Finally, peanut oil's versatility extends beyond frying. It's a healthy choice for salad dressings, marinades, and even baking due to its high monounsaturated fat content. While the "Food Processing" segment utilizes peanut oil in snacks and dressings, the sheer volume of peanut oil used for home and restaurant cooking secures the "Cooking" application's leading role.

North America Peanut Oil Market Segmentation By Packaging Type:

- Bottles

- Drums

- Bulk

The North American peanut Oil Market is Segmented by Packaging Type, Bottles held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The growth of the peanut oil market is fueled by consumer preferences for convenient packaging options like bottles, reflecting a desire for easy-to-use solutions. Bottles provide a user-friendly experience, allowing consumers to dispense the desired amount of oil with precision and minimal mess. This convenience factor aligns well with modern lifestyles, contributing to increased consumption of peanut oil among households. Conversely, in industrial settings, where large quantities of oil are required for food manufacturing processes, drums, and bulk containers are preferred. These larger packaging options cater to the needs of food manufacturers, enabling efficient storage, handling, and usage of peanut oil in bulk quantities. Consequently, the market's expansion is propelled by the combined demand for both consumer-friendly bottles and industrial-scale drums and bulk containers, addressing diverse requirements across various sectors of the peanut oil industry.

North America Peanut Oil Market Segmentation Region Analysis:

- U.S.

- Canada

- Mexico

The North America Peanut Oil Market is Segmented by Region, the U.S. held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The dominance of the United States in the North American peanut oil market is underscored by several key factors. With a significantly larger population compared to Canada and Mexico, the U.S. exhibits a greater demand for peanut oil across a wide array of culinary applications, buoyed by its well-developed food culture and diverse cuisines that frequently incorporate this versatile oil. Moreover, the strong presence of the food processing industry in the U.S., utilizing peanut oil in various products ranging from snacks to salad dressings, contributes substantially to its market share. American consumers' heightened health consciousness further drives demand, as they gravitate towards peanut oil for its perceived health benefits such as its high smoke point and favorable fat content. Additionally, the popularity of Asian and Latin American cuisines, where peanut oil is a staple ingredient, further bolsters its prevalence in the U.S. market. While Canada and Mexico are experiencing growth in the peanut oil sector, the U.S.'s combination of size, established culinary landscape, and consumer preferences establish it as the dominant force in North America.

COVID-19 Impact Analysis on the North American Peanut Oil Market:

The global peanut oil business has been significantly impacted by the COVID-19 epidemic, primarily as a result of government-mandated restrictions and lockdown protocols. Restrictions forced the closure of several manufacturing facilities across the globe, resulting in a major reduction in peanut oil production. The peanut oil market issues were exacerbated by this decrease in production capacity, which rippled through the trading chambers. The problem was made worse by the widespread imposition of partial or complete lockdowns in numerous nations, which caused the demand for cooking peanut oil to drop precipitously in the early stages of the pandemic. As consumers prioritized necessities and reduced non-necessities, the market for peanut oil experienced a significant decline. As a result, the pandemic-caused supply chain disruptions combined with a decline in consumer demand made the climate in which peanut oil market participants operated difficult. Resilience and adaptability tactics are essential for minimizing the effects and promoting recovery in the peanut oil sector as the globe works through the current crisis.

Latest Trends/ Developments:

Market developments and changing consumer tastes are causing a revolution in the peanut oil industry. As customers place a higher value on superior, less processed products like cold-pressed, organic, and single-origin peanut oils, premiumization is on the rise. Along with the increased demand for traceability and fair-trade certificates, sustainability has also been a major concern, with an increasing emphasis on eco-friendly packaging and sustainable sourcing methods. To satisfy a wide range of culinary tastes and health benefits, producers of peanut oil are always innovating and experimenting with new blends and flavored types. These include alternatives with flavors inspired by ethnic cuisine or additional health benefits. Peanut oil's health benefits and adaptability are being brought to customers' attention through targeted marketing initiatives, and its popularity is increased through collaborations with influencers. Peanut oil's health benefits and adaptability are being brought to customers' attention through targeted marketing initiatives, and its popularity is increased through collaborations with influencers. In addition, peanut oil capitalizes on the increasing popularity of plant-based diets by positioning itself as a healthy substitute for animal fats in frying and cooking during the plant-based boom. The market environment for peanut oil is shaped by these trends taken as a whole, presenting chances for expansion and modification in response to changing customer demands and preferences.

Key players:

- Archer Daniels Midland Company

- Bunge Limited

- Cargill, Incorporated

- Louis Dreyfus Company

- ACH Food Companies, Inc.

- Fuji Oil Corporation (US), Inc.

- Wilmar International Limited

- The J.M. Smucker Company

- Hormel Foods Corporation

- Spectrum Naturals Products, Inc.

Chapter 1. North American Peanut Oil Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North American Peanut Oil Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North American Peanut Oil Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North American Peanut Oil Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North American Peanut Oil Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North American Peanut Oil Market– By Application

6.1. Introduction/Key Findings

6.2. Cooking

6.3. Food Processing

6.4. Cosmetics

6.5. Pharmaceuticals

6.6. Y-O-Y Growth trend Analysis By Application

6.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 7. North American Peanut Oil Market– By Packaging Type

7.1. Introduction/Key Findings

7.2. Bottles

7.3. Drums

7.4. Bulk

7.5. Y-O-Y Growth trend Analysis By Packaging Type

7.6. Absolute $ Opportunity Analysis By Packaging Type , 2024-2030

Chapter 8. North American Peanut Oil Market– By Type

8.1. Introduction/Key Findings

8.2. Refined Peanut Oil

8.3. Unrefined Peanut Oil

8.4. Y-O-Y Growth trend Analysis By Type

8.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 9. North American Peanut Oil Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.1.4. Rest of North America

9.1.2. By Application

9.1.3. By type

9.1.4. Distribution Channel

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North American Peanut Oil Market– Company Profiles – (Overview, Application Portfolio, Financials, Strategies & Developments)

10.1. Archer Daniels Midland Company

10.2. Bunge Limited

10.3. Cargill, Incorporated

10.4. Louis Dreyfus Company

10.5. ACH Food Companies, Inc.

10.6. Fuji Oil Corporation (US), Inc.

10.7. Wilmar International Limited

10.8. The J.M. Smucker Company

10.9. Hormel Foods Corporation

10.10. Spectrum Naturals Products, Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

By 2023, the North American Peanut Oil market is expected to be valued at USD 7.84 billion.

Through 2030, the North American Peanut Oil market is expected to grow at a CAGR of 6.9%.

By 2030, the North American Peanut Oil market is expected to grow to a value of USD 12.50 billion.

The US is predicted to lead the market for North American Peanut Oil.

The North American Peanut Oil market has segments of Type, Packaging Type, Application, and Region