North America Modified Starch Market Size (2024-2030)

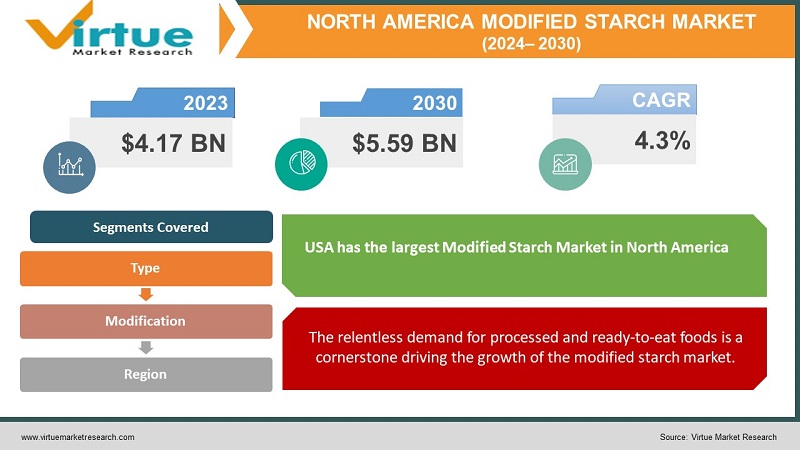

The North America Modified Starch Market was valued at USD 4.17 Billion in 2024 and is projected to reach a market size of USD 5.59 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.3%

Native starches are extracted from crops like corn, potato, wheat, or tapioca. They are then chemically, physically, or enzymatically treated to change their properties, making them perform specific functions within various industrial and food applications. Modified starches can handle everything from high temperatures to freezing or acidic conditions, making them suitable for various food processing methods. Modifications can improve adhesion, film-forming abilities, shelf-life, and even control the release of flavors or nutrients. Modified starches are found in countless items like baked goods, processed meats, dairy products, sauces, confectionaries, beverages, and even pet food. Modified starches play a role in papermaking for strength and printability, textiles for sizing and finishing, the pharmaceutical industry as binders and disintegrants, construction, and various other niche areas. The North American modified starch market is poised for continued growth, driven by its versatility and role in the innovation of food and industrial applications.

Key Market Insights:

Modified starches offer a vast array of functional properties. They thicken, stabilize, bind, emulsify, and act as carriers for flavors or nutrients. This makes them invaluable across a spectrum of food products. The relentless growth of processed, convenient, and ready-to-eat foods creates an ever-increasing demand for the abilities that modified starches bring to the table. Modified starches help address trends like gluten-free alternatives, clean-label requirements, and the creation of new textures and sensory experiences sought by consumers. Corn leads the way, but starches from potato, wheat, tapioca, and other sources each offer unique properties influencing their suitability for various food and industrial applications. Techniques like pregelatinization, oxidation, esterification, and crosslinking achieve different results. Understanding the specific type of modification is key to pinpointing the intended function of a modified starch. The market isn't just about off-the-shelf products. Collaboration between modified starch manufacturers and food or industrial users leads to customized solutions for specific needs. The demand for "clean-label", natural, and plant-based options pushes manufacturers to innovate, both in terms of novel starch sources and less heavily processed modification techniques. Developing biodegradable modified starches for industrial applications like packaging or finding ways to reduce resource consumption in their production aligns with the emphasis on sustainability. Research explores potential uses in areas like functional foods, nutraceuticals, and advanced materials, potentially opening new market segments in the future.

North America Modified Starch Market Drivers:

The relentless demand for processed and ready-to-eat foods is a cornerstone driving the growth of the modified starch market.

Modern lifestyles demand convenience. Hectic work schedules, long commutes, and a desire for simplified meal preparation have transformed how we approach food. This shift has profound implications for the modified starch market. Pre-made meals, microwavable dinners, and vast aisles of snacks all cater to the need for food that requires minimal time and effort. The success of these products heavily relies on modified starches. Consumers look to ready-made sauces, baking mixes, instant soups, and other products that accelerate cooking processes. Modified starches provide the essential textures and properties to make these shortcuts possible. A single modified starch can thicken a sauce, stabilize a pudding, prevent freezer burn in ice cream, or keep a salad dressing from separating. This versatility makes them essential across diverse processed food categories. Modified starches help products maintain quality over extended shelf lives. They thicken without deteriorating, prevent staling, and minimize ingredient separation – crucial for mass-produced foods. Modified starches offer a cost-effective way to achieve functionality within processed foods. This aligns with the price-sensitive nature of the convenience food market. Modified starches impart sheen to sauces, maintain the crispiness of coatings, and contribute to an overall visually enticing product. The dominance of processed and convenience foods in North America shows no signs of disappearing overnight. The modified starch market will continue to benefit but must adapt to changing consumer tastes.

The quest to create food products aligned with shifting consumer preferences fuels significant demand for modified starches.

Gluten-free, plant-based, and other specialized diets are no longer a niche, with consumers opting for these choices due to allergies, intolerances, or lifestyle preferences. Modern consumers are less bound by traditional cuisines. They crave new flavors, textures, and globally inspired food experiences. The industry is responding to the clean-label trend. Innovation focuses on new starch sources (like sweet potato or pea) and less severe modification techniques to create starches that resonate with consumers seeking 'simpler' ingredients. Replicating the functions of gluten is key in the gluten-free market. Modified starches provide structure, elasticity, and texture, enabling a vast array of gluten-free products that closely mimic their gluten-containing counterparts. Modified starches enhance the taste and texture of plant-based alternatives to meat and dairy. They contribute to the realistic textures and cooking behavior that make these products appealing to a broader consumer base. Collaboration between modified starch manufacturers and food companies leads to highly tailored solutions, optimized for specific product goals and consumer preferences. While the industry develops modified starches for healthier and 'cleaner' products, lingering consumer perception of 'processed ingredients' may be a hurdle. Transparency and education about the benefits are crucial.

North America Modified Starch Market Restraints and Challenges:

A growing number of consumers prefer foods made with identifiable, basic ingredients. Some people may find the word "modified starch" alarming because they believe it to be unduly processed or "unnatural."

A growing segment of consumers desires foods with simple, recognizable ingredients. The term "modified starch" can raise concerns, with some perceiving it as overly processed or 'unnatural'. Balancing the demand for simplicity with the need for modified starches functionality requires ongoing innovation in sourcing 'cleaner' starches and less severe modification methods. The modified starch market is inherently tied to the prices of source crops like corn, potato, and others. Droughts, floods, or global market shifts in these commodities directly impact prices for modified starches. Price volatility in raw materials complicates cost control for manufacturers and food companies utilizing modified starches. This can squeeze profit margins or necessitate passing increased costs onto consumers. Manufacturers may seek alternative starch sources or invest in long-term contracts with growers to mitigate price fluctuations and secure their supply chains. Differences between regulations in the US, Canada, and Mexico, even if subtle, can create complexity for manufacturers and influence trade dynamics within North America. As the industry develops modified starches from new sources or utilizing innovative modification techniques, consumer acceptance isn't guaranteed. We might see a more pronounced division between highly functional modified starches for mass-market products and growth in the "clear label" starch segment catering to niche markets.

North America Modified Starch Market Opportunities:

As the plant-based sector matures, expect refined demands for modified starches tailored to specific protein sources used in these products (think peas, soy, and new alternatives). Consumers seeking products free of specific ingredients (gluten, allergens) or those desiring 'clean labels' are a growing force, influencing the food industry landscape. Developing modified starches from diverse sources (potato, tapioca, rice) and employing minimal processing techniques opens up opportunities to cater to these specific market demands. Increasingly, consumers consider the environmental footprint of the food they purchase. Sustainability is becoming a purchase motivator. Research into modified starches that readily biodegrade could revolutionize their role in packaging, single-use items, and industrial applications. This aligns with the desire to minimize waste and environmental impact. The lines between food and health supplements continue to blur. There's a rise in products fortified with vitamins, prebiotics, or other beneficial components. Modified starches can encapsulate and protect nutrients, control their release, and improve the sensory experience of functional foods. As the North American population ages, so does the demand for foods and supplements that back health. Modified starches can play a role in product formats tailored to seniors. Success in capitalizing on these opportunities depends heavily on the pace of innovation within the modified starch sector to meet the evolving market demands. Proactive education on the benefits, safety, and role of modified starches (particularly cleaner starches and those used in sustainable applications) is crucial for market acceptance.

NORTH AMERICA MODIFIED STARCH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.3% |

|

Segments Covered |

By Type, Modification, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, Canada, mexico, |

|

Key Companies Profiled |

Cargill Incorporated, Ingredion Incorporated, Archer-Daniels-Midland Company (ADM), Tate & Lyle, Roquette Frères, AGRANA, Emsland Group, Avebe U.A |

North America Modified Starch Market Segmentation:

North America Modified Starch Market Segmentation: By Type

- Corn

- Potato

- Tapioca

- Wheat

Corn-derived modified starches hold the lion's share of the North American market. Estimates often place this at around 60-70%. Reasons include its wide availability, cost-effectiveness, and extensive history of use. Potato starch is the second most significant source. Its suitability for clean-label and gluten-free applications contributes to its substantial share, likely in the 15-25% range. Tapioca (cassava) is the rising star. Its neutral flavor, non-GMO status, and suitability for various modifications fuel its growth. Its share might fall within the 10-15% range but is steadily increasing. While wheat starch exists, its gluten content can be limiting. Its market share is often less than 5%, used in specific applications where gluten isn't a concern. Corn's dominance stems from its vast cultivation in North America and well-established processing infrastructure, contributing to its cost-competitiveness. The surging popularity of gluten-free and clean-label products drives the rise of potato and tapioca starches, likely leading to future gains in their market share. Specific sources possess unique properties for different applications. Tapioca's clarity is valued in some products, while potato starch might excel in freeze-thaw stability. Research into extracting starches from new plants or less resource-intensive crops could disrupt the market in the long term. Tapioca, potato, and niche sources catering to 'clean label' and plant-based trends will continue to gain ground.

North America Modified Starch Market Segmentation: By Modification

- Pregelatinized Starches

- Oxidized Starches

- Acetylated Starches

- Clean-Label Modifications

Pregelatinized Starches: These starches hold a significant position in the market due to their versatility and ease of use. Their ability to thicken and gel in cold water makes them indispensable across food products like instant sauces, puddings, and bakery fillings. Oxidized Starches: Widely utilized as stabilizers and thickeners, oxidized starches find applications in various processed foods, sauces, and industrial products like textile finishes and adhesives. They offer advantages like good clarity and film-forming properties. Acetylated Starches: This segment is experiencing noteworthy growth. Their enhanced stability across various conditions (freezing, heating, acidic environments) makes them increasingly preferred in frozen foods, baked goods, and industrial uses where durability matters. Clean-Label Modifications: While not a single type, starches derived from sources like potato, tapioca, or rice, or those subjected to gentler modification processes are on the rise. This segment aligns with the demand for simpler ingredients in foods.

North America Modified Starch Market Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

USA: Likely holds approximately 40-50% of the market share. This agricultural heartland, characterized by extensive corn and potato cultivation, holds the lion's share of modified starch production and a well-established user base. US South: Potentially commands 20-30% of the market. Expanding population and agricultural growth have led to an increase in both modified starch production and diverse applications in this region. Western US: accounts for around 15-25% share. While boasting a significant agricultural sector, modified starch production here is more varied, catering to the diverse mix of food industries that cater to specialized crops and niche applications. Canada: Estimated to contribute somewhere in the range of 10-20%. Canada is a major contributor to the modified starch market overall, with significant utilization within its food processing industries, particularly in wheat-based and other specialized applications. The US Midwest takes the crown as the most dominant region within the North American modified starch market. The US South appears to be the most rapidly growing region.

COVID-19 Impact Analysis on the North America Modified Starch Market:

Lockdowns, social distancing measures, and logistical hiccups led to temporary disruptions in the production and distribution of modified starches, causing challenges for manufacturers and users. Panic buying and subsequent shifts in consumer spending patterns created unpredictable fluctuations in demand. This was especially evident in the initial surge in demand for staples from the residential sector. Increased emphasis on securing reliable food supplies initially raised some concerns within the agricultural sector, potentially impacting the priority given to food processing inputs (like starch). Lockdowns and increased time spent at home fueled a DIY surge, particularly in areas like baking and home cooking. This vast number higher the demand for modified starches in consumer-facing products within the residential market segment. While the pandemic didn't fundamentally eliminate the need for food processing, it forced temporary adjustments. Supply chain bottlenecks and price fluctuations led some farmers to adjust their crop mix, potentially impacting starch availability long-term. A heightened focus on ensuring a stable food supply chain supported the ongoing use of essential ingredients like modified starches for food production, even in the face of disruptions. Lockdowns and preferences for contactless shopping pushed more consumers towards online platforms for purchasing modified starch products, especially for residential and niche applications. The growth of e-commerce has created opportunities for smaller suppliers and distributors, potentially increasing competition within the market. The pandemic highlighted the potential for online channels to become more significant in modified starch sales for agricultural purposes. This could reshape interactions between manufacturers, distributors, and farmers. The pandemic exposed potential vulnerabilities. Expect a greater focus on securing supply chains, diversifying starch sources, and building resilience for future disruptions. Heightened environmental awareness during the pandemic could translate to growing demand for sustainable modified starches and eco-friendly alternatives. This might create niche opportunities for innovation. The convenience of purchasing modified starches online will likely persist and become an established channel alongside traditional brick-and-mortar retail, prompting adaptation from manufacturers.

Latest Trends/ Developments:

There's a strong demand for foods with simple, recognizable ingredients. The word "modified" can trigger unease among consumers seeking "natural" products. Innovation focuses on starches derived from sources like sweet potato, peas, rice, and others which resonate with clean-label preferences. The development of modified starches utilizing less severe or purely physical modification techniques aims to cater to this segment. Expect a more distinct segmentation between conventional modified starches and those aligning with the clean-label movement. This creates niches for new players and may drive premium pricing. The astonishing rise of plant-based alternatives to meat and dairy products creates a substantial demand for modified starches as vital functional ingredients. Modified starches are crucial for achieving realistic textures, cooking behaviors, and the satisfying eating experience that makes plant-based products successful. This sector will demand modified starches specifically optimized for the unique protein sources (pea, soy, etc.) being utilized in these innovative products. Plant-based often aligns with clean-label and health-conscious consumers, creating a powerful synergy for growth across these segments.

Key Players:

- Cargill Incorporated

- Ingredion Incorporated

- Archer-Daniels-Midland Company (ADM)

- Tate & Lyle

- Roquette Frères

- AGRANA

- Emsland Group

- Avebe U.A

Chapter 1. North America Modified Starch Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Modified Starch Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Modified Starch Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Modified Starch Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Modified Starch Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Modified Starch Market– By Type

6.1. Introduction/Key Findings

6.2. Corn

6.3. Potato

6.4. Tapioca

6.5. Wheat

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. North America Modified Starch Market– By Modification

7.1. Introduction/Key Findings

7.2. Pregelatinized Starches

7.3. Oxidized Starches

7.4. Acetylated Starches

7.5. Clean-Label Modifications

7.6. Y-O-Y Growth trend Analysis By Modification

7.7. Absolute $ Opportunity Analysis By Modification , 2024-2030

Chapter 8. North America Modified Starch Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Modification

8.1.3. By Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Modified Starch Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Cargill Incorporated

9.2. Ingredion Incorporated

9.3. Archer-Daniels-Midland Company (ADM)

9.4. Tate & Lyle

9.5. Roquette Frères

9.6. AGRANA

9.7. Emsland Group

9.8. Avebe U.A

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Busy schedules and the desire for simple meal solutions create a massive demand for processed, ready-to-eat, and convenient food products. Modified starches are essential for their texture, stability, and shelf-life extension.

The clean-label trend compels manufacturers to either reformulate using less heavily modified starches or find ways to communicate the benefits of any modified starches used.

Cargill Incorporated, Ingredion Incorporated, Archer-Daniels-Midland Company (ADM), Tate & Lyle, Roquette Frères, AGRANA, Emsland Group

US Midwest currently holds the largest market share, estimated at around 40%.

The US South exhibits the fastest growth, driven by its increasing population, and expanding economy.