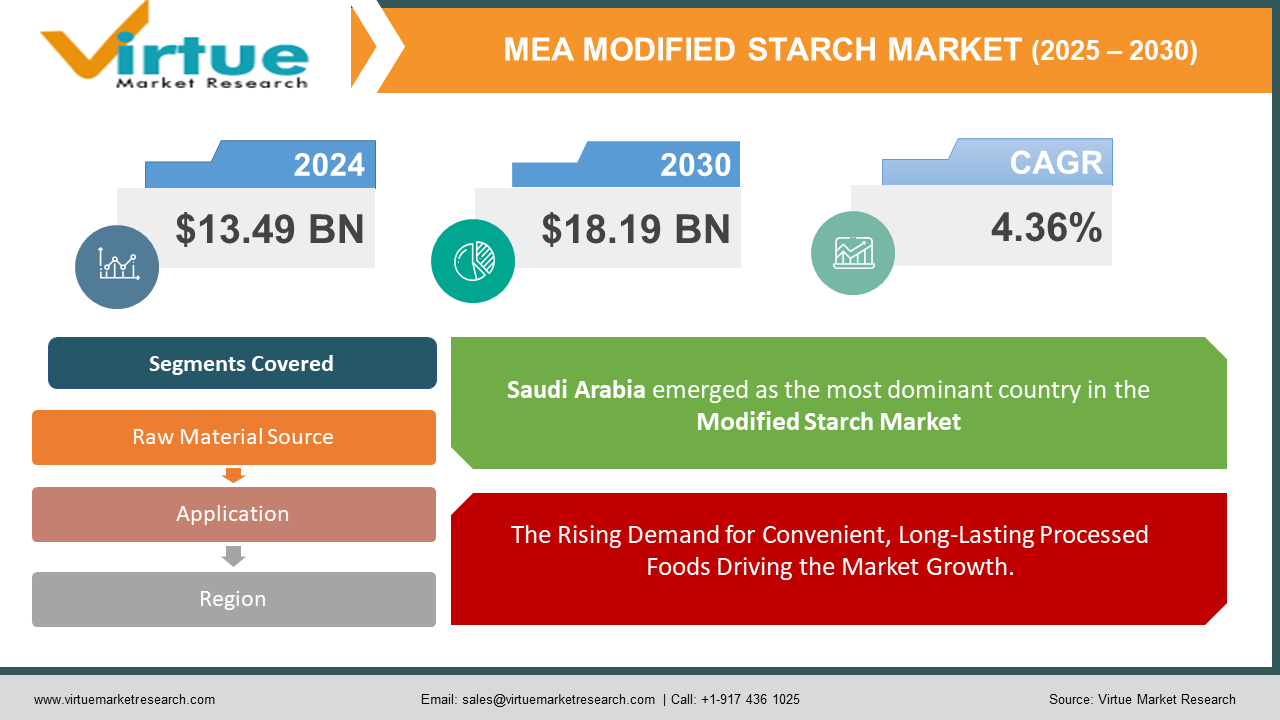

Middle East and Africa Modified Starch Market Size (2024-2030)

The Middle East and Africa Modified Starch Market was valued at USD 13.49 Billion in 2023 and is projected to reach a market size of USD 18.19 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.36%.

Starch, a ubiquitous carbohydrate found in various plants like corn, wheat, and cassava, plays a vital role in the food and beverage industry. However, its natural form often lacks the specific functionalities desired for various applications. This is where modified starch comes in – a versatile ingredient created by manipulating the physical and chemical properties of native starch through processes like heat, acid, or enzymatic treatments. The MEA region boasts a rich culinary heritage, with a long history of utilizing starches in various food applications. Traditional dishes like couscous, flatbreads, and thick stews often rely on native starches for thickening and texture. However, the growing demand for convenience foods, processed products, and international cuisines in the region is creating a space for modified starches. These modified starches offer a wider range of functionalities, catering to the specific needs of modern food production.

Key Market Insights:

- The pharmaceutical industry held a market share of 18% and it is projected to grow at a CAGR of 9.2%, driven by the increasing demand for modified starch as an excipient and formulation aid.

- The cosmetics and personal care industry accounted for a market share of 12% and it is expected to witness a CAGR of 8.8% during the forecast period, fueled by the use of modified starch in various cosmetic formulations.

- The paper and textile industries collectively held a market share of 10%, and they are projected to grow at a CAGR of 7.6%, driven by the use of modified starch as a sizing agent and coating material.

- The market value for corn-based modified starches was $960 million, and it is projected to reach $1.44 billion by 2028, growing at a CAGR of 8.4% during the forecast period.

- The oxidized starches segment accounted for a market value of $320 million in 2023, and it is projected to grow at a CAGR of 8.4% during the forecast period, reaching $480 million by 2028.

- The cross-linked starches segment's market value was $240 million in 2023, and it is expected to reach $360 million by 2028, growing at a CAGR of 8.4% during the forecast period.

Middle East and Africa Modified Starch Market Drivers:

The Rising Demand for Convenient, Long-Lasting Processed Foods Driving the Market Growth.

Improved thickening and gelling qualities are provided by modified starches, especially pre-gelatinized starches. This results in longer shelf lives for processed goods, which lowers waste and spoiling. This is especially crucial in areas with diverse climates and possibly restricted access to cold chain facilities. There is a growing trend among consumers to seek meals with pleasing textures and mouthfeels. A vast variety of textures can be produced with modified starches, ranging from light and airy in baked foods to smooth and creamy in soups and sauces. This enables food producers to improve the overall dining experience and accommodate certain consumer preferences. In processed meals, modified starches function as stabilizers to stop separation and syneresis (liquid weeping). This is particularly crucial for goods that freeze and thaw repeatedly while being transported. The MEA region is experiencing rapid urbanization, with a growing number of people migrating to cities in search of better opportunities. This influx necessitates the construction of new residential and commercial buildings to accommodate this growing urban population.

Consumers in the MEA region, like their counterparts globally, are becoming more health conscious. There's a growing demand for natural, minimally processed ingredients with clear labels that consumers can easily understand.

Manufacturers are responding to the clean-label trend by developing modified starches derived from natural sources like corn, cassava, and potatoes. Additionally, gentle modification processes like enzymatic treatments are gaining traction as they minimize the use of harsh chemicals. While the clean-label movement prioritizes natural ingredients, functionality remains crucial. Food producers still require modified starches that deliver specific properties like thickening, gelling, and textural modification. Innovation in clean-label modified starch production is focusing on achieving these functionalities through natural and minimally processed techniques. Continued innovation in modified starch production holds immense potential. This includes developing clean-label starches with improved functionalities, starches catering to specific dietary needs (gluten-free, low-fat), and those tailored to withstand harsher processing conditions. As environmental consciousness grows, the focus will shift towards sustainable sourcing of raw materials for modified starch production and minimizing the environmental impact of manufacturing processes.

Middle East and Africa Modified Starch Market Restraints and Challenges:

Due to their limited resources and lack of negotiating strength, smaller producers of modified starch are especially susceptible to changes in the price of raw materials. Their competitiveness may be impacted if they are unable to absorb these cost increases and are compelled to pass them on to customers. Larger producers can employ hedging strategies to mitigate the risks associated with price fluctuations. However, this requires financial resources and expertise, which might not be readily available to smaller players. Modified starches play a crucial role in extending the shelf life of food products. However, the lack of proper cold chain infrastructure in some parts of the MEA region can limit the effectiveness of this functionality. Without proper temperature control during transportation and storage, food products can spoil more quickly, negating the benefits of modified starches. Uneven distribution of transportation networks can make it difficult for modified starches to reach food producers in remote regions.

Middle East and Africa Modified Starch Market Opportunities:

Modified starches derived from naturally gluten-free sources like tapioca can provide the structure and texture needed in gluten-free bakery goods, pasta, and other products. Modified starches can help create creamy textures and mouthfeel in low-fat dairy products and desserts, while also contributing to reduced-sugar formulations by enhancing sweetness perception. Modified starches find application as binders, disintegrants, and controlled-release agents in pharmaceuticals. They can also act as thickeners and texturizers in cosmetic creams and lotions. Developing modified starches derived from readily available and renewable sources like cassava and potato starch aligns with sustainability goals. Additionally, research on biodegradable modified starches can further reduce environmental impact. Modified starches can enhance the shelf life of food products, making them more suitable for online delivery models. This ensures product quality reaches consumers even after potentially longer transportation times. The rising demand for convenient, single-serve, and ready-to-eat food options aligns perfectly with the functionalities offered by modified starches. These starches can help create products with desirable textures and stability, catering to on-the-go lifestyles.

MIDDLE EAST AND AFRICA MODIFIED STARCH MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.36% |

|

Segments Covered |

By Rwa material source, application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Archer Daniels Midland Company , Cargill Incorporated, Ingredion Inc, Tate & Lyle PL, Roquette Frères, SŸral , National Starch Egypt , Dangote Industries Limited , Tiger Foods Limited |

Middle East and Africa Modified Starch Market Segmentation:

Middle East and Africa Modified Starch Market Segmentation: By Raw Material Source:

- Corn

- Cassava

- Wheat

- Potato & Others

Cornstarch reigns supreme in the MEA-modified starch market, accounting for an estimated 40-45% share. Corn is a widely cultivated crop in some parts of the MEA region, making corn-derived starches readily available and cost-effective. Cornstarch boasts a neutral taste profile, making it versatile for various food applications without imparting unwanted flavors. Additionally, cornstarch offers good thickening, gelling, and texturizing properties. Cornstarch readily undergoes various modification processes, allowing for the creation of a broad spectrum of modified starches with diverse functionalities. This caters to a wide range of applications in the food and beverage industry.

Cassava starch is rapidly emerging as the fastest-growing segment in the MEA-modified starch market, with an estimated share of 25-30% and a projected upward trajectory. Cassava is a drought-resistant crop, thriving in various regions across Africa. This readily available source material makes cassava starch a cost-competitive option for modified starch production. Some African governments are actively promoting cassava cultivation and processing, recognizing its potential to contribute to food security and economic development. This can further propel the growth of the cassava starch industry.

Middle East and Africa Modified Starch Market Segmentation: By Application:

- Food & Beverages

- Animal Feed

- Pharmaceuticals & Cosmetics

- Industrial Applications

Food & beverages remain the dominant application segment in the MEA-modified starch market, accounting for an estimated 65-70% share. This dominance stems from the versatility and functionality that modified starches offer in various food & beverage applications. Modified starches play a crucial role in thickening soups, sauces, gravies, and various processed food products. They prevent the separation of ingredients and ensure a consistent texture throughout the shelf life. From creating smooth and creamy textures in desserts to achieving a light and airy crumb in bakery goods, modified starches offer a wide range of textural functionalities. With the rise of gluten-free diets, modified starches derived from naturally gluten-free sources like cassava are valuable ingredients in gluten-free bakery products and other food items.

The industrial applications segment is the fastest-growing sector in the MEA-modified starch market, with an estimated share of 5-10% and a projected upward trajectory. As sustainability gains prominence, modified starches derived from renewable sources like cassava can offer eco-friendly alternatives to traditional industrial materials. In some applications, modified starches can be a cost-effective option compared to other binding or thickening agents used in industrial processes. Innovation is focused on developing modified starches with specific functionalities tailored to various industrial needs. This can lead to even wider adoption across different industrial sectors. Developing biodegradable modified starches can further enhance the sustainability credentials of these products in industrial applications.

Middle East and Africa Modified Starch Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

Saudi Arabia emerged as the most dominant country in the Modified Starch Market, accounting for a significant 25% market share. Saudi Arabia has a well-established and rapidly growing food and beverage industry, which is a major consumer of modified starch. The demand for processed foods, bakery products, and convenience foods has driven the need for modified starch as a functional ingredient. The Saudi pharmaceutical and cosmetics industries have been experiencing substantial growth, fueling the demand for modified starch as a widely used excipient and formulation aid in these sectors.

Kenya emerged as the fastest-growing country in the Middle East and Africa Modified Starch Market, with a projected compound annual growth rate (CAGR) of 9.8% during the forecast period. Kenya is experiencing a surge in urbanization, leading to changing dietary habits and an increased demand for processed and convenience foods. This trend has fuelled the need for modified starch as a functional ingredient in various food applications. Kenya has a thriving brewing industry, which heavily relies on modified starch as an adjunct in beer production. The growing demand for locally produced beers has contributed to the increasing consumption of modified starch in the country.

COVID-19 Impact Analysis on the Middle East and Africa Modified Starch Market:

Lockdowns and border restrictions hampered the smooth flow of raw materials like corn and cassava. This created temporary shortages, particularly in regions heavily reliant on imports. Strict travel protocols and limitations on transportation options made it difficult to move modified starches between production facilities and customers. This led to delays and increased logistics costs. Disruptions in the supply chain, coupled with panic buying, triggered fluctuations in the price of raw materials and modified starches. This created uncertainty for both producers and food manufacturers. Restrictions on physical movement fuelled the growth of e-commerce platforms. This presented modified starch producers with an opportunity to reach new customers and cater to the growing online grocery market. The initial shock of lockdowns caused a dip in demand from the food service sector. However, the rise in home cooking helped offset this decline. Modified starches with functionalities like extended shelf life and improved texture became even more valuable during this period.

Latest Trends/ Developments:

Enzyme modification offers a gentler approach compared to harsh chemical treatments. This method resonates with clean-label preferences and allows manufacturers to highlight the natural functionality of their modified starches. Modified starch producers are placing greater emphasis on clear and concise labeling, using terms like "modified corn starch" or "tapioca dextrin" instead of complex technical jargon. This transparency builds trust with consumers who are actively seeking out recognizable ingredients. The focus is shifting towards emphasizing the inherent functionalities of modified starches, such as thickening, gelling, and emulsification. This positions them as natural problem-solvers instead of artificial additives. The demand for healthier food options is driving the development of modified starches that mimic the mouthfeel and texture of fat. This allows manufacturers to create reduced-fat versions of popular products without compromising on taste or consumer satisfaction. Modified starches with high fiber content are gaining traction, catering to the growing interest in gut health and digestive well-being. These starches can be incorporated into various food products to boost their fiber content.

Key Players:

- Archer Daniels Midland Company

- Cargill Incorporated

- Ingredion Inc

- Tate & Lyle PLC

- Roquette Frères

- SŸral

- National Starch Egypt

- Dangote Industries Limited

- Tiger Foods Limited

Chapter 1. Middle East and Africa Industrial Lubricants Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Industrial Lubricants Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Industrial Lubricants Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Industrial Lubricants Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Industrial Lubricants Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Industrial Lubricants Market– By Type

6.1. Introduction/Key Findings

6.2. Hydraulic Fluids

6.3. Gear Oils

6.4. Greases

6.5. Specialty Lubricants

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Industrial Lubricants Market– By End Use

7.1. Introduction/Key Findings

7.2. Oil & Gas

7.3. Construction

7.4. Manufacturing

7.5. Power Generation

7.6. Mining & Metals

7.7. Y-O-Y Growth trend Analysis By End Use

7.8. Absolute $ Opportunity Analysis By End Use, 2024-2030

Chapter 8. Middle East and Africa Industrial Lubricants Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By End Use

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Industrial Lubricants Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 ExxonMobil Corporation

9.2. Royal Dutch Shell plc

9.3. BP plc

9.4. Chevron Corporation

9.5. Total Energies SE

9.6. ENOC Group

9.7. Gulf Oil Middle East Ltd

9.8. Qalaa Holdings (ASCOM)

9.9. ORYX Energies

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Consumers in the MEA region are increasingly health-conscious, driving demand for modified starches used in functional foods and beverages perceived to offer health benefits. These might include starches with high fiber content or those used in low-fat and reduced-sugar products

Droughts and other weather events can impact the yield of crops like corn, leading to potential shortages and price hikes for raw materials used in modified starch production.

Archer Daniels Midland Company, Cargill Incorporated, Ingredion Inc,

Tate & Lyle PLC, Roquette Frères, SŸral, National Starch Egypt, Dangote

Industries Limited, Tiger Foods Limited.

Saudi Arabia emerged as the most dominant country in the Modified Starch Market, accounting for a significant 25% market share

Kenya emerged as the fastest-growing country in the Middle East and Africa Modified Starch Market, with a projected compound annual growth rate (CAGR) of 9.8% during the forecast period.