North American K-beauty Products Market Size (2024-2030)

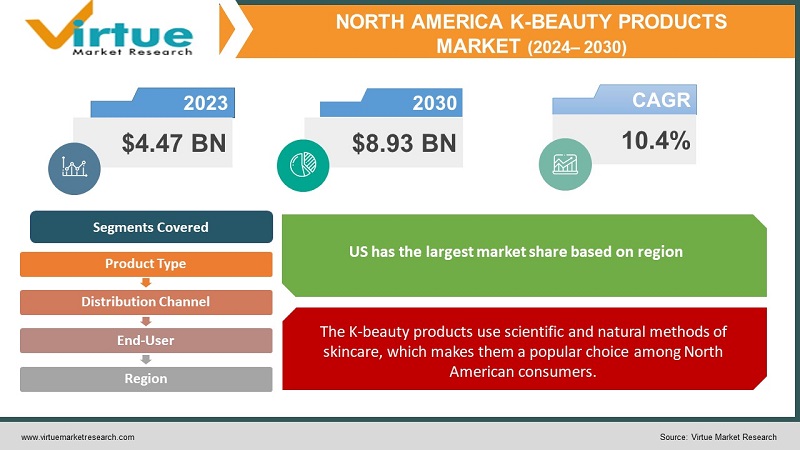

The North American K-beauty Products Market was valued at USD 4.47 billion and is projected to reach a market size of USD 8.93 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 10.4%.

K-beauty emphasizes skincare above all else, but its products are certainly reasonably priced and aesthetically pleasing. New technology is always being included in Korean beauty products, especially when it comes to raw components. Some strange ingredients used in K-beauty products are snail slime, bee venom, snail extracts, hog collagen, and morph masks. The K-beauty market is growing in importance and profitability for cosmetics companies due to its high product margin. Korean beauty standards prioritize straight eyebrows, smooth skin, a small face, a v-like jaw, a pale complexion, slim figures, and larger eyes. Aegyo-Sal, a term from Korea that describes the little fat deposits under the eyes that are meant to make a person appear younger, is one of the requirements for having beautiful eyes. As a result, after learning about the benefits of utilizing K-beauty goods, customers in the United States and Canada became increasingly interested in buying them, which fueled the expansion of the K-beauty product business in North America. The increasing usage of cosmetics by women as a result of their greater participation in economic and social affairs has significantly boosted the market for K-beauty goods. In addition, as income levels rise, there is an increased desire for high-end, luxury cosmetics. The K-beauty product market in North America is driven by these factors together. However, the majority of people in North America now realize that such K-beauty products are suitable for all genders. As a result, more consumers are buying these K-beauty items, which is driving the market's expansion in North America.

Key Market Insights:

Canada and the US are evaluated to project the expansion of the North American K-beauty product market. Face cosmetics was the second fastest-growing industry in the US, with $1.9 billion in sales. Future market segments that provide chemical-free goods made with natural ingredients and essential oils are expected to rise significantly as consumers' concerns about the potential toxicity of cosmetics increase. In a survey on the adoption of South Korean beauty products abroad, over 29.4% of American participants said that the reason K-beauty is popular in the nation is due to the organic ingredients it uses. According to the majority of those who responded to the survey, people often purchase beauty products a few times a year. Customers opted to buy these items from Shoppers Drug Mart or Walmart rather than Safeway. According to KOTRA's study, the expected value of Korean cosmetics shipped into Canada in the last few years represents a 25.4% increase year by year. In addition, the market has seen an annual growth rate of 10.4% CAGR. Throughout the projection period, these factors should support the market expansion in the region.

North America K-beauty Produce Market Drivers:

The K-beauty products use scientific and natural methods of skincare, which makes them a popular choice among North American consumers.

K-beauty grew from a niche trend to a massive skincare sector to be reckoned with, mostly due to generations of skincare connoisseurs with refined regimens and state-of-the-art scientific developments. Korean customers have an insatiable thirst for skincare products, which motivates Seoul-based beauty enterprises to invest heavily in research and development. Natural components that have been passed down from generation to generation have made up the foundation of Korean beauty history. Instead of employing harsh chemicals, formulas based on plant and animal byproducts, such as honey and snail mucin, are used, along with the greatest understanding of Western beauty techniques. All this inspires the American natives to use K-beauty products.

The ancient Korean formation techniques, the ingredients, and the multi-step skincare routine make it a popular choice and are increasing the market of K-beauty Produce in North America.

Natural components that have been passed down from generation to generation have made up the foundation of Korean beauty history. Instead of employing harsh chemicals, formulas based on plant and animal byproducts, such as honey and snail mucin, are used, along with the greatest understanding of Western beauty techniques. Korean beauty product companies often use thick layers of humectants, occlusives, and emollients combined with large doses of SPF because they have a specific skincare objective in mind and prioritize skin health and optimal hydration. Applying moisturizing products in layers to improve their skin penetration is a crucial part of the process. These products give skin a natural glow and a plumper, younger appearance almost immediately.

The rise in influencer marketing and the use of social media in the beauty industry is facilitating the expansion.

Influencers and beauty bloggers significantly shape consumer preferences in the age of social media dominance. Influencer marketing, in which celebrities promote items to their following on social media, has become increasingly popular in the cosmetic industry, including the K-beauty Products market. Because K-beauty products are so visually appealing, natural, and good for the skin, influencers, and producers of beauty content love to write about them. Their support creates trends and redefines beauty standards, in addition to introducing the products to a wider market. The market for K-beauty products is anticipated to increase steadily as long as social media continues to shape customer decisions. This growth will be fueled by the influencer marketing method's impact and reach.

North America K-beauty Products Market Restraints and Challenges:

Significant obstacles face the North American K-beauty Products industry, including worries about possible health and safety risks associated with beauty product exposure during the process of using it. K-beauty products provide long-lasting nourishment to the skin, but frequent exposure to the sun increases concerns about skin harm. Manufacturers need to minimize the overuse of SPF, investigate alternate formulations, and explain safety standards to address these concerns. The market is also challenged by the enduring appeal of conventional American skin care products, which are prized for their accessibility, simplicity of use, and range of skincare benefit options without requiring Korean techniques. Despite the higher price tag attached to K-beauty, producers must successfully differentiate their goods by highlighting advantages like antiaging and good and pure skin to close the convenience gap and keep or grow their market share.

North America K-beauty Products Market Opportunities:

In the last several years, the K-beauty products sector of the beauty business has grown significantly. This is mostly because the market for cosmetic beauty products has seen an increase in inventiveness and innovation. One of the newest technologies on the market, User of Korean skincare products, promises to offer consumers a wider selection of skincare beauty products at a lower cost than traditional ones. In addition to having a longer lifespan, being more protective, and being designed with many organic and natural ingredients, these products are also less harsh on the skin. K-beauty products are incredibly thin, safer for the environment, less toxic, and more natural-looking. They also don't chip easily. The increasing absorption of K-beauty products by commercial skin care and home users can be attributed to these causes. K-beauty product penetration is higher in the US and Canada. This trend is expected to have an impact on other fast-urbanizing economies, which will present chances for the K-beauty products market to grow.

NORTH AMERICA K-BEAUTY PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.4% |

|

Segments Covered |

By Product Type, End User, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, Canada, Mexico |

|

Key Companies Profiled |

Clio, The Face Shop, Inc., AMOREPACIFIC, TolyMoly, CARVER KOREA CO. (Unilever), Able C&C, BANILLA CO, Nature Republic, LG HOUSEHOLD & HEALTH CARE LTD., The Crème Shop |

North America K-beauty Products Market Segmentation

North America K-beauty Products Market Segmentation: By Product Type

- Body Care (Hand Care, Foot Care, and Hair Care)

- Skincare (Cleanser, Toner, Moisturizer, Sheet Mask & Spot Patch, Lip Care, Eye Care, and Sun Protection)

- Makeup (Eye Makeup, Lip Makeup, and Face Makeup)

- Haircare (Conditioner, Shampoo, and Serums)

Based on product types, in 2023, the skincare segment holds the largest market share of 65.8% and is poised to maintain its dominance throughout the forecast period Skincare. All skin types can use K-beauty products without experiencing any aggravation. These products are suitable for use on a range of skin types, including sensitive skin. Furthermore, people are becoming more aware of and drawn to K-beauty skin care products, which is driving up demand for them. For example, a report on the UMMA website estimates that 44.6% of Americans will have sensitive skin in 2023. A greater range of skin-friendly products is available in the K-Beauty market for people with sensitive or mixed skin types. Therefore, in the long run, it is anticipated that this scenario will strengthen the skin care sector of the industry.

The hair care segment is the fastest-growing product type. Throughout the forecast period from 2024 to 2030, the hair care category is anticipated to develop at a CAGR of 10.5%. K-beauty hair care products frequently contain natural and herbal elements, much like their skincare counterparts. Green tea, ginseng, camellia oil, and fermented plant extracts are common constituents. These components are said to nourish, hydrate, and enhance the health of the hair and scalp. Among the businesses that sell these goods are Innisfree and Etude House.

North America K-beauty Products Market Segmentation By Distribution Channel

- Single-brand Store

- Supermarket

- E-commerce

Supermarket is the largest segment by distribution channel, with a share of around 45% in 2023. Supermarkets are one-stop shops that are helpful to busy working women. The emphasis of these retail establishments has been on offering in-person product demos so that consumers can select from a variety of manufacturers before making a purchase. Additionally, because these products are available in supermarkets, clients have a choice of a wide range of products.

Between 2024 and 2030, the online distribution channel is predicted to develop at the fastest rate. One of the main factors propelling market growth is the e-commerce industry's rise in emerging economies. In China and India, online browsing and shopping for cosmetic items is growing in popularity. Furthermore, the growing link between large e-commerce companies and manufacturers of cosmetic items in emerging economies is expected to provide ample opportunities for the industry shortly.

North America K-beauty Products Market Segmentation By End-User

- Male

- Female

Females are the largest growing end-users, with a rough share of 62.7% in 2023. The usage of cosmetic goods by women who participate actively in social and economic activities has increased significantly. Rising income levels are associated with an increased demand for high-end, fashionable beauty products. These elements, taken together, continue to be the main forces behind women's demand for K-beauty products.

Throughout the projected period, the end-user sector with the fastest CAGR of 10.2% is predicted to be men. It is anticipated that growing concerns about aging, sensitivity, acne, lack of moisture, and reactive problems affecting men's skin would fuel the popularity of K-beauty products. Innovative goods tailored specifically for males are being offered by K-beauty product manufacturing companies. One such product is the after-shave serum Snail Truecica Miracle Serum, which is offered by KEOJI. The product has black snail mucus extract, which is frequently used for therapeutic facials.

Region Analysis:

- USA.

- Canada

- Mexico

The US has the largest market share based on region. The natural components that go into making the products are largely responsible for their success. In the upcoming years, it is anticipated that the market for fragrance-free products made with essential oils will grow quickly as consumers become more aware of the potential toxicity of cosmetics. Canada is the fastest-growing region. Canadian consumers will prioritize pampering and self-care more to keep their skin healthy. Although the pampering movement was mostly employed as a stress-reduction strategy, it greatly enhanced general-purpose body care. Moreover, Canadians developed a holistic perspective on skin care as they started to see body care as an extension of facial skincare. Thus, these are the key elements that are anticipated to affect the expansion of K-beauty products.

COVID-19 Impact Analysis on the North American K-beauty Products Market:

As a result of the pandemic's strong demand, producers of K-Beauty products are refocusing their efforts on hand sanitizers, cleaning supplies, and personal hygiene items. To reach a wider audience, manufacturers have increased the social media promotion of their herbal skin care items in light of the COVID-19 pandemic. Curfews and lockdowns were implemented globally, impacting people's lives, health, and well-being, as well as manufacturing enterprises. In addition, a lot of exporters are facing significant challenges because of the outbreak, such as government-enforced lockdowns and quarantines, as well as restrictions on the import and export of commodities.

Latest Trends/ Developments:

The K-beauty product market is fiercely competitive, with numerous companies offering a wide range of tours. Many large businesses are devoting much of their effort to new product releases, partnerships, and market expansion to effectively compete. Saturday Skin, a product company, teamed up with Nykaa in July 2022 to increase its market share in India. Saturday Skin and Nykaa have partnered to sell a range of skincare products on the Nykaa website and mobile app. In cooperation with the Korean firm Shihyo, L'Oréal announced in November 2022 the debut of C-Beauty, K-Beauty, and J-Beauty consumers. 24 herbal ingredients are immersed in fermented rice and other creative Asian processes as part of the brand's assortment.

Key Players:

- Clio

- The Face Shop, Inc.

- AMOREPACIFIC

- TolyMoly

- CARVER KOREA CO. (Unilever)

- Able C&C

- BANILLA CO

- Nature Republic

- LG HOUSEHOLD & HEALTH CARE LTD.

- The Crème Shop

Chapter 1. North America K-beauty Product Type s Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America K-beauty Product Type s Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America K-beauty Product Type s Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America K-beauty Product Type s Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America K-beauty Product Type s Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America K-beauty Product Type s Market– By Product Type

6.1. Introduction/Key Findings

6.2. Body Care (Hand Care, Foot Care, and Hair Care)

6.3. Skincare (Cleanser, Toner, Moisturizer, Sheet Mask & Spot Patch, Lip Care, Eye Care, and Sun Protection)

6.4. Makeup (Eye Makeup, Lip Makeup, and Face Makeup)

6.5. Haircare (Conditioner, Shampoo, and Serums)

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America K-beauty Product Type s Market– By End-User

7.1. Introduction/Key Findings

7.2. Male

7.3. Female

7.4. Y-O-Y Growth trend Analysis By End-User

7.5. Absolute $ Opportunity Analysis By End-User , 2024-2030

Chapter 8. North America K-beauty Product Type s Market– By Distribution Channels

8.1. Introduction/Key Findings

8.2. Single-brand Store

8.3. Supermarket

8.4. E-commerce

8.5. Y-O-Y Growth trend Analysis By Distribution Channels

8.6. Absolute $ Opportunity Analysis By Distribution Channels , 2024-2030

Chapter 9. North America K-beauty Product Type s Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.1.4. Rest of North America

9.1.2. By end use

9.1.3. By Distribution Channel

9.1.4. product Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America K-beauty Product Type s Market– Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1. Clio

10.2. The Face Shop, Inc.

10.3. AMOREPACIFIC

10.4. TolyMoly

10.5. CARVER KOREA CO. (Unilever)

10.6. Able C&C

10.7. BANILLA CO

10.8. Nature Republic

10.9. LG HOUSEHOLD & HEALTH CARE LTD.

10.10. The Crème Shop

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

North American K-beauty Products play an important role in the beauty business as the demand for natural, organic effective Skincare body care, haircare, and makeup products has been increasing in recent years.

The Plastic Packaging Market was around 4.47 billion USD in 2023 and is expected to grow at a CAGR of 10.4% in the coming years.

The US has the largest market of K-beauty Products in North America.

The market for K-beauty products is expanding at an impressive rate, propelled by customers' rising awareness of natural and organic products. The growing awareness of the value of keeping well-groomed and healthy skin has led to an increase in demand for long-lasting and novel beauty solutions like K-beauty products.

Skincare products are used the most in North America