K-Beauty Products Market Size (2024 – 2030)

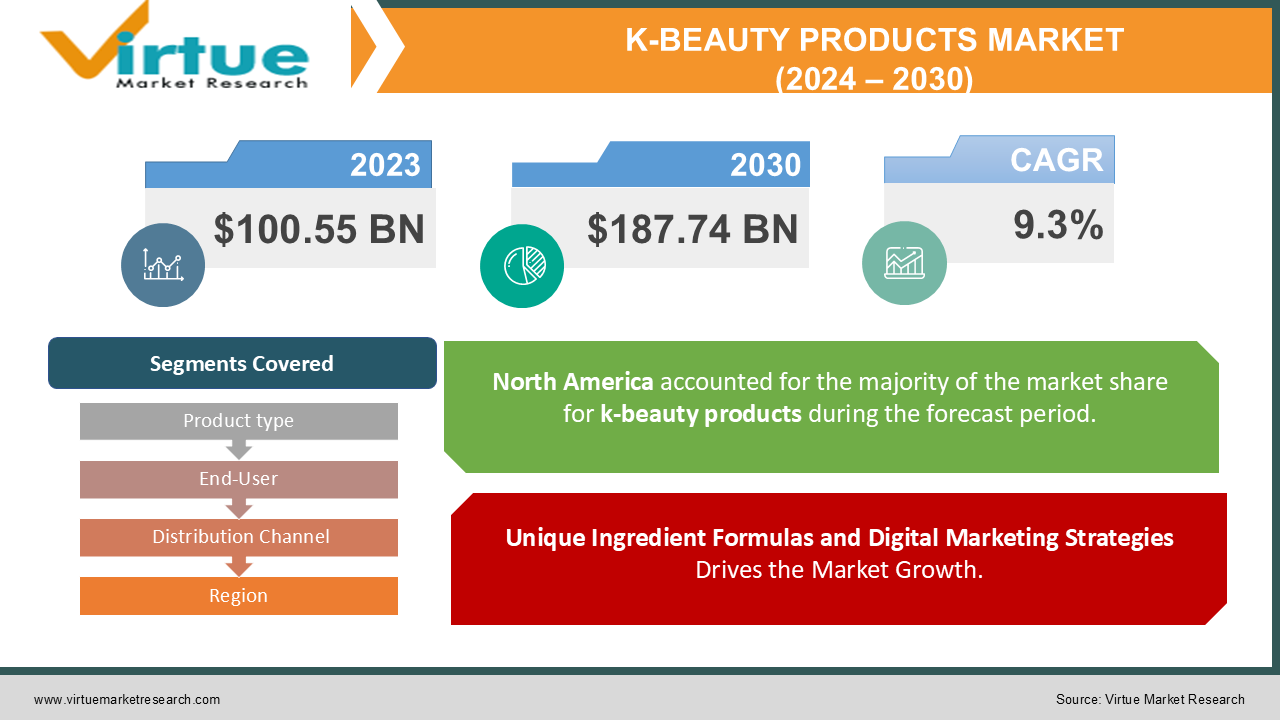

The K-Beauty Products Market was valued at USD 100.55 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 187.74 billion by 2030, growing at a CAGR of 9.3%.

The category of skincare products originating from South Korea is commonly known as K-Beauty. This trend has garnered significant global recognition, especially in regions such as East Asia, Southeast Asia, South Asia, and the Western Hemisphere. It highlights aspects such as skin health, hydration, and the promotion of a radiant complexion. Korean beauty items are notably formulated with mild compositions, owing to Korea's heritage of utilizing natural, unique, and gentle ingredients passed down through generations. Manufacturers prioritize the use of clearly labeled natural elements in their products. K-Beauty focuses extensively on skincare routines while ensuring that its offerings remain trendy and competitively priced. The Korean cosmetics sector continues to expand, embracing advancements in raw materials. Noteworthy components found in K-Beauty formulations include snail secretion filtrate, bee venom, starfish extract, porcine collagen, and transformative facial masks.

Key Market Insights:

The K-beauty market is proving to be highly lucrative for cosmetic companies, largely owing to its substantial profit margins. This profitability is further amplified by a surge in demand for K-beauty products, particularly among women, as they become more actively engaged in social and economic pursuits. As disposable incomes grow, there is a heightened inclination towards indulging in expensive, luxury cosmetics. Furthermore, K-beauty offerings are tailored to meet the cosmetic needs of both men and women. However, the burgeoning trend of veganism poses potential challenges to the development of K-beauty products. The expansion of the K-beauty market faces constraints stemming from the growing number of environmentally conscious consumers, particularly regarding sustainability, environmental impact, and animal welfare concerns.

K-Beauty Products Market Drivers:

Unique Ingredient Formulas and Digital Marketing Strategies Drives the Market Growth.

The distinctive compositions of Korean beauty products stand out as their primary strength. In Korea, women adhere to skincare routines that can encompass anywhere from four to twenty steps, utilizing a variety of products tailored to address specific skin concerns. These cosmetics predominantly rely on natural ingredients, a characteristic not commonly found in Western beauty products due to its association with Eastern culture. For instance, snail slime, long known and utilized in Korea for its anti-aging properties, is a key ingredient in wrinkle-reducing lotions.

Furthermore, K-beauty products often incorporate unique ingredients such as pearls for skin brightening and bee propolis for nourishment. Modern consumers are increasingly discerning about the ingredients in their skincare products, favoring natural components. Consequently, the K-beauty industry has thrived as it aligns with consumer preferences for skincare choices.

Moreover, Korean beauty companies leverage their expertise in digital and e-commerce platforms to effectively tap into the growing demand from international markets. This strategic approach enables them to capitalize on the expanding global interest in K-beauty product

K-Beauty Products Market Restraints and Challenges:

Rising Veganism Goods restraints market growth.

Animal-derived ingredients such as beeswax, animal collagen, eggs, and snail extract are commonly utilized in Korean beauty products. However, there is a growing trend among consumers towards veganism, driven by concerns for animal welfare, environmental conservation, and personal health. As a result, there is an increasing preference for plant-based alternatives, including substances like coconut oil, tea tree oil, green tea extract, and lotus leaf extract.

The rising adoption of veganism is anticipated to lead to a significant shift in consumer preferences, potentially limiting the market for K-beauty products containing animal-derived ingredients. This shift reflects evolving consumer values and a heightened awareness of the impact of their purchasing decisions on animals and the environment.

K-Beauty Products Market Opportunities:

The surge in social media usage, particularly in North America and Asia, has played a pivotal role in elevating the visibility of K-beauty products among fashion-forward individuals. Platforms such as blogs, YouTube, and Instagram have emerged as key channels for promoting and sharing narratives about skincare routines and products. This widespread use of social media has facilitated the dissemination of information regarding these practices and offerings. Moreover, the millennial demographic has shown a keen interest in products offered by companies like Innisfree and Skin Food, which boast natural, organic, and sustainably sourced ingredients. This demographic's inclination towards environmentally conscious and ethically sourced products has further fueled the popularity of K-beauty goods within this consumer segment.

K-BEAUTY PRODUCTS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

9.3% |

|

Segments Covered |

By Product type, End-User, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cosrx, Etude House, Laneige, The Face Shop, Innisfree, Skinfood, Sulwhasoo, Missha, Klairs TonyMoly |

K-Beauty Products Market Segmentation: By Product Type

-

Skin Care

-

Hair Care

-

Bodycare

The sheet mask segment is projected to experience a compound annual growth rate (CAGR) of 8.87% and dominate the market share, reflecting its widespread popularity globally. This surge in popularity is attributable to the simplicity and convenience offered by sheet masks, appealing to a diverse demographic ranging from stay-at-home mothers to celebrities. Furthermore, the influence of celebrities on social media platforms is significantly shaping consumer perceptions and driving adoption in the United States, thereby transforming the beauty industry landscape.

In response to growing health consciousness among consumers, there is a notable preference for organic skin care products, leading to increased demand for organic sheet masks. This trend presents manufacturers with opportunities for market expansion, capitalizing on the rising demand for natural and sustainable skincare solutions.

The moisturizer segment is anticipated to hold the second-largest market share. Korean skincare companies are renowned for their meticulous efforts in developing tailored solutions for specific skin concerns. Their moisturizers feature lightweight textures infused with ceramides to strengthen the skin barrier and plant-based oils for nourishment. This formulation approach has garnered favor among global consumers seeking effective skincare solutions. The appeal of K-beauty moisturizers lies in their lighter texture compared to traditional heavy moisturizers, making them particularly attractive to beauty enthusiasts. These moisturizers are crafted using scientifically backed formulas and innovative ingredients, all while remaining affordable, further enhancing their appeal in the market.

K-Beauty Products Market Segmentation: By End-User

-

Male

-

Female

The female segment is forecasted to grow at a CAGR of 8.8% and maintain the largest market share. A modern interpretation of luxury entails the ability to customize and personalize products according to individual preferences. Women increasingly prefer skincare and beauty products formulated with ingredients that address their specific concerns, driving a notable trend in the market for women's K-beauty products. Furthermore, there is a substantial consumer base gravitating towards online purchases of beauty products due to the convenience it offers and the myriad of possibilities it presents.

The male segment is poised to hold the second-largest market share. South Korea is renowned for setting high standards in men's aesthetics. Men in Korea allocate a greater portion of their spending towards cosmetics compared to their counterparts elsewhere. With an increasing focus on personal appearance, men are turning to skincare and makeup products to enhance their self-confidence. The range of men's skincare options offered by K-beauty encompasses popular items such as BB creams, sheet masks, serums, and moisturizers, catering to the evolving needs of male consumers. Consequently, the market has significant potential for growth in terms of sales value.

K-Beauty Products Market Segmentation: By Distribution Channel

-

Supermarkets and Hypermarkets

-

Convenience Stores

-

specialty store

-

Online Retail

-

Others

The specialty store segment is expected to lead with the highest shareholding, projected to grow at a CAGR of 8.27%. Within the beauty and cosmetics retail market, specialty retailers such as Sephora and Ulta dominate. These establishments leverage in-store beauty experts to provide comprehensive product knowledge, enabling customers to explore various product options. Specialty stores are staffed with highly knowledgeable personnel who offer valuable advice to customers, particularly regarding the cosmetics they sell. Customers investing in high-end K-beauty products seek specialized goods and personalized services tailored to their specific needs. Furthermore, specialty retailers foster customer loyalty through post-sale services, promotions, and other strategies aimed at enhancing the overall shopping experience.

The supermarket/hypermarket segment is anticipated to hold the second-largest market share. Supermarkets and hypermarkets, often referred to as "one-stop shops," are particularly convenient for busy working women, as they allow for the purchase of beauty products alongside groceries. The presence of beauty products in supermarkets and hypermarkets enhances accessibility for customers of various K-beauty brands, providing them with time-saving benefits and a wide selection of products. The rapid expansion of supermarket chains across multiple countries has contributed to the increased availability of K-beauty products, thereby expanding the potential customer base.

K-Beauty Products Market Segmentation- by region

-

North America

-

Europe

-

Asia Pacific

-

South America

-

Middle East & Africa

The regional market for K-beauty products will be dominated by Asia Pacific and North America. The Asia Pacific region is expected to lead, commanding the market with a projected CAGR of 8.3%. This region serves as the primary manufacturing hub for K-beauty products, with a strong consumer interest in skincare regimens. Additionally, there is a growing demand for beauty products formulated with natural and organic ingredients, reflecting shifting consumer preferences away from synthetic alternatives. Major players in the Korean beauty market include industry giants like AmorePacific and LG Household & Health Care, alongside numerous smaller businesses with unique positioning strategies. The Asia-Pacific region's dominance is further reinforced by its large population, rapid economic growth, and increasing consumer spending power.

North America is forecasted to hold a significant market share, reaching USD 3,547 million and growing at a CAGR of 10.5%. Consumers in North America are embracing a holistic approach to skincare, influenced by Korean skincare rituals that emphasize beauty. There is a notable preference for beauty products with lightweight textures and distinctive natural ingredients, particularly among women. The market for K-beauty products in North America is expanding due to innovative packaging designs that resonate with consumers, playing a crucial role in driving growth and market penetration.

COVID-19 Pandemic: Impact Analysis

Amid the COVID-19 pandemic, the Korean cosmetics industry experienced steady growth, buoyed by heightened awareness of the diverse benefits offered by its products. Furthermore, major K-beauty companies responded to the surge in consumer popularity by undertaking strategic initiatives such as increased investment in research and development (R&D), launching new products, and engaging in mergers and acquisitions to maintain market share. These proactive measures enable companies to adapt to evolving market dynamics and meet consumer demands by introducing a wide array of innovative and appealing items.

Latest Trends/ Developments:

-

In 2023, Justera Health Ltd. significantly expanded its portfolio by acquiring all shares of Triniti Trading Corp., a recognized distributor of TonyMoly products in Canada. This acquisition was executed as part of a definitive agreement aimed at strengthening Justera Health's presence in the Canadian market.

-

In March 2023, Sulwhasoo, a prominent K-beauty brand, entered into a year-long sponsorship agreement with New York's Metropolitan Museum of Art. This collaboration involved funding various programs and events at the museum. To kick off the partnership, brand ambassadors Rosé, Yuh-Jung Youn, and Jia Song hosted an event at the museum, further solidifying Sulwhasoo's commitment to supporting cultural initiatives.

-

In 2022, the Beauty Factory, Ltd. introduced its latest product, the Plaiveille Medicated Disinfectant Mist, which was featured in WWD Beauty Weekly as one of Shibuya Loft's “STAY HOME Top 5 Useful Self-Care Items.” This recognition highlights the product's efficacy and relevance in promoting self-care during the global health crisis.

-

Also in 2022, three leading B2B trade show organizers, namely BolognaFiere, Informa Markets, and PBA – Professional Beauty Association, joined forces to deliver an unparalleled series of beauty events in the US beauty sector. This collaboration aimed to provide industry professionals with access to the most significant and remarkable beauty exhibitions, fostering networking opportunities and business growth within the sector.

Key Players:

These are the top 10 players in the K-Beauty Products Market:-

-

Cosrx

-

Etude House

-

Laneige

-

The Face Shop

-

Innisfree

-

Skinfood

-

Sulwhasoo

-

Missha

-

Klairs

-

TonyMoly

Chapter 1. K-Beauty Products Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. K-Beauty Products Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. K-Beauty Products Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. K-Beauty Products Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. K-Beauty Products Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. K-Beauty Products Market – By Product Type

6.1 Introduction/Key Findings

6.2 Skin Care

6.3 Hair Care

6.4 Bodycare

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Product Type, 2024-2030

Chapter 7. K-Beauty Products Market – By End-User

7.1 Introduction/Key Findings

7.2 Male

7.3 Female

7.4 Y-O-Y Growth trend Analysis By End-User

7.5 Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 8. K-Beauty Products Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 Supermarkets and Hypermarkets

8.3 Convenience Stores

8.4 specialty store

8.5 Online Retail

8.6 Others

8.7 Y-O-Y Growth trend Analysis By Distribution Channel

8.8 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. K-Beauty Products Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product Type

9.1.3 By End-User

9.1.4 By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product Type

9.2.3 By End-User

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product Type

9.3.3 By End-User

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product Type

9.4.3 By End-User

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product Type

9.5.3 By End-User

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. K-Beauty Products Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Cosrx

10.2 Etude House

10.3 Laneige

10.4 The Face Shop

10.5 Innisfree

10.6 Skinfood

10.7 Sulwhasoo

10.8 Missha

10.9 Klairs

10.10 TonyMoly

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The K-beauty market is proving to be highly lucrative for cosmetic companies, largely owing to its substantial profit margins.

The top players operating in the K-Beauty Products Market are - Cosrx, Etude House, Laneige, The Face Shop, Innisfree, and Skinfood.

Amid the COVID-19 pandemic, the Korean cosmetics industry experienced steady growth, buoyed by heightened awareness of the diverse benefits offered by its products.

In 2023, Justera Health Ltd. significantly expanded its portfolio by acquiring all shares of Triniti Trading Corp., a recognized distributor of TonyMoly products in Canada.

North America is forecasted to hold a significant market share, reaching USD 3,547 million and growing at a CAGR of 10.5%.