North America Food Packaging Market Size (2024-2030)

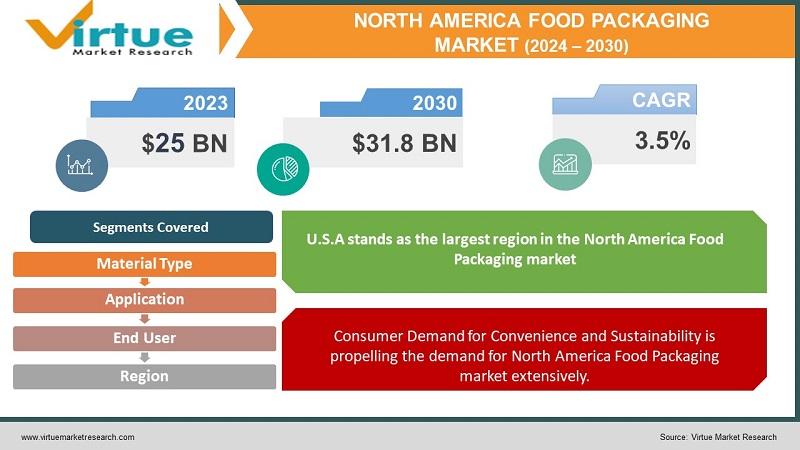

The North America Food Packaging Market was valued at USD 25 Billion in 2023 and is projected to reach a market size of USD 31.8 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.5%.

The North American food packaging market remains a dynamic and evolving sector characterized by a blend of innovation, sustainability, and regulatory adaptations. With a focus on convenience, freshness, and safety, the market witnesses a continuous surge in demand for eco-friendly and technologically advanced packaging solutions. Key drivers include the increasing preference for on-the-go meals, the rise of e-commerce impacting packaging designs, and a growing emphasis on reducing food waste. Sustainable packaging materials, such as bioplastics and recycled materials, continue to gain traction, aligning with consumer and regulatory pressures for environmentally responsible practices. The region's food packaging landscape is marked by a competitive environment where companies constantly strive to meet evolving consumer preferences while adhering to stringent packaging regulations and sustainability mandates.

Key Market Insights:

The majority of quick-service restaurants (QSRs) rely on plastic materials like expanded polystyrene (EPS), polyethylene terephthalate (PET), polypropylene (PP), and polylactic acid, as well as paper-based products such as paper, paperboard, and molded pulp for their food service items. QSRs specialize in delivering high-quality food and beverages swiftly, often using dispensers that ensure precise portions, ensuring consistency across orders. For instance, flavored coffee syrup bottles dispense a specified amount of syrup, typically ranging from 5ml to 30ml, to ensure uniform flavor in each customer's coffee.

Some QSRs incorporate self-service options to blend restaurant efficiency with customer individuality. These controlled-volume dispensers, often found in self-service sauce stations, aim to enhance customer service, minimize product wastage, and optimize cost savings.

Additionally, a Harris Poll conducted for the Flexible Packaging Association revealed that 83% of brand owners prefer flexible packaging. Polyethylene, a lightweight thermoplastic resin known for its sound insulation, chemical resistance, and low moisture absorption, is primarily used in plastic bottle packaging for these purposes.

North America Food Packaging Market Drivers:

Consumer Demand for Convenience and Sustainability is propelling the demand for North America Food Packaging market extensively.

Consumers in North America increasingly seek convenience in their food choices, which drives the need for packaging that facilitates on-the-go consumption, portion control, and easy handling. Simultaneously, there's a growing awareness and concern about environmental impact. This has led to a surge in demand for sustainable packaging solutions, such as biodegradable materials, recyclable packaging, and eco-friendly alternatives. Companies respond to this demand by innovating in packaging designs and materials to offer both convenience and sustainability.

E-commerce and Changing Retail Dynamics is shifting the trend towards advanced food packaging, increasing the growth of this market.

The rise of e-commerce and changes in retail trends significantly impact food packaging. Online grocery shopping and meal kit delivery services require packaging that ensures product freshness, durability during transportation, and ease of handling. This shift toward online shopping also influences packaging designs that are suitable for smaller, individual portions or meal-sized servings. As consumer behavior continues to evolve towards online purchases, food packaging needs to adapt to meet the specific requirements of these distribution channels, emphasizing robustness, shelf-life extension, and branding to stand out in a digital marketplace.

North America Food Packaging Market Restraints and Challenges:

Sustainability and Environmental Concerns associated with food packaging material is the biggest challenge for the market.

There's a pressing need to address the environmental impact of food packaging. Balancing the demand for convenient, durable packaging with the imperative to reduce waste and adopt sustainable materials poses a significant challenge. Finding alternatives to single-use plastics and optimizing packaging designs to minimize environmental footprints while ensuring product protection and shelf life remains a complex task. Additionally, educating consumers about recycling practices and encouraging behavior change adds another layer of difficulty.

Regulatory measures posed by government bodies of North America pose significant hinderance and Innovation in food packaging market slows down.

Keeping pace with evolving regulations while fostering innovation poses a challenge. The industry faces continual shifts in packaging regulations, which often vary across regions. Compliance with diverse regulatory frameworks necessitates substantial investment in research, development, and manufacturing processes. Simultaneously, while striving to meet compliance requirements, companies must innovate to meet changing consumer preferences, demanding designs that balance sustainability, convenience, and cost-effectiveness. This dual focus on compliance and innovation presents a persistent challenge in the food packaging sector.

North America Food Packaging Market Opportunities:

The North American food packaging market presents ample opportunities driven by the increasing consumer demand for convenience, safety, and sustainability. Emerging trends such as on-the-go lifestyles, rising e-commerce for food products, and heightened awareness regarding health and environmental impact propel the need for innovative packaging solutions. Opportunities abound for companies to capitalize on this landscape by investing in eco-friendly materials, smart packaging technologies, and personalized, functional designs. Additionally, the market offers prospects for enhancing supply chain efficiency, meeting stringent regulatory requirements, and catering to diverse consumer preferences, thereby fostering growth and market expansion.

NORTH AMERICA FOOD PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.5% |

|

Segments Covered |

By Material Type, Application, End User, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

USA, CANDA, MEXICO |

|

Key Companies Profiled |

Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi plc, Sonoco Products Company, WestRock Company, Bemis Company, Inc. (now part of Amcor), Graphic Packaging Holding Company, Winpak Ltd., Printpack, Inc. |

North America Food Packaging Market Segmentation:

North America Food Packaging Market Segmentation: By Material Type:

- Plastics

- Paper & Paperboard

- Metal

- Glass

- Others

In the North American food packaging market, plastics stand out as the largest segment by material type holding 49% market share in 2023. This dominance can be attributed to the versatility, cost-effectiveness, and durability of plastic packaging. Plastics offer a wide range of packaging solutions that cater to diverse food products, ensuring preservation, convenience, and shelf life extension. Their flexibility in design, lightweight nature facilitating transportation efficiency, and ability to accommodate various food types contribute to their widespread adoption. In recent years, the fastest-growing segment in material type within the North American food packaging market has been the "Others" category, encompassing materials like bioplastics and recycled materials. This surge is primarily propelled by the escalating consumer demand for sustainable and eco-friendly packaging solutions. Bioplastics, derived from renewable sources like corn starch or sugarcane, offer a promising alternative to traditional plastics, reducing dependence on fossil fuels and minimizing environmental impact. Similarly, recycled materials, including post-consumer recycled plastics or paper, address concerns about waste and pollution, aligning with increasing regulatory pressures and consumer preferences for environmentally responsible packaging options.

North America Food Packaging Market Segmentation: By Application:

- Dairy Products

- Bakery & Confectionery

- Beverages

- Meat, Poultry & Seafood

- Fruits & Vegetables

- Ready-to-Eat Meals

- Others

In the North American food packaging market, the largest segment by application is the Beverages category having 35% revenue share in 2023. This dominance is attributed to several factors, primarily driven by the widespread consumption of a variety of beverages, including soft drinks, bottled water, juices, alcoholic beverages, and sports drinks. The demand for innovative packaging solutions in the beverage sector is propelled by evolving consumer preferences, such as convenience, portability, and sustainability. The surge in on-the-go lifestyles and the expanding market for ready-to-drink beverages further contribute to the prominence of packaging solutions tailored for the diverse range of beverages consumed across the region. The ready-to-eat meals segment stands out as the fastest-growing application within the North American food packaging market anticipated to grow with a rate of 9.2%. This growth is propelled by shifting consumer lifestyles favoring convenience, time-efficiency, and a surge in demand for on-the-go food options. The rise in urbanization, coupled with increased disposable incomes, has led to a growing preference for ready-to-eat meals that offer convenience without compromising on quality or taste. As consumers seek quick, hassle-free meal solutions, the demand for efficiently packaged, shelf-stable, and easily accessible ready-to-eat meals continues to escalate. This trend emphasizes the need for innovative packaging solutions that ensure product freshness, convenience, and ease of consumption, driving the rapid growth of this market segment.

North America Food Packaging Market Segmentation: By End User:

- Retail

- Food Service

- Institutional

In the North American food packaging market, in 2023 the largest segment by end user is the Retail category having significant share of 78%. Retail dominates due to its expansive reach across supermarkets, convenience stores, and online platforms, catering to the diverse demands of individual consumers. The retail sector's significance lies in its role as the primary point of contact between packaged food products and end consumers. Consumers' inclination toward packaged foods for home consumption, combined with the vast array of products available in retail settings, drives the demand for efficient, attractive, and informative packaging. Moreover, evolving consumer preferences, including the demand for smaller pack sizes, convenience, and sustainability, further amplify the significance of the retail segment within the food packaging market in North America. The food service segment stands out as the fastest-growing end-user category in the North American food packaging market. This accelerated growth is primarily attributed to the rapid expansion of food delivery services, an increasing preference for takeout meals, and the burgeoning trend of ready-to-eat options. With the evolving lifestyle patterns and a surge in online food ordering platforms, there's a heightened demand for packaging that ensures convenience, freshness, and safety during transit. Additionally, stringent regulations concerning food safety and hygiene further drive the need for robust and efficient packaging solutions tailored for the food service industry, fueling the remarkable growth trajectory of this segment.

North America Food Packaging Market Segmentation: Regional Analysis:

- U.SA.

- Canada

- Mexico

U.S.A stands as the largest region in the North America Food Packaging market having market share of 54% in 2023. Its dominance is fueled by a combination of robust consumer demand for diverse packaged food products, a highly developed food retail sector, and significant technological advancements in packaging solutions. Moreover, the U.S. market benefits from substantial investments in research and development, fostering innovation in packaging materials and technologies. The country's expansive food and beverage industry, coupled with a culture of convenience-driven consumption patterns, further solidifies its position as the leading region in the North American food packaging landscape. Mexico stands out as the fastest-growing region. This rapid growth is primarily attributed to several factors such as the burgeoning food and beverage industry, increased urbanization, and rising disposable incomes. Mexico's expanding middle class is propelling the demand for packaged foods, driving the need for diverse and innovative packaging solutions. Additionally, the country's strategic geographical location makes it an attractive hub for export-oriented food production, further stimulating the demand for sophisticated packaging that meets international standards.

COVID-19 Impact Analysis on the North America Food Packaging Market:

The COVID-19 pandemic significantly influenced the North American food packaging market, triggering shifts in consumer behavior, supply chain dynamics, and packaging preferences. The outbreak accelerated trends favoring e-commerce and contactless delivery, driving a surge in demand for packaged foods, ready-to-eat meals, and online grocery shopping. This necessitated packaging solutions emphasizing convenience, safety, and longer shelf life. Simultaneously, the pandemic-induced disruptions in manufacturing, logistics, and raw material supplies posed challenges, prompting a reevaluation of supply chain resilience and packaging sustainability. Amidst these challenges, the market witnessed a pivot towards sustainable packaging materials and heightened hygiene-focused designs to meet evolving consumer expectations and regulatory changes in response to the pandemic.

Latest Trends/ Developments:

One prominent trend in the North American food packaging market is the escalating adoption of sustainable packaging solutions. Consumers are increasingly conscious of environmental impact, prompting a shift towards eco-friendly materials like bioplastics, recyclable packaging, and compostable materials. This trend drives innovation and pushes companies to prioritize packaging designs that reduce waste and carbon footprints, meeting both consumer preferences and regulatory demands.

A significant development in this market is the integration of smart packaging technologies. These technologies, including RFID tags, sensors, and QR codes, enable enhanced traceability, improved shelf-life monitoring, and better interaction with consumers. Smart packaging facilitates real-time data collection on product freshness, authenticity, and consumption, thereby enhancing food safety measures and providing consumers with valuable information about the products they purchase.

Key Players:

- Amcor plc

- Sealed Air Corporation

- Berry Global, Inc.

- Mondi plc

- Sonoco Products Company

- WestRock Company

- Bemis Company, Inc. (now part of Amcor)

- Graphic Packaging Holding Company

- Winpak Ltd.

- Printpack, Inc.

Chapter 1. North America Food Packaging Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Food Packaging Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Food Packaging Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Food Packaging Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Food Packaging Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Food Packaging Market– By Material Type

6.1. Introduction/Key Findings

6.2. Plastics

6.3. Paper & Paperboard

6.4. Metal

6.5. Glass

6.6. Others

6.7. Y-O-Y Growth trend Analysis By Material Type

6.8. Absolute $ Opportunity Analysis By Material Type , 2024-2030

Chapter 7. North America Food Packaging Market– By End-User Industry

7.1. Introduction/Key Findings

7.2. Retail

7.3. Food Service

7.4. Institutional

7.5. Y-O-Y Growth trend Analysis By End-User Industry

7.6. Absolute $ Opportunity Analysis By End-User Industry, 2024-2030

Chapter 8. North America Food Packaging Market– By Application

8.1. Introduction/Key Findings

8.2. Dairy Products

8.3. Bakery & Confectionery

8.4. Beverages

8.5. Meat, Poultry & Seafood

8.6. Fruits & Vegetables

8.7. Ready-to-Eat Meals

8.8. Others

8.9. Y-O-Y Growth trend Analysis By Application

8.10. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 9. North America Food Packaging Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.1.4. Rest of North America

9.1.2. By Material Type

9.1.3. By End Use Industry

9.1.4. Application

9.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Food Packaging Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1. Amcor plc

10.2. Sealed Air Corporation

10.3. Berry Global, Inc.

10.4. Mondi plc

10.5. Sonoco Products Company

10.6. WestRock Company

10.7. Bemis Company, Inc. (now part of Amcor)

10.8. Graphic Packaging Holding Company

10.9. Winpak Ltd.

10.10. Printpack, Inc.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The North America Food Packaging Market was valued at USD 25 Billion in 2023 and is projected to reach a market size of USD 31.8 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.5%.

. Consumer Demand for Convenience and Sustainability along with E-commerce and Changing Retail Dynamics are drivers of North America Food Packaging market.

Based on end user, the North America Food Packaging Market is segmented into Retail, Food Service, Institutional

U.S.A is the most dominant region for the North America Food Packaging Market.

Amcor plc, Sealed Air Corporation, Berry Global, Inc., Mondi plc are few of the key players operating in the North America Food Packaging Market.