North America Composites Market Size (2025 – 2030)

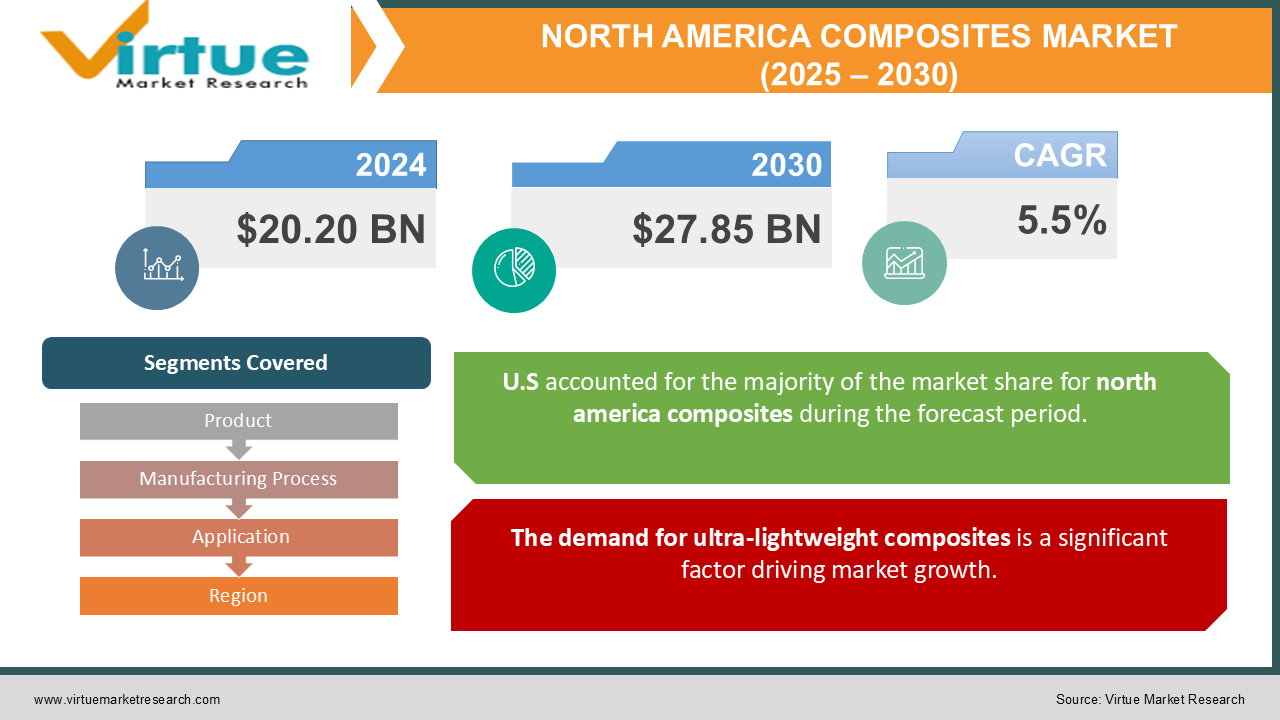

The North America Composites Market was valued at USD 20.20 billion in 2024. Over the forecast period of 2025-2030, it is projected to reach USD 27.85 billion by 2030, growing at a CAGR of 5.5%.

Composites are advanced materials consisting of a polymer matrix reinforced with fibers, designed to offer a superior strength-to-weight ratio and modulus-to-weight ratio. Frequently used fibers include glass fiber, carbon fiber, aramid fiber, and natural fibers. The polymers typically utilized are thermosetting resins, such as epoxy, polyester, vinyl ester, and polyurethane. Additionally, certain thermoplastics are also employed as polymer matrices.

Key Market Insights:

The growing need for lightweight materials in the automotive sector is a key factor driving the demand for composites in the U.S. In the aerospace and defense industries, the demand for composites is fueled by several factors, including the rise in air passenger traffic, which results in larger fleet sizes, as well as the expansion of commercial space aircraft production for space exploration missions by companies such as Northrop Grumman Corporation, Space Exploration Technologies Corp, and Virgin Galactic.

North America Composites Market Drivers:

The demand for ultra-lightweight composites is a significant factor driving market growth.

The emergence of ultra-lightweight composites is significantly influencing the market, making a notable impact across industries such as aviation, automotive, and renewable energy. These advanced materials provide exceptional performance while being cost-effective, resulting in considerable savings in both operational and construction costs, particularly when compared to traditional, heavier materials.

In the renewable energy sector, for instance, the installation cost of commercial wind turbines typically ranges from $1.3 million to $2.2 million per MW of nameplate capacity. While multiple factors contribute to these costs, the adoption of specialized composite materials significantly reduces overall expenses. These composites are designed to enhance durability, resistance to weather and environmental conditions, and, in turn, improve the quality and lifespan of wind turbines and their components.

The aerospace industry is also a key adopter of lightweight composites, including carbon nano-reinforced polymers. These materials not only offer increased strength but are also better equipped to withstand extreme conditions. Additionally, they are about 30% lighter than traditional materials, leading to reduced fuel consumption and lower aerodynamic drag in aircraft. The benefits of these composites extend beyond aviation, also being applied in space exploration and the automotive sector, particularly in electric and fuel-efficient vehicles.

North America Composites Market Restraints and Challenges:

The high cycle time and the cost of raw materials are significant factors hindering market growth.

Mass production and the affordability of composite materials present significant challenges in the market. In the automotive industry, the high cost of materials and long cycle times have notably hindered the widespread use of composites in high-volume vehicle production. The supply of carbon fiber further complicates matters, as much of it is consumed by the high-value aerospace sector. Additionally, the lack of automation, higher raw material costs compared to traditional materials like steel, wood, and thermoplastics, as well as the high production expenses, are limiting the growth of the composites market across various sectors. The industry must also address recycling challenges, as carbon fiber composites are difficult and costly to recycle due to their inability to melt and reform like other materials.

North America Composites Market Opportunities:

The demand for eco-friendly materials presents significant opportunities in the market.

The growing demand for eco-friendly materials is a key driver in the composites market, with sustainability and environmental awareness becoming central priorities across industries. Organizations are increasingly adopting green and sustainable practices to minimize their environmental impact, improve customer perception, and set positive examples within their communities. As a result, there has been a stronger focus on green technologies, with composite materials emerging as a significant player in this transition.

Composite materials, known for their versatility and eco-friendly potential, are at the forefront of this sustainability shift. Innovations in nano and bio-resins, often derived from recycled materials, have led to the development of composites with improved eco-friendly attributes. These include reduced carbon emissions and a lower risk of soil contamination. Such advancements are helping to expand the composites market by offering environmentally responsible solutions. One of the key benefits of composite materials is their adaptability to various production methods. Some composites can now be manufactured on-site or through advanced technologies like industrial 3D printing, which minimizes transportation needs, reduces labor and material costs, and enhances production efficiency.

NORTH AMERICA COMPOSITES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product, Manufacturing Process, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Woodward Inc, Owens Corning, PPG Industries, Inc., Hexcel Corp., DuPont, Huntsman Corporation LLC, Momentive Performance Materials, Inc., Weyerhaeuser Company, Mitsubishi Chemical Corporation , Cytec Industries |

North America Composites Market Segmentation: By Product

-

Carbon Fiber

-

Silicon carbide fiber

-

Glass Fiber

The glass fiber segment holds the largest market share due to the increasing demand for composite materials across industries such as construction, wind energy, electrical and electronics, and automotive and transportation. Ongoing innovations aimed at enhancing the strength and durability of these composites are making them more common in pipe manufacturing applications. Additionally, the growing need for high-strength materials in the automotive and aerospace sectors is expected to further drive market growth in the coming years. Glass fibers are particularly favored in the transportation sector for applications such as deck lids, engine covers, air ducts, underbody systems, and front-end modules, owing to their exceptional strength, stability, flexibility, heat resistance, lightness, and durability.

The carbon fiber segment also holds a significant market share, driven by its remarkable properties, including a high strength-to-weight ratio, high-temperature tolerance, high stiffness, low thermal expansion, and excellent chemical resistance. These attributes make carbon fiber ideal for applications in building and construction, military and defense, and sporting equipment. Carbon fiber consists of carbon atoms bonded in crystals aligned parallel to the fiber, and these fibers are combined with other materials to create composites. Carbon fiber reinforced polymer (CFRP) is formed by molding carbon fibers with plastic resin. In the aerospace sector, carbon fiber-reinforced polymer composite materials are extensively used in sandwich structures for both interior and exterior applications of aircraft.

North America Composites Market Segmentation: By Manufacturing Process

-

Layup

-

Filament

-

Injection Molding

-

Pultrusion

The layup process leads the market, accounting for the largest revenue share. This segment in the global composites market is expected to continue growing throughout the forecast period, driven by the increasing production of boats, wind turbine blades, and architectural moldings. Wet layup processes are cost-effective and capable of producing composite products in various shapes and sizes for applications such as marine prototypes and storage tanks. On the other hand, dry layup processes use pre-impregnated fibers, or prepregs, which are molded in a cavity under high temperature and pressure. This method results in more uniform and consistent composites, which are mechanically stronger than those produced through wet layup due to the controlled curing conditions.

The injection molding process also accounts for a substantial share of the market. It is widely employed for manufacturing a variety of composites, with the resulting products being used across numerous end-use industries. This process offers a diverse range of products in terms of shape, size, and properties. It involves preparing a resin and fiber mixture, which is then heated and poured into a predetermined mold. The mixture is then allowed to cool and solidify within the mold, resulting in the final composite product.

North America Composites Market Segmentation:By Application

-

Automotive & Transportation

-

Electrical & Electronics

-

Wind Energy

-

Construction & Infrastructure

-

Pipes & Tanks

-

Marine

-

Others

The automotive and transportation segment led the market, holding the largest market share, primarily due to the advantages of composites, such as fuel savings resulting from their lightweight nature. However, the high cost of composite products has limited their widespread adoption in high-end vehicles. Despite this, technological advancements aimed at reducing vehicle weight are expected to drive increased demand for carbon composites, given their superior properties such as durability and lightness, which are essential for designing and manufacturing automotive parts.

The electrical and electronics sector also captured a significant market share, driven by the lightweight and cost-effective solutions composites offer to the industry. Moreover, the heat-resistant properties of composites have contributed to their increased use in electronic devices that are prone to overheating. Composites are now widely used in the production of electronic components, including connections, electrical housings, meter boxes, laptops, handheld devices, and switch panels.

North America Composites Market Segmentation- by region

-

US

-

Canada

-

Mexico

The U.S. composites market is marked by a moderate level of innovation, fueled by continuous advancements in composite materials, particularly within the aerospace and automotive industries. Several well-established companies dominate the U.S. composites market, with most focusing on direct sales to end-users across various industries. U.S. automotive manufacturers are advancing their technologies to produce vehicles with lower emissions, responding to growing environmental concerns and stringent pollution control regulations. The integration of composites into automotive production is expected to accelerate market growth, particularly as environmental regulations continue to shape the industry.

Additionally, increasing capacity additions in the electrical and electronics industries, along with steady growth in the automotive and aerospace sectors, are expected to further support the industry's growth during the forecast period.

COVID-19 Pandemic: Impact Analysis

The global outbreak of COVID-19 has had a significant impact on supply chains, as major economies halted trade operations. Furthermore, the demand for composite products in key end-use industries, including aerospace, automotive, and construction, experienced a decline in 2020. However, with the relaxation of trade restrictions, the market is anticipated to recover in 2021, restoring its growth trajectory.

Latest Trends/ Developments:

In February 2024, Owens Corning reached a definitive agreement to acquire all outstanding shares of Masonite. This offer represents a 38% premium over Masonite’s closing share price and a 46% premium over its 20-day volume-weighted average price. The total transaction value is approximately $3.9 billion, which corresponds to a purchase multiple of about 8.6x the estimated adjusted EBITDA for 2023, or 6.8x when factoring in synergies of $125 million.

Key Players:

These are top 10 players in the North America Composites Market:-

-

Woodward Inc.

-

Owens Corning

-

PPG Industries, Inc.

-

Hexcel Corp.

-

DuPont

-

Huntsman Corporation LLC

-

Momentive Performance Materials, Inc.

-

Weyerhaeuser Company

-

Mitsubishi Chemical Corporation

-

Cytec Industries

Chapter 1. North America Composites Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. North America Composites Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. North America Composites Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. North America Composites Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. North America Composites Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. North America Composites Market – By Product

6.1 Introduction/Key Findings

6.2 Carbon Fiber

6.3 Silicon carbide fiber

6.4 Glass Fiber

6.5 Y-O-Y Growth trend Analysis By Product

6.6 Absolute $ Opportunity Analysis By Product, 2025-2030

Chapter 7. North America Composites Market – By Manufacturing Process

7.1 Introduction/Key Findings

7.2 Layup

7.3 Filament

7.4 Injection Molding

7.5 Pultrusion

7.6 Y-O-Y Growth trend Analysis By Manufacturing Process

7.7 Absolute $ Opportunity Analysis By Manufacturing Process, 2025-2030

Chapter 8. North America Composites Market – By Application

8.1 Introduction/Key Findings

8.2 Automotive & Transportation

8.3 Electrical & Electronics

8.4 Wind Energy

8.5 Construction & Infrastructure

8.6 Pipes & Tanks

8.7 Marine

8.8 Others

8.9 Y-O-Y Growth trend Analysis By Application

8.10 Absolute $ Opportunity Analysis By Application, 2025-2030

Chapter 9. North America Composites Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By Product

9.1.3 By Manufacturing Process

9.1.4 By Application

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By Product

9.2.3 By Manufacturing Process

9.2.4 By Application

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By Product

9.3.3 By Manufacturing Process

9.3.4 By Application

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By Product

9.4.3 By Manufacturing Process

9.4.4 By Application

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By Product

9.5.3 By Manufacturing Process

9.5.4 By Application

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. North America Composites Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Woodward Inc.

10.2 Owens Corning

10.3 PPG Industries, Inc.

10.4 Hexcel Corp.

10.5 DuPont

10.6 Huntsman Corporation LLC

10.7 Momentive Performance Materials, Inc.

10.8 Weyerhaeuser Company

10.9 Mitsubishi Chemical Corporation

10.10 Cytec Industries

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The growing need for lightweight materials in the automotive sector is a key factor driving the demand for composites in the U.S.

The top players operating in the North America Composites Market are - Huntsman Corporation LLC, Momentive Performance Materials, Inc. and Weyerhaeuser Company.

The global outbreak of COVID-19 has had a significant impact on supply chains, as major economies halted trade operations.

In February 2024, Owens Corning announced a definitive agreement to acquire all outstanding shares of Masonite for $133.00 per share in cash.

The U.S is the fastest-growing region in the North America Composites Market.