Composites Market Size (2025 – 2030)

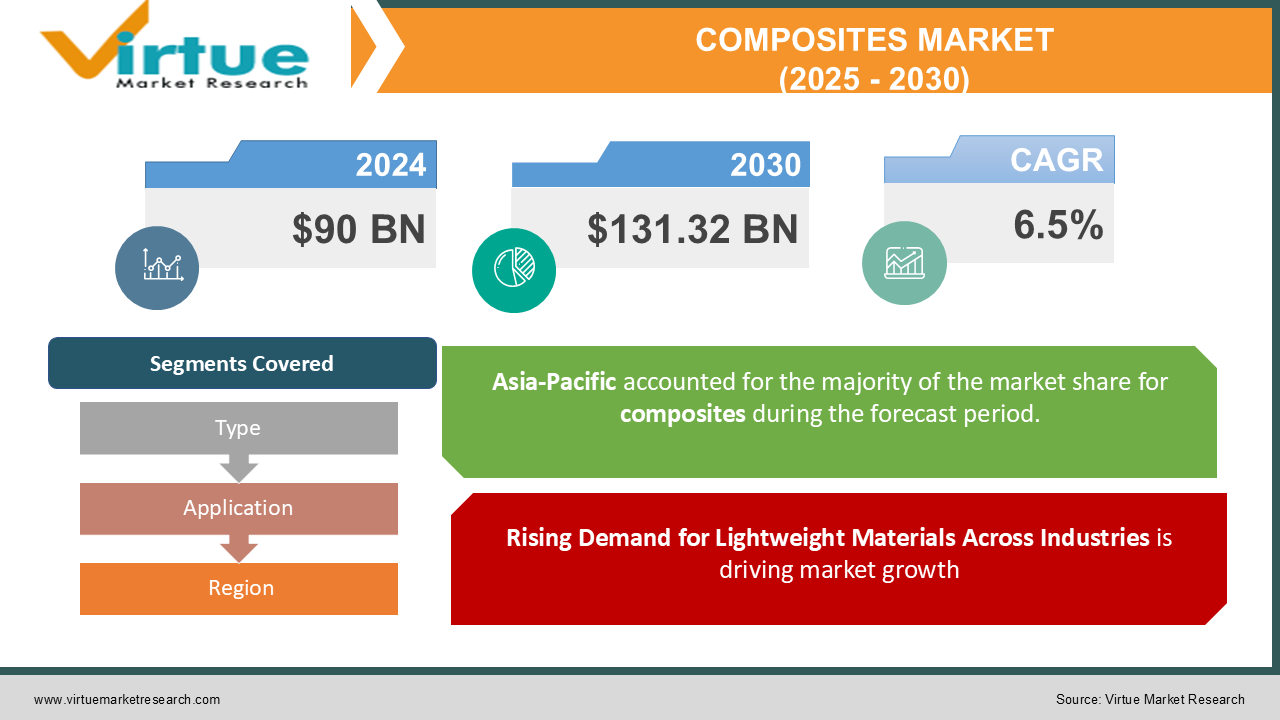

The Global Composites Market was valued at USD 90 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 131.32 billion by 2030.

Composites are engineered materials made by combining two or more constituent materials with different physical and chemical properties, resulting in enhanced performance. These materials are widely used across industries such as aerospace, automotive, construction, wind energy, and sports. Furthermore, sustainability initiatives and advancements in manufacturing technologies, such as 3D printing and automated fiber placement, are expected to bolster market growth.

Key Market Insights:

-

Asia-Pacific is the fastest-growing region, projected to grow at a CAGR of 8% from 2025 to 2030, driven by robust growth in automotive and construction industries in China and India.

-

Bio-composites are emerging as a sustainable alternative, with a CAGR of 9% anticipated through 2030, driven by environmental regulations and consumer demand for eco-friendly materials.

-

The global composites recycling market is expanding rapidly, projected to reach USD 3 billion by 2030, as industries prioritize circular economy practices.

Global Composites Market Drivers:

Rising Demand for Lightweight Materials Across Industries is driving market growth:

The global focus on energy efficiency and environmental sustainability is driving the demand for lightweight materials, particularly in industries like aerospace, automotive, and wind energy. Composites are favored for their superior strength-to-weight ratio, enabling manufacturers to design components that are both lightweight and highly durable. In aerospace, for example, the use of carbon fiber composites in aircraft such as Boeing's 787 Dreamliner and Airbus A350 reduces fuel consumption by approximately 20%. Similarly, in the automotive sector, composites help lower vehicle weight, enhancing fuel efficiency and reducing CO2 emissions. With governments worldwide tightening emission regulations, the adoption of lightweight composites is set to accelerate across key industries.

Growing Wind Energy Sector is driving market growth:

The shift toward renewable energy sources has placed wind energy at the forefront of global energy strategies. Composites are critical in the wind energy sector, particularly for manufacturing large turbine blades that must withstand high stress and harsh environmental conditions. Glass fiber composites are widely used in turbine blades due to their cost-effectiveness and strength. With countries such as the US, China, and India aggressively expanding their wind energy capacity, the demand for composite materials in this sector is expected to surge. By 2030, the global installed wind energy capacity is projected to reach 1,800 GW, further solidifying the role of composites in the energy transition.

Technological Advancements in Manufacturing Processes is driving market growth:

Innovations in manufacturing technologies are significantly enhancing the efficiency and cost-effectiveness of composite production. Automated processes such as Automated Fiber Placement (AFP) and Resin Transfer Molding (RTM) are enabling high-precision, large-scale production, reducing material wastage and labor costs. Additionally, advancements in 3D printing are opening new possibilities for custom-designed composite components, particularly in aerospace and healthcare applications. Thermoplastic composites, known for their recyclability and faster processing times, are gaining popularity, further supported by these technological advancements. As industries continue to adopt smart manufacturing techniques, the production of composites is expected to become more streamlined and scalable, driving market growth.

Global Composites Market Challenges and Restraints:

High Production Costs is restricting market growth:

Despite their numerous advantages, the high cost of raw materials and manufacturing processes remains a significant barrier to widespread adoption of composites. Carbon fiber composites, in particular, are expensive to produce due to the energy-intensive nature of their manufacturing processes. For instance, the cost of carbon fiber is approximately USD 10-20 per pound, compared to USD 0.50 per pound for traditional steel. This price disparity limits their application to high-performance industries such as aerospace and luxury automotive, while cost-sensitive sectors often opt for alternative materials. Additionally, the capital investment required for advanced manufacturing equipment, such as AFP machines, further escalates production costs, making it challenging for small and medium-sized enterprises to enter the market.

Challenges in Recycling and Waste Management is restricting market growth:

The recycling of composite materials presents significant challenges due to their heterogeneous nature and the use of thermosetting resins, which are difficult to break down. While thermoplastic composites offer recyclability, they constitute a smaller portion of the market compared to thermosetting composites. As a result, a large volume of composite waste ends up in landfills, raising environmental concerns. For example, wind turbine blades, which have a lifespan of 20-25 years, are increasingly contributing to landfill waste as they reach the end of their service life. Addressing these challenges requires substantial investment in recycling technologies and infrastructure, as well as the development of biodegradable and sustainable composite materials.

Market Opportunities:

The Composites Market is poised for significant growth, driven by emerging applications and advancements in sustainable materials. One of the key opportunities lies in the development and adoption of bio-composites, which use natural fibers such as jute, hemp, and flax as reinforcements. These materials offer a sustainable alternative to traditional composites, addressing growing consumer and regulatory demand for environmentally friendly products. Bio-composites are particularly gaining traction in the automotive and construction sectors, where they can replace conventional materials without compromising performance. The rapid expansion of the electric vehicle (EV) market presents another lucrative opportunity for composites. As automakers strive to improve battery efficiency and range, lightweight composites are emerging as a critical solution for reducing vehicle weight. Additionally, composites are being used in battery casings, structural components, and interiors, further broadening their scope of application in the EV industry. Emerging economies such as India, Brazil, and Indonesia also offer untapped potential for the composites market. With rising industrialization, urbanization, and government investments in infrastructure, the demand for advanced materials is growing in these regions. Companies that establish local production facilities and cater to region-specific needs are well-positioned to capture significant market share.

COMPOSITES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

6.5% |

|

Segments Covered |

By Type, Application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Toray Industries, Hexcel Corporation, Owens Corning, SGL Carbon, Mitsubishi Chemical Corporation, Teijin Limited, Huntsman Corporation, Solvay S.A., BASF SE, Gurit |

Composites Market Segmentation: By Type

-

Glass Fiber Composites

-

Carbon Fiber Composites

-

Aramid Fiber Composites

-

Bio-Composites

-

Others

Glass fiber composites dominate the market, accounting for 60% of the total share in 2024. Their versatility, cost-effectiveness, and wide range of applications make them the preferred choice across industries such as construction, automotive, and wind energy.

Composites Market Segmentation: By Application

-

Aerospace and Defense

-

Automotive

-

Construction

-

Wind Energy

-

Marine

-

Sports and Leisure

-

Others

The aerospace and defense sector leads the market, with a 35% share in 2024. The use of composites in aircraft structures, such as fuselage, wings, and interiors, enhances fuel efficiency and performance, driving demand in this segment.

Composites Market Segmentation: By Region

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

Asia-Pacific is the dominant region in the Global Composites Market, accounting for 45% of the market revenue in 2024. The region’s growth is fueled by rapid industrialization, urbanization, and strong demand from the automotive and construction industries. China is the largest producer and consumer of composites, benefiting from a robust manufacturing ecosystem and government support for sustainable materials. India is also emerging as a key market, with significant investments in infrastructure and renewable energy projects. The rising adoption of electric vehicles and increased wind energy capacity further contribute to the dominance of the Asia-Pacific region.

COVID-19 Impact Analysis on the Composites Market:

The COVID-19 pandemic had a mixed impact on the Composites Market. During the initial phases of the pandemic, production halts, supply chain disruptions, and reduced industrial activity led to a decline in demand. Key sectors such as aerospace and automotive faced significant setbacks, with airline travel plummeting and vehicle production slowing down. For instance, global air passenger traffic dropped by 60% in 2020, directly impacting the demand for aerospace composites. However, certain segments, such as wind energy and healthcare, experienced increased demand during the pandemic. Wind turbine manufacturers continued to invest in renewable energy projects, and composites found applications in medical equipment, such as ventilators and protective gear. As industries recovered, the market rebounded, driven by pent-up demand and the resumption of manufacturing activities. The pandemic also underscored the importance of sustainability and innovation, leading to increased investment in bio-composites and recycling technologies. Moving forward, the market is expected to grow robustly as industries adapt to the post-pandemic landscape.

Latest Trends/Developments:

The Composites Market is evolving rapidly, driven by innovation and shifting consumer demands. One of the most notable trends is the rise of thermoplastic composites, which offer recyclability and faster processing times compared to traditional thermosetting composites. Another emerging trend is the use of advanced manufacturing techniques, such as 3D printing and Automated Fiber Placement (AFP). These technologies enable precision manufacturing, reduce material wastage, and lower production costs, making composites more accessible to a broader range of industries. Sustainability remains a key focus, with increasing investment in bio-composites and recycling solutions. Companies are exploring the use of natural fibers and bio-resins to develop eco-friendly materials, addressing regulatory requirements and consumer preferences. For example, automotive manufacturers are incorporating bio-composites into interior panels and dashboards to enhance sustainability without compromising performance. Additionally, the integration of smart technologies into composite materials is gaining momentum. Self-healing composites, for instance, can repair micro-cracks autonomously, extending the lifespan of components and reducing maintenance costs. These innovations are expected to unlock new applications and drive market growth in the coming years.

Key Players:

-

Toray Industries

-

Hexcel Corporation

-

Owens Corning

-

SGL Carbon

-

Mitsubishi Chemical Corporation

-

Teijin Limited

-

Huntsman Corporation

-

Solvay S.A.

-

BASF SE

-

Gurit

Chapter 1. Composites Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Composites Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Composites Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Composites Market - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Composites Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Composites Market – By Type

6.1 Introduction/Key Findings

6.2 Glass Fiber Composites

6.3 Carbon Fiber Composites

6.4 Aramid Fiber Composites

6.5 Bio-Composites

6.6 Others

6.7 Y-O-Y Growth trend Analysis By Type

6.8 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 7. Composites Market – By Application

7.1 Introduction/Key Findings

7.2 Aerospace and Defense

7.3 Automotive

7.4 Construction

7.5 Wind Energy

7.6 Marine

7.7 Sports and Leisure

7.8 Others

7.9 Y-O-Y Growth trend Analysis By Application

7.10 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. Composites Market , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Type

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Type

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Type

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Type

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Type

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. Composites Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Toray Industries

9.2 Hexcel Corporation

9.3 Owens Corning

9.4 SGL Carbon

9.5 Mitsubishi Chemical Corporation

9.6 Teijin Limited

9.7 Huntsman Corporation

9.8 Solvay S.A.

9.9 BASF SE

9.10 Gurit

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Composites Market was valued at USD 90 billion in 2024 and is projected to grow at a CAGR of 6.5% from 2025 to 2030. The market is expected to reach USD 131.32 billion by 2030.

Key drivers include the rising demand for lightweight materials, growth in the wind energy sector, and advancements in manufacturing technologies.

The market is segmented by type (glass fiber, carbon fiber, aramid fiber, bio-composites) and application (aerospace, automotive, construction, wind energy, marine, sports, and leisure).

Asia-Pacific dominates the market, accounting for 45% of the revenue in 2024, driven by strong growth in automotive, construction, and renewable energy sectors.

Key players include Toray Industries, Hexcel Corporation, Owens Corning, SGL Carbon, and Teijin Limited.