North America Butter Market Size (2024-2030)

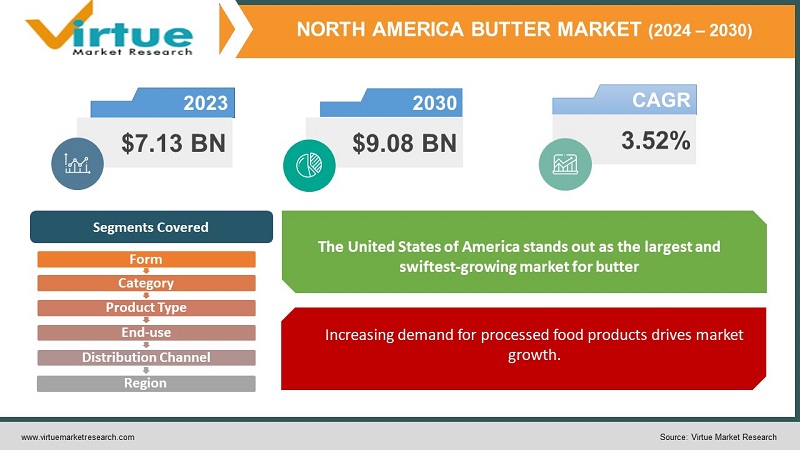

The North America Butter Market was valued at USD 7.13 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 9.08 billion by 2030, growing at a CAGR of 3.52%.

Key Market Insights:

The food industry has experienced a notable surge in demand, driven by heightened consumer preference for processed food items, including bakery goods, confectionery, desserts, and ready-to-eat meals.

Within this context, the bakery sector emerges as a notable consumer of butter, as bakers depend on its distinctive characteristics to craft flaky pastries, decadent cakes, and buttery croissants.

North America Butter Market Drivers:

Increasing demand for processed food products drives market growth.

There has been a shift in demand for dairy products away from vegetable oil-based substitutes and towards dairy fats. This trend can be attributed to evolving taste preferences and a growing recognition of the health advantages associated with dairy fat. Projections indicate a further increase in dairy consumption in emerging economies, driven by greater consumption of processed foods due to rising discretionary incomes and the globalization of dietary habits.

North America Butter Market Restraints and Challenges:

The rise in popularity of lactose-free and plant-based foods hinders market growth.

The heightened awareness among consumers regarding animal welfare is bolstering the demand for plant-derived foods. Furthermore, plant-based food and beverage products are gaining traction in mainstream retail markets. The prevailing perception that plant-based products offer health and safety benefits is fueling the demand for natural butter alternatives like soy milk and nut milk-based butter. Similarly, there is a rising demand for butter derived from nut milk.

North America Butter Market Opportunities:

The increasing popularity of butter across retail & food service sectors creates opportunities.

One of the rapidly selling items across various retail channels is packaged butter. During the epidemic and subsequent lockdowns, a significant portion of consumers turned to home-cooked meals and baked goods. Consequently, there was a surge in demand for packaged butter in both developed and developing economies. Additionally, premium-grade products have witnessed increased demand in developed nations over recent years. Butter derived from A2 milk, organic milk, and varieties with no added ingredients are all regarded as premium options. It is anticipated that increasing levels of consumer discretionary spending will further drive the demand for premium butter among customers.

NORTH AMERICA BUTTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

3.52% |

||

|

Segments Covered |

|

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

USA, Canada, Rest of North America | ||

|

Lactalis International, Fonterra Co-operative Group, Ornua Co-operative Limited, Organic Valley, Dairy Farmers of America, Inc., Amul Dairy, Meadow Foods Ltd., Arla Foods amba, MS Iceland Dairies, Muller |

North America Butter Market Segmentation:

North America Butter Market Segmentation By Form:

- Spreads

- Blocks

- Liquid/Oil

- Others

The spreads category emerged as the highest revenue generator, representing a popular form of butter known for its convenience and ease of use. Typically, spreads are crafted by blending butter with oils or other ingredients to achieve a softer, more spreadable texture. They are commonly used for spreading on bread, toast, or bagels. Additionally, spreads are available in a variety of flavors including garlic, herb, or honey.

North America Butter Market Segmentation By Category:

- Salted

- Unsalted

- Spreadable

- Non-Spreadable

The salted segment commands the largest market share owing to its higher consumption rates. With widespread popularity and reach, salted products hold the highest market value.

Predominantly distributed through retail and food service channels as packaged butter, salted butter boasts an extended shelf life and easier preservation compared to unsalted varieties. Furthermore, the addition of salt enhances both the flavor and texture of the product. Anticipated expansion in industry growth is fueled by continuously expanding distribution channels and the burgeoning internet retail sector.

Conversely, the unsalted variety finds utility across a range of processed items, including bakery goods, noodles, and pasta. The demand for unsalted varieties has seen a significant surge among food manufacturers. Moreover, the increased consumption of refined butter can be attributed to its heightened usage in emerging culinary products such as premixes and ready-to-cook meals.

North America Butter Market Segmentation By Product Type:

- clarified Butter

- Cultured Butter

- Uncultured Butter

- standard Butter

- Whipped Butter

- Others

The fastest-growing segment within the North American butter market is cultured butter. Its fermentation process imbues beneficial bacteria, resulting in a richer, creamier flavor profile and smoother texture compared to its uncultured counterparts. This superior taste and texture resonate with consumers seeking a premium butter experience, establishing cultured butter as a favored choice in the market. Additionally, the burgeoning artisan and specialty butter markets heavily rely on cultured butter due to its distinct flavor profile, making it ideal for gourmet recipes and specific culinary pairings. Furthermore, some consumers perceive cultured butter as offering potential health benefits attributed to its fermentation process, which may enhance digestibility and provide probiotic advantages.

Conversely, uncultured butter is the largest growing segment. Produced by churning fresh, pasteurized cream, uncultured butter is unsalted, neutral-tasting, and frequently utilized in baking as it preserves the flavor of the finished product. Anticipated growth is expected to be driven by the increasing demand for uncultured butter in the bread and confectionery industries.

North America Butter Market Segmentation By End-use:

- food processing

- Foodservice

- food retail

- Bakery

- Dairy and Frozen Desserts

- Dressings and Spreads

- Others

The industrial processing sector dominates the market, with its growth primarily fueled by heightened demand for butter in the food processing industry. Butter serves as a principal ingredient in the confectionery industry, where manufacturers extensively utilize it. The increasing investment in innovation and the development of unique confectionery products has further elevated the segment's reliance on butter. Moreover, butter is a staple ingredient in various baked goods, particularly bread and cakes. It is anticipated that the rapid expansion of the bakery industry in the foreseeable future will drive further market growth.

North America Butter Market Segmentation By Distribution Channel:

- Supermarkets

- Retailers

- Online Stores

- Others

The rapid expansion of retail channels can be attributed to their enhanced distribution capabilities, which serve as a solid foundation for packaged butter sales. In recent years, consumer interest in home baking has grown significantly, whether out of necessity or as a pastime. The packed butter segment has experienced substantial growth, particularly during the pandemic, owing to increased home cooking and baking practices.

North America Butter Market Segmentation- by Region

- USA

- Canada

- Mexico

The United States of America stands out as the largest and swiftest-growing market for butter. This status is propelled by the nation's robust dairy infrastructure, characterized by a rich history of butter production and a well-developed network of dairy farms and processing facilities. This strong foundation not only ensures efficient and large-scale butter manufacturing but also solidifies the country's position as a prominent player in the dairy industry.

Moreover, butter holds a revered status within the American culinary landscape, serving as a fundamental ingredient in a myriad of culinary traditions. Its presence spans a wide spectrum of recipes, from savory to baked goods. The diverse and multicultural nature of American society contributes to a rich culinary tapestry, where various cultural influences shape consumer preferences and drive demand for an extensive array of butter varieties, ranging from traditional to artisanal.

Additionally, American butter producers capitalize on their extensive experience and marketing expertise to craft compelling narratives around the quality, versatility, and nutritional benefits of butter. This strategic marketing approach fosters strong brand recognition and cultivates positive consumer perceptions. Consequently, these successful marketing endeavors not only reinforce the United States' position as a leading player in the North American butter market but also fortify its market dominance amid increasing competition from emerging markets.

COVID-19 Pandemic: Impact Analysis

The COVID-19 pandemic brought about a mixed set of effects on the butter market. Initially, disruptions in the food supply chain and panic buying of shelf-stable staples like regular eggs led to a temporary decrease in demand for butter, perceived as less readily available. However, the pandemic also presented unforeseen opportunities. With consumers placing greater emphasis on food safety and hygiene, the inherent safety benefits of butter gained renewed recognition.

Moreover, the surge in home cooking during lockdowns potentially benefited the market as consumers sought convenient options such as pre-cracked liquid egg products. The most notable long-term impact of COVID-19 on the butter market could be a potential shift in consumer behavior. The heightened focus on hygiene and convenience may result in a lasting preference for the safety and ease of use offered by butter. However, realizing this trend depends on overcoming existing price barriers and ensuring broader product availability across all regions.

Overall, the pandemic's impact on the butter market remains somewhat uncertain in the long term. While initial disruptions were observed, the focus on food safety and convenience has the potential to drive future growth, provided the industry addresses concerns regarding affordability and accessibility.

Latest Trends/ Developments:

- In January 2024, Bregott expanded its product line by introducing three new package sizes: 250 g, 500 g, and 750 g. The company announced that these new packages would be made available in the refrigerated sections of grocery stores.

- Also in January 2024, Arla Foods AMBA, the Danish dairy giant, increased its ownership stake in Massby Facility and Service, a property management company that operates a dairy in Sipoo, near Helsinki. Arla Foods now holds 100% ownership of Massby Facility and Service, up from its previous 60% stake.

- In October 2023, Ornua Co-operative invested EUR 40 million in Kerrygold Park, its primary butter production facility located in Mitchelstown, County Cork. This investment facilitated the installation of ten packing lines capable of producing 50 different product formats at the facility.

Key Players:

These are the top 10 players in the North America Butter Market: -

- Lactalis International

- Ornua Co-operative Limited

- Fonterra Co-operative Group

- Dairy Farmers of America, Inc.

- Organic Valley

- Meadow Foods Ltd.

- Amul Dairy,

- MS Iceland Dairies

- Arla Foods amba

- Muller

Chapter 1. North America Butter Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Butter Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Butter Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Butter Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Butter Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Butter Market– By Form

6.1. Introduction/Key Findings

6.2. Spreads

6.3. Blocks

6.4. Liquid/Oil

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Form

6.7. Absolute $ Opportunity Analysis By Form , 2024-2030

Chapter 7. North America Butter Market– By Category

7.1. Introduction/Key Findings

7.2. Salted

7.3. Unsalted

7.4 Spreadable

7.5. Non-Spreadable

7.6. Y-O-Y Growth trend Analysis By Category

7.7. Absolute $ Opportunity Analysis By Category , 2024-2030

Chapter 8. North America Butter Market– By Product Type

8.1. Introduction/Key Findings

8.2. clarified Butter

8.3. Cultured Butter

8.4. Uncultured Butter

8.5. standard Butter

8.6. Whipped Butter

8.7. Others

8.8. Y-O-Y Growth trend Analysis By Product Type

8.9. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 9 . North America Butter Market– By End-User

9 .1. Introduction/Key Findings

9 .2. food processing

9.3. Foodservice

9.4. food retail

9.5. Bakery

9.6. Dairy and Frozen Desserts

9.7. Dressings and Spreads

9.8. Others

9.9. Y-O-Y Growth trend Analysis By End-User

9.10. Absolute $ Opportunity Analysis By End-User, 2024-2030

Chapter 10 . North America Butter Market– By Distribution Channel

10 .1. Introduction/Key Findings

10 .2. Supermarkets

10.3. Retailers

10.4. Online Stores

10.5. Others

10.6. Y-O-Y Growth trend Analysis By Distribution Channel

10.7. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 11. North America Butter Market, By Geography – Market Size, Forecast, Trends & Insights

11.1. North America

11.1.1. By Country

11.1.1.1. U.S.A

11.1.1.2. Canada

11.1.1.3. Mexico

11.1.1.4. Rest of North America

11.1.2. By Form

11.1.3. By Category

11.1.4. Product Type

11.1.5. End User Industry

11.1.6. Distribution Channel

11.1.7. Countries & Segments - Market Attractiveness Analysis

Chapter 12. North America Butter Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

12.1. Lactalis International

12.2. Ornua Co-operative Limited

12.3. Fonterra Co-operative Group

12.4. Dairy Farmers of America, Inc.

12.5. Organic Valley

12.6. Meadow Foods Ltd.

12.7. Amul Dairy,

12.8. MS Iceland Dairies

12.9. Arla Foods amba

12.10. Muller

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The food industry has experienced a notable surge in demand, driven by heightened consumer preference for processed food items, including bakery goods, confectionery, desserts, and ready-to-eat meals.

The top players operating in the North America Butter Market are - Lactalis International, Ornua Co-operative Limited, Fonterra Co-operative Group, Dairy Farmers of America, Inc., Organic Valley, Meadow Foods Ltd., Amul Dairy, MS Iceland Dairies, Arla Foods amba, Muller

The COVID-19 pandemic brought about a mixed set of effects on the butter market. Initially, disruptions in the food supply chain and panic buying of shelf-stable staples like regular eggs led to a temporary decrease in demand for butter, perceived as less readily available.

Butter derived from A2 milk, organic milk, and varieties with no added ingredients are all regarded as premium options. It is anticipated that increasing levels of consumer discretionary spending will further drive the demand for premium butter among customers

The United States of America stands out as the largest and swiftest-growing market for butter