Europe Butter Market Size (2024-2030)

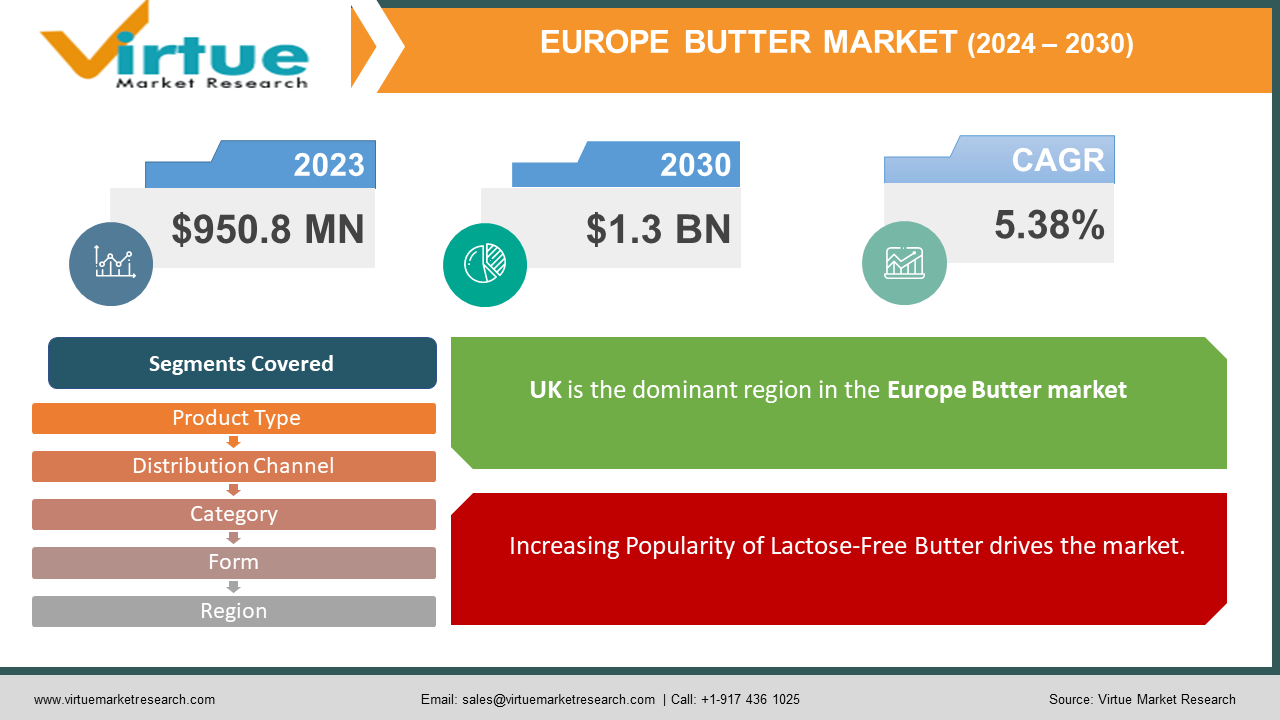

The Europe Butter Market was valued at USD 950.8 million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 1.3 billion by 2030, growing at a CAGR of 5.38%.

Butter represents a dairy product derived from churning cream, extracting its fat and protein components. With an approximate butterfat content of 80%, it forms a semi-solid emulsion at normal room temperatures. Its versatility is evident as it serves various culinary roles: as a spread when at room temperature, as a melted condiment, and as a fat source in baking, sauce-making, pan frying, and other cooking methods.

Although predominantly sourced from cow's milk, butter can also originate from the milk of alternative mammals, such as sheep, goats, buffalo, and yaks. The process entails churning milk or cream to separate the fat globules from the resulting buttermilk. Historically, salt has been a common addition to butter for preservation, particularly during transportation. While salt still contributes to preservation, modern refrigeration along the entire supply chain has diminished its significance.

Rising consumer interest in processed foods like bakery goods, confectionery, desserts, and ready-to-eat meals has dramatically increased demand in the food industry. This trend is evident throughout the sector. The butter market is expected to expand due to the growing demand for packaged products in both retail and food service channels.

Key Market Insights:

Butter stands as a fundamental ingredient in numerous household dishes worldwide, contributing to its heightened consumer demand. Furthermore, the proliferation of various flavored butter variants is anticipated to amplify its market appeal. However, factors like the emergence of healthier substitutes like margarine and governmental regulations governing butter production and distribution hinder market expansion. Conversely, the increasing inclination of consumers towards shelf-stable dairy products, including butter, for in-home consumption emerges as a pivotal driver propelling market growth in the region.

Europe Butter Market Drivers:

Increasing Popularity of Lactose-Free Butter drives the market.

While it's common for individuals to experience physical reactions to certain foods, there's a growing prevalence of lactose intolerance among residents worldwide. This trend has spurred an increased demand for lactose-free dairy products. Various butter variants that are free from lactose have witnessed a surge in popularity, crafted either from lactose-free milk (containing added lactase enzyme) or sourced from plant-based or microbial origins (such as cultured butter).

Lactose, a sugar naturally occurring in milk and dairy items like butter, ranks among the most prevalent food intolerances. Those with lactose intolerance often struggle to digest fresh milk products like butter and ice cream but can consume lactose-free dairy items without issue.

Despite butter containing lower levels of lactose compared to milk, there's been a significant uptick in demand for lactose-free butter and plant-based alternatives, spurred by the broader demand for lactose-free dairy products. Additionally, manufacturers are innovating with new butter products to accommodate the growing population of lactose-intolerant individuals worldwide.

Advanced Technologies ensuring quality control increase the market growth.

The market growth is being propelled by technological advancements, such as the implementation of IoT in the transportation of butter and other milk products, aimed at ensuring safe handling practices. These published federal guidelines and regulations are designed to maintain the quality of dairy products following hygienic standards for consumption.

Europe Butter Market Restraints and Challenges:

Consuming excess Butter can lead to health problems which hinder market growth.

Butter is recognized for its high saturated fat content, with approximately seven grams per tablespoon, constituting roughly one-third of the recommended daily allowance. Consumption of a diet rich in saturated fats is associated with elevated levels of LDL ("bad") and HDL cholesterol. Elevated LDL cholesterol can potentially contribute to the development of atherosclerosis, consequently increasing the risk of blood clots, strokes, and heart attacks. Additionally, butter is calorie-dense, containing approximately 100 calories per tablespoon, and excessive consumption can contribute to weight gain.

The increasing popularity of plant-based foods hinders market growth.

The increasing popularity of lactose-free and plant-based foods is driven by several factors. Growing consumer awareness about animal welfare boosts demand for plant-derived foods. Plant-based products, perceived as healthier and safer, are rapidly entering mainstream markets. This trend fuels the rise of natural butter substitutes like soymilk and nut milk-based butter.

Rising lactose intolerance also drives demand for dairy substitutes. Lactose-containing products are often seen as unhealthful due to links with obesity and lifestyle-related conditions. The rapidly expanding dairy alternatives market, featuring innovations like non-dairy ice creams and vegetable oil-based bakery items, is expected to challenge the traditional dairy industry.

Europe Butter Market Opportunities:

Increasing demand for organic products creates opportunities

The growing health consciousness among consumers has led to a heightened demand for organic products, despite their higher prices and limited availability. Health-conscious individuals are increasingly gravitating towards private-label goods that offer high quality, health benefits, and sustainability.

These shifting consumer preferences are anticipated to generate fresh opportunities for manufacturers of organic products. Consequently, the demand for organic butter is on the rise. The increasing desire for high-quality, flavorful, and convenient food options is expected to drive butter sales in the years to come.

EUROPE BUTTER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.38% |

|

Segments Covered |

By Product Type, category, form, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Germany, United Kingdom, France, Italy, Spain, Rest of Europe |

|

Key Companies Profiled |

Lactalis International, Ornua Co-operative Limited, Fonterra Co-operative Group, Dairy Farmers of America, Inc, Organic Valley, Arla Foods amba, Amul Dairy, Meadow Foods Ltd., Muller and MS Iceland Dairies |

Europe Butter Market Segmentation:

Europe Butter Market Segmentation-By Product Type:

- Standard Butter

- Clarified Butter

- Whipped Butter

- Others

The market is predominantly led by the standard butter segment. This type of butter is crafted by churning fresh cream or milk, resulting in a smooth and creamy texture. Renowned for its rich flavor, standard butter finds extensive utilization in cooking, baking, and as a spread. Its versatility allows for diverse culinary applications, making it a staple in many kitchens.

Europe Butter Market Segmentation-By Category:

- Salted

- Unsalted

The highest revenue in the market was generated by the salted butter category. Salted butter is produced by churning cream and incorporating salt into the mixture. This addition of salt imparts a savory flavor profile to the butter, enriching its taste with a subtle saltiness. Widely utilized for spreading bread, toast, and various baked goods, salted butter is a staple in many households. Additionally, the salt content serves as a natural preservative, prolonging the shelf life of the butter. Moreover, the inclusion of salt in butter aids in accentuating the flavors in a variety of recipes, rendering it a favored choice among chefs and bakers alike.

Europe Butter Market Segmentation-By Form:

- Spreads

- Liquid/oil

- Blocks

- Others

The dominant segment in the market is blocks. These blocks are readily accessible and boast versatility, suitable for use across various cuisines. On the other hand, spreads represent the fastest-growing segment within the market.

Europe Butter Market Segmentation-By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience stores

- Online Retail Stores

- Other Distribution Channels

Supermarkets emerge as the leading segment in the market, offering a wide array of butter varieties in diverse forms and flavors. Meanwhile, the online segment stands out as the fastest-growing sector, enabling customers to conveniently purchase a range of traditional and innovative butter flavors with ease.

Online retail offers various benefits like free shipping and coupon advantages. With a wide range of lactose-free butter products available, this segment is expected to grow in popularity. The rise of delivery services and app-based merchants further boosts this trend.

Europe Butter Market Segmentation- by region

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Europe

The UK dominates the butter market, benefiting from the largest grassland area, ideal for dairy farming, and being home to the EU Protected Designation of Origin West Country Farmhouse Cheddar. Following the UK, Germany, France, and Russia rank as the second, third, and fourth biggest butter consumers, respectively.

COVID-19 Pandemic: Impact Analysis

The growth rate of the butter market experienced a decline amidst the COVID-19 pandemic. Government-imposed lockdowns and restrictions, implemented as precautionary measures, disrupted supply chains, trade, and butter production. The lockdown measures resulted in reduced availability of raw materials to manufacturing plants, consequently leading to decreased production within a short period. Furthermore, sales of butter through supermarkets, grocery stores, and similar outlets declined significantly due to reduced foot traffic from customers.

However, it is anticipated that the market will gradually recover to pre-pandemic growth levels over the forecast period. This recovery is expected to be facilitated by the relaxation of restrictions, the resumption of economic activities, and the continued growth of online delivery services.

Latest Trends/ Developments:

- In October 2022, Singapore's EATNUF brand, known for its natural nut butter products, revealed its expansion plans for China and Malaysia in 2023. The company announced its intention to introduce black sesame seed spread alongside its existing almond and cashew nut butter offerings on e-commerce platforms.

- In June 2022, Cavin's brand, a prominent FMCG company under CavinKare headquartered in Chennai, introduced a new line of butter products to the market. The brand unveiled two variants: frying butter and table butter, catering to diverse consumer preferences and culinary needs.

- In April 2022, The New Zealand Dairy Co-operative and Anchor Fonterra jointly launched their organic carbon zero-certified butter. Independently certified by ToitūEnvirocare, this butter is designed to reduce and offset carbon emissions, reflecting a commitment to sustainability and environmental stewardship.

Key Players:

These are top 10 players in the Europe Butter Market: -

- Lactalis International

- Ornua Co-operative Limited

- Fonterra Co-operative Group

- Dairy Farmers of America, Inc

- Organic Valley

- Arla Foods amba

- Amul Dairy

- Meadow Foods Ltd.

- Muller

- MS Iceland Dairies

Chapter 1. Europe Butter Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Butter Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Butter Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Butter Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Butter Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Butter Market – By Product Type

6.1. Introduction/Key Findings

6.2. Standard Butter

6.3. Clarified Butter

6.4. Whipped Butter

6.5. Others

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Europe Butter Market – By Category

7.1. Introduction/Key Findings

7.2 Salted

7.3. Unsalted

7.4. Y-O-Y Growth trend Analysis By Category

7.5. Absolute $ Opportunity Analysis By Category, 2024-2030

Chapter 8. Europe Butter Market – By Form

8.1. Introduction/Key Findings

8.2 Spreads

8.3. Liquid/oil

8.4. Blocks

8.5. Others

8.6. Y-O-Y Growth trend Analysis Form

8.7. Absolute $ Opportunity Analysis Form , 2024-2030

Chapter 9. Europe Butter Market – By Distribution Channel

9.1. Introduction/Key Findings

9.2 Supermarkets/Hypermarkets

9.3. Convenience stores

9.4. Online Retail Stores

9.5. Other Distribution Channels

9.6. Y-O-Y Growth trend Analysis Distribution Channel

9.7. Absolute $ Opportunity Analysis Distribution Channel , 2024-2030

Chapter 10. Europe Butter Market , By Geography – Market Size, Forecast, Trends & Insights

10.1. Europe

10.1.1. By Country

10.1.1.1. U.K.

10.1.1.2. Germany

10.1.1.3. France

10.1.1.4. Italy

10.1.1.5. Spain

10.1.1.6. Rest of Europe

10.1.2. By Product Type

10.1.3. By Distribution Channel

10.1.4. By Category

10.1.5. Form

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Europe Butter Market – Company Profiles – (Overview, Flavor Product Type Portfolio, Financials, Strategies & Developments)

11.1 Lactalis International

11.2. Ornua Co-operative Limited

11.3. Fonterra Co-operative Group

11.4. Dairy Farmers of America, Inc

11.5. Organic Valley

11.6. Arla Foods amba

11.7. Amul Dairy

11.8. Meadow Foods Ltd.

11.9. Muller

11.10. MS Iceland Dairies

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Rising consumer interest in processed foods like bakery goods, confectionery, desserts, and ready-to-eat meals has dramatically increased demand in the food industry. This trend is evident throughout the sector.

The top players operating in the Europe Butter Market are - Lactalis International, Ornua Co-operative Limited, Fonterra Co-operative Group, Dairy Farmers of America, Inc, Organic Valley, Arla Foods amba, Amul Dairy, Meadow Foods Ltd., Muller and MS Iceland Dairies.

The growth rate of the butter market experienced a decline amidst the COVID-19 pandemic. Government-imposed lockdowns and restrictions, implemented as precautionary measures, disrupted supply chains, trade, and butter production.

In October 2022, Singapore's EATNUF brand, known for its natural nut butter products, revealed its expansion plans for China and Malaysia in 2023. The company announced its intention to introduce black sesame seed spread alongside its existing almond and cashew nut butter offerings on e-commerce platforms.

Following the UK, Germany, France, and Russia rank as the second, third, and fourth biggest butter consumers, respectively.