North America Asparagus Market Size (2024-2030)

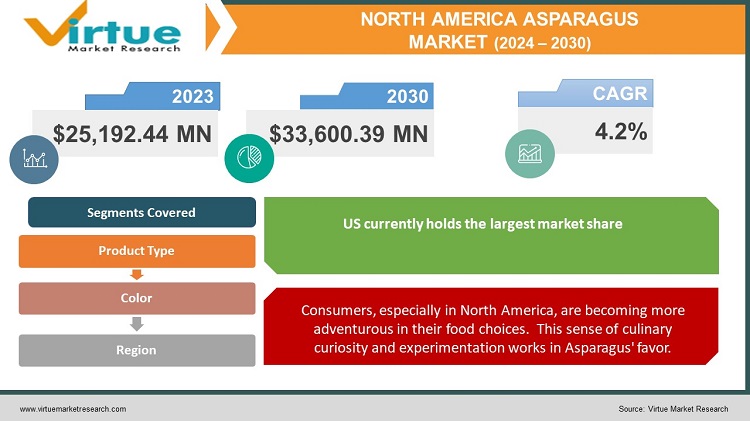

The North America Asparagus Market was valued at USD 25,192.44 Million in 2023 and is projected to reach a market size of USD 33,600.39 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 4.2%.

Asparagus, the springtime delicacy, has carved a significant niche in the North American market. While Mexico dominates production, both the United States and Canada play crucial roles as producers and consumers. Mexico leads the way, with areas like the Caborca region in Sonora ideal for both fresh and processed asparagus cultivation. Extensive acreage and favorable climatic conditions contribute to its market dominance. Washington State, especially the Yakima Valley, produces high-quality asparagus with vibrant color and flavor, catering to a discerning market segment. The majority of asparagus is consumed fresh. However, processing methods like canning or freezing allow for year-round availability and cater to the needs of the food service industry. Asparagus reaches consumers through supermarkets, grocery stores, farmers' markets, and increasingly through online sales platforms directly from growers. The demand for organic asparagus is steadily growing, driven by health-conscious consumers who prefer food grown with sustainable practices.

Key Market Insights:

North America, specifically the United States, heavily relies on asparagus imports, predominantly from Mexico and Peru. This is due to favorable growing climates and labor costs in these regions. While cultivation techniques are extending the season, asparagus remains heavily seasonal. Early spring sees a surge in domestic production, but imports fill the gaps before and after this localized peak. Demand exists for both fresh asparagus sold directly to consumers and processed asparagus (frozen, canned) used in soups, sauces, and prepared meals. This creates distinct supply chains and pricing patterns. Asparagus' reputation as a nutrient-dense, low-calorie vegetable aligns well with consumer focus on healthy eating. This provides a positive long-term demand driver. The demand for organically grown asparagus mirrors the larger trend towards organic produce. This segment caters to health-conscious and environmentally-conscious consumers who are willing to pay a premium for pesticide-free options. Pre-washed, pre-cut, or ready-to-cook asparagus formats appeal to time-strapped consumers. These offer a value-add, potentially commanding higher prices. Asparagus is moving beyond being a simple side dish. The rise of foodie culture and diverse recipes encourage more adventurous use of asparagus in salads, stir-fries, and other dishes. While limited by seasonality, some regions show a preference for locally grown asparagus during its peak season. This supports smaller farms and aligns with the "eat local" trend.

North America Asparagus Market Drivers:

The shift towards prioritizing health and wellness has become a major force shaping consumer choices, with ripple effects throughout the food industry – and asparagus benefits significantly from this trend.

Consumers increasingly focus on foods that prevent illness and contribute to long-term health rather than simply reacting to existing issues with restrictive diets. There's an emphasis on whole, minimally processed foods packed with nutrients. This aligns perfectly with the nutritional profile of asparagus. Consumers today are better informed about ingredients and their impact. Label reading, nutrition apps, and the abundance of credible health information online make people more discerning about their food choices. Gone are the days of one-size-fits-all diets. Consumers personalize their eating habits based on individual needs, preferences, and what makes them feel their best, creating space for vegetables like asparagus. Asparagus delivers a powerful array of vitamins, minerals, and fiber in a package that won't break the calorie bank. This makes it a perfect choice for people who aim for nutrient-rich diets and may be watching their weight. As consumers shift away from heavily processed snacks and meals, asparagus, with its fresh flavor and minimal preparation required, becomes a desirable alternative. The potential diuretic properties of asparagus, along with its reputation for being rich in antioxidants, tap into the consumer desire for foods that support the body's natural cleansing mechanisms. Demand for organic asparagus skyrockets due to consumer avoidance of pesticides, herbicides, and potential residues. This creates a lucrative market segment for producers and retailers. Consumers prioritize unblemished, crisp asparagus spears – visual indicators of quality and peak nutritional goodness. This influences harvesting cycles and supply chain efficiency. Healthy eating is propelling online grocery sales and subscription boxes specializing in fresh produce delivery. Asparagus can expand its reach through these emerging channels. The perception of asparagus as a "superfood" could open up possibilities for its inclusion (perhaps in powdered or juiced forms) in healthy smoothies, snack bars, and supplemental products.

Consumers, especially in North America, are becoming more adventurous in their food choices. This sense of culinary curiosity and experimentation works in Asparagus' favor.

Restaurants featuring cuisines from the Mediterranean, Asia, and Latin America often incorporate asparagus in innovative ways, exposing diners to new flavors and preparations. Social media and food blogs amplify these trends. Stunning images of asparagus dishes, creative recipes, and cooking tutorials make asparagus less intimidating and more exciting for the home cook. The availability of pre-washed, pre-trimmed, or even pre-cooked asparagus lowers the barrier to entry. People short on time can still experiment with this vegetable without labor-intensive preparation. Asparagus is no longer confined to special occasions. Recipes showcasing how to incorporate it into quick weeknight meals widen its potential customer base. Consumers become interested in different colored asparagus (purple, white), each with unique flavor profiles, keeping things exciting. Recipes utilizing different asparagus forms (frozen, canned) make it possible to enjoy asparagus dishes year-round, smoothing out the supply and demand peaks. Producers specializing in niche asparagus varieties or those focused on innovative prepared asparagus products find an audience ready to explore. Consumers might buy asparagus with a specific recipe in mind, moving it from an impulse buy to an intentional ingredient. Some consumers may still find asparagus unfamiliar or be unsure how to cook it. Recipes need to be clear, and basic cooking methods made easily accessible.

North America Asparagus Market Restraints and Challenges:

Fresh asparagus has a notoriously short shelf life compared to many other vegetables. Asparagus cultivation, especially harvesting, is labor-intensive. This poses a major challenge, particularly in North America.

Loss due to spoilage impacts the bottom line for growers, distributors, and retailers. It drives up costs and can potentially inflate prices for consumers. The need for quick transport and strict temperature control throughout the supply chain from field to shelf creates additional expense and limits distribution reach. While fresh asparagus is flown internationally, its short lifespan puts limits on how far afield asparagus from North America can realistically be exported in fresh form. If consumers have had prior negative experiences with quickly wilting asparagus, they might be less likely to repurchase, dampening demand. The agricultural sector often struggles to attract and retain enough workers, and asparagus is no exception. This shortage can lead to delayed harvests, impacting both yield and quality. When workers are available, the need to pay competitive wages in an already price-sensitive market puts pressure on producers to keep costs down in other areas and can impact product pricing for consumers. Reliance on seasonal migrant labor makes asparagus farming vulnerable to shifts in immigration policies and potential visa restrictions. While mechanization efforts for asparagus harvesting are ongoing, the technology isn't yet commercially viable on a large scale. This reliance on manual labor remains a constraint. The cost of fertilizers, pest control, irrigation (especially in dry regions), and fuel impacts asparagus production significantly. Fluctuations in these costs can put a squeeze on growers' margins. Imported asparagus, often from countries with lower production costs, puts downward pressure on prices for domestically grown asparagus. This can be particularly pronounced outside of peak season. Asparagus doesn't exist in isolation. Consumers might opt for cheaper or more familiar vegetables, especially if they perceive asparagus as "only for special occasions.

North America Asparagus Market Opportunities:

Different asparagus varieties have slightly varying growing seasons. By meticulously planning the cultivation of early, mid, and late-season varieties, producers can potentially extend the availability of fresh domestic asparagus. Hydroponic systems and advanced greenhouse cultivation offer more control over growing conditions. While potentially more capital-intensive, this approach can allow for asparagus production outside of the traditional season. Collaboration with South American growers, where the asparagus season complements North America's, can ensure reliable, high-quality supply even during the traditional off-season, meeting consistent demand. Organic asparagus commands a premium price due to its alignment with consumer values surrounding pesticide-free food and environmentally conscious production methods. The organic label draws in consumers who might not normally consider asparagus due to price sensitivity, creating a larger potential customer base. Online platforms and subscription boxes focused on organic produce increase the visibility and accessibility of organic asparagus to consumers nationwide. Collaborations with chefs, food bloggers, and recipe developers to create exciting dishes featuring asparagus in new ways can spark consumer interest and increase its perceived value. Teaming up with complementary products – think specialty olive oils, gourmet vinegar, or seasoning blends – can elevate asparagus and boost sales for both parties. Marketing campaigns highlighting the unique uses of green, white, and purple asparagus, and guiding their preparation can expand consumption occasions. Emphasizing the local origin, showcasing farmers' stories, or even offering farm visits can create a strong emotional connection with consumers willing to support their regional food system.

NORTH AMERICA ASPARAGUS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Product Type, Colour, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, USA, CANADA, MEXICO |

|

Key Companies Profiled |

DanPer Trujillo S.A.C, Sociedad Agrícola Virú, Beta S.A., Camposol, Cranberry Country Growers , Church Brothers Farms, Agrizar, Sun Belle, Sysco, United Natural Foods Inc |

North America Asparagus Market Segmentation:

North America Asparagus Market Segmentation: By Color

- Green Asparagus

- White Asparagus

- Purple Asparagus

Green Asparagus: This is the most widely cultivated and consumed asparagus variety. It boasts a fresh, grassy flavor with subtly sweet undertones. Green asparagus becomes more tender towards its tips. White Asparagus: Grown in a unique way where it's deprived of sunlight, preventing chlorophyll development. This gives it a pale, creamy color and a milder, less herbaceous flavor than green asparagus. It's often considered a delicacy. Purple Asparagus: A specialty variety with a striking purple hue. It offers a slightly sweeter and nuttier flavor profile compared to green and may potentially contain higher levels of antioxidants. Green asparagus enjoys a very substantial market share in North America. Green asparagus is the easiest to cultivate on a large scale. Production methods are well-established, resulting in widespread availability. Green asparagus works well with a plethora of cooking methods – grilling, roasting, steaming, stir-frying – making it approachable to a wide range of consumers. Purple asparagus is the most exciting from a growth potential perspective. The vivid color makes purple asparagus stand out on shelves and plates, attracting curious consumers.

North America Asparagus Market Segmentation: By Product Type

- Fresh Asparagus

- Frozen Asparagus

- Canned Asparagus

- Other Processed Forms

Fresh Asparagus: Comprises the vast majority of the market, likely somewhere in the 70-80% range. This is unquestionably the reigning champion of the market. Consumers associate asparagus primarily with its crisp snap, vibrant color, and peak flavor in its fresh, unprocessed state. Frozen Asparagus: Holds a substantial share, potentially around 15-25%, with its popularity fluctuating somewhat based on the seasonality of fresh asparagus. A significant player, frozen asparagus offers advantages in terms of convenience, year-round availability, and often, a more budget-friendly price point. Canned Asparagus: These represent a much smaller slice of the market, likely below 10% combined. While still present on grocery store shelves, canned asparagus is a declining segment. Its use is largely limited to situations where fresh or frozen aren't available, or as an ingredient in prepared dishes where texture is less important. Other Processed Forms: These represent a niche but growing category. Examples include pickled asparagus, ready-to-eat asparagus snacks, asparagus puree used in soups or smoothies, and even powdered asparagus for use in supplements. While fresh asparagus will likely remain the top dog, the processed asparagus category holds the potential for significant growth.

North America Asparagus Market Segmentation: Regional Analysis:

- USA

- Canada

- Mexico

The United States: Holds the lion's share of the asparagus market in North America. It boasts a range of climates suitable for asparagus cultivation, a sizable domestic consumer base, and an established agricultural infrastructure. Mexico: Mexico's asparagus production has been steadily increasing, making it a major supplier to the North American market, especially outside of the peak domestic growing season. Canada: While smaller than the U.S. and Mexico, Canada has a dedicated asparagus sector. Its proximity to the U.S. market and focus on fresh produce create opportunities for Canadian growers. The U.S. holds a leadership position in the asparagus market. California, Michigan, and Washington state are major asparagus producers. The variation in climates allows for somewhat staggered growing seasons, extending the availability of fresh domestic asparagus. The large population of the U.S. provides a sizable consumer base for asparagus. Urban centers and their surrounding regions drive steady demand. Mexico's asparagus production and export to North America have seen significant expansion in recent years. Mexico's warmer climate and longer growing seasons complement the traditional U.S. asparagus season, providing a source of fresh asparagus during a larger portion of the year. Mexican growers have been investing in advanced cultivation techniques and infrastructure, improving both the quality and yield of their asparagus.

COVID-19 Impact Analysis on the North America Asparagus Market:

Restaurant closures and initial consumer anxieties about fresh produce safety led to a significant drop in demand for fresh asparagus. This was particularly hard on producers who relied heavily on supplying the food service industry. As consumers stocked their pantries with shelf-stable options, sales of frozen and canned asparagus increased. Their longer shelf life and familiar presence in meals offered a sense of security during uncertain times. Restaurants offering takeout and delivery options created some demand for fresh asparagus. Grocery stores saw a rise in home cooking, leading to renewed interest in fresh produce as restrictions eased. With people wary of in-person shopping, online grocery platforms offering fresh asparagus delivery experienced a surge in popularity. This provided new sales channels for some producers. Consumers, concerned about food security and wanting to support local businesses, turned to farmers' markets and local farms for fresh asparagus, potentially benefiting smaller producers. Demand for fresh asparagus in the food service sector gradually recovered, but it likely hasn't yet reached pre-pandemic levels. The pandemic heightened awareness of food system vulnerabilities. Consumers might be more receptive to asparagus grown with sustainable practices, creating opportunities for producers who emphasize eco-friendly methods. The emergence of new COVID variants might lead to renewed restrictions, impacting both supply chains and consumer behavior. Extreme weather events linked to climate change could disrupt asparagus production in some regions, impacting overall supply and potentially driving price fluctuations.

Latest Trends/ Developments:

Efforts to address food waste throughout the supply chain will impact the asparagus market. Innovations in post-harvest storage methods to extend shelf life and developing uses for less-than-perfect spears contribute to minimizing losses. Communicating a commitment to sustainability to consumers through labeling, certifications, and brand storytelling can become a competitive advantage, especially for values-conscious shoppers. Research is underway to develop asparagus varieties better adapted to extreme weather events, heat, and drought, which are increasing due to climate change. This aims to ensure a stable supply, even in less predictable climates. While still experimental, some companies are exploring indoor vertical farming systems for asparagus production. This has potential for urban areas, and regions with limited arable land, allowing for year-round, ultra-local supply. With advances in cultivation techniques and the right varieties, regions not traditionally associated with asparagus could become niche production areas, expanding the reach of domestic asparagus within North America.

Key Players:

- DanPer Trujillo S.A.C

- Sociedad Agrícola Virú

- Beta S.A.

- Camposol

- Cranberry Country Growers

- Church Brothers Farms

- Agrizar

- Sun Belle

- Sysco

- United Natural Foods Inc

Chapter 1. North America Asparagus Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. North America Asparagus Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. North America Asparagus Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. North America Asparagus Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. North America Asparagus Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. North America Asparagus Market– By Product Type

6.1. Introduction/Key Findings

6.2. Fresh Asparagus

6.3. Frozen Asparagus

6.4. Canned Asparagus

6.5. Other Processed Forms

6.6. Y-O-Y Growth trend Analysis By Product Type

6.7. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. North America Asparagus Market– By Colour

7.1. Introduction/Key Findings

7.2. Green Asparagus

7.3. White Asparagus

7.4. Purple Asparagus

7.5. Y-O-Y Growth trend Analysis By Colour

7.6. Absolute $ Opportunity Analysis By Colour , 2024-2030

Chapter 8. North America Asparagus Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.1.4. Rest of North America

8.1.2. By Colour

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. North America Asparagus Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. DanPer Trujillo S.A.C

9.2. Sociedad Agrícola Virú

9.3. Beta S.A.

9.4. Camposol

9.5. Cranberry Country Growers

9.6. Church Brothers Farms

9.7. Agrizar

9.8. Sun Belle

9.9. Sysco

9.10. United Natural Foods Inc

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Asparagus boasts a stellar nutritional profile: low-calorie, high fiber, packed with vitamins (especially Vitamin K, folate, vitamin C) and antioxidants. This perfectly aligns with consumer demand for nutrient-dense foods

Asparagus cultivation, especially harvesting, is labor-intensive. Shortages of farmworkers or rising labor costs significantly impact production and can create bottlenecks during peak harvesting periods

. DanPer Trujillo S.A.C, Sociedad Agrícola Virú, Beta S.A, Camposol

The US currently holds the largest market share, estimated at around 65%.

Mexico exhibits the fastest growth, driven by its increasing population, and expanding economy.