Europe Asparagus Market Size (2024-2030)

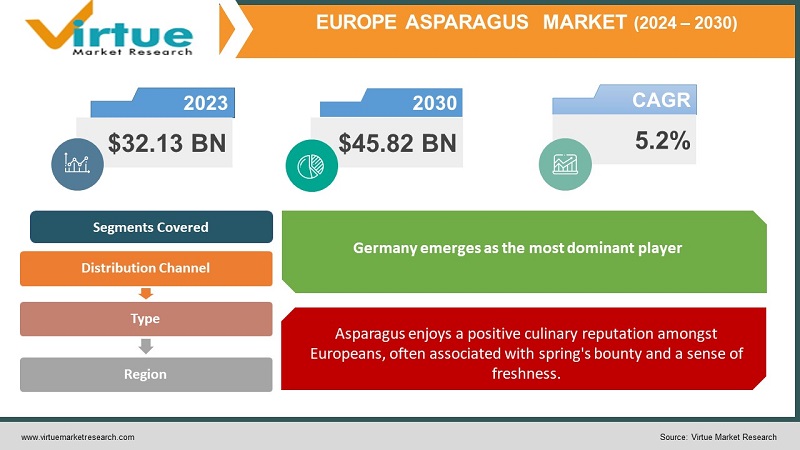

The European asparagus Market was valued at USD 32.13 Billion and is projected to reach a market size of USD 45.82 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 5.2%.

The most widely recognized variety, green asparagus gains its color from chlorophyll due to being grown above ground in sunlight. A delicacy in some European countries, white asparagus is cultivated underground, preventing chlorophyll development and creating a milder flavor profile. Asparagus is a low-calorie vegetable packed with vitamins (K, folate, C, A), minerals, and antioxidants. Asparagus is often perceived as a 'detoxifying' and cleansing food, aligning with wellness trends. Fresh asparagus, particularly white asparagus in certain regions, signals the arrival of spring and carries a sense of culinary anticipation. Asparagus regularly graces restaurant menus, often prepared in classic European styles with hollandaise, butter, or as part of composed salads. Asparagus is relatively easy to prepare with methods like roasting, grilling, and steaming, increasing its usage in home cooking. Asparagus cultivation, particularly white asparagus, is labor-intensive, especially during harvesting periods. This impacts costs and poses labor availability challenges.

Key Market Insights:

Approximately 55% of the distribution routes for asparagus are comprised of supermarkets and hypermarkets. Throughout the forecast period, direct sales from farms and local marketplaces are anticipated to increase at a CAGR of 7.8%.

Approximately 70–80% of the value of the asparagus market in Europe is derived from fresh asparagus. An estimated 300,000 to 350,000 metric tons of asparagus are produced annually in Europe.

About 20–30% of the asparagus that is eaten in Europe comes from imports, mostly from Mexico and Peru.

By 2027, it is anticipated that the European asparagus market will provide over 25,000 new jobs.

By 2027, the green asparagus market segment is predicted to command a commanding 75% of the market. European consumers generally have a positive perception of asparagus as a healthy and nutritious vegetable.

Pre-cut, pre-washed, or ready-to-cook asparagus formats are gaining interest, driven by a desire for convenience. Asparagus is a common menu item in European restaurants, particularly in traditional preparations, with the potential for modern interpretations

Europe Asparagus Market Drivers:

European consumers are increasingly conscious about the food they eat, prioritizing health and well-being. Asparagus perfectly aligns with this trend.

Asparagus is a nutrient powerhouse – a low-calorie source of fiber, vitamins K, C, A, folate, and an array of antioxidants. Asparagus fits seamlessly into diverse dietary patterns, whether vegetarian, vegan, flexitarian, gluten-free or those focused on whole, plant-forward foods. The prebiotic fiber (inulin) in asparagus supports digestive health, a growing focus area for health-conscious consumers. Consumers recognize that asparagus delivers genuine nutritional benefits rather than just hyped-up 'cleansing' properties. While fresh asparagus still has seasonal appeal, its health benefits drive demand even outside of its peak season, boosting the market for imported and processed options. Consumers are willing to pay more for fresh, high-quality asparagus, especially local or organic varieties when they perceive it as an investment in their health. Innovation in processed asparagus products (e.g., soups, spreads) that emphasize the vegetable's natural goodness can gain traction with health-minded segments. Highlighting the evidence-backed nutritional benefits of asparagus, through clear labeling and targeted campaigns, resonates with discerning consumers.

Asparagus enjoys a positive culinary reputation amongst Europeans, often associated with spring's bounty and a sense of freshness.

Chefs champion asparagus on their menus, showcasing both classic preparations (with hollandaise, and poached eggs) alongside modern, globally inspired interpretations. In countries like Germany, white asparagus holds a special culinary status, with dedicated festivals and a strong sense of tradition. Social media, cooking shows, and food blogs fuel interest in exploring new ways to prepare asparagus beyond simple steaming – roasted, grilled, pickled, or incorporated into stir-fries. Asparagus adapts to various cuisines, from Mediterranean flavors to Asian-inspired dishes, expanding its appeal to adventurous palates. The anticipation for the arrival of locally grown fresh asparagus drives significant market activity during its peak. Greater culinary awareness translates to increased year-round demand, encouraging the availability of both fresh and processed asparagus. Offering diverse varieties (green, white, purple) caters to both traditionalists and those seeking culinary novelty. Pre-prepared fresh asparagus formats (trimmed, ready-to-cook) or innovative frozen options can cater to busy home cooks who want delicious asparagus with minimal hassle. Providing easy-to-follow recipes showcasing asparagus' versatility can drive sales and overcome potential culinary intimidation for less familiar consumers.

Europe Asparagus Market Restraints and Challenges:

One of the most significant challenges plaguing the European asparagus market is its inherent seasonality. Asparagus is a cool-weather crop with a limited harvesting window, typically from spring to early summer. This seasonality leads to significant fluctuations in supply throughout the year. During peak harvest periods, the market can become saturated, driving down prices for producers. Conversely, outside the harvest window, asparagus becomes a scarce and expensive commodity. Asparagus cultivation is a labor-intensive process. From meticulously preparing the beds for planting to the delicate task of hand-harvesting the spears, asparagus requires significant manpower. This translates to high production costs for European growers, especially when compared to other regions with lower labor wages. Additionally, asparagus is a perennial crop requiring several years to establish mature crowns before yielding a decent harvest. This extended lead time can be a financial burden for farmers, further impacting the overall market stability. Asparagus is a highly perishable vegetable with a short shelf life. This necessitates efficient post-harvest handling, including rapid cooling, proper storage, and timely transportation to market. Maintaining a cold chain throughout the supply chain adds extra costs and complexity, particularly for long-distance exports. Spoilage during transportation can lead to significant financial losses for producers and disrupt the overall supply chain. The European asparagus market is not immune to the challenges posed by climate change. Fluctuations in temperature and precipitation patterns can disrupt asparagus growth cycles, leading to reduced yields and lower quality produce. Furthermore, asparagus is susceptible to various fungal diseases and pests. The changing climate can exacerbate these threats, requiring growers to invest in additional resources for disease and pest control, further impacting production costs.

Europe Asparagus Market Opportunities:

Europe's diverse climates, from the mild Mediterranean to the cooler northern regions, provide ideal growing conditions for different asparagus varieties. This allows for a longer harvest season, stretching from early spring to late summer. Europeans have incorporated asparagus into their cuisines for generations. From gracing French gratins to adorning Italian risottos, asparagus holds a prominent place in European gastronomy. This deep-rooted appreciation fuels consumer demand. European asparagus growers have embraced innovative techniques like hydroponics and vertical farming. These methods not only increase yield but also ensure consistent quality and minimize environmental impact. Consumers are increasingly prioritizing healthy eating habits. Asparagus, packed with vitamins, minerals, and antioxidants, perfectly aligns with this trend. Its reputation as a digestive aid and potential weight-loss booster further enhances its appeal. The market is witnessing a surge in the popularity of colored asparagus varieties like purple and white alongside the traditional green. These unique offerings cater to adventurous palates and visually-enhanced dishes. Furthermore, innovative products like roasted asparagus snacks and pickled asparagus are attracting new consumer segments.

EUROPE ASPARAGUS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.2% |

|

Segments Covered |

By Type, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Italy, Spain, Russia, Germany, UK, France, Rest of Europe |

|

Key Companies Profiled |

Emsland asparagus, Pfalz asparagus, Grupo ANECO, Grupo Batín, Les Asperges de Provence, Pertuis asparagus, Selezione asparagus , Canino asparagus, Elmasonic |

Europe Asparagus Market Segmentation:

Europe Asparagus Market Segmentation: By Type

- Fresh Asparagus

- Processed Asparagus

Fresh asparagus reigns supreme in the European market, accounting for a substantial share of approximately 75-80%. Fresh asparagus offers an unmatched sensory experience. The crisp snap, subtle sweetness, and slight bitterness contribute to its culinary appeal. Consumers value the ability to integrate fresh asparagus into various dishes, from simple roasting to complex culinary creations. The limited harvesting window of asparagus elevates its perceived value. Consumers associate fresh asparagus with spring and enjoy the opportunity to incorporate this seasonal delicacy into their meals. Asparagus holds a prominent place in European cuisine, particularly in countries like France, Germany, and Italy. Traditional recipes and cooking methods have solidified its position as a desirable vegetable.

The processed asparagus segment is experiencing the fastest growth, estimated to hold a market share of around 20-25%. This segment caters to the evolving needs of European consumers, particularly those with busy lifestyles. Processed asparagus, available in canned, frozen, and pickled varieties, offers a convenient alternative to fresh asparagus. It eliminates the need for washing, peeling, and preparation, making it ideal for quick meals. Processed asparagus can sometimes be a more affordable option compared to fresh asparagus, particularly during the off-season when fresh prices are higher. The processed asparagus segment is witnessing innovation, with offerings like pre-cut spears and ready-to-heat options catering to even busier consumers.

Europe Asparagus Market Segmentation: By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Retailers

- Direct-to-Consumer

Supermarkets hold a staggering 55–60% of the European asparagus market, making them the largest section. Supermarkets and hypermarkets give customers easy access to a wide range of processed and fresh asparagus items under one roof, making them one-stop shopping experiences. These big merchants have a lot of negotiation power when it comes to pricing with producers because of their sheer size and purchasing strength. A wide range of products (fresh, frozen, and canned), cheap prices owing to bulk purchasing, ease of use, one-stop shopping, and well-established marketing and promotional tactics are all advantages. During peak harvest seasons, supermarkets might offer attractive discounts on asparagus to stimulate demand.

With an estimated 5-8% market share in asparagus, the online grocery shopping category is growing at an exponential rate in Europe. With this channel, customers can order fresh asparagus and have it delivered right to their door, providing unparalleled convenience. Online shoppers are further empowered by the capacity to acquire comprehensive product information and compare costs across multiple stores. Benefits include convenience, time savings, a larger selection than local retailers (perhaps including niche types), access to in-depth product information and reviews, and eliminating transportation headaches with home delivery. Online merchants can gain access to fresh and distinctive produce by partnering with local asparagus producers, which could draw in high-end customers.

Europe Asparagus Market Segmentation: Regional Analysis:

- UK

- Germany

- France

- Italy

- Spain

- Rest of Europe

Germany emerges as the most dominant player, accounting for approximately 20% of the overall Europe Asparagus Market. Germany's robust agricultural sector, coupled with its well-established network of asparagus growers and distributors, has solidified the country's position as a leading regional player. Germany is one of the largest producers of asparagus in Europe, with its temperate climate and fertile soils providing ideal conditions for asparagus cultivation. The country's asparagus market is characterized by strong domestic production, with a well-established network of asparagus growers and distributors catering to the growing consumer demand.

The fastest-growing region in the Europe Asparagus Market is Spain, which has witnessed a surge in demand for asparagus driven by the country's thriving agricultural industry and the growing health consciousness among consumers. Spain's asparagus market is expected to continue its rapid expansion, driven by the increasing popularity of organic and sustainably grown asparagus, as well as the growing demand for innovative and value-added asparagus products. Spain is a major producer and exporter of asparagus in Europe, with its diverse climatic conditions and fertile farmlands providing favorable conditions for asparagus cultivation. The Spanish asparagus market is characterized by strong domestic production, with a network of asparagus growers and distributors catering to the local and regional demand.

COVID-19 Impact Analysis on the Europe Asparagus Market:

The implementation of nationwide lockdowns across Europe during the initial stages of the pandemic significantly impacted the asparagus market. Restrictions on movement hampered the flow of migrant labor, a crucial element in asparagus harvesting, which is a labor-intensive process. This labor shortage translated into potential yield losses and higher production costs for European growers. With physical stores experiencing limited capacity or temporary closures, online grocery shopping witnessed a meteoric rise during the pandemic. While convenient, this channel presented challenges for asparagus sales. The delicate nature of the vegetable necessitates a robust cold chain for transportation, which can add extra costs and raise concerns about maintaining freshness during delivery. Many asparagus growers, facing disruptions in traditional distribution channels, pivoted towards direct-to-consumer sales models. This involved setting up online stores, offering farm stand pickups, or collaborating with local delivery services. By connecting directly with consumers, growers potentially captured a larger share of the profits and catered to a growing desire for locally sourced produce. The pandemic heightened consumer awareness of food safety and sustainability practices. Asparagus growers who emphasized sustainable farming methods, fair labor practices, and transparent communication about their supply chains were more likely to resonate with environmentally conscious consumers.

Latest Trends/ Developments:

Vertical farms offer a controlled environment with optimized lighting and temperature conditions. This allows for asparagus cultivation throughout the year, potentially mitigating price fluctuations and ensuring a consistent supply for consumers. Vertical farms utilize significantly less water compared to traditional open-field cultivation. Additionally, the controlled environment minimizes the need for pesticides and herbicides, promoting a more sustainable approach to asparagus production. Fungal diseases can significantly impact asparagus yields. Research into disease-resistant varieties holds immense potential to reduce reliance on chemical treatments and ensure a healthier crop. Developing asparagus varieties with shorter maturation times can lead to quicker harvests and potentially more profitable growing cycles for European producers. While green and white asparagus are the dominant varieties, there's growing interest in asparagus with unique colors like purple or violet. These colored varieties might offer additional health benefits or cater to specific culinary applications, attracting a wider consumer base. Pre-packaged asparagus salads and snack packs combine asparagus with other complementary ingredients like cherry tomatoes, feta cheese, or a light vinaigrette, offering a healthy and portable snack option.

Key Players:

- Emsland asparagus

- Pfalz asparagus

- Grupo ANECO

- Grupo Batín

- Les Asperges de Provence

- Pertuis asparagus

- Selezione asparagus

- Canino asparagus

- Elmasonic

Chapter 1. Europe Asparagus Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Source

1.5. Secondary Source

Chapter 2. Europe Asparagus Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Asparagus Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Asparagus Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Asparagus Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Asparagus Market– By Type

6.1. Introduction/Key Findings

6.2. Fresh Asparagus

6.3. Processed Asparagus

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Asparagus Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2 Supermarkets and Hypermarkets

7.3. Specialty Stores

7.4. Online Retailers

7.5. Direct-to-Consumer

7.6. Y-O-Y Growth trend Analysis By Distribution Channel

7.7. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Europe Asparagus Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Europe

8.1.1. By Country

8.1.1.1. U.K

8.1.1.2. Germany

8.1.1.3. France

8.1.1.4. Italy

8.1.1.5. Spain

8.1.1.6. Rest of Europe

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Europe Asparagus Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Emsland asparagus

9.2. Pfalz asparagus

9.3. Grupo ANECO

9.4. Grupo Batín

9.5. Les Asperges de Provence

9.6. Pertuis asparagus

9.7. Selezione asparagus

9.8. Canino asparagus

9.9. Elmasonic

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

Asparagus is a rich source of vitamins, minerals, and dietary fiber. Consumers increasingly seek healthy and nutritious foods, and asparagus's impressive nutrient profile makes it an attractive addition to their diets.

Asparagus is a cool-weather crop with a restricted harvesting period, typically spring to early summer. This seasonality leads to significant fluctuations in supply throughout the year. During peak harvest, the market can become saturated, driving down prices for producers. Conversely, outside the harvest window, asparagus becomes a scarce and expensive commodity.

Emsland asparagus, Pfalz asparagus, Grupo ANECO, Grupo Batín, Les Asperges de Provence, and Pertuis asparagus are some of the key players.

Germany currently holds the largest market share, estimated at around 20%.

The fastest-growing region in the Europe Asparagus Market is Spain, which has witnessed a surge in demand for asparagus driven by the country's thriving agricultural industry and the growing health consciousness among consumers