Non-GMO Soybean Market Size (2025 – 2030)

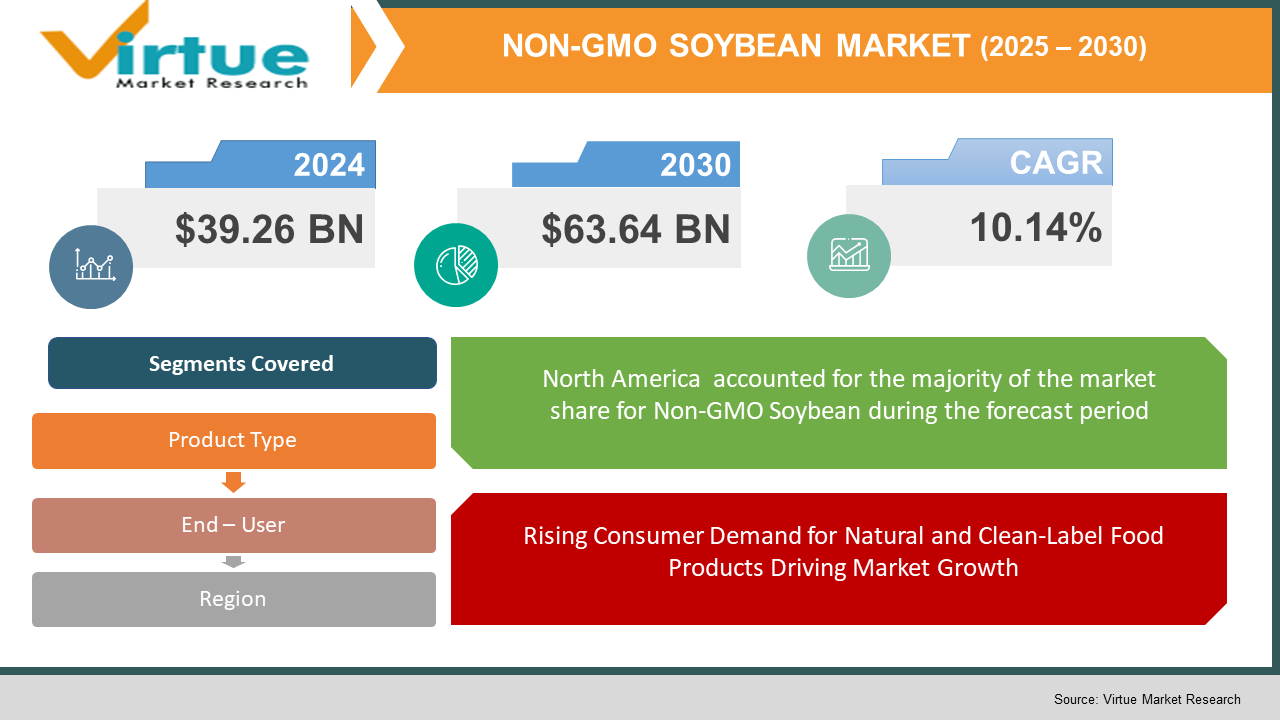

The Global Non-GMO Soybean Market was valued at USD 39.26 billion in 2024 and is projected to reach a market size of USD 63.64 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10.14%.

The Non-GMO Soybean Market is experiencing significant growth because of rising consumer awareness regarding health benefits and sustainability concerns associated with genetically modified organisms (GMOs). Non-GMO soybeans are cultivated without genetic engineering, making them a preferred choice for consumers seeking natural and organic food products. Additionally, increasing demand for clean-label and non-GMO verified products in food processing, animal feed, and soy-based derivatives is further propelling market expansion. Growing concerns about the environmental impact of GMO cultivation, along with stringent government regulations on genetically modified crops in regions like Europe and Asia-Pacific, are driving demand for non-GMO soybeans. The market is also benefiting from the rising adoption of non-GMO soybean derivatives such as soy protein, soy oil, and soy lecithin in industries like food & beverage, pharmaceuticals, and personal care.

Key Market Insights:

- The animal feed industry is a key contributor to the expansion of the non-GMO soybean market. With an increasing focus on natural and organic feed for livestock, poultry, and aquaculture, farmers are shifting towards non-GMO soybeans to meet consumer demand for ethically sourced meat and dairy products. This trend is particularly strong in regions with strict GMO regulations, such as the European Union.

- Moreover, increasing concerns about the environmental impact of genetically modified crops have led to a shift in agricultural practices. Farmers and food producers are opting for non-GMO soybeans due to their perceived sustainability and lower ecological footprint. This is further supported by regulatory bodies and certification programs that promote non-GMO farming, strengthening market growth globally.

Non-GMO Soybean Market Drivers:

Rising Consumer Demand for Natural and Clean-Label Food Products Driving Market Growth

With increasing health consciousness among consumers, there is a strong preference for food products that are free from genetic modification. The need for non-GMO soybeans is significantly fueled by the growing trend of clean-label food, organic diets, and plant-based nutrition. Consumers are actively seeking transparency in food sourcing, which has encouraged food manufacturers to use non-GMO soybeans in various products, including tofu, soy milk, and plant-based meat alternatives. This shift in consumer preferences is a major factor driving the market forward.

Stringent Regulations and Labeling Requirements Supporting Non-GMO Crop Adoption

Governments across the globe have implemented strict regulations regarding GMO crops, further boosting the need for non-GMO soybeans. Many regions, including Europe and Asia-Pacific, have introduced stringent labeling requirements that mandate the disclosure of genetically modified ingredients. This has pushed food manufacturers and farmers to shift towards non-GMO soybean cultivation to meet regulatory standards and consumer expectations. The Non-GMO Project Verification and other certification programs have also contributed to building consumer trust and expanding the market.

Expanding Application of Non-GMO Soybeans in the Food and Beverage Industry

The versatility of non-GMO soybeans has led to their growing use across multiple industries, particularly in the food and beverage sector. From soy-based dairy alternatives to protein-rich snacks, the demand for non-GMO soy ingredients has surged. Additionally, soy-based animal feed, which avoids genetically modified ingredients, is gaining popularity among livestock farmers who want to maintain organic and sustainable farming practices. This rising adoption across various segments is accelerating market growth.

Increasing Export Demand for Non-GMO Soybeans from Europe and Asia

The export market for non-GMO soybeans is expanding, with Europe and Asia-Pacific being the major importers. These regions have a strong preference for non-GMO and organic soy products, driving international trade and supply chain growth. The United States and Brazil are among the largest exporters of non-GMO soybeans, catering to the rising global demand. The increasing emphasis on sustainable agriculture and non-GMO certification has further strengthened market opportunities in the export segment.

Non-GMO Soybean Market Restraints and Challenges:

High Production Costs and Supply Chain Limitations Hindering Market Growth

The cultivation of non-GMO soybeans requires stringent farming practices, including segregation from GMO crops, specialized storage, and strict certification processes, which significantly rise production costs. Additionally, lower crop yields compared to genetically modified soybeans make it less profitable for farmers, discouraging large-scale cultivation. Supply chain complexities, including cross-contamination risks, traceability issues, and limited availability of non-GMO seeds, further pose challenges for market expansion. These factors create hurdles for farmers, processors, and exporters, restricting the wider adoption of non-GMO soybeans in the global market.

Non-GMO Soybean Market Opportunities:

The increasing consumer preference for clean-label, organic, and sustainably sourced food products presents a significant growth opportunity for the non-GMO soybean market. As awareness about health benefits, environmental sustainability, and transparency in food production rises, food manufacturers and retailers are expanding their offerings of non-GMO soy-based products, including plant-based proteins, dairy alternatives, and soy-based snacks. Additionally, the growing adoption of non-GMO soybean meal in livestock feed because of concerns over genetically modified ingredients further boosts market demand, encouraging farmers to shift toward non-GMO cultivation.

NON-GMO SOYBEAN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

10.14% |

|

Segments Covered |

By Product Type, end user, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Cargill, Incorporated, Archer Daniels Midland Company (ADM), Bunge Limited, Scoular Company |

Non-GMO Soybean Market Segmentation:

Non-GMO Soybean Market Segmentation: By Product Type:

- Non-GMO Whole Soyabeans

- Non-GMO Soybean Meal

- Non-GMO Soybean Oil

Non-GMO whole soybeans have emerged as the dominant segment in the market, largely because of their versatility, nutritional benefits, and increasing consumer preference for clean-label and organic products. These soybeans are widely utilized in various food products, including tofu, soy milk, tempeh, and soy flour, making them a staple in the plant-based food industry. The growing trend of veganism, vegetarian diets, and plant-based protein alternatives has significantly propelled their demand. Additionally, the livestock and poultry industry rely heavily on non-GMO whole soybeans for animal feed, ensuring a high-protein diet without genetic modifications.

On the other hand, non-GMO soybean meal is witnessing the fastest growth in the industry, fueled by its increasing usage in animal feed and sustainable livestock farming. As consumers become more conscious about the quality of meat, dairy, and poultry products, there is a strong push toward clean and traceable animal feed ingredient. Non-GMO soybean meal, rich in protein and essential nutrients, is gaining traction among livestock farmers, feed manufacturers, and organic dairy producers looking for sustainable feed alternatives. Additionally, the demand for organic and non-GMO meat and dairy products is rising in both developed and developing economies, further fueling the expansion of this segment. With regulatory bodies imposing stringent labeling laws and retailers prioritizing non-GMO products, the non-GMO soybean meal segment is positioned for exponential growth, making it one of the most promising areas in the non-GMO soybean market.

Non-GMO Soybean Market Segmentation: By End User:

- Food & Beverages

- Animal Feed

- Industrial

The food & beverages segment dominates the non-GMO soybean market, driven by increasing consumer awareness and preference for clean-label, organic, and plant-based products. Non-GMO soybeans are widely used in soy-based dairy alternatives, protein supplements, tofu, soy milk, and various processed food items, catering to the growing vegan and vegetarian population. Many health-conscious consumers are shifting toward non-GMO and organic food choices, fueling demand across supermarkets, specialty stores, and online platforms. Furthermore, stringent regulatory standards and labeling requirements in many regions promote the adoption of non-GMO food ingredients, ensuring the continued dominance of this segment.

Meanwhile, the animal feed segment is the fastest-growing, primarily due to growing concerns about genetically modified feed and its impact on livestock health and productivity. Non-GMO soybean meal serves as a high-protein, sustainable alternative in poultry, dairy, and aquaculture feed, meeting the demand for clean-label and traceable animal nutrition. As organic and non-GMO meat, dairy, and egg production expands, farmers and feed manufacturers are rapidly transitioning toward non-GMO feed options. Additionally, regulatory pressures and consumer demand for ethically sourced livestock products further accelerate the growth of this segment, positioning it as a key driver of market expansion.

Non-GMO Soybean Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

North America continues to be the dominant region in the Non-GMO Soybean Market, primarily because of the strong presence of large-scale soybean farms in the United States and Canada. The U.S. remains one of the largest producers and exporters of non-GMO soybeans, with increasing demand from both domestic and international markets. Strict labeling regulations, rising consumer preference for organic and natural food products, and the growing plant-based food industry are driving market growth.

Asia-Pacific is emerging as the fastest-growing region in the Non-GMO Soybean Market, driven by a rapidly expanding health-conscious consumer base and a growing demand for organic and non-GMO food ingredients. Countries like China, India, and Japan are witnessing an increased reliance on non-GMO soybean imports due to their extensive use in traditional soy-based food products such as tofu, soy milk, and miso, as well as in the expanding plant-based protein sector. Moreover, government initiatives promoting organic farming, coupled with rising disposable incomes and a shift toward sustainable agriculture, are accelerating market growth in the region.

COVID-19 Impact Analysis on the Global Non-GMO Soybean Market:

The COVID-19 pandemic had a mixed impact on the Global Non-GMO Soybean Market, disrupting supply chains while also influencing increased demand for healthier, natural food products. Lockdowns and trade restrictions led to logistical challenges, affecting the transportation and export of non-GMO soybeans. However, as consumers became more health-conscious and preferred organic, chemical-free foods, the demand for non-GMO soybean products, including soy-based protein alternatives, witnessed a surge. Additionally, the livestock industry faced feed shortages, impacting the availability of non-GMO soybean meal. As economies recovered, the market rebounded with stronger supply chain resilience and increased investments in sustainable, non-GMO agricultural practices.

Latest Trends/ Developments:

The Non-GMO Soybean Market is witnessing a rise in demand for plant-based and organic food products, driven by shifting consumer preferences toward clean-label and sustainable ingredients. With the growing popularity of vegan and vegetarian diets, food manufacturers are incorporating non-GMO soybeans into plant-based meat substitutes, dairy alternatives, and protein-enriched snacks. Additionally, the rise of functional foods and beverages fortified with non-GMO soy protein is gaining traction, as consumers seek healthier, high-protein options. Major food brands are also expanding their non-GMO product lines, further strengthening the market presence of non-GMO soybeans in the global food industry.

Another major development in the market is the increasing adoption of non-GMO soybean meal in the livestock and poultry industries, as farmers respond to consumer demand for organic and ethically sourced animal products. The push for sustainable agriculture and non-GMO certification programs has encouraged producers to invest in non-GMO farming practices, boosting market expansion. Additionally, advancements in precision agriculture and traceability technologies are enabling better supply chain management, ensuring quality control, reduced cross-contamination, and enhanced transparency in non-GMO soybean production. With global regulatory bodies tightening restrictions on GMO crops, the demand for non-GMO soybeans is expected to grow further, creating new opportunities in food, feed, and industrial applications.

Key Players:

- Cargill, Incorporated

- Archer Daniels Midland Company (ADM)

- Bunge Limited

- Scoular Company

- Grain Millers, Inc.

- Hain Celestial Group

- SunOpta Inc.

- Perdue Agribusiness

- AGT Foods

- Benson Hill

Chapter 1. NON-GMO SOYBEAN MARKET – SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. NON-GMO SOYBEAN MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. NON-GMO SOYBEAN MARKET – COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. NON-GMO SOYBEAN MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes Players

4.5.6. Threat of Substitutes

Chapter 5. NON-GMO SOYBEAN MARKET - LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. NON-GMO SOYBEAN MARKET – By Product Type

6.1 Introduction/Key Findings

6.2 Non-GMO Whole Soyabeans

6.3 Non-GMO Soybean Meal

6.4 Non-GMO Soybean Oil

6.5 Y-O-Y Growth trend Analysis By Product Type

6.6 Absolute $ Opportunity Analysis By Type, 2025-2030

Chapter 7. NON-GMO SOYBEAN MARKET – By End – User

7.1 Introduction/Key Findings

7.2 Food & Beverages

7.3 Animal Feed

7.4 Industrial Y-O-Y Growth trend Analysis By End – User

7.5 Absolute $ Opportunity Analysis By End – User , 2025-2030

Chapter 8. NON-GMO SOYBEAN MARKET - By Geography – Market Size, Forecast, Trends & Insights

8.1. North America

8.1.1. By Country

8.1.1.1. U.S.A.

8.1.1.2. Canada

8.1.1.3. Mexico

8.1.2. By End – User

8.1.3. By Product Type

8.1.4. Countries & Segments - Market Attractiveness Analysis

8.2. Europe

8.2.1. By Country

8.2.1.1. U.K.

8.2.1.2. Germany

8.2.1.3. France

8.2.1.4. Italy

8.2.1.5. Spain

8.2.1.6. Rest of Europe

8.2.2. By Product Type

8.2.3. By End – User

8.2.4. Countries & Segments - Market Attractiveness Analysis

8.3. Asia Pacific

8.3.1. By Country

8.3.1.1. China

8.3.1.2. Japan

8.3.1.3. South Korea

8.3.1.4. India

8.3.1.5. Australia & New Zealand

8.3.1.6. Rest of Asia-Pacific

8.3.2. By Product Type

8.3.3. By End – User

8.3.4. Countries & Segments - Market Attractiveness Analysis

8.4. South America

8.4.1. By Country

8.4.1.1. Brazil

8.4.1.2. Argentina

8.4.1.3. Colombia

8.4.1.4. Chile

8.4.1.5. Rest of South America

8.4.2. By Product Type

8.4.3. By End – User

8.4.4. Countries & Segments - Market Attractiveness Analysis

8.5. Middle East & Africa

8.5.1. By Country

8.5.1.1. United Arab Emirates (UAE)

8.5.1.2. Saudi Arabia

8.5.1.3. Qatar

8.5.1.4. Israel

8.5.1.5. South Africa

8.5.1.6. Nigeria

8.5.1.7. Kenya

8.5.1.8. Egypt

8.5.1.8. Rest of MEA

8.5.2. By Product Type

8.5.3. By End – User

8.5.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. NON-GMO SOYBEAN MARKET – Company Profiles – (Overview, Packaging Product Type Product Type Portfolio, Financials, Strategies & Developments)

9.1 Cargill, Incorporated

9.2 Archer Daniels Midland Company (ADM)

9.3 Bunge Limited

9.4 Scoular Company

9.5 Grain Millers, Inc.

9.6 Hain Celestial Group

9.7 SunOpta Inc.

9.8 Perdue Agribusiness

9.9 AGT Foods

9.10 Benson Hill

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Non-GMO Soybean Market was valued at USD 39.26 billion in 2024 and is projected to reach a market size of USD 63.64 billion by the end of 2030. Over the forecast period of 2025-2030, the market is projected to grow at a CAGR of 10.14%.

Increasing consumer demand for organic, non-GMO foods and sustainable agriculture practices.

Based on End User, the Global Non-GMO Soybean Market is segmented into Food & Beverage, Animal Feed, Industrial.

North America is the most dominant region for the Global Non-GMO Soybean Market.

Cargill, Incorporated, Archer Daniels Midland Company (ADM), Bunge Limited, Scoular Company are the leading players in the Global Non-GMO Soybean Market.