Natural Rubber And Gums Market Size (2024 – 2030)

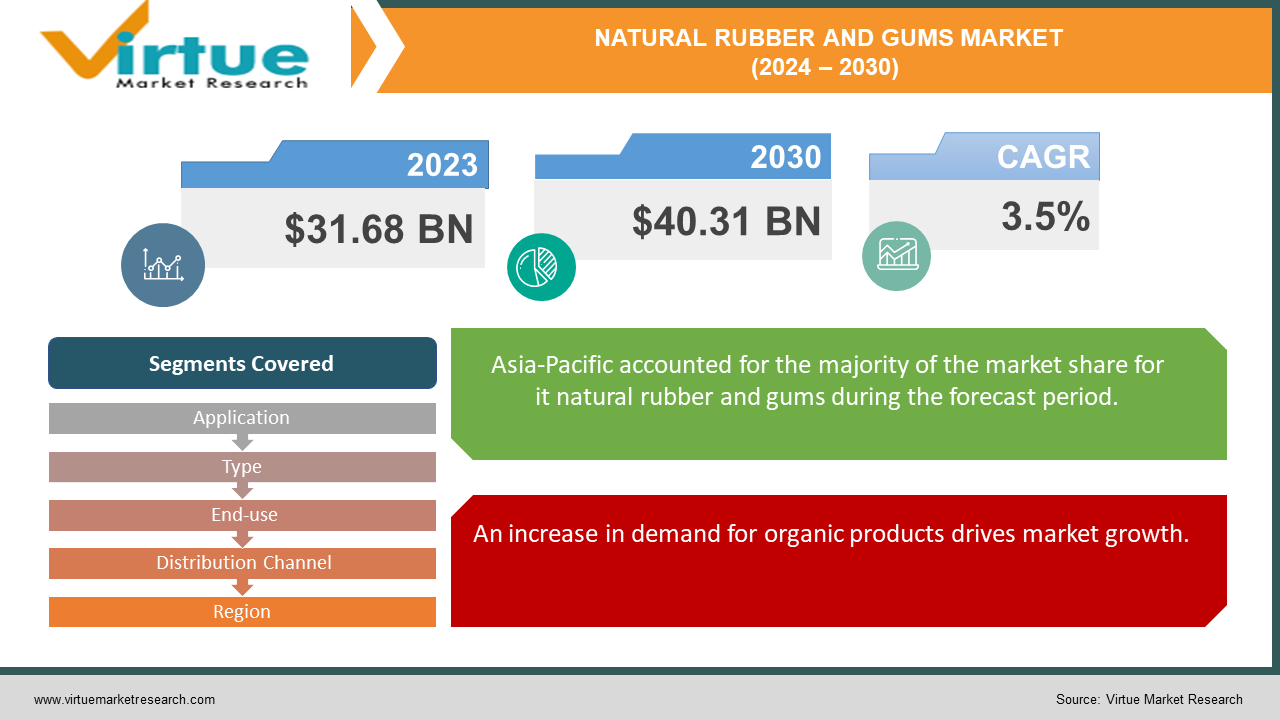

The Natural Rubber And Gums Market was valued at USD 31.68 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 40.31 billion by 2030, growing at a CAGR of 3.5%.

Natural rubber is an organic elastic hydrocarbon polymer sourced from the latex sap of trees belonging to the Hevea and Ficus genera. Known as an elastomer, this type of rubber is produced from the latex of rubber trees containing isoprene. The latex is usually extracted from tree trunks and processed into various forms, including vulcanized rubber, gum elastic, and caoutchouc. Natural rubber is utilized in the production of automobile tires, toys, rug pads, surgical gloves, flotation devices, tubes, adhesives, roll coverings, hoses, and gaskets. It possesses several beneficial properties, such as high resiliency, vibration dampening, tensile strength, resistance to tearing and water, and the ability to stretch at low temperatures. The global natural rubber market is expected to grow during the forecast period due to the rise in automotive production. Its high elasticity, flexibility, and abrasion resistance make natural rubber an ideal raw material for manufacturing automotive tires, floor mats, window sealants, and shock absorbers.

Key Market Insights:

The rise in automotive production driven by technological advancements and strong consumer demand for passenger vehicles has positively influenced the use of natural rubber in the automotive sector. The increased global production volume of passenger vehicles is expected to boost the utilization of natural rubber polymer in the manufacturing of tires and other automotive accessories. This trend will contribute to the growth of the natural rubber market.

Natural Rubber And Gums Market Drivers:

An increase in demand for organic products drives market growth.

Traditional rubber and gum production methods, especially those involving large-scale rubber plantations, have historically sparked concerns about deforestation, soil degradation, and excessive water use. Consequently, there is a growing focus on sustainable practices throughout the supply chain. Certifications such as the Forest Stewardship Council (FSC) are becoming more recognized for promoting responsible forestry practices in rubber production. Moreover, advancements in precision agriculture techniques, which optimize resource use and reduce chemical inputs, are being explored. The demand for eco-friendly products opens new opportunities for the natural rubber industry. For instance, green tires, which contain a higher proportion of natural rubber compared to synthetic alternatives, provide a more sustainable option for the automotive industry. Natural rubber's inherent elasticity and lower rolling resistance contribute to better fuel efficiency, aligning with environmental objectives. Additionally, bio-based materials incorporating natural gums have significant potential. Xanthan gum, for example, can be used in biodegradable packaging films, offering a more eco-friendly alternative to conventional plastics.

Advanced technologies are playing an increasingly crucial role in enhancing new market opportunities.

In addition to being ineffective, conventional slash-and-burn techniques used for clearing land for rubber plantations are detrimental to the ecosystem. The adoption of data analytics, drone technology, and satellite imaging in precision agriculture is transforming the management of rubber plants. These advancements optimize resource use and minimize environmental impact by enabling precise application of fertilizers and pesticides. Sensor technologies track soil moisture and nutrient levels, allowing for optimized growth conditions for rubber trees. Traditionally, the processes of coagulation and drying to extract latex from rubber trees have been labor-intensive. However, emerging technologies such as centrifugation and enzyme use are streamlining this procedure. These innovations have the potential to enhance latex processing yield and efficiency, resulting in higher-quality rubber with improved consistency and performance characteristics.

Natural Rubber And Gums Market Restraints and Challenges:

The negative impact of natural rubber on health and the environment is constraining the growth of the global natural rubber market during the forecast period. Natural rubber poses a health risk to individuals allergic to latex, as natural latex can trigger anaphylactic shock, a severe allergic reaction that can be fatal. Besides health concerns, the processing of natural rubber requires substantial amounts of water, energy, and chemicals. When discharged as waste and effluents, these substances cause environmental problems, such as chemical-laden wastewater and thermal emissions. The adverse effects of natural rubber on health and the environment may limit its production volume, potentially hindering the growth of the global natural rubber industry.

Natural Rubber And Gums Market Opportunities:

Advancements in technology and the miniaturization of electrical devices are driving a global increase in demand for chemicals used in cleaning semiconductor components. The industrial sector's focus on energy-efficient equipment is expected to boost the need for natural rubber during the projected period. Chemicals for cleaning semiconductor components are gaining popularity due to their ease of use and programmability, offering accurate timekeeping compared to traditional electromechanical timers. Additionally, the growing public awareness of the benefits of these advanced cleaning chemicals is anticipated to further drive the growth of the natural rubber market.

NATURAL RUBBER AND GUMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.5% |

|

Segments Covered |

By Application, Type, End-use, Distribution Channel, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Southland Rubber Co., Sri Trang Agro-Industry Public Company Ltd, Yunnan State Farms Group Co., Von Bundit Co., Firestone Natural Rubber Company, Num Rubber & Latex Co., Ltd, Hua Rubber Public Company Ltd, Sinochem Group Co. Ltd., Halcyon Agri, Ltd, Apcotex Industries Ltd. |

Natural Rubber And Gums Market Segmentation: By Application

-

Automotive Components

-

Surgical Gloves

-

Conveyor Belts

-

Footwear

-

Latex Products

-

Rubber Pipes

-

General Products

-

Others

The footwear segment is expected to experience the highest CAGR growth over the forecast period. This segment produces a wide range of footwear, including formal and casual shoes as well as technical products like safety and protective footwear, made from various materials. The physical properties essential for manufacturing shoe soles include durability, slip resistance, oil resistance, abrasion resistance, tensile resistance, moldability into various shapes, and tear strength resistance. Increased footwear production to cater to diverse customer preferences may drive the growth of the natural rubber market during the forecast period.

Natural Rubber And Gums Market Segmentation: By Type

-

Natural Rubber

-

Natural Gums

Natural rubber is primarily utilized in the automotive sector, especially in the production of tires. It is a valuable material for fuel-efficient tires due to its superior elasticity and lower rolling resistance compared to synthetic alternatives. Additionally, natural rubber is used in various industrial products, including hoses, shoes, and conveyor belts. While natural rubber remains the market leader, the market for natural gums is expanding at the highest rate, with annual growth expected to reach between 5 and 7 percent.

Natural Rubber And Gums Market Segmentation: By End-use

-

Automotive

-

Construction

-

Aerospace

-

Electronic & Electrical

-

Medical

-

Oil & Gas

-

Footwear

-

Printing

-

Others

The automotive segment is expected to experience rapid growth during the forecast period. Natural rubber, which contains an isoprene compound, boasts high elasticity and can be molded into various shapes and sizes. This makes it ideal for manufacturing tires for a wide range of vehicles, including passenger and light commercial vehicles, due to its excellent elasticity and flexibility. Beyond tires, natural rubber is also used to produce window sealants, automotive mats, engine mounts, and wiper blades. Advancements in automotive technology and the high demand for new vehicles have boosted productivity in the automotive sector, further driving the demand for natural rubber.

Natural Rubber And Gums Market Segmentation: By Distribution Channel

-

Direct Sales

-

Trading Companies and Brokers

-

Online Marketplaces

Direct Sales (Estimated Market Share: 40-45%) remains the dominant distribution channel, especially for large-scale producers of natural rubber and gums. These producers sell their products directly to major manufacturers or distributors, bypassing intermediaries and potentially capturing higher profit margins. This channel is particularly suited for established players with strong industry relationships. Large-scale producers often maintain well-established connections with major tire manufacturers (for natural rubber) or food and pharmaceutical companies (for natural gums). These direct relationships facilitate streamlined communication, bulk order fulfillment, and customized product offerings.

Online platforms provide smallholder farmers and newcomers access to a global audience of potential consumers, avoiding geographic restrictions. By eliminating intermediaries, online marketplaces can promote pricing transparency and potentially lead to more equitable agreements for producers. These platforms also have the potential to reduce transaction costs for both producers and buyers by removing certain middlemen.

Natural Rubber And Gums Market Segmentation- by Region

-

North America

-

Latin America

-

Europe

-

Asia-Pacific

-

Middle East & Africa

The Asia-Pacific region dominates the natural rubber market and is expected to maintain its dominance throughout the forecast period, with Thailand, Indonesia, and Malaysia emerging as major contributors. These countries are the leading global suppliers of natural rubber. The increased use of natural rubber-based products, such as medical gloves in the healthcare industry, will further drive growth in the natural rubber market. Additionally, the rising demand for natural rubber in the automotive industry will contribute to the market's growth.

COVID-19 Pandemic: Impact Analysis

The global lockdowns implemented to mitigate the effects of COVID-19 led to reduced manufacturing and consumption among the major end-users of natural rubber. Natural rubber, known for its rich chemical properties and high elasticity, is widely used in various industries, including automotive, construction, and footwear. In the automotive industry, it is used to produce tires and rubber mats; in the construction industry, it is utilized in the production of cement and adhesives; and in the footwear industry, it is employed in the manufacturing of shoe soles.

Latest Trends/ Developments:

In April 2022, The Goodyear Tire & Rubber Company announced a multi-year, multi-million-dollar program with Ohio-based Farmed Materials to develop a domestic source of natural rubber from a specific species of dandelion, funded by the United States Department of Defense (DoD), the Air Force Research Lab (AFRL), and BioMADE.

In November 2022, the four largest tire manufacturers in India—Apollo Tyres, CEAT, JK Tyre, and MRF—pledged significant investments to expand rubber plantations in Northeast and West Bengal. This initiative, overseen by the Rubber Board and the Automotive Tyre Manufacturers Association (ATMA), aims to develop over 200,000 hectares of land across states such as Assam, West Bengal, Arunachal Pradesh, Manipur, Meghalaya, Mizoram, Nagaland, Tripura, and West Bengal as part of a five-year project.

Key Players:

These are the top 10 players in the Natural Rubber And Gums Market: -

-

Southland Rubber Co.

-

Sri Trang Agro-Industry Public Company Ltd

-

Yunnan State Farms Group Co.

-

Von Bundit Co.

-

Firestone Natural Rubber Company

-

Num Rubber & Latex Co., Ltd

-

Hua Rubber Public Company Ltd

-

Sinochem Group Co. Ltd.

-

Halcyon Agri, Ltd

-

Apcotex Industries Ltd.

Chapter 1. Natural Rubber And Gums Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Natural Rubber And Gums Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Natural Rubber And Gums Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Natural Rubber And Gums Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Natural Rubber And Gums Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Natural Rubber And Gums Market – By Application

6.1 Introduction/Key Findings

6.2 Automotive Components

6.3 Surgical Gloves

6.4 Conveyor Belts

6.5 Footwear

6.6 Latex Products

6.7 Rubber Pipes

6.8 General Products

6.9 Others

6.10 Y-O-Y Growth trend Analysis By Application

6.11 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 7. Natural Rubber And Gums Market – By Type

7.1 Introduction/Key Findings

7.2 Natural Rubber

7.3 Natural Gums

7.4 Y-O-Y Growth trend Analysis By Type

7.5 Absolute $ Opportunity Analysis By Type, 2024-2030

Chapter 8. Natural Rubber And Gums Market – By End-Use Industry

8.1 Introduction/Key Findings

8.2 Automotive

8.3 Construction

8.4 Aerospace

8.5 Electronic & Electrical

8.6 Medical

8.7 Oil & Gas

8.8 Footwear

8.9 Printing

8.10 Others

8.11 Y-O-Y Growth trend Analysis End-Use Industry

8.12 Absolute $ Opportunity Analysis End-Use Industry, 2024-2030

Chapter 9. Natural Rubber And Gums Market – By Distribution Channel

9.1 Introduction/Key Findings

9.2 Direct Sales

9.3 Trading Companies and Brokers

9.4 Online Marketplaces

9.5 Y-O-Y Growth trend Analysis End-User

9.6 Absolute $ Opportunity Analysis End-User, 2024-2030

Chapter 10. Natural Rubber And Gums Market, By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Application

10.1.2.1 By Type

10.1.3 By End-Use Industry

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Application

10.2.3 By Type

10.2.4 By End-Use Industry

10.2.5 By Distribution Channel

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Application

10.3.3 By Type

10.3.4 By End-Use Industry

10.3.5 By Distribution Channel

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Application

10.4.3 By Type

10.4.4 By End-Use Industry

10.4.5 By Distribution Channel

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Application

10.5.3 By Type

10.5.4 By End-Use Industry

10.5.5 By Distribution Channel

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Natural Rubber And Gums Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 Southland Rubber Co.

11.2 Sri Trang Agro-Industry Public Company Ltd

11.3 Yunnan State Farms Group Co.

11.4 Von Bundit Co.

11.5 Firestone Natural Rubber Company

11.6 Num Rubber & Latex Co., Ltd

11.7 Hua Rubber Public Company Ltd

11.8 Sinochem Group Co. Ltd.

11.9 Halcyon Agri, Ltd

11.10 Apcotex Industries Ltd.

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

Traditional rubber and gum production methods, especially those involving large-scale rubber plantations, have historically sparked concerns about deforestation, soil degradation, and excessive water use.

The top players operating in the Natural Rubber And Gums Market are - Southland Rubber Co., Sri Trang Agro-Industry Public Company Ltd, Yunnan State Farms Group Co., Von Bundit Co., Firestone Natural Rubber Company, Num Rubber & Latex Co., Ltd, Hua Rubber Public Company Ltd, Sinochem Group Co. Ltd., Halcyon Agri, Ltd, Apcotex Industries Ltd.

The global lockdowns implemented to mitigate the effects of COVID-19 led to reduced manufacturing and consumption among the major end-users of natural rubber.

Chemicals for cleaning semiconductor components are gaining popularity due to their ease of use and programmability, offering accurate timekeeping compared to traditional electromechanical timers.

Asia-Pacific is the fastest-growing region in the Natural Rubber And Gums Market.