Latin America Natural Rubber and Gums Market Size (2024-2030)

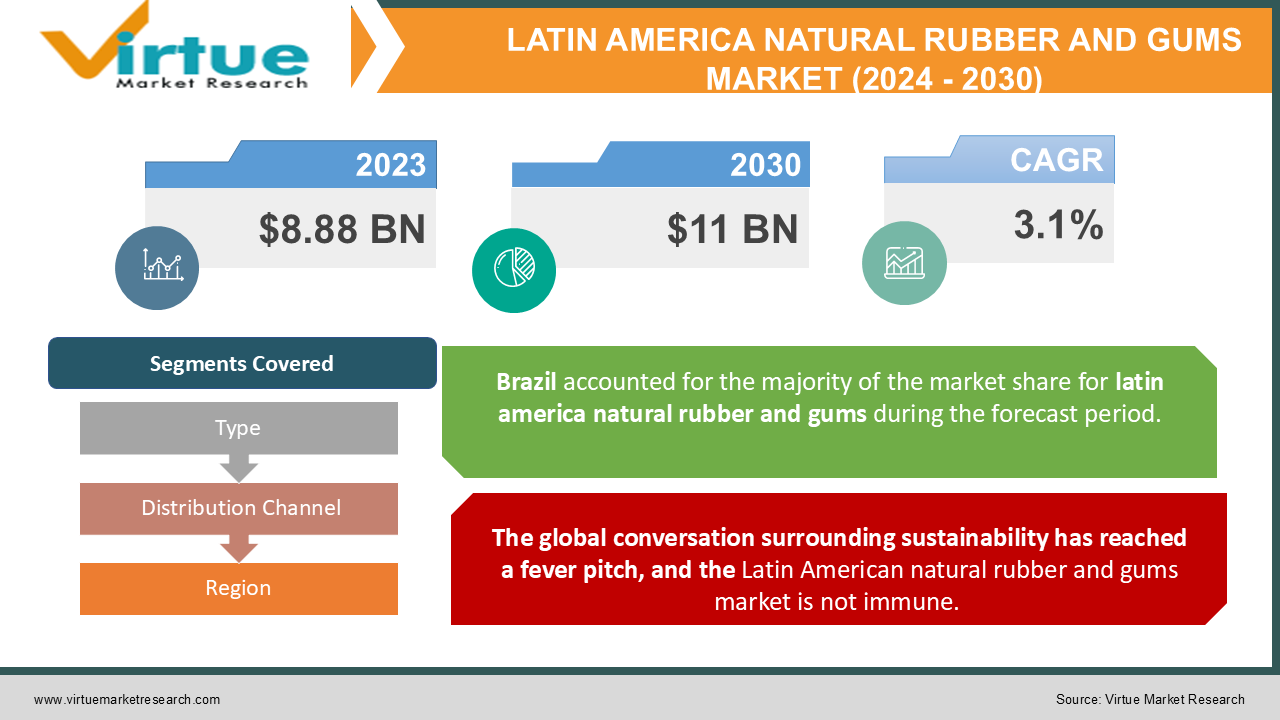

The Latin America Natural Rubber and Gums Market was valued at USD 8.88 Billion in 2023 and is projected to reach a market size of USD 11 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 3.1%.

Natural rubber dominates the Latin American rubber market, with Brazil and Thailand being the major producers. The rubber industry is a significant contributor to these regions' economies, providing employment and export revenue. However, competition from synthetic rubber and fluctuating global prices pose challenges for natural rubber producers. Natural gums encompass a wide variety, including guar gum, carrageenan, and xanthan gum. These gums find uses in thickening, stabilizing, and gelling applications across the food, pharmaceutical, and cosmetics industries. The demand for natural gums is expected to rise due to their functional properties and growing consumer preference for natural ingredients. The environmental impact of rubber and gum production is receiving greater scrutiny. Sustainable practices like reduced deforestation, responsible water management, and fair labour conditions are gaining importance for producers and consumers alike.

Key Market Insights:

The global demand for natural rubber and gums is estimated to be around $38.5 billion in 2024, with Latin America accounting for approximately 33.2% of the total market share.

Brazil's export revenue from natural rubber and gums is anticipated to reach $4.2 billion in 2024, reflecting a year-over-year growth of 4.9%.

Colombia's natural rubber and gums export earnings are projected to surpass $650 million by the end of 2024, representing a significant 12.3% increase compared to the previous year.

The automotive industry is expected to be the largest consumer of natural rubber and gums in Latin America, with an estimated demand of $5.1 billion in 2024.

The construction sector's demand for natural rubber and gums in the region is forecasted to reach $2.9 billion by the end of 2024, driven by infrastructure development projects.

Subject to variations depending on global supply and demand dynamics, the average price of natural rubber in the region is projected to be approximately $1.6 per kilogramme in 2024.

Brazil's sophisticated plantation management techniques are expected to generate an average rubber output per hectare of about 1,800 kg in 2024.

By the end of 2024, the average rubber production per hectare in Colombia is expected to reach 1,500 kg due to investments made in advancing growing methods and implementing contemporary agricultural practices.

With an estimated value of $2.1 billion in 2024, the market for natural rubber and gums in Latin America is expected to experience a boom in demand for sustainable and eco-friendly products.

Latin America Natural Rubber and Gums Market Drivers:

The global conversation surrounding sustainability has reached a fever pitch, and the Latin American natural rubber and gums market is not immune.

The traditional methods of rubber and gum production, particularly large-scale rubber plantations, have historically raised concerns about deforestation, soil degradation, and excessive water usage. This has led to a growing emphasis on sustainable practices throughout the supply chain. Certifications like the Forest Stewardship Council (FSC) are gaining recognition, signifying responsible forestry practices in rubber production. Additionally, advancements in precision agriculture techniques that optimize resource utilization and minimize chemical use are being explored. The demand for "green" products presents exciting opportunities for the natural rubber industry. Green tires, containing a higher percentage of natural rubber compared to synthetic alternatives, offer a more sustainable option for the automotive industry. Natural rubber's inherent elasticity and lower rolling resistance translate to improved fuel efficiency, further aligning with environmental goals. Similarly, bio-based materials incorporating natural gums hold tremendous potential. For example, xanthan gum can be used in biodegradable packaging films, offering a more environmentally friendly alternative to traditional plastics.

Technological advancements are playing an increasingly crucial role in enhancing efficiency, product quality, and unlocking new market opportunities.

In addition to being ineffective, the conventional slash-and-burn techniques used to clear land for rubber plantations are harmful to the ecosystem. The use of data analytics, drone technology, and satellite imaging in precision agriculture is revolutionizing the management of rubber plants. These developments optimize resource use and reduce environmental impact by enabling tailored fertilizer and pesticide application. Rubber tree growth conditions can be optimized by using sensor technologies to track soil moisture and nutrient levels. Traditionally, coagulation and drying are labor-intensive processes used to remove latex from rubber trees. Emerging technologies like centrifugation and the use of enzymes are helping to simplify this procedure. These developments have the potential to increase latex processing yield and efficiency, producing rubber of a higher caliber with better consistency and performance traits.

Latin America Natural Rubber and Gums Market Restraints and Challenges:

Smallholder farmers are the backbone of much of Latin America's natural rubber production, especially when it comes to gums like guar gum. These farmers experience severe financial difficulties when prices fall, which may cause them to give up on rubber farming entirely. In the long run, this might cause shortages as it upsets the supply chain. Hedging techniques can be used by large-scale rubber producers to lessen the effects of price changes. Nevertheless, many smallholder farmers may not be able to access or understand these financial tools. Producers can make better judgements and manage price volatility by collaborating with one another and by having better access to market information. The ever-present competition from synthetic rubber adds another layer of complexity. Synthetic rubber offers a cost-effective alternative, particularly in the tire industry. Latin American producers need to focus on delivering high-quality natural rubber, potentially through certifications or unique processing techniques, to justify a premium price and maintain market share. South American Leaf Blight is one of the fungal infections that might spread due to rising temperatures and altered precipitation patterns (SALB). These illnesses have the power to completely destroy rubber plantations, drastically reducing output and even wiping out whole harvests.

Latin America Natural Rubber and Gums Market Opportunities:

There is a growing market for "green" tires—those with a higher proportion of natural rubber than synthetic—instead of synthetic tires. This trend is a fantastic fit with the Latin American market's advantages. By emphasizing premium natural rubber that is produced sustainably, the area can serve tire manufacturers looking for eco-friendly options as well as consumers who care about the environment. Innovative fillers and composites can be made by combining natural rubber with other bio-based materials. These materials provide environmentally sustainable substitutes for conventional petroleum-based solutions in a range of applications, including building and automotive parts. For producers in Latin America, research and development initiatives examining the possibilities of these bio-composites may open up new markets. Consumers are increasingly seeking products with certifications that demonstrate environmentally responsible sourcing and production practices. Embracing sustainability certifications like the Rainforest Alliance or FSC can enhance the reputation of Latin American natural rubber and command premium prices. Natural gums offer unique properties valuable in the pharmaceutical and cosmetics industries. For instance, xanthan gum can be used as a thickening and stabilizing agent in topical creams or gels, while carrageenan finds applications in controlled-release drug delivery systems. Exploring these niche markets can add significant value to the Latin American natural gums industry.

LATIN AMERICA NATURAL RUBBER AND GUMS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|||

|

Market Size Available |

2023 - 2030 |

|||

|

Base Year |

2023 |

|||

|

Forecast Period |

2024 - 2030 |

|||

|

CAGR |

3.1% |

|||

|

Segments Covered |

By Type, Distribution Channel and Region |

|||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|||

|

Regional Scope |

|

|||

|

Key Companies Profiled |

Bridgestone Americas, Hainan Rubber Industry Group Co., Ltd. , Grupo Incau , Ingredion Incorporated, Cargill Incorporated , CP Kelco , River Plate Commodities, OLAM International |

Latin America Natural Rubber and Gums Market Segmentation:

Latin America Natural Rubber and Gums Market Segmentation: By Type

- Natural Rubber

- Natural Gums

In Latin America, natural rubber is the market leader, holding between 70 and 75 percent of the overall share. The region's historical emphasis on rubber plantations and the well-established processing infrastructure are responsible for its supremacy. Natural rubber is mostly used in the automotive sector, especially in the manufacture of tyres. Here, it is a useful material for tyres that use less gasoline because of its increased elasticity and decreased rolling resistance when compared to synthetic equivalents. Natural rubber is also used in many industrial items, such as hoses, shoes, and conveyor belts.

Although natural rubber continues to be the market leader, the natural gums market is expanding at the highest rate, with growth expected to reach between 5 and 7 percent each year. Guar gum is an important ingredient that is mostly made in Brazil and Argentina. It is used in the food industry as a stabiliser, thickener, and gelling agent. The increased popularity of low-fat and gluten-free food products is the main driver of its expanding demand. Carrageenan, which is extracted from red seaweeds, has thickening and gelling qualities that make it useful in the food and medicine industries. Carrageenan is used in dairy and processed meat products in the food business and in controlled-release medicine delivery systems in the pharmaceutical sector.

Latin America Natural Rubber and Gums Market Segmentation: By Distribution Channel

- Direct Sales

- Trading Companies and Brokers

- Online Marketplaces

Direct Sales (Estimated Market Share: 40-45%) remains the dominant distribution channel, particularly for large-scale producers of natural rubber and gums. These producers directly sell their products to major manufacturers or distributors, eliminating intermediaries and potentially capturing a higher profit margin. This channel is well-suited for established players with strong relationships within specific industries. Large-scale producers often have well-established relationships with major tire manufacturers (for natural rubber) or food and pharmaceutical companies (for natural gums). These direct relationships allow for streamlined communication, bulk order fulfilment, and potentially customized product offerings.

In the Latin American market for natural rubber and gums, online marketplaces are the distribution route that is expanding the fastest. By avoiding geographic restrictions, online platforms provide smallholder farmers and newcomers with access to a worldwide audience of potential consumers. By cutting out middlemen, online markets might encourage more pricing transparency and possibly result in more equitable agreements for producers. Online marketplaces have the potential to reduce transaction costs for producers and buyers by doing away with some middlemen.

Latin America Natural Rubber and Gums Market Segmentation: Regional Analysis:

-

Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

Brazil stands as the most dominant country in the Latin American natural rubber and gums market. Known for its vast natural resources and favourable climate conditions, Brazil has established itself as a major producer and exporter of natural rubber and gums. Brazil's tropical climate provides ideal conditions for the cultivation of rubber trees, particularly in the Amazon region, where the majority of the country's rubber plantations are located. The Brazilian government has implemented policies and initiatives to support the rubber industry, including tax incentives, research and development programs, and infrastructure development. Brazil is a major exporter of natural rubber and gums, with a significant portion of its production destined for international markets, particularly in the automotive, construction, and industrial sectors.

Colombia is seeing the fastest pace of growth in Latin America for both natural rubber and gums. Colombia's growing manufacturing and industrial sectors, both domestically and globally, have led to a greater need for gums and natural rubber. Colombia has seen a notable increase in rubber plantations in recent years, particularly in the climate-suitable regions of Caquetá, Meta, and Putumayo. Colombian rubber producers have invested in modern technologies and processing facilities, enhancing efficiency and productivity while ensuring adherence to international quality standards.

COVID-19 Impact Analysis on the Latin America Natural Rubber and Gums Market:

The implementation of lockdowns and border closures across Latin America significantly disrupted the flow of natural rubber and gums. Transportation restrictions hindered the movement of goods from plantations and processing facilities to manufacturers, creating bottlenecks and delays. This not only impacted delivery schedules but also led to potential spoilage of perishable natural latex. Social distancing measures and lockdowns hampered labour availability in both rubber plantations and processing facilities. This resulted in reduced production capacity and potential yield losses, particularly for labour-intensive tasks like latex collection and tapping. Smallholder farmers, who often rely on family labour, were particularly affected. Smallholder farmers, a vital backbone of the natural rubber and gums market in Latin America, faced significant hardships. Limited access to markets due to transportation disruptions and a decline in demand from certain sectors (like the automotive industry) squeezed their already-thin profit margins.

Latest Trends/ Developments:

Eco-conscious consumers are driving demand for sustainable products, and the natural rubber industry is taking note. "Green tires" manufactured using low-environmental-impact natural rubber and bio-based composites reinforced with natural fibres are gaining traction. Major tire manufacturers are increasingly seeking eco-friendly materials, and Latin American natural rubber, with its sustainable credentials, is well-positioned to capitalize on this trend.

Natural rubber's unique properties also make it suitable for various non-tire applications. Research and development efforts are exploring its potential in medical gloves, vibration dampening components, and even self-sealing materials. This diversification can help reduce dependence on the automotive sector and mitigate the impact of price fluctuations. Research is ongoing to develop more efficient and environmentally friendly extraction techniques for natural gums. This can reduce processing costs and minimize the environmental impact, further enhancing the market's appeal to sustainability-conscious consumers and manufacturers.

Key Players:

- Bridgestone Americas

- Hainan Rubber Industry Group Co., Ltd.

- Grupo Incau

- Ingredion Incorporated

- Cargill Incorporated

- CP Kelco

- River Plate Commodities

- OLAM International

Chapter 1. Latin America Natural Rubber and Gums Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Natural Rubber and Gums Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Natural Rubber and Gums Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Natural Rubber and Gums Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Natural Rubber and Gums Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Natural Rubber and Gums Market– By Type

6.1. Introduction/Key Findings

6.2 Natural Rubber

6.3. Natural Gums

6.4. Y-O-Y Growth trend Analysis By Type

6.5. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Latin America Natural Rubber and Gums Market– By Distribution channel

7.1. Introduction/Key Findings

7.2 Direct Sales

7.3. Trading Companies and Brokers

7.4. Online Marketplaces

7.5. Y-O-Y Growth trend Analysis By Distribution channel

7.6. Absolute $ Opportunity Analysis By Distribution channel , 2024-2030

Chapter 8. Latin America Natural Rubber and Gums Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Latin America

8.1.1. By Country

8.1.1.1. Mexico

8.1.1.2. Brazil

8.1.1.3. Argentina

8.1.1.4. Chile

8.1.1.5. Rest of Latin America

8.1.2. By Type

8.1.3. By Distribution channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Latin America Natural Rubber and Gums Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1. Bridgestone Americas

9.2. Hainan Rubber Industry Group Co., Ltd.

9.3. Grupo Incau

9.4. Ingredion Incorporated

9.5. Cargill Incorporated

9.6. CP Kelco

9.7. River Plate Commodities

9.8. OLAM International

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

A growing segment of consumers is prioritizing sustainable and eco-friendly products. Natural rubber, a biodegradable and renewable resource, is well-positioned to capitalize on this trend

Synthetic rubber offers a cost-effective alternative, and continuous innovation in synthetic materials can threaten natural rubber's market share. Manufacturers seeking lower production costs might be swayed towards synthetic options, impacting the demand for natural rubber.

Bridgestone Americas, Hainan Rubber Industry Group Co., Ltd., Grupo Incau,

Ingredion Incorporated, Cargill Incorporated, CP Kelco, River Plate Commodities,

OLAM International

Brazil's market share in the Latin American natural rubber and gums market is estimated to be around 60%, solidifying its position as the dominant player in the region.

Colombia's market share in the Latin American natural rubber and gums market

is estimated to be around 12%, and it is expected to continue its rapid growth trajectory.