Milk Powder Market Size (2024 – 2030)

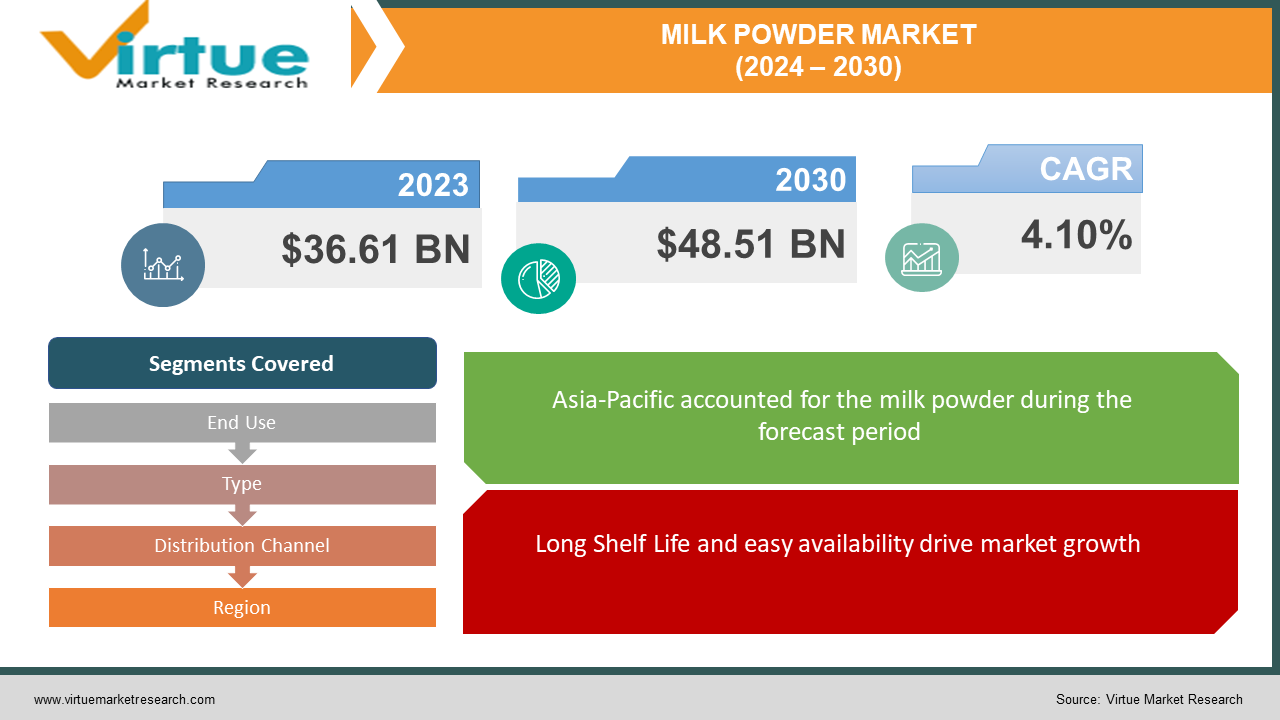

The Milk Powder Market was valued at USD 36.61 billion in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 48.51 billion by 2030, growing at a CAGR of 4.10%.

Powdered milk, alternatively labeled as milk powder or dried milk, is a dairy derivative acquired through the evaporation of milk's liquid component to eliminate moisture. The resultant powder encompasses milk solids such as proteins, lactose, minerals, and vitamins. This desiccation technique prolongs the product's shelf life and enhances its suitability for storage and transit.

Key Market Insights:

The burgeoning demand for milk powder is propelled by several factors, including convenience, prolonged shelf life, and ease of storage. Moreover, it satisfies consumers' preferences for extended shelf life while retaining nutritional integrity. The simplicity of reconstituting milk from powdered form is particularly appealing to individuals leading busy lifestyles. Furthermore, the global milk powder market is significantly influenced by factors such as population growth, urbanization, and evolving dietary patterns, thereby constituting a pivotal catalyst for its sustained expansion on the global stage.

Milk Powder Market Drivers:

Long Shelf Life and easy availability drive market growth.

Extended shelf life and convenience are among the primary factors propelling the global milk powder market forward. Powdered milk presents an easier storage and transportation solution in comparison to its liquid counterpart. The market for milk powder has witnessed significant expansion, largely driven by its inherent benefits of prolonged shelf life and convenience. Through the dehydration process employed during production, liquid milk is stripped of moisture, endowing milk powder with resistance to spoilage and ensuring an extended shelf life. Additionally, effective packaging plays a vital role in maintaining product quality by safeguarding against moisture ingress and contamination.

Increasing Demand in Developing Markets drives market growth.

The escalating urbanization, evolving lifestyles, and burgeoning population in emerging markets are driving an upsurge in the demand for convenient and durable dairy items like milk powder. Particularly in developing markets, the global milk powder market has experienced a notable uptick, mirroring shifts in consumer preferences and economic dynamics. This upward trend owes itself to several pivotal factors. Primarily, with the rising urbanization in developing economies, there arises a heightened demand for products offering both convenience and prolonged shelf life.

Milk Powder Market Restraints and Challenges:

The prevalence of lactose intolerance among certain consumers poses a significant constraint in the global milk powder market, necessitating the development of lactose-free or reduced-lactose alternatives. This condition, affecting an increasing number of individuals worldwide, impacts market dynamics considerably. Lactose intolerance, characterized by the body's inability to digest lactose, the sugar present in milk and dairy products due to insufficient lactase enzyme levels, has prompted notable adaptations within the milk powder market.

Moreover, the rising popularity of dairy alternatives, including plant-based milk substitutes, presents a challenge to the conventional global milk powder market, particularly among consumers seeking non-dairy options. Adherence to manufacturer guidelines and collaboration with experienced HVAC professionals can offer valuable insights and ensure the implementation of proper maintenance practices.

Furthermore, challenges such as unfavorable reimbursement scenarios, limited technology penetration in developing economies, high customs duties on medical devices, and inadequate infrastructure in low- and middle-income countries are anticipated to impede market growth in the forecast period.

Milk Powder Market Opportunities:

Market players have an opportunity to innovate and introduce new product variants in the milk powder segment, such as fortified options enriched with added vitamins, minerals, or functional ingredients, to address evolving consumer preferences. The milk powder market has entered a transformative phase characterized by inventive product offerings, aligning with dynamic shifts in consumer tastes and dietary patterns. Particularly, manufacturers have broadened their product ranges with fortified variations, enhancing milk powders with supplementary vitamins and minerals to cater to the preferences of health-conscious consumers.

Furthermore, the burgeoning awareness surrounding health and wellness presents an opportunity to position milk powder as a vital source of essential nutrients, advocating its inclusion in a balanced diet. The global milk powder market is witnessing a significant impact from the burgeoning health and wellness trends, as consumers increasingly prioritize nutritional content, functional ingredients, and dietary choices. The emphasis on health-conscious decisions is driving various notable developments within the industry.

MILK POWDER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.10% |

|

Segments Covered |

By End Use, Type, Distribution Channel and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Nova Dairy (India), Nestlé (Switzerland), Fonterra Co-operative Group (New Zealand), Arla Foods amba (Denmark), Dairy Farmers of America Inc. (U.S.), China Mengniu Dairy Company Limited (China), Synlait Ltd. (New Zealand), Land O'Lakes, Inc. (U.S.), Sodiaal (France), MORINAGA MILK INDUSTRY CO., LTD. (Japan) |

Milk Powder Market Segmentation: By type

-

dairy milk powder

-

non-dairy milk powder

While dairy milk powder continues to hold a dominant position in the market, there is a noticeable shift towards non-dairy milk powder, which represents the fastest-growing segment. Positioned as a favored dairy commodity, dairy milk powder serves as a versatile ingredient across a diverse array of culinary contexts, offering a convenient alternative for individuals lacking regular access to fresh milk.

Milk Powder Market Segmentation: By End Use

-

Nutritional Food

-

Infant Formulas

-

Confectionaries

-

Baked Sweets

-

Savories

-

Household

-

Foodservice Industry

-

Others

The escalating usage of milk powder in bakery and confectionery products emerges as a key driver propelling the growth of the milk powder market in the region. Given that the United States stands as one of the largest markets for bakery products globally, the increasing incorporation of milk powder in such products positively impacts the milk powder market in North America.

Furthermore, a growing consumer inclination toward investing in innovative and health-conscious dairy, bakery, and ice cream products is contributing to the surge in demand for milk powder. Manufacturers are swiftly investing in this market sector, with a focus on developing high-protein nutritional products designed to resonate with a broad consumer demographic.

Currently, whole milk powder holds the lion's share of the total market, primarily due to its extensive use in the formulation of baby food and infant formulas.

Milk Powder Market Segmentation: By distribution channel

-

hypermarkets/supermarkets

-

convenience stores

-

online retail stores

-

other distribution channels

Hypermarkets and supermarkets have emerged as the dominant and rapidly expanding segment within the market for milk powder. Their widespread presence near stores ensures convenient accessibility for consumers. Additionally, the ease of use and relatively affordable pricing contribute to the heightened demand for milk powder within this distribution channel.

Milk Powder Market Segmentation- by Region

-

North America

-

Europe

-

Asia-Pacific

-

South America

-

Middle East and Africa

In the Asia-Pacific region, dominance in the global milk powder market is attributed to shifting lifestyles and the substantial population residing within the region. Over the projection period, factors such as globalization and an expanding working population are expected to further fuel growth in the region's milk powder market. Advancements in processing and shipping technologies are anticipated to drive significant expansion within the Asia-Pacific milk powder industry. Additionally, lower transportation expenses and the utilization of export subsidies are poised to propel the region's milk powder sector forward. According to the Department of Agriculture, Fisheries, and Forestry of the Australian Government, the dairy industry holds paramount importance in Australia's rural sector. Approximately 35% of Australia's milk production is exported, with a significant portion comprising value-added products like milk powders, ultra-heat-treated milk, and similar items.

In Europe, substantial growth is forecasted for the global milk powder market, primarily due to advancements in processing and shipping technologies. Furthermore, the reduction in transportation costs and the implementation of export subsidies are anticipated to drive market expansion in the region in the forthcoming years.

COVID-19 Pandemic: Impact Analysis

The outbreak of COVID-19 prompted consumers worldwide to stock up on food products, leading to increased demand for items with extended shelf life. Given that milk powder offers a longer shelf life compared to liquid milk, consumers began opting for milk powder as a practical alternative.

Furthermore, the global awareness surrounding personal health during the COVID-19 pandemic prompted consumers to seek out functional food products that could bolster their immune systems. In response to this trend, milk powder manufacturers began introducing highly enriched variants to capitalize on this opportunity.

Latest Trends/ Developments:

-

In March 2023, Dairy Farmers of America (DFA) unveiled a partnership with Good Culture aimed at expanding its probiotic milk products portfolio.

-

In December 2022, Chinese dairy company Junlebao introduced a new milk powder range named "Le Gai" to invigorate the established category. The product, targeted at middle-aged and elderly consumers, supports calcium absorption and boasts 1200 mg of calcium per 100 g of milk powder, purportedly double the calcium content of regular whole milk powder.

-

March 2022 saw Z Natural Foods launch its new organic oat milk powder. Available in 1 lb, 5 lb, and 50 lb options, the product comes in an air-locked, freezer-tight, resealable, stand-up foil pouch, ensuring a safe storage duration of two years.

Key Players:

These are the top players in the Milk Powder Market: -

-

Nova Dairy (India)

-

Nestlé (Switzerland)

-

Fonterra Co-operative Group (New Zealand)

-

Arla Foods amba (Denmark)

-

Dairy Farmers of America Inc. (U.S.)

-

China Mengniu Dairy Company Limited (China)

-

Synlait Ltd. (New Zealand)

-

Land O'Lakes, Inc. (U.S.)

-

Sodiaal (France)

-

MORINAGA MILK INDUSTRY CO., LTD. (Japan)

Chapter 1. Milk Powder Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Milk Powder Market – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Milk Powder Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Milk Powder Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Milk Powder Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Milk Powder Market – By type

6.1 Introduction/Key Findings

6.2 dairy milk powder

6.3 non-dairy milk powder

6.4 Y-O-Y Growth trend Analysis By type

6.5 Absolute $ Opportunity Analysis By type, 2024-2030

Chapter 7. Milk Powder Market – By End Use

7.1 Introduction/Key Findings

7.2 Nutritional Food

7.3 Infant Formulas

7.4 Confectionaries

7.5 Baked Sweets

7.6 Savories

7.7 Household

7.8 Foodservice Industry

7.9 Others

7.10 Y-O-Y Growth trend Analysis By End Use

7.11 Absolute $ Opportunity Analysis By End Use, 2024-2030

Chapter 8. Milk Powder Market – By Distribution Channel

8.1 Introduction/Key Findings

8.2 hypermarkets/supermarkets

8.3 convenience stores

8.4 online retail stores

8.5 other distribution channels

8.6 Y-O-Y Growth trend Analysis By Distribution Channel

8.7 Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 9. Milk Powder Market , By Geography – Market Size, Forecast, Trends & Insights

9.1 North America

9.1.1 By Country

9.1.1.1 U.S.A.

9.1.1.2 Canada

9.1.1.3 Mexico

9.1.2 By type

9.1.3 By End Use

9.1.4 By By Distribution Channel

9.1.5 Countries & Segments - Market Attractiveness Analysis

9.2 Europe

9.2.1 By Country

9.2.1.1 U.K

9.2.1.2 Germany

9.2.1.3 France

9.2.1.4 Italy

9.2.1.5 Spain

9.2.1.6 Rest of Europe

9.2.2 By type

9.2.3 By End Use

9.2.4 By Distribution Channel

9.2.5 Countries & Segments - Market Attractiveness Analysis

9.3 Asia Pacific

9.3.1 By Country

9.3.1.1 China

9.3.1.2 Japan

9.3.1.3 South Korea

9.3.1.4 India

9.3.1.5 Australia & New Zealand

9.3.1.6 Rest of Asia-Pacific

9.3.2 By type

9.3.3 By End Use

9.3.4 By Distribution Channel

9.3.5 Countries & Segments - Market Attractiveness Analysis

9.4 South America

9.4.1 By Country

9.4.1.1 Brazil

9.4.1.2 Argentina

9.4.1.3 Colombia

9.4.1.4 Chile

9.4.1.5 Rest of South America

9.4.2 By type

9.4.3 By End Use

9.4.4 By Distribution Channel

9.4.5 Countries & Segments - Market Attractiveness Analysis

9.5 Middle East & Africa

9.5.1 By Country

9.5.1.1 United Arab Emirates (UAE)

9.5.1.2 Saudi Arabia

9.5.1.3 Qatar

9.5.1.4 Israel

9.5.1.5 South Africa

9.5.1.6 Nigeria

9.5.1.7 Kenya

9.5.1.8 Egypt

9.5.1.9 Rest of MEA

9.5.2 By type

9.5.3 By End Use

9.5.4 By Distribution Channel

9.5.5 Countries & Segments - Market Attractiveness Analysis

Chapter 10. Milk Powder Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nova Dairy (India)

10.2 Nestlé (Switzerland)

10.3 Fonterra Co-operative Group (New Zealand)

10.4 Arla Foods amba (Denmark)

10.5 Dairy Farmers of America Inc. (U.S.)

10.6 China Mengniu Dairy Company Limited (China)

10.7 Synlait Ltd. (New Zealand)

10.8 Land O'Lakes, Inc. (U.S.)

10.9 Sodiaal (France)

10.10 MORINAGA MILK INDUSTRY CO., LTD. (Japan)

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Extended shelf life and convenience are among the primary factors propelling the global milk powder market forward. Powdered milk presents an easier storage and transportation solution in comparison to its liquid counterpart.

The top players operating in the Milk Powder Market are - Nova Dairy (India), Nestlé (Switzerland)Fonterra Co-operative Group (New Zealand), Arla Foods amba, (Denmark), Dairy Farmers of America Inc. (U.S.), China Mengniu Dairy Company Limited (China), Synlait Ltd. (New Zealand), Land O'Lakes, Inc. (U.S.), Sodiaal (France), MORINAGA MILK INDUSTRY CO., LTD. (Japan).

The outbreak of COVID-19 prompted consumers worldwide to stock up on food products, leading to increased demand for items with extended shelf life. Given that milk powder offers a longer shelf life compared to liquid milk, consumers began opting for milk powder as a practical alternative.

The milk powder market has entered a transformative phase characterized by inventive product offerings, aligning with dynamic shifts in consumer tastes and dietary patterns. Particularly, manufacturers have broadened their product ranges with fortified variations, enhancing milk powders with supplementary vitamins and minerals to cater to the preferences of health-conscious consumers.

In Europe, substantial growth is forecasted for the global milk powder market, primarily due to advancements in processing and shipping technologies.