Europe Milk Powder Market Size (2024-2030)

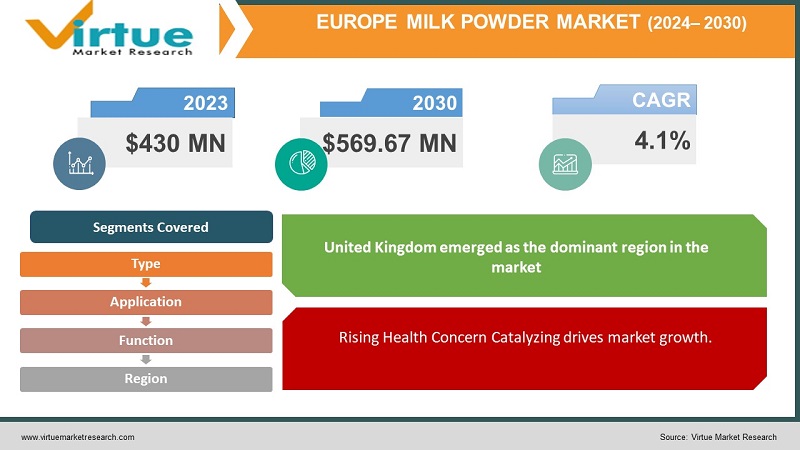

The Europe Milk Powder Market was valued at USD 430 Million in 2023. Over the forecast period of 2024-2030, it is projected to reach USD 569.67 Million by 2030, growing at a CAGR of 4.1%.

Milk powder represents a condensed iteration of milk, typically produced through the dehydration of liquid milk using spray drying techniques until it transforms into a powdered form. Renowned for its convenience and prolonged shelf life, consumers widely embrace it as a substitute for fresh milk across various culinary applications, spanning confectioneries, infant formulas, savory dishes, and desserts. The capacity of milk powders to absorb water, coupled with their foaming and emulsifying attributes, renders them significant components in food preparation. Presently, milk powder enjoys global consumption owing to its rich composition of essential nutrients, encompassing proteins, vitamins, calcium, iron, sodium, cholesterol, potassium, fats, and carbohydrates, all of which contribute to overall health and development.

Key Market Insights:

The surge in demand for convenient food items among consumers stands out as a pivotal driver propelling the sales of milk powder. Its ability to be stored without refrigeration and transported effortlessly, sans the necessity of a cold chain infrastructure, significantly contributes to market growth. Furthermore, its widespread adoption across the food and beverage sector positively impacts market expansion. The market outlook is further buoyed by notable advancements in e-commerce infrastructure, enhancements in supply chain distribution channels, and the emergence of online delivery models.

Europe Milk Powder Market Drivers:

Rising Health Concern Catalyzing drives market growth.

The emergence of cutting-edge technologies in milk powder production, facilitating the preservation of milk nutrients post-drying, alongside minimal fat content resulting in low-calorie characteristics, is attracting widespread attention toward milk powder consumption. This attribute proves beneficial for individuals aiming to manage or reduce weight, while also promoting cardiovascular health. Additionally, being a rich reservoir of complete proteins, crucial for lean muscle development and maintenance, has led to heightened consumption among athletes.

The advancement of modern technology in milk powder production, facilitating the retention of milk's nutritional content post-drying while containing minimal fat content, has garnered attention toward its utilization. This characteristic renders it beneficial for weight management and promotes cardiovascular health. Additionally, its consumption has surged among athletes owing to its rich concentration of complete proteins, vital for lean muscle development and maintenance.

Europe Milk Powder Market Restraints and Challenges:

The enforcement of government laws and regulations about milk powder across various nations is anticipated to impede the growth trajectory of the milk powder market. Additionally, the powder should exhibit uniform color, pleasant taste, and flavor devoid of off-flavor and rancidity. It must also be free from vegetable oil/fat, mineral oil, added flavor, and any extraneous substances not inherent to milk. Consequently, the imposition of rigorous regulatory measures poses challenges to the expansion of the milk powder market.

Europe Milk Powder Market Opportunities:

Innovation, processing, and packaging emerge as pivotal domains within the milk powder market, presenting significant growth opportunities. Factors such as heightened health awareness among consumers and evolving dietary preferences are expected to drive innovation in product offerings. Manufacturers are diversifying their product portfolios by incorporating functional ingredients, vitamins, minerals, and additional nutrients to cater to evolving consumer demands.

Innovative packaging strategies, including eye-catching jars, larger packages, resealable packaging, and sizable tubs, play a crucial role in boosting product sales. For instance, Tetra Pak is renowned for its expertise in handling powder materials. The company employs computational fluid dynamics (CFD) tools during pilot testing in actual factory settings to model trials effectively. CFD aids in optimizing line designs for each dairy, ensuring the efficient utilization of energy and other utilities. Tetra Pak's solutions are designed to minimize food wastage and safeguard milk powder from contamination by foreign particles, further enhancing product quality and consumer trust.

EUROPE MILK POWDER MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

||

|

Market Size Available |

2023 - 2030 |

||

|

Base Year |

2023 |

||

|

Forecast Period |

2024 - 2030 |

||

|

CAGR |

4.1% |

||

|

Segments Covered |

By Type, Application, function, and Region |

||

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

||

|

Regional Scope |

|

||

|

Key Companies Profiled |

Nestlé S.A., Dean Foods, Saputo, Inc., Danone S.A., Arla Foods, Lactalis Group, Kraft Heinz Company, Fonterra Co-operative Group Limited, Dairy Farmers of America Inc., Royal FrieslandCampina N.V. |

Europe Milk Powder Market Segmentation

Europe Milk Powder Market Segmentation By Type:

- Dry Buttermilk

- Dry Whey Products

- Dry Whole Milk

- Dry Dairy Blends

- Non-Fat Dry Milk

While many consumers perceive whole milk as the most natural variant, its popularity is relatively lower among individuals mindful of their weight or adhering to specific dietary regimens. Whole milk powder, being calorie-dense, appeals more to individuals requiring higher calorie intake, making it a preferred choice. Moreover, its utility as a food ingredient further contributes to its prominence within the Milk Powder market segment. These factors collectively propel the growth of this segment.

Europe Milk Powder Market Segmentation By Application:

- Infant Formulas

- Nutritional Formulas

- Confectionery and Bakery

- Sweets And Savories

The confectionery segment stands as the largest application area for milk powder, boasting high utilization rates. However, the growth of the confectionery market faces constraints due to the surge in prices of essential raw materials necessary for production. Key raw materials such as milk, milk powder, cocoa, and sugar are pivotal in confectionery manufacturing. The prices of milk powder, in particular, exhibit volatility influenced by various factors, including milk production, quality, processing conditions, drying methods, and storage conditions. Furthermore, an expanding supply-demand gap in fresh milk has further exacerbated the pricing dynamics of milk powder. The escalation in prices and scarcity of raw materials pose significant hurdles to the growth and advancement of the confectionery industry.

The Infant Formulas segment is poised for rapid expansion in the forecast period. The surge in female labor force participation has contributed significantly to the growth of the infant formula industry. Working mothers, seeking convenience and tailored nutrition for their infants, increasingly turn to infant formulas to meet their babies' needs while balancing work commitments. These factors serve as primary drivers propelling the growth of this segment within the Milk Powder market.

Europe Milk Powder Market Segmentation By Function:

- Foaming

- Emulsification

- Flavouring

- Thickening

The thickening segment holds a dominant position within the market. The capacity of milk powders to bind water, thicken, gel, and exhibit emulsifying and foaming properties underscores their significance as valuable food ingredients. Thickening powders, in particular, are typically derived from modified corn starch, which absorbs water molecules and undergoes gelatinization. This process, known as gelatinization, occurs when starch bonds break down upon mixing with water, enabling hydrogen to engage with more water molecules. Thickening powders are beneficial for individuals with dysphagia, aiding in the thickening of liquids, water, or foods to facilitate easier swallowing.

Europe Milk Powder Market Segmentation- by Region

- UK

- France

- Spain

- Germany

- Italy

- Rest of Europe

The United Kingdom emerged as the dominant region in the market, with France, Germany, and Italy also experiencing rapid growth in the market. Continual technological progressions in milk production processes aimed at preserving nutrient content are identified as additional growth catalysts. Moreover, the market gains momentum from increased investments by key industry players in the development of robust marketing strategies, promotional initiatives, celebrity endorsements, and innovative packaging solutions.

Factors such as rapid urbanization, escalating health awareness among individuals, and evolving dietary preferences further bolster market prospects, indicating a favorable trajectory for the milk powder market.

COVID-19 Pandemic: Impact Analysis

The milk powder market experienced a positive response amidst the COVID-19 pandemic. However, operational challenges arose for both farmers and company employees due to stringent government lockdown measures. The pandemic introduced heightened uncertainty and volatility for dairy producers, disrupting output due to resource shortages for manufacturing milk powder variants. Fluctuating prices ensued as a result of limited milk supply, leading to an overall increase in the final product's price compared to the average market rate.

In an attempt to meet demand from dairy corporations, farmers sought to increase output volume, albeit at the expense of the final product's quality. Furthermore, rising transportation costs contributed to frequent disruptions in product distribution. Food and beverage companies grappled with reduced consumption and supply chain disruption challenges. Supply chains experienced significant breakdowns due to rapidly shifting consumer behavior and demand patterns resulting from lockdown measures.

Amidst these challenges, milk powder emerged as a viable alternative to fresh milk due to its extended shelf life and convenience. Consumers, restricted by lockdown measures, turned to milk powder as a suitable substitute, further driving demand during the pandemic.

Latest Trends/ Developments:

- In March 2022, Z Natural Foods introduced its latest offering, organic oat milk powder. Available in 1 lb, 5 lb, and 50 lb options, this product is packaged in air-locked, freezer-tight, resealable, stand-up foil pouches, ensuring freshness. With a shelf life of two years, consumers can safely store this oat milk powder.

- In July 2022, Danone S.A. unveiled its new Dairy & Plants Blend baby formula, addressing the growing demand for feeding options suitable for vegetarian, flexitarian, and plant-based diets. This formula is carefully formulated to meet the specific nutritional requirements of babies while accommodating various dietary preferences.

Key Players:

These are the top 10 players in the Europe Milk Powder Market: -

- Nestlé S.A.

- Dean Foods

- Saputo, Inc.

- Danone S.A.

- Arla Foods

- Lactalis Group

- Kraft Heinz Company

- Fonterra Co-operative Group Limited

- Dairy Farmers of America Inc.

- Royal FrieslandCampina N.V.

Chapter 1. Europe Milk Powder Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Europe Milk Powder – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Europe Milk Powder Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Europe Milk Powder - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Europe Milk Powder Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Europe Milk Powder Market– By Type

6.1. Introduction/Key Findings

6.2. Dry Buttermilk

6.3. Dry Whey Products

6.4. Dry Whole Milk

6.5. Dry Dairy Blends

6.6. Non-Fat Dry Milk

6.7. Y-O-Y Growth trend Analysis By Type

6.8. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Europe Milk Powder Market– By Application

7.1. Introduction/Key Findings

7.2 Infant Formulas

7.3. Nutritional Formulas

7.4. Confectionery and Bakery

7.5. Sweets And Savories

7.6. Y-O-Y Growth trend Analysis By Application

7.7. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Europe Milk Powder Market– By Function

8.1. Introduction/Key Findings

8.2. Foaming

8.3. Emulsification

8.4. Flavouring

8.5. Thickening

8.6. Y-O-Y Growth trend Analysis Function

8.7. Absolute $ Opportunity Analysis Function , 2024-2030

Chapter 9. Europe Milk Powder Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Europe

9.1.1. By Country

9.1.1.1. U.K.

9.1.2.1. Germany

9.1.1.3. France

9.1.1.4. Italy

9.1.1.5. Spain

9.1.1.6. Rest of Europe

9.1.2. By Type

9.1.3. By Application

9.1.4. By Function

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Europe Milk Powder Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Nestlé S.A.

10.2. Dean Foods

10.3. Saputo, Inc.

10.4. Danone S.A.

10.5. Arla Foods

10.6. Lactalis Group

10.7. Kraft Heinz Company

10.8. Fonterra Co-operative Group Limited

10.9. Dairy Farmers of America Inc.

10.10. Royal FrieslandCampina N.V.

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The surge in demand for convenient food items among consumers stands out as a pivotal driver propelling the sales of milk powder. Its ability to be stored without refrigeration and transported effortlessly, sans the necessity of a cold chain infrastructure, significantly contributes to market growth.

The top players operating in the Europe Milk Powder Market are - Nestlé S.A., Dean Foods, Saputo, Inc., and Danone S.A

The milk powder market experienced a positive response amidst the COVID-19 pandemic. However, operational challenges arose for both farmers and company employees due to stringent government lockdown measures. The pandemic introduced heightened uncertainty and volatility for dairy producers, disrupting output due to resource shortages for manufacturing milk powder variants.

Innovative packaging strategies, including eye-catching jars, larger packages, resealable packaging, and sizable tubs, play a crucial role in boosting product sales. For instance, Tetra Pak is renowned for its expertise in handling powder materials

The United Kingdom emerged as the dominant region in the market, with France, Germany, and Italy also experiencing rapid growth