Middle East and Africa Powder Coating Market Size (2024-2030)

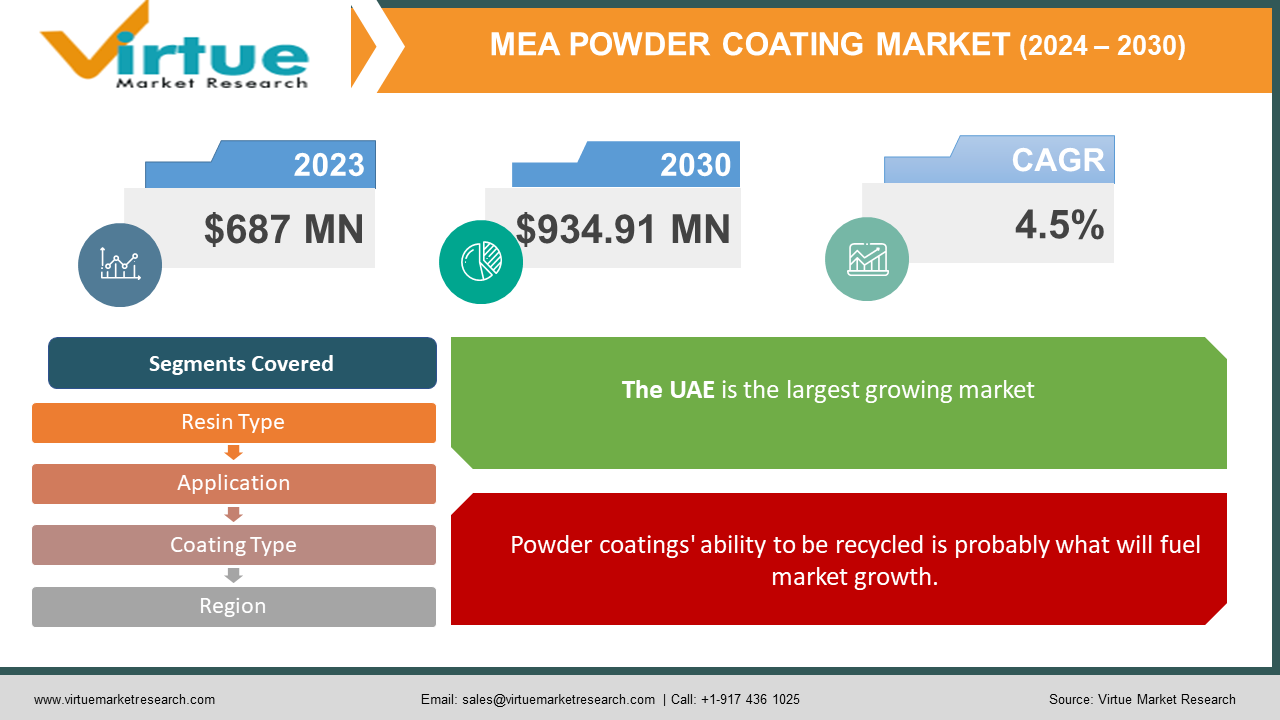

The Middle East and Africa Powder Coating Market was valued at USD 687 million and is projected to reach a market size of USD 934.91 million by the end of 2030. The market is anticipated to expand at a compound annual growth rate (CAGR) of 4.5% between 2024 and 2030.

Even domestic objects and machines are shielded against externally induced harm by powder coating. It offers both a gorgeous finish and a more durable finish than liquid paints can produce. During the forecast period, the powder coatings market is expected to develop at a faster rate due to several factors, including rising per capita income, increased consumer spending, and technological advancements. The architectural and ornamental sector will benefit from socioeconomic development and an increase in housing subsidies, which will also indirectly help the growth of the powder coatings business. Moreover, increasing development and construction activity in developing nations is anticipated to fuel market expansion for powder coatings during the projection period. Nonetheless, the market for powder coatings will grow more slowly due to a lack of knowledge in underdeveloped regions. Additionally, during the aforementioned forecast period, market expansion will be hampered by strict environmental restrictions as well as a growing emphasis on adhering to state and local wastewater discharge standards. Furthermore, during the estimated period, the powder coatings market will have plenty of chances due to a greater utilization rate when compared to liquid versions. This market report on powder coatings includes information on recent developments, trade laws, import/export analysis, production analysis, value chain optimization, market share, and the effects of local and domestic market players. It also analyses opportunities for emerging revenue pockets, changes in market regulations, market size, category market growth, application dominance and niches, product approvals, product launches, market expansions geographically, and technological innovations. For an analyst brief and other information about the powder coatings industry, get in touch with Data Bridge Industry Research. Our staff can assist you in making well-informed decisions that will lead to market expansion.

Key Market Insights:

Many manufacturers are expanding their operations in this region due to the combination of cheaper infrastructure costs and the availability of inexpensive labour. More job opportunities have arisen from this, which has improved the local economy and raised wages for residents. The growing population and rising disposable income of customers have led to a rise in the demand for various products like as furniture, electronics, cars, home and commercial appliances, and agricultural equipment. Powder is applied to a variety of surfaces, including those of engines, pipes, fixtures, home appliance metal parts, and other products. Thus, these nations' expanding need for powder coatings is a result of their greater demand for finished goods. Traditionally, powder has only been used to cover specific automobile components, such as the engine and chassis. But an increasing number of automakers are covering other components as well, including wheels, mirror frames, coil springs, engine blocks, radiators, bumpers, and shock absorbers. As a result, the powder coating market has seen growth in demand from the automotive sector. Powder coatings were developed in Europe as a result of environmental pressure, and different end-use industries are the ones that drive their adoption. Liquid finishing has been superseded by powder coatings as a coating application process. Over time, powder coatings have been improved, using multiple technologies and techniques of application. In the late 1940s and early 1950s, the idea of putting polymer in powder form was developed.

Middle East and Africa Powder Coating Market Market Drivers:

Growing Need for Eco-Friendly Coatings to Drive Industry Development in the Middle East and Africa Powder Coating Market

The market is growing quickly because fewer volatile organic compounds (VOCs) are being used. These coatings have no volatile organic compounds (VOCs), which lowers air pollution and promotes safe handling, storage, and fire safety. VOCs, or volatile organic compounds, are the main contributors to ground-level air pollution. They vaporise at room temperature. In humans, nitrogen oxides can lead to memory loss, visual problems, throat, eye, and nose irritations, headaches, and cancer when they combine with volatile organic compounds (VOCs) to create smog.The manufacturing of these coatings is being aided by manufacturers' growing awareness of the need to control pollution. often needed to apply for licences and abide by stringent environmental laws governing the quantity of solvent and volatile organic compounds (VOCs) released into the atmosphere. Manufacturers who violate the regulations pertaining to VOC content are subject to fines and penalties. These coatings provide a substitute that keeps air pollution to a minimum while adhering to rules and guidelines. Petroleum solvents are not used in the production of these coatings, hence no environmentally hazardous volatile organic compounds are released. The market is anticipated to be driven by these coatings' compliance with environmental laws.

Powder coatings' ability to be recycled is probably what will fuel market growth.

The application of these coatings involves two steps. Using a powder gun that is electrostatically charged, the product is first sprayed with powder. The part is adhered to by the powder and subsequently reassembled within a coating oven. The powder is liquefied in this coating oven, causing it to stream together and firmly adhere to the part. The relieving process helps shield the metal underneath by forming a strong bond that endures. An average transfer effectiveness of 60% is achieved by powder coating. As a result, 40% of the powder cannot stick to the part. A process known as powder reclamation can be utilised to collect and repurpose any extra powder that was sprayed onto the part. When only one or two primary colours are utilised for the products, powder reclamation performs better because many colour changes result in significantly higher equipment expenses. The powder can be recovered to a large extent if the component is sprayed with one or two colours. The powder that was oversprayed may become stuck in the spray booth or filters. Because the recycled powder is reusable, it makes the powder.

Middle East and Africa Powder Coating Market Restraints and Challenges:

The challenge of producing thin films with powder coatings to impede the demand for products.There is no liquid carrier present in these coatings. It may apply thicker coatings in this manner compared to traditional liquid coatings. Applying thick coatings and texture-free coatings is quite easy, however applying smooth thin films is more difficult. Due to the molecular size and glass transition temperature (Tg) of these coatings, the film becomes more and more orange stripped on the surface as the film thickness decreases. Particle size of powder coatings ranges from 30 to 50 µm, with a Tg > 40°C. Film fabrication ups of greater than 50 um may be necessary when using these coatings in order to obtain an acceptable level of smoothness. These coatings with a Tg < 40°C or less than 30 µm are used in specialised activities to create smooth thin films. Because of this, it is challenging to produce thin films with this coating, which is expected to impede market growth over the forecast period.

Middle East and Africa Powder Coating Market Opportunities:

The increased demand for durable coatings is driving the growth of the real estate industry in African nations. In addition, factors driving overall market growth include rising per capita income, greater consumer expenditure, and technology advancements. Architectural applications will benefit from socioeconomic development and increased housing subsidies, which will also indirectly support the powder coating market in the Middle East and Africa. The MEA region's economy is expanding quickly, which is encouraging investment in infrastructure projects like buildings, bridges, and roads. Powder coatings, which are utilised to embellish and preserve the metalwork employed in these projects, are becoming more and more in demand as a result. The application of powder coatings to give items functional qualities including heat resistance, corrosion resistance, and scratch resistance is growing. The demand for products that are more robust and resilient to challenging environmental conditions is driving this. The market for powder coatings in MEA is being driven by the region's growing demand for automobiles, including cars and commercial vehicles, as well as the growing use of powder coatings on various automotive parts.

MIDDLE EAST AND AFRICA POWDER COATING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.5% |

|

Segments Covered |

By Resin Type, application, coating type, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Iran, UAE, Qatar, Oman, Iraq, Bahrain, Kuwait, Rest of Middle East |

|

Key Companies Profiled |

Jazeera Paints, AKZO Novel NV, PPG Industries, Jotun, National Paints factory |

Middle East and Africa Powder Coating Market Segmentation:

Middle East and Africa Powder Coating Market Segmentation By Resin Type:

- Thermoset

- Thermoplastic

The Middle East and Africa Powder Coating Market Segmented by Resin, Thermoset the Construction Industry held the largest market share of last year and is poised to maintain its dominance throughout the forecast period. It is anticipated that the thermoset category would continue to dominate the worldwide powder coatings market and increase at a quick rate. Thermoset coatings, which are characterised by their melting and flowing properties under heat, have advantages over thermoplastics in terms of operation, including reduced curing temperatures. Different subcategories within the thermoset category include acrylic, polyester, polyurethane, epoxy, and others. Interestingly, epoxy-polyester mixtures have a substantial piece of the market due to their greater qualities over pure epoxy alternatives, such as increased resistance to overbake yellowing and improved weatherability. Epoxy-polyester coatings, which are widely considered the industry standard, are very versatile and perform admirably in a wide range of applications, making them indispensable.

Middle East and Africa Powder Coating Market Segmentation: By Coating Method:

- Electrostatic Spray

- Fluidized Bed

The Middle East and Africa Powder Coating Market Segmented by Coating Methods, Electrostatic Spray held the largest market share of last year and is poised to maintain its dominance throughout the forecast period. The coating methods market is divided into categories such as fluidized bed, electrostatic spray, and others. Currently holding a dominant market position, the electrostatic spray method is expected to grow at a quick pace during the projection period due in large part to the growing demand for thermoset powder coatings across a range of industries. By applying an electrical charge to the coating particles inside the spray gun, this method makes application more accurate and consistent. On the other hand, the fluidized bed approach, which provides effective adherence and coverage, is mainly useful for applying thermoplastic powder coatings. Furthermore, applications needing a high film build in thermoset powder are preferred to use the fluidized bed approach. These unique coating techniques meet a range of industry demands and promote efficiency and creativity in powder coating applications globally.

Middle East and Africa Powder Coating Market Segmentation: By Application:

- Architectural

- Jobbers

- Agricultural

- Construction equipment

- Pipeline

- Oil & Gas

- Appliances

- General Metal

- Automotive & Transportation Components

- HVAC

- Electrical

The Middle East and Africa Powder Coating Market Segmented by Applications, appliances held the largest market share last year and is poised to maintain its dominance throughout the forecast period. The primary market share was held by the appliance category. The ACS, water heating systems, washers, dryers, dishwashers, freezer liners, floor cleaners, microwaves, racks and cabinets, mixers and blenders, and other appliances are among the many appliances that use these coatings. These coatings are typically applied to appliances and other items that need to be both aesthetically pleasing and resistant to chemicals, abrasion, and temperature changes. They provide resistance to chemicals, temperature fluctuations, and abrasion, while also enhancing the aesthetic appeal. Durable coatings are necessary for appliances to withstand wear and tear from regular use. Because they offer a thick covering, these coatings are therefore frequently used. Because of their ability to withstand extreme temperature changes without chipping or wearing off, these coatings are frequently seen on panels and other parts of ovens, microwaves, and refrigerators.

Middle East and Africa Powder Coating Market Segmentation: By Regional Analysis:

- Middle East

- Africa

The Africa and Middle East Powder Coating markets segmented by region, UAE held the largest market share. Due to the government's implementation of plans for the development of social infrastructure, the United Arab Emirates (UAE) controls the Middle East and Africa powder coatings industry. The market is also being driven by rising personal disposable income, growing environmental laws, growing technical breakthroughs, and high demand from the transportation, energy, utility, and construction industries.The powder coatings market report's country section offers specific market-impacting variables as well as domestic regulatory changes that have an affect on the industry's present and future developments. Some of the key indicators utilised to predict the market situation for certain countries are data points like consumption volumes, production sites and volumes, import export analysis, price trend analysis, cost of raw materials, and upstream and downstream value chain analysis. Additionally, when presenting a forecast analysis of the country data, the impact of domestic tariffs and trade routes, as well as the presence and availability of global brands and the problems they face from abundant or sparse competition from local and domestic brands, are taken into account.

COVID-19 Impact Analysis on the Africa and Middle East Powder Coating Market:

Due to COVID-19, the powder coatings market is facing significant issues that are affecting the industrial and architectural industries. Since the Middle East and Africa are not the virus's hotspots, all economic and industrial activity was suspended in Saudi Arabia, Qatar, the United Arab Emirates, and other African nations. The suspension of construction projects and the production of oil and gas resulted in a considerable decline in the market for powder coatings. Due to their reliance on the production of oil and gas, the Middle Eastern countries suffered greatly, with prices even falling to negative levels during this time. The increasing demand for packaged goods has led to a minor increase in the need for coating materials, which has led to the prediction that the packaging industry will grow. However, by the end of 2021, the industry is predicted to suffer generally. After 2021, economic recovery can be expected, but growth is extremely unlikely before then.

Latest Trends/ Developments:

In order to increase its footprint in South and Central America, AkzoNobel has announced its strategic acquisition of Grupo Orbis. Depending on regulatory approvals, the deal is expected to close by the end of this year or in early 2022. The acquisition includes the resin-focused Poliquim, Andercol, and Pintuco paints and coatings in addition to Mundial, which is concentrated on distribution and services. Simultaneously, PPG has introduced its CORAFLON Platinum architectural metal paints, which feature unique technology that provides superior corrosion resistance and transfer efficiency rates over 20% when compared to conventional fluoroethylene vinyl ether coatings. These ground-breaking products, which are accessible everywhere, represent a major breakthrough in the technology of architectural coatings and come in a vast array of colours, glosses, micas, and metallic finishes.

Key players:

- Jazeera Paints

- AKZO Novel NV

- PPG Industries

- Jotun

- National Paints factory

Chapter 1. Middle East and Africa Powder Coating Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Powder Coating Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Powder Coating Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Powder Coating Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Powder Coating Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Powder Coating Market– By Resin Type

6.1. Introduction/Key Findings

6.2. Thermoset

6.3. Thermoplastic

6.4. Y-O-Y Growth trend Analysis By Resin Type

6.5. Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Middle East and Africa Powder Coating Market– By Application

7.1. Introduction/Key Findings

7.2. Architectural

7.3. Jobbers

7.4. Agricultural

7.5. Construction equipment

7.6. Pipeline

7.7. Oil & Gas

7.8. Appliances

7.9. General Metal

7.10. Automotive & Transportation Components

7.11. HVAC

7.12. Electrical

7.13. Y-O-Y Growth trend Analysis By Application

7.14. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Middle East and Africa Powder Coating Market– By Coating Method

8.1. Introduction/Key Findings

8.2. Electrostatic Spray

8.3. Fluidized Bed

8.4. Y-O-Y Growth trend Analysis By Coating Method

8.5. Absolute $ Opportunity Analysis By Coating Method , 2024-2030

Chapter 9 . Middle East and Africa Powder Coating Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Resin Type

9.1.3. By application

9.1.4. Coating Method

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East and Africa Powder Coating Market– Company Profiles – (Overview, Resin Type Type Portfolio, Financials, Strategies & Developments)

10.1. Jazeera Paints

10.2. AKZO Novel NV

10.3. PPG Industries

10.4. Jotun

10.5. National Paints factory

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Based on Application, Resin Type, Coating Method and Region the Africa and Middle East Powder Coating Market report's segments are covered

In the African and Middle East Powder Coating market, the UAE is anticipated to hold the largest share

The Africa and Middle East Powder Coating market is predicted to reach a value of USD 934.91 million by

2030

The Africa and Middle East Powder Coating market is expected to grow between 2024 and 2030

. In 2023, the Africa and Middle East Powder Coating market was estimated to be worth USD 687million