Powder Coating Market Size (2024 – 2030)

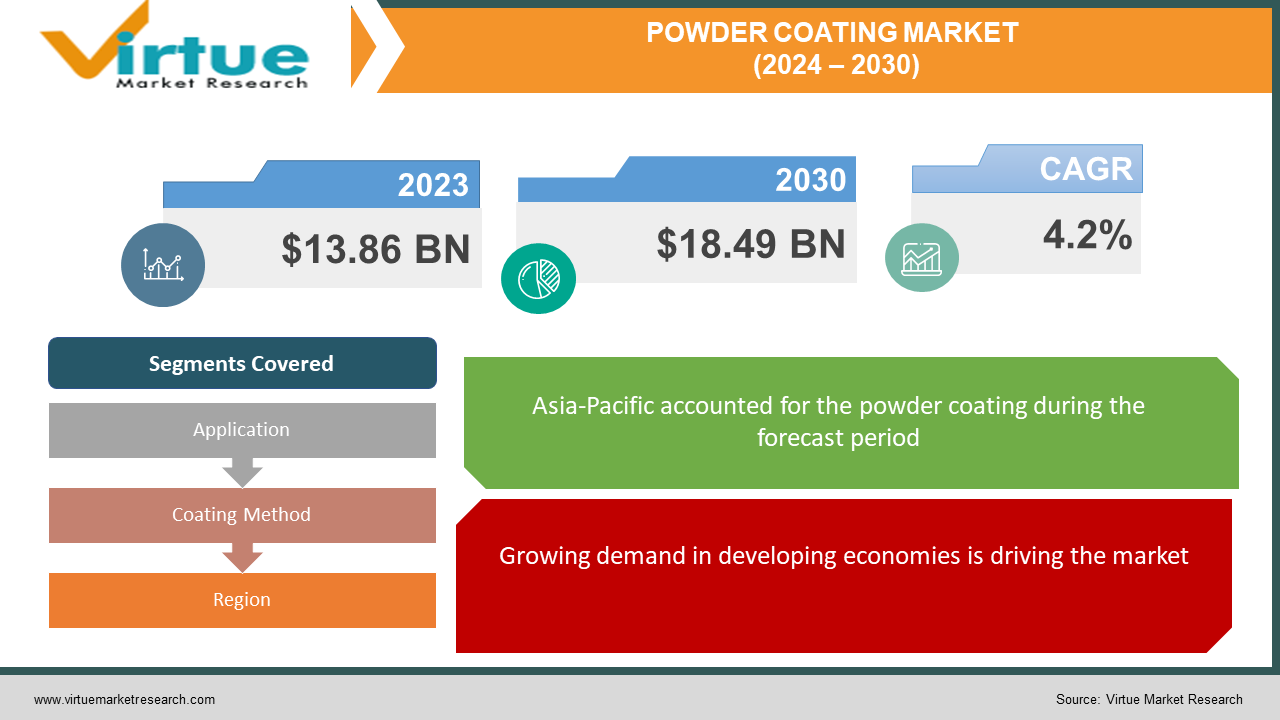

The Global Powder Coating Market was valued at USD 13.86 billion in 2023 and will grow at a CAGR of 4.2% from 2024 to 2030. The market is expected to reach USD 18.49 billion by 2030.

Key Market Insights:

The global powder coating market is expected to keep growing at a steady clip, reaching nearly $19 billion by 2030. This trend is driven by several factors. First, powder coatings offer a more environmentally friendly alternative to traditional liquid coatings, with minimal VOC emissions and the ability to be recycled. Stringent government regulations and a growing focus on sustainability are making powder coatings more attractive. Additionally, the durability, corrosion resistance, and overall performance of powder coatings are fueling demand in appliance, automotive, and general industrial applications. The Asia Pacific region is currently the leader, but growth is expected across the globe as infrastructure development and disposable income rise. However, challenges like achieving thin film application and navigating stricter environmental regulations still exist. Opportunities for manufacturers who adapt to evolving technologies and regional demands.

Global Powder Coating Market Drivers:

Growing demand in developing economies is driving the market

Developing economies like China, India, and Brazil are becoming fertile ground for the powder coating market. Rising disposable income fuels a surge in demand for consumer goods like appliances and vehicles, all requiring a durable, attractive finish. This, coupled with rapid urbanization and booming construction activity, creates a massive need for infrastructure development – think buildings, bridges, and transportation networks. Powder coatings perfectly address this need with their exceptional durability, corrosion resistance, and ability to withstand harsh weather conditions. As these economies prioritize sustainability, the environmentally friendly nature of powder coatings, with minimal VOC emissions and overspray recyclability, becomes another major selling point.

Powder coatings offer superior performance compared to traditional liquid coatings is driving the market growth

Powder coating outmuscles traditional liquid coatings in terms of performance. Unlike paint that can chip or fade, powder coating forms a tough, resilient layer that shrugs off scratches, dents, and even UV rays. Its superior chemical resistance makes it ideal for harsh environments where exposure to chemicals or cleaning agents is a concern. This translates to a longer lifespan for coated products, reducing maintenance needs and replacement costs. From the sleek finish on your refrigerator to the weatherproof coating on outdoor furniture, powder coating's durability and resistance benefit a vast array of applications across appliances, automotive parts, and countless industrial products.

Advancements in powder coating technology are also driving market growth

Innovation in powder coating technology is fueling the market's growth. New resin systems are constantly being developed, offering a wider range of performance characteristics. This allows for customized powder coatings that excel in specific environments, like heat resistance for engines or anti-microbial properties for hospitals. Application techniques are also evolving, with improved spray guns and automation leading to more efficient and consistent application. Perhaps the most exciting advancement is the ability to achieve thinner film applications. This offers several advantages: reduced material usage, lower energy consumption during curing, and a more aesthetically pleasing finish that rivals traditional paints. With these advancements, powder coatings are becoming even more versatile and user-friendly, opening doors to new applications and solidifying their position in the finishing industry.

Global Powder Coating Market challenges and restraints:

High Initial Investment is restricting the market growth

The biggest hurdle for companies considering powder coating is the upfront investment. Powder coating systems require specialized equipment like booths, ovens, and spraying units, along with ventilation and safety gear. These costs can easily reach tens of thousands of dollars, especially for industrial setups. This can be a significant barrier to entry, particularly for smaller companies or those new to the technology. The high initial investment makes it difficult to justify the cost without a guaranteed high volume of work or the confidence to compete in the market. This can stifle innovation and slow down the wider adoption of powder coating despite its environmental and durability benefits.

Environmental regulations, particularly regarding VOC emissions, are becoming more stringent globally

While powder coating boasts minimal VOC emissions, the regulatory landscape is constantly shifting, posing a challenge for producers. Stringent environmental regulations, particularly regarding VOC limits, are implemented globally and can vary by region. Even though powder coating falls under environmentally friendly practices, staying compliant requires powder coating facilities to adapt their processes to meet these evolving regulations. This ongoing need to adjust procedures adds complexity to operations and necessitates additional costs. Producers must invest in research and development to ensure their processes adhere to the latest standards, which can strain resources and impact profit margins.

Market Opportunities:

The powder coating market presents a treasure trove of opportunities for companies looking to capitalize on the growing demand for sustainable and high-performance finishes. One key area lies in developing new eco-friendly powder formulations that meet stricter environmental regulations and cater to the rising consumer focus on sustainability. Secondly, innovation in application technologies like electrostatic spray guns and automation can improve efficiency, reduce waste, and make powder coating more accessible to smaller manufacturers. The potential in developing economies is immense, with rising disposable income and booming infrastructure projects demanding durable and attractive finishes for appliances, vehicles, and construction materials. Focusing on cost-effective powder coatings alongside educational initiatives to promote their benefits can unlock this vast market. Furthermore, advancements in achieving thinner film applications open doors to new applications – think heat-resistant coatings for electronics or aesthetically pleasing finishes for architectural applications. By addressing these opportunities, companies can position themselves at the forefront of the powder coating revolution, ensuring a sustainable and vibrant future for this dynamic market.

POWDER COATING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

4.2% |

|

Segments Covered |

By Application, Coating Method, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

AkzoNobel N.V., Axalta Coating Systems LLC, PPG Industries, Inc., BASF SE, The Sherwin-Williams Company, Nippon Paint Holdings Co., Ltd., Kansai Paint Co., Ltd., Jotun A/S, RPM International Inc. |

Powder Coating Market Segmentation - by Application

-

Appliances

-

Automotive

-

Furniture

-

Architectural

Powder coatings have infiltrated our everyday lives through a variety of applications. They are the workhorse behind the durable and attractive finishes on everyday appliances like refrigerators, washing machines, and toasters. In the automotive world, they shield wheels, rims, and other car parts from corrosion while maintaining a sleek look. Moving to our built environment, powder coatings adorn building facades and window frames, offering weather resistance and a wide variety of colors for architectural appeal. Even our furniture benefits from this technology, with powder coatings providing a long-lasting and scratch-resistant finish on pieces designed for both indoor and outdoor use

Powder Coating Market Segmentation - By Coating Method

-

Electrostatic Spray

-

Fluidized Bed

Electrostatic spray reigns supreme in the world of powder coating application. This method utilizes an electrostatic charge to attract powder particles to the grounded workpiece. Imagine tiny, charged magnets drawn to a metal surface. This targeted approach offers several advantages: it minimizes overspray, reduces waste, and ensures efficient application, making it the dominant choice for most powder coating jobs. However, for complex shapes where even coverage is crucial, fluidized bed technology comes into play. Here, parts are dipped into a vibrated bed of powder, ensuring a uniform coating that reaches all the nooks and crannies. While not as widely used, fluidized bed dipping remains a valuable technique for specific applications.

Powder Coating Market Segmentation - Regional Analysis

-

North America

-

Asia-Pacific

-

Europe

-

South America

-

Middle East and Africa

The Asia Pacific region currently holds the crown as the dominant player in the powder coating market. This leadership stems from the region's booming industrial sector and rapid urbanization. Countries like China and India are experiencing explosive growth, fueling the demand for durable finishes on everything from appliances to infrastructure projects. While North America and Europe boast established markets with a strong focus on high-performance and eco-friendly coatings, Asia Pacific is the region to watch for the fastest growth in the coming years.

COVID-19 Impact Analysis on the Global Powder Coating Market

The COVID-19 pandemic threw a curveball at the global powder coating market, disrupting its steady growth trajectory. The initial months of 2020 saw a significant decline due to a triple threat: nationwide lockdowns, supply chain disruptions, and a plummeting demand across industries. Lockdowns forced manufacturing facilities to halt operations, stalling the need for powder coatings in appliances, automotive parts, and general industrial applications. Simultaneously, disrupted supply chains hampered access to raw materials, hindering powder coating production. Finally, the economic slowdown caused by the pandemic led to a drop in demand for finished goods, further impacting the powder coating market. As the pandemic progressed, the market exhibited signs of recovery. By 2021, a resurgence in manufacturing activity and a gradual return to normalcy led to a rebound in demand for powder coatings. The inherent advantages of powder coatings – their environmental friendliness, durability, and performance benefits – continued to be attractive factors for manufacturers. Additionally, government stimulus packages and a growing focus on sustainable practices further aided the market's recovery.

Latest trends/Developments

The powder coating industry is witnessing a surge in innovation focused on sustainability, efficiency, and aesthetics. A key trend is the development of low-temperature cure (LTC) powder coatings. These coatings cure at significantly lower temperatures (around 110-130°C) compared to traditional methods, enabling the coating of heat-sensitive materials and reducing energy consumption. Another exciting area is the emergence of "smart" coatings with unique functionalities. Photocatalytic coatings can absorb harmful pollutants and convert them into harmless substances under UV light, contributing to a cleaner environment. Researchers are also developing insect-repellent coatings and coatings with self-healing properties. Furthermore, the demand for visually appealing finishes is driving the creation of innovative metallic and special-effect powder coatings, catering to industries like automotive, consumer electronics, and home appliances. These advancements, along with a growing focus on environmental regulations and waste management solutions, are shaping the future of the powder coating industry.

Key Players:

-

AkzoNobel N.V.

-

Axalta Coating Systems LLC

-

PPG Industries, Inc.

-

BASF SE

-

The Sherwin-Williams Company

-

Nippon Paint Holdings Co., Ltd.

-

Kansai Paint Co., Ltd.

-

Jotun A/S

-

RPM International Inc.

Chapter 1. POWDER COATING MARKET – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. POWDER COATING MARKET – Executive Summary

2.1 Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. POWDER COATING MARKET – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. POWDER COATING MARKET - Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. POWDER COATING MARKET – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. POWDER COATING MARKET – By Coating Method

6.1 Introduction/Key Findings

6.2 Electrostatic Spray

6.3 Fluidized Bed

6.4 Y-O-Y Growth trend Analysis By Coating Method

6.5 Absolute $ Opportunity Analysis By Coating Method, 2024-2030

Chapter 7. POWDER COATING MARKET – By Application

7.1 Introduction/Key Findings

7.2 Appliances

7.3 Automotive

7.4 Furniture

7.5 Architectural

7.6 Y-O-Y Growth trend Analysis By Application

7.7 Absolute $ Opportunity Analysis By Application, 2024-2030

Chapter 8. POWDER COATING MARKET , By Geography – Market Size, Forecast, Trends & Insights

8.1 North America

8.1.1 By Country

8.1.1.1 U.S.A.

8.1.1.2 Canada

8.1.1.3 Mexico

8.1.2 By Coating Method

8.1.3 By Application

8.1.4 Countries & Segments - Market Attractiveness Analysis

8.2 Europe

8.2.1 By Country

8.2.1.1 U.K

8.2.1.2 Germany

8.2.1.3 France

8.2.1.4 Italy

8.2.1.5 Spain

8.2.1.6 Rest of Europe

8.2.2 By Coating Method

8.2.3 By Application

8.2.4 Countries & Segments - Market Attractiveness Analysis

8.3 Asia Pacific

8.3.1 By Country

8.3.1.1 China

8.3.1.2 Japan

8.3.1.3 South Korea

8.3.1.4 India

8.3.1.5 Australia & New Zealand

8.3.1.6 Rest of Asia-Pacific

8.3.2 By Coating Method

8.3.3 By Application

8.3.4 Countries & Segments - Market Attractiveness Analysis

8.4 South America

8.4.1 By Country

8.4.1.1 Brazil

8.4.1.2 Argentina

8.4.1.3 Colombia

8.4.1.4 Chile

8.4.1.5 Rest of South America

8.4.2 By Coating Method

8.4.3 By Application

8.4.4 Countries & Segments - Market Attractiveness Analysis

8.5 Middle East & Africa

8.5.1 By Country

8.5.1.1 United Arab Emirates (UAE)

8.5.1.2 Saudi Arabia

8.5.1.3 Qatar

8.5.1.4 Israel

8.5.1.5 South Africa

8.5.1.6 Nigeria

8.5.1.7 Kenya

8.5.1.8 Egypt

8.5.1.9 Rest of MEA

8.5.2 By Coating Method

8.5.3 By Application

8.5.4 Countries & Segments - Market Attractiveness Analysis

Chapter 9. POWDER COATING MARKET – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 AkzoNobel N.V.

9.2 Axalta Coating Systems LLC

9.3 PPG Industries, Inc.

9.4 BASF SE

9.5 The Sherwin-Williams Company

9.6 Nippon Paint Holdings Co., Ltd.

9.7 Kansai Paint Co., Ltd.

9.8 Jotun A/S

9.9 RPM International Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The Global Powder Coating Market was valued at USD 13.86 billion in 2023 and will grow at a CAGR of 4.2% from 2024 to 2030. The market is expected to reach USD 18.49 billion by 2030.

Advancements in powder coating technology, superior performance compared to traditional liquid coatings, and growing demand in developing economies are the reasons that are driving the market.

Based on Application it is divided into four segments- Appliances, Automotive, Furniture, Architectural

Asia-Pacific is the most dominant region for the Powder Coating Market.

AkzoNobel N.V., Axalta Coating Systems LLC, PPG Industries, Inc., BASF SE