Middle East and Africa (MEA) Poultry Feed Market Size (2024-2030)

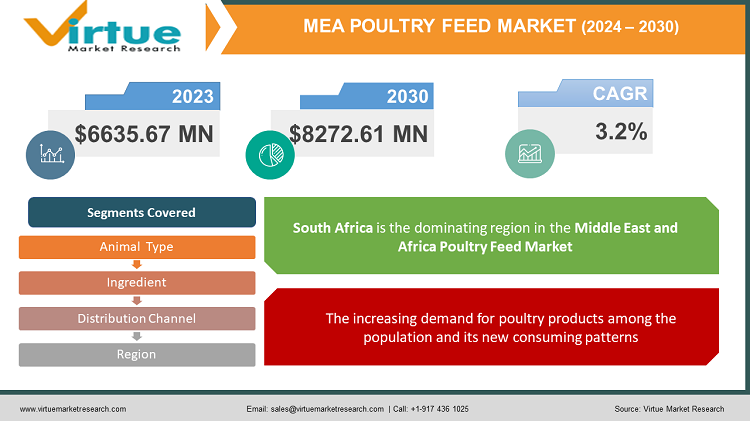

The MEA Poultry Feed Market was valued at USD 6635.67 Million in 2023. Over the forecast period of 2024-2030 it is projected to reach USD 8272.61 Million by 2030, growing at a CAGR of 3.2%.

Broiler feeds rank as the foremost category in compound feed manufacturing within the Middle East when categorized by species. In both Africa and the Middle East, broiler feeds stand out as the predominantly manufactured type of feed.

Key Market Insights:

Poultry feed encompasses the nourishment provided to poultry farms, encompassing ducks, chickens, geese, and various domestic avian species. The optimal development of poultry necessitates the provision of essential nutrients in adequate quantities and appropriate proportions. Factors such as a heightened demand for poultry meat, increased reliance on animal protein sources like eggs, and the expansion of livestock production in the Middle East are anticipated to propel the poultry feed market in the Middle East and Africa (MEA). Furthermore, the industrialization of the meat industry and the strategic expansion of global market players through local distributors within the region for the promotion of poultry feed and its additives are poised to augment market growth. Nonetheless, challenges such as the escalation in raw material costs and elevated maintenance expenses are expected to impede market expansion throughout the forecast period.

Middle East and Africa (MEA) Poultry Feed Market Drivers:

The increasing demand for poultry products among the population and itys new consuming patterns are leading to the market growth.

In recent times, the poultry industry has emerged as one of the most rapidly expanding segments within the agricultural sector. Over the past two decades, the poultry sector has undergone substantial structural transformations attributable to the introduction of modern intensive production methods, genetic advancements, enhanced preventive disease control and biosecurity measures, rising income levels, population growth, and increased urbanization. The growth of chilled and frozen poultry product retailing is supported by the emergence of supermarkets and shopping malls. Additionally, government policies play a crucial role in ensuring a competitively priced supply of poultry products, thereby fostering growth in the poultry sector. The escalating demand for convenient and high-quality chicken products is driven by an expanding working population and rising incomes. As consumers become increasingly health-conscious, there is a willingness to invest more in healthier meat products, contributing further to the overall market expansion.

Middle East and Africa Poultry Feed Market Restraints and Challenges:

Anticipated impediments to the market's expansion include elevated prices of animal nutrition products and environmental challenges affecting livestock production. However, the burgeoning technological advancements within the feed industry are poised to present opportunities for market growth in the forecasted period. It is worth noting that the presence of counterfeit products in the animal nutrition market poses a substantial challenge, potentially impacting the market significantly.

Middle East and Africa Poultry Feed Market Opportunities:

The increasing demand for poultry meat from rapidly expanding fast-food chains, including but not limited to McDonald's, KFC, Nando's, Marrybrown, and various other outlets, is propelling the growth of the poultry sector. This surge, in turn, is generating opportunities for market development.

MIDDLE EAST AND AFRICA POULTRY FEED MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

3.2% |

|

Segments Covered |

By Animal Type, Ingredient, Distribution Channel, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, UAE, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of the Middle East |

|

Key Companies Profiled |

Cagill, Incorporated, ADM, Alltech, AFGRI animal Feeds, SHV Holding, De Heus Animal Nutrition, Charoen pokphand food PCL |

Middle East and Africa Poultry Feed Market Segmentation:

Middle East and Africa Poultry Feed Market: By Animal Type:

- Layer

- Broiler

- Turkey

- Other animal types

In 2023, the most dominant segment in by animal type in the MEA poultry feed market is layer, with feeds specifically formulated for chickens engaged in laying table eggs intended for human consumption. Layer feeds typically consist of approximately 16 percent protein and an additional supply of calcium to facilitate the laying of eggs with robust shells. Laying hens typically consume between 100 and 150 grams of feed per day, equivalent to approximately 0.25 pounds.

In contrast, turkeys generally require higher protein levels, particularly during their early growth stages, with their feed containing up to 28% protein. For chickens, commonly referred to as broilers and raised for meat, protein requirements are slightly lower, ranging from 18% to 23%, depending on the growth stage.

Meat chickens, also known as broilers, are typically floor-raised on litter materials such as wood shavings, peanut shells, and rice hulls, within climate-controlled indoor housing. These facilities are equipped with ventilation systems and heaters to maintain optimal conditions. However, in intensive broiler sheds, there is a risk of air pollution from ammonia emitted by the droppings. To mitigate this, farmers may need to operate additional fans to ensure a continuous supply of clean and fresh air. Failure to do so can lead to potential damage to the chickens' eyes and respiratory systems, as well as cause painful burns on their legs.

Middle East and Africa Poultry Feed Market: By Ingredient:

- Cereal

- Oilseed Meal

- Molasses

- Fish Oil

- Fish Meal

- Supplements

- Other Ingredients

Traditional feed comprises an equivalent or, in certain instances, even greater nutritional content compared to organic feed. Typical poultry rations within conventional practices encompass a diverse range of cereals, including maize, rice, wheat, oats, and barley. Additionally, these rations incorporate various cereal byproducts such as wheat bran or rice polish, along with sources of animal and vegetable proteins like fish meal, meat meal, soybean oil meal, groundnut cake, and others, contingent upon their availability. The comprehensive feed is fortified with essential minerals and vitamins, achieved either through chemical means or by incorporating food recognized for its high content of these components. These advantages contribute to securing the predominant share during the forecasted period in the MEA poultry feed market and is also anticipated to be the fastest-growing segment.

Middle East and Africa Poultry Feed Market: By Distribution channel:

- Online

- Offline

Categorized by distribution channels, the market is segmented into offline and online channels. Currently, traditional physical channels remain the predominant choice for procuring poultry feed. However, with the expanding market for feed and a notable increase in the accessibility of poultry feed through online sales channels, it is anticipated that online sales channels will experience the most rapid growth rate during the forecast period.

Middle East and Africa Poultry Feed Market: By Region

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of Middle East and Africa

South Africa witnessed a growth of over 2%, and Namibia also reported an increase in feed tonnage in 2023. However, on a broader scale in Africa, there was a 3.86% decrease in feed tonnage. In the Middle East, there has been a substantial surge in total compound feed production, registering an increase of 24.7%, surpassing other regions. According to the Alltech report, this surge in the Middle East is attributed in part to an initiative by the Saudi Arabian government aimed at expanding broiler chicken production to fulfill the country’s self-sufficiency objectives. The total compound feed production of Saudi Arabia, another major producer in the region, stands at approximately 7 million tons, with broiler feed being the predominant type at 4.5 million tons.

Egypt holds the position of the largest producer in the region, with an estimated total compound feed production of around 6 million tons. In Egypt, broiler feed takes precedence as the most produced feed type, accounting for 2.3 million tons.

COVID-19 Pandemic: Impact Analysis

The Middle East and Africa Poultry Feed Market experienced adverse effects from the Covid-19 pandemic, significantly impeding its growth. Governments throughout the region implemented port closures, leading to disruptions in the poultry feed supply chain. The pandemic also had repercussions on the availability of raw materials essential for poultry feed preparation in affected countries. Nations relying on imports for key raw ingredients like corn and soybeans encountered substantial challenges in procurement. The closure of feed plants further exacerbated difficulties in accessing poultry feed, contributing to a decline in the consumption of poultry meat.

The poultry feed industry faced significant setbacks due to the closure of restaurants across the region. Despite these challenges, the anticipated recovery in demand for poultry feed and substantial investments by prominent manufacturers are expected to drive growth in the poultry feeds market.

Latest Trends/ Developments:

In January 2022, Nutreco officially confirmed a strategic partnership with Unga Group Plc to establish two joint ventures in East Africa, operating under the name Tunga Nutrition. This collaboration aims to enhance the provision of high-quality protein within the region, contributing to an expanded market presence in the animal nutrition sector. The establishment of Tunga Nutrition reflects a concerted effort to strengthen market share and bolster Nutreco's position in the East African animal nutrition markets.

Key Players:

These are few top players in the Middle East and Africa Poultry Feed Market: -

- Cagill, Incorporated

- ADM

- Alltech

- AFGRI animal Feeds

- SHV Holding

- De Heus Animal Nutrition

- Charoen pokphand food PCL

Chapter 1. Middle East and Africa Poultry Feed Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Poultry Feed Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysi

Chapter 3. Middle East and Africa Poultry Feed Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Poultry Feed Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Poultry Feed Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Poultry Feed Market– By Animal Type

6.1. Introduction/Key Findings

6.2. Layer

6.3. Broiler

6.4. Turkey

6.5. other animal Ingredient s

6.6. Y-O-Y Growth trend Analysis By Animal Type

6.7. Absolute $ Opportunity Analysis By Animal Type , 2024-2030

Chapter 7. Middle East and Africa Poultry Feed Market– By Ingredient

7.1. Introduction/Key Findings

7.2. cereal

7.3. oilseed meal

7.4. molasses

7.5. fish oil

7.6. fish meal

7.7. supplements

7.8. other ingredients

7.9. Y-O-Y Growth trend Analysis By Ingredient

7.10. Absolute $ Opportunity Analysis By Ingredient , 2024-2030

Chapter 8. Middle East and Africa Poultry Feed Market– By Distribution Channels

8.1. Introduction/Key Findings

8.2. Online

8.3. Offline

8.4. Y-O-Y Growth trend Analysis By Distribution Channels

8.5. Absolute $ Opportunity Analysis By Distribution Channels , 2024-2030

Chapter 9. Middle East and Africa Poultry Feed Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Animal Type

9.1.3. By Ingredient

9.1.4. Distribution Channels

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East and Africa Poultry Feed Market– Company Profiles – (Overview, Animal Type Portfolio, Financials, Strategies & Developments)

10.1. Cagill, Incorporated

10.2. ADM

10.3. Alltech

10.4. AFGRI animal Feeds

10.5. SHV Holding

10.6. De Heus Animal Nutrition

10.7. Charoen pokphand food PCL

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Poultry feed encompasses the nourishment provided to poultry farms, encompassing ducks, chickens, geese, and various domestic avian species. The optimal development of poultry necessitates the provision of essential nutrients in adequate quantities and appropriate proportions. Factors such as a heightened demand for poultry meat, increased reliance on animal protein sources like eggs, and the expansion of livestock production in the Middle East are anticipated to propel the poultry feed market in the Middle East and Africa (MEA)

The Top Players operating in the Middle East and Africa Poultry Feed Market are- Cagill, Incorporated, ADM, Alltech, AFGRI animal Feeds, SHV Holding, De Heus Animal Nutrition, Charoen pokphand food PCL.

The Middle East and Africa Poultry Feed Market experienced adverse effects from the Covid-19 pandemic, significantly impeding its growth. Governments throughout the region implemented port closures, leading to disruptions in the poultry feed supply chain

The increasing demand for poultry meat from rapidly expanding fast-food chains, including but not limited to McDonald's, KFC, Nando's, Marrybrown, and various other outlets, is propelling the growth of the poultry sector.

Egypt holds the position of the largest producer in the MEA region.