Middle East and Africa Lactoferrin Market Size (2024-2030)

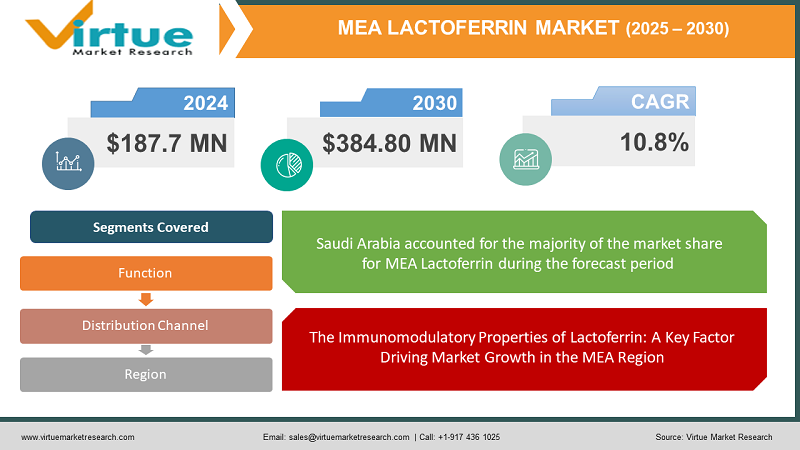

The Middle East and Africa Lactoferrin Market was valued at USD 187.7 Million in 2023 and is projected to reach a market size of USD 384.80 Million by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 10.8%.

Lactoferrin, a multifunctional glycoprotein naturally present in milk, is gaining traction in the Middle East and Africa (MEA) region. This emerging market holds immense potential, driven by growing awareness of its health benefits and a rising focus on preventive healthcare. Lactoferrin's diverse benefits, including immune system support, iron absorption enhancement, and potential anti-inflammatory and anti-bacterial properties, are attracting increasing attention from healthcare professionals and consumers alike. The MEA region boasts a rapidly growing young population. As parents become more informed about health and wellness, the demand for lactoferrin-fortified infant formula is expected to rise significantly. The region is witnessing rapid urbanization, leading to shifts in dietary patterns. Consumers are increasingly opting for processed and convenience foods, creating a potential demand for lactoferrin-fortified products for enhanced nutritional value.

Key Market Insights:

- The Middle East and Africa lactoferrin market is expected to create job opportunities for over 20,000 people by 2028, with the manufacturing and distribution sectors being the major contributors.

- The Middle East and Africa's lactoferrin market is expected to witness a surge in the demand for organic and plant-based lactoferrin products, with their market share projected to increase from 18% in 2023 to 28% by 2028.

- The category of dietary supplements held the biggest share of the lactoferrin market in the Middle East and Africa in 2023, accounting for 38% of the market.

- The growing demand for newborn formulae supplemented with lactoferrin is projected to propel the infant nutrition segment, which is predicted to develop at the highest rate of 12.4% during the forecast period.

- With 38% of the market, the dietary supplements category accounted for the largest portion of the lactoferrin market in the Middle East and Africa.

- In terms of share, the pharmaceutical sector led the Middle East and Africa lactoferrin market with a share of 32%.

- By 2028, Saudi Arabia, Egypt, and the United Arab Emirates are anticipated to generate more than half of the Middle East and Africa lactoferrin market's overall revenue.

- Due to supply chain interruptions and decreased demand from the pharmaceutical and nutraceutical industries, the COVID-19 pandemic had a mild effect on the Middle East and Africa lactoferrin market, which saw a nearly 6% decline in size in 2020.

Middle East and Africa Lactoferrin Market Drivers:

The Immunomodulatory Properties of Lactoferrin: A Key Factor Driving Market Growth in the MEA Region

One important motivator is the growing understanding of lactoferrin's ability to alter immune function and fight infections. Lactoferrin's presence in breast milk highlights its significance for infant health. Educational campaigns and healthcare professional recommendations emphasizing the importance of lactoferrin for gut health, immune development, and iron absorption in infants are driving demand for lactoferrin-fortified infant formula and other nutritional products. Emerging research exploring lactoferrin's potential benefits in areas like bone health, anaemia management, and even some cancers is sparking further interest. While more research is needed, these possibilities contribute to the growing perception of lactoferrin as a versatile health supplement.

The MEA region boasts a young population with a high birth rate. This translates to a burgeoning market for infant nutrition products.

Lactoferrin's presence in breast milk and its role in infant immune development make it a valuable ingredient in infant formula and other paediatric nutritional products. Increasing disposable incomes allow parents to invest in premium infant nutrition products perceived to offer superior health benefits. Formulations containing lactoferrin cater to this growing demand, potentially commanding a price premium. Government regulations in some MEA countries regarding infant formula composition can influence the inclusion of lactoferrin in these products. Regulatory bodies may require specific levels of essential nutrients like iron, and lactoferrin can contribute to improved iron absorption.

Middle East and Africa Lactoferrin Market Restraints and Challenges:

Consumers across the MEA region, particularly in developing economies, are often highly price-sensitive. Lactoferrin, often considered a premium ingredient, can be more expensive than other sources of iron or immune support supplements. This can limit its accessibility to a broader consumer base. Despite growing scientific evidence, awareness about lactoferrin's benefits remains relatively low compared to more established dietary supplements. Educational initiatives are needed to bridge this knowledge gap and encourage consumer adoption. The MEA region currently lacks significant lactoferrin production capabilities. This necessitates dependence on imports, which can be susceptible to price fluctuations and supply chain disruptions. Regulatory frameworks surrounding lactoferrin use as a food additive or dietary supplement can vary across MEA countries. This ambiguity can create challenges for manufacturers seeking to introduce lactoferrin-based products into the market.

Middle East and Africa Lactoferrin Market Opportunities:

Lactoferrin uniquely binds to iron, facilitating its absorption in the body. This is particularly beneficial for infants, pregnant women, and individuals with iron deficiency. Lactoferrin possesses immunomodulatory properties, potentially enhancing the immune response and helping the body fight infections. The MEA region boasts a rapidly growing young population, particularly infants. This demographic shift fuels demand for products that promote infant health and development, creating a potential market for lactoferrin-fortified formulas. Consumers in the MEA region are increasingly health-conscious, actively seeking out products that promote well-being. Lactoferrin's well-documented immune-boosting properties, ability to promote iron absorption, and potential benefits for gut health resonate with this trend. As economic development progresses across the MEA region, disposable incomes are on the rise. This empowers consumers to explore a wider variety of health and wellness products, including those containing lactoferrin. Incorporating lactoferrin into functional foods and beverages can be a way to tap into the growing health and wellness trend. Targeting specific consumer segments like athletes or health-conscious adults can be a successful strategy.

MIDDLE EAST AND AFRICA LACTOFERRIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

10.8% |

|

Segments Covered |

By Function, Distribution Channel and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Saudi Arabia, Qatar, UAE, Israel, South Africa, Nigeria, Kenya, Egypt, Rest of the Middle East |

|

Key Companies Profiled |

MILEI GmbH, Savencia SA , Ingredia SA, Glanbia Plc, Friesland Campina DOMO, Biotec Pharma, Julphar, Nestle, Danone, Abbott Laboratories |

Middle East and Africa Lactoferrin Market Segmentation:

Middle East and Africa Lactoferrin Market Segmentation: By Function:

- Immune Support

- Iron Absorption

- Antibacterial and Antiviral Properties

Immune Support (60-70%) is the dominant function driving the MEA lactoferrin market. Parents seeking to bolster their infants' developing immune systems and health-conscious individuals seeking overall immune system support are the primary target audiences for this segment. Infant formula manufacturers are major players incorporating lactoferrin for its immune-boosting properties. Increased health awareness across the MEA region is driving a focus on preventive healthcare and boosting the immune system. Consumers are receptive to products containing ingredients like lactoferrin that can potentially contribute to overall well-being and reduce the risk of infections. Infant formula manufacturers effectively leverage the immune-supporting benefits of lactoferrin in their marketing campaigns. This message resonates with parents seeking the best possible start for their babies' health.

Lactoferrin's antiviral and antibacterial qualities make it a possible game-changer in the MEA lactoferrin industry. Functional meals and drinks that provide more health advantages than just basic nourishment are becoming more and more in demand. Functional food and beverage manufacturers can leverage lactoferrin's potential gut health and immune system benefits to cater to this growing demand. Ongoing research is shedding light on the mechanisms by which lactoferrin may combat bacterial and viral infections. As this research progresses, the functional food and nutraceutical industries may see a wider range of products incorporating lactoferrin for these properties.

Middle East and Africa Lactoferrin Market Segmentation: By Distribution Channel:

- Modern Trade

- Traditional Trade

- E-commerce

Modern trade channels, encompassing supermarkets, hypermarkets, and specialty health food stores, currently reign supreme in the MEA lactoferrin market. Modern stores provide prominent shelf space for lactoferrin-containing products, allowing established brands to capture consumer attention. These stores typically offer a broader selection of lactoferrin products, catering to diverse needs and budgets. Consumers can find infant formulas, nutritional supplements, and even functional food and beverages containing lactoferrin.

E-commerce platforms are the fastest-growing distribution channel for lactoferrin products in the MEA region. Online shopping offers convenience, allowing consumers to browse and purchase lactoferrin products from the comfort of their homes. E-commerce platforms can potentially offer a broader selection of lactoferrin products compared to physical stores, providing access to niche offerings or international brands.

Middle East and Africa Lactoferrin Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

With 25.7% of the industry's total revenue, Saudi Arabia accounted for the highest portion of the lactoferrin market in the Middle East and Africa. A major factor in the need for lactoferrin has been Saudi Arabia's well-established pharmaceutical sector. Because lactoferrin has antibacterial, antioxidant, and immunomodulatory qualities, it is employed in a variety of pharmaceutical goods, such as infant formulae, medicinal meals, and supplements. The country's large population and rising healthcare expenditure have fueled the demand for lactoferrin-based products, particularly in the areas of infant nutrition and dietary supplements.

Egypt is expected to be the fastest-growing lactoferrin market in the Middle East and Africa, with a projected compound annual growth rate (CAGR) of 9.8% over the forecast period. Egypt has a large and growing population, with a significant portion being infants and young children. This demographic trend has driven the demand for lactoferrin-based infant formulas and nutritional supplements, as lactoferrin is known to support immune function and cognitive development in infants. The rising prevalence of lifestyle-related diseases, such as obesity and diabetes, has led to an increased focus on preventive healthcare and the adoption of dietary supplements in Egypt. Lactoferrin's potential benefits in regulating blood sugar levels and promoting weight management have contributed to its growing popularity in the country.

COVID-19 Impact Analysis on the Middle East and Africa Lactoferrin Market:

Global lockdowns and travel restrictions disrupted the flow of raw materials and finished lactoferrin products. This created shortages, particularly for lactoferrin sourced from established producers in Europe and North America. With the immediate focus on essential goods like food and hygiene products, consumer spending on lactoferrin-containing products, particularly non-essential supplements, witnessed a temporary decline. Lockdowns and restrictions on movement hampered the distribution of lactoferrin products, particularly through traditional trade channels in some regions. E-commerce platforms, however, experienced a surge in demand but faced logistical hurdles in ensuring timely and temperature-controlled deliveries. Scientific discourse around the potential benefits of lactoferrin for immune health gained wider public attention. Consumers, increasingly concerned about strengthening their defences against COVID-19, showed a renewed interest in lactoferrin-fortified products. The infant formula segment, a key driver of the MEA lactoferrin market, remained relatively stable. Parents continued to prioritize premium formulas containing lactoferrin for their babies' developing immune systems.

Latest Trends/ Developments:

While infant formula remains a dominant application, the focus is shifting toward incorporating lactoferrin into a wider range of functional foods and beverages. This caters to health-conscious adults seeking to boost their immune system, improve gut health, or enhance iron absorption. Manufacturers are exploring ways to mask the slightly metallic taste of lactoferrin, making it more palatable for a wider consumer base. Flavoured yogurt drinks, protein bars with various coatings, or even effervescent tablets containing lactoferrin are potential innovations. Research suggests a synergistic effect between lactoferrin and human milk oligosaccharides (HMOs), which are naturally present in breast milk. Combining these two components in infant formulas could offer a more holistic approach to supporting infant immune development. Formulas containing both HMOs and lactoferrin are likely to be positioned as premium offerings, catering to parents seeking the most advanced nutritional support for their babies. Regulatory frameworks for HMOs may vary across MEA countries. Harmonization of regulations will be crucial for the widespread adoption of HMO-lactoferrin combinations in infant formulas.

Key Players:

- MILEI GmbH

- Savencia SA

- Ingredia SA

- Glanbia Plc

- Friesland Campina DOMO

- Biotec Pharma

- Julphar

- Nestle

- Danone

- Abbott Laboratories

Chapter 1. Middle East and Africa Lactoferrin Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Lactoferrin Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Lactoferrin Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Lactoferrin Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Lactoferrin Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Lactoferrin Market– By Function

6.1. Introduction/Key Findings

6.2. Immune Support

6.3. Iron Absorption

6.4. Antibacterial and Antiviral Properties

6.5. Y-O-Y Growth trend Analysis By Function

6.6. Absolute $ Opportunity Analysis By Function , 2024-2030

Chapter 7. Middle East and Africa Lactoferrin Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Modern Trade

7.3. Traditional Trade

7.4. E-commerce

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Middle East and Africa Lactoferrin Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Function

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Lactoferrin Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 MILEI GmbH

9.2. Savencia SA

9.3. Ingredia SA

9.4. Glanbia Plc

9.5. Friesland Campina DOMO

9.6. Biotec Pharma

9.7. Julphar

9.8. Nestle

9.9. Danone

9.10. Abbott Laboratories

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

Consumers in the MEA region are increasingly health-conscious and actively seeking out products that promote well-being. Lactoferrin's well-documented immune-boosting properties, ability to promote iron absorption, and potential benefits for gut health resonate with this trend

Global lactoferrin prices can fluctuate depending on factors like raw material availability and production costs. This can impact the affordability of lactoferrin-fortified products for consumers in the MEA region

MILEI GmbH, Savencia SA, Ingredia SA, Glanbia Plc, Friesland

Campina DOMO, Biotec Pharma, Julphar, Nestle, Danone, Abbott

Laboratories,

With 25.7% of the industry's total revenue, Saudi Arabia accounted for the highest portion of the lactoferrin market in the Middle East and Africa. A major factor in the need for

Egypt is expected to be the fastest-growing lactoferrin market in the Middle East and Africa, with a projected compound annual growth rate (CAGR) of 9.8% over the forecast period.