Lactoferrin Market Size (2024-2030)

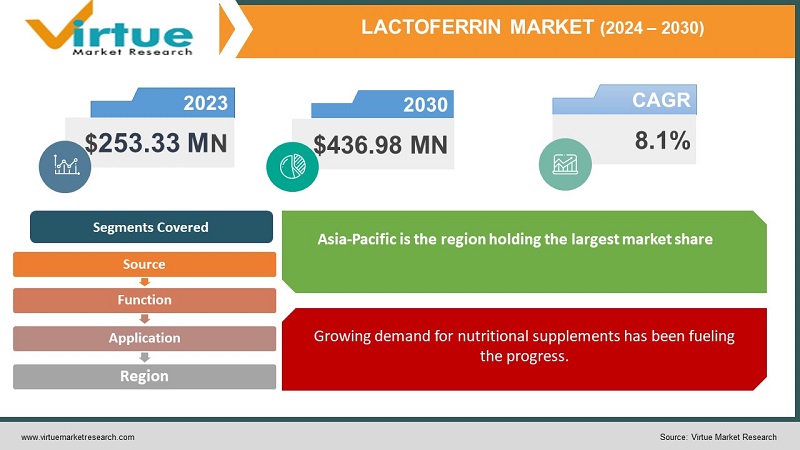

The global lactoferrin market was valued at USD 253.33 million in 2023 and is projected to reach a market size of USD 436.98 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.1%.

Lactoferrin is a member of the transferrin family and a glycoprotein, which is a class of proteins with sugars. It is essential for several biological functions, including immune system function and iron metabolism in particular. Human and cow's milk, as well as other body fluids like saliva and tears, contain lactoferrin. This market has had a considerable presence in the past because of its various properties, which made it an important supplement in the pharmaceutical industry. Presently, with its growing demand for various dietary supplements, this industry has expanded significantly. In the future, with extensive research and developmental activities along with other medical applications, notable growth is anticipated.

Key Market Insights:

A glass of cow's milk contains roughly 25–75 mg of lactoferrin.

Human colostrum has a lactoferrin content of 5-7 mg/mL.

By 2025, the amount of lactoferrin consumed in the United States is expected to have increased to 111.8 metric tons.

Sales of lactoferrin are predicted to increase by 2028 at a compound annual rate of 12.6%, reaching $1.46 billion.

Over 7.2 grams of lactoferrin taken daily may raise the chance of adverse effects, according to WebMD. Therefore, it is essential to have proper awareness of consumption and dosage. Companies and several other social organizations have been working towards spreading the right education and guidelines to avoid any potential risk.

Lactoferrin Market Drivers:

Growing demand for nutritional supplements has been fueling the progress.

Lactoferrin is one such compound that has been associated with many health benefits. Studies have indicated lactoferrin's ability to keep off viral illnesses such as the flu, herpes, gastroenteritis, and the common cold. Lactoferrin is known to do this by inhibiting viruses from attaching to the cells and thereby preventing replication. Additionally, it uses the same mechanism to prevent bacterial infections. A few studies have shown its assistance in preventing a few infections caused by certain bacteria. Secondly, although research on the bone-building advantages of lactoferrin is limited, a preliminary study shows that lactoferrin may assist in avoiding osteoporosis. Through cell signaling, it is known to reduce the symptoms of osteoporosis. The method by which cells interact with one another and the environment is called cell signaling. Cell signaling includes cells producing and receiving hormones and other signaling chemicals. Thirdly, it also regulates the amount of iron that is absorbed into the intestine. Furthermore, lactoferrin is an important compound for infants. According to clinical investigations, adding bovine lactoferrin to infant formula or taking it as a supplement may lower the risk of infections. This might aid in the growth of developing organs. High levels in newborns, particularly those born before full term, may support the immune development and general health of the child. It can also help with the maturation of the digestive system in babies. In general, it is believed to possess antiviral, antibacterial, and antioxidant qualities when taken as a supplement. This enhances the immunity of an individual, making this an attractive option.

The advantages of lactoferrin for skin have been aiding the growth globally.

By strengthening the early inflammatory phase of wound healing, the iron-binding glycoprotein lactoferrin, which is produced in bodily fluids by glandular epithelial cells, aids in the healing of skin wounds. Additionally, lactoferrin has anti-inflammatory properties that balance out an overactive immune response. This can support a decrease in redness and swelling, creating skin comfort. Few studies have indicated that individuals who consumed milk rich in lactoferrin were known to be less prone to skin issues like acne, psoriasis, and diabetic ulcerations. But more scientific evidence is required for this benefit. Lactoferrin was known to reduce the sebum content by a significant amount. This sebum is usually responsible for oily skin, which can lead to increased skin issues like acne. Moreover, this is associated with antioxidant properties that help with the neutralization of free radicals. This helps in achieving a healthy skin look and is known to reduce premature aging.

Lactoferrin Market Restraints and Challenges:

High production costs, the possibility of allergens, and regulatory challenges are the main issues that the market is currently facing.

Even though this compound has a lot of advantages, the extraction, purification, and other involved processes can be very complex, requiring special expertise and technology. This can create a lot of expenses that can drain the firm financially. Secondly, few individuals have reported side effects due to consumption that include nausea, sickness, and dizziness. This may be due to various allergens if it is derived from animals like cows. It is essential to follow clean transparency because many people who are lactose intolerant are prone to adverse effects. Apart from this, there are different rules in each country regarding the use of various applications. This can create hurdles for quality checks and meeting the various guidelines regarding certifications and other approvals.

Lactoferrin Market Opportunities:

Over the years, there has been a change in the standard of living. This includes the consumption of junk food regularly, changing environmental factors, and increased exposure to radiation. This has elevated the chances of chronic illnesses. Various statistics and surveys have revealed a drastic rise in various diseases at a young age. This has resulted in an increased health consciousness. People have become more aware of what they consume and have started to incline towards the consumption of functional ingredients and healthy food. This has created numerous possibilities for the market as the demand for nutritional supplements has been on the rise by incorporating lactoferrin in various foods, beverages, probiotics, etc. These health and wellness trends have augmented sales, resulting in greater revenue generation. R&D activities have been facilitating the expansion. By investing in research studies and lab experiments, human understanding of medical uses can be broadened. The growth of e-commerce has been beneficial. Through this channel, a broader consumer base is achieved. Besides, people have the option of selecting from a wide range of choices.

LACTOFERRIN MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

8.1% |

|

Segments Covered |

By Source, function, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

Fonterra Co-operative Group Limited, Glanbia plc, APS BioGroup, Synlait Milk Limited, MP Biomedicals, Tatura Milk Industries Ltd., Farbest Brands, Milei GmbH, InVitria, Hilmar Cheese Company |

Lactoferrin Market Segmentation:

Lactoferrin Market Segmentation: By Source:

- Human Milk

- Animal Milk

- Others

Based on the source, human milk is the largest segment, with a share of around 62% in 2023. Females produce breast milk after they give birth. Lactoferrin is one of the major proteins found in breast milk. This protein is the reason why most of the iron is absorbed. Apart from this, it ensures the overall growth of babies and provides them with the necessary strength due to its associated nutritional profile. This helps with fighting infections, be they bacterial, viral, or fungal. Animal milk is the fastest-growing segment. It functions as a natural defense system, lowering the possibility of microbial contamination and enhancing the well-being of the milk and the mammary gland. Lactoferrin has a role in facilitating tissue repair and wound healing. This may be advantageous for preserving the mammary gland's health and the general well-being of the nursing animals. It also helps with the growth of healthy gut bacteria, which benefits gastrointestinal health.

Lactoferrin Market Segmentation: By Function:

- Iron Absorption

- Anti-inflammatory

- Intestinal Flora Protection

- Antibacterial

- Immune Cell Stimulation

- Antioxidant

Iron absorption is the largest segment, with a share of around 30% in 2023. Iron is essential for a healthy, functioning system. Lactoferrin is known for its iron-binding properties. This helps with the essential absorption of iron, which improves the production of hemoglobin. The protein found in red blood cells, called hemoglobin, transports oxygen from the lungs to every area of the body. Hence, this is a very important protein required for the growth and development of our body. The antibacterial category is the fastest-growing. Free iron is essential for the growth of bacteria. Lactoferrin helps with the removal of free iron from the body. This inhibits the growth and replication of bacteria, protecting the body against various infections.

Lactoferrin Market Segmentation: By Application:

- Food and Beverages

- Infant Formula

- Sports and Functional Foods

- Pharmaceuticals

- Personal Care Products

- Animal Feed

In 2023, based on application, infant formula is the most dominant category, holding a share of around 38%. Lactoferrin is an important protein found in human and animal milk. This is essential for the baby to develop a good and strong immune system. It helps with the development of organs and the transportation of iron. It provides strength to the bones and overall body. Hence, it is very vital for the overall growth of the baby. The segment growing at the fastest rate is personal care products. Various studies have implied the advantages of lactoferrin in beauty and wellness products. It is known to reduce acne and skin inflammation, resulting in glowing skin. This is done by binding with iron and inhibiting lipid secretion, which consequently promotes healthy skin.

Lactoferrin Market Segmentation: Regional Analysis:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

Based on region, Asia-Pacific is the region holding the largest market share of roughly 35% in 2023. Countries like India, Japan, China, and South Korea are at the forefront. The primary reason for this is increasing health awareness. Lactoferrin has had significant importance in many Asian countries, and many people know about its advantages. As such, a greater percentage of the population tends to buy supplements and other products that contain lactoferrin. Besides, infant formula forms a major part of this success. Lactoferrin, found in breast milk, is added to infant formulas due to its benefits. This practice has been prevalent for a long time, making this region a dominant one in this market. Urbanization has played a crucial role as well. Due to increasing disposable income and the rising middle class, more people have started to buy various nutraceuticals and other health-related products. Furthermore, a lot of major players are involved in this industry, which has a global presence. A few of them are Synlait Milk Limited, Morinaga Milk Industry Co., Ltd, Westland Milk Products, and Tatua Co-operative Dairy Company Ltd. A lot of dairy products that have lactoferrin are regularly launched, creating more sales. However, North America is the fastest-growing region, with an approximate share of 25%. Countries like the United States and Canada are at the top. There is a rise in the availability of this product in this area. Food and beverage products that contain lactoferrin are easily accessible through various supermarkets, hypermarkets, online retail, and other specialty stores. This accessibility has facilitated the creation of a greater customer base. This area has a good presence in the pharmaceutical sector. As such, more emphasis is being placed on these substances, which have the potential to cure many illnesses. Many R&D activities are being conducted by various prestigious universities and companies to support this cause. Investments are being increased in this area to help with this. Furthermore, consumer awareness has seen an upsurge. This has helped a greater number of people who are willing to try various supplements and functional ingredients.

COVID-19 Impact Analysis on the Global Lactoferrin Market:

The outbreak of the virus had a positive impact on the market. The pandemic highlighted the importance of having good physical and mental health. People started to cut down on their unhealthy food intake and relied on the incorporation of healthy foods and supplements. Lactoferrin experienced demand due to its anti-viral, anti-bacterial, and anti-inflammatory properties that enhanced the overall health of an individual. Besides, there was a lot of prominence given to research and developmental activities regarding healthcare applications. According to a report by Evaluate Pharma, 11 major pharmaceutical companies experienced an 11% increase in their total R&D spending during the pandemic. Several studies were conducted that proposed using lactoferrin for prevention, treatment, and recovery from the coronavirus. This was widely proposed as an anti-viral agent and a booster for increasing immunity. Post-pandemic, the market has continued to grow owing to increased awareness and demand.

Latest Trends/ Developments:

The organizations operating in this market are driven to attain a greater market share through the use of various tactics, including collaborations, acquisitions, and investments. Businesses are also investing a lot of money in research activities. This has led to an even greater enlargement.

The incorporation of lactoferrin in various beverages like yogurt, skimmed milk, milk mixes, flavored fermented milk, and other dairy drinks has been on the rise. This go-to drink is enriched with various proteins and supplements and has become a convenient option for many people because of their busy schedules.

Key Players:

- Fonterra Co-operative Group Limited

- Glanbia plc

- APS BioGroup

- Synlait Milk Limited

- MP Biomedicals

- Tatura Milk Industries Ltd.

- Farbest Brands

- Milei GmbH

- InVitria

- Hilmar Cheese Company

- In March 2023, the animal-free lactoferrin LF+ was introduced by the Singaporean biotech business TurtleTree. It is manufactured using precision fermentation. LF+ is the first lactoferrin in the world, according to the business. The company envisions a healthier food future where more people than ever may enhance their nutrition sustainably by gaining access to one of the most potent and versatile proteins found in milk.

- In March 2023, to help fulfill the increasing demand in the early life and adult nutrition sectors worldwide, FrieslandCampina Ingredients, a leading manufacturer of proteins and prebiotics, announced the launch of its new lactoferrin production plant in Veghel, the Netherlands. The company's annual capacity is increased by the facility from 20 metric tonnes to 80 metric tonnes. The facility has brand-new equipment that is specially made to guarantee the purity and quality of the company's lactoferrin while also adhering to the most recent ecological regulations.

- In August 2022, a novel baby formula containing lactoferrin was introduced by the Chinese dairy manufacturer Junlebao Dairy Group. Quan Zhen Ai, the formula, has 660 mg of lactoferrin per liter of milk. This is within the range of lactoferrin present in mature breast milk. This new launch is said to contain the highest lactoferrin content in the market.

Chapter 1. GLOBAL LACTOFERRIN MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL LACTOFERRIN MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL LACTOFERRIN MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL LACTOFERRIN MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL LACTOFERRIN MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL LACTOFERRIN MARKET– BY SOURCE

6.1. Introduction/Key Findings

6.2. Human Milk

6.3. Animal Milk

6.4. Others

6.5. Y-O-Y Growth trend Analysis By Source

6.6. Absolute $ Opportunity Analysis By Source , 2024-2030

Chapter 7. GLOBAL LACTOFERRIN MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Food and Beverages

7.3. Infant Formula

7.4. Sports and Functional Foods

7.5. Pharmaceuticals

7.6. Personal Care Products

7.7. Animal Feed

7.8. Y-O-Y Growth trend Analysis By APPLICATION

7.9. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL LACTOFERRIN MARKET– BY Function

8.1. Introduction/Key Findings

8.2. Iron Absorption

8.3. Anti-inflammatory

8.4. Intestinal Flora Protection

8.5. Antibacterial

8.6. Immune Cell Stimulation

8.7. Antioxidant

8.8. Y-O-Y Growth trend Analysis Function

8.9. Absolute $ Opportunity Analysis Function , 2024-2030

Chapter 9. GLOBAL LACTOFERRIN MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By APPLICATION

9.1.3. By Source

9.1.4. By Function

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By APPLICATION

9.2.3. By Function

9.2.4. By Source

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.2. By Country

9.3.2.2. China

9.3.2.2. Japan

9.3.2.3. South Korea

9.3.2.4. India

9.3.2.5. Australia & New Zealand

9.3.2.6. Rest of Asia-Pacific

9.3.2. By APPLICATION

9.3.3. By Source

9.3.4. By Function

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.3. By Country

9.4.3.3. Brazil

9.4.3.2. Argentina

9.4.3.3. Colombia

9.4.3.4. Chile

9.4.3.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Source

9.4.4. By Function

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.4. By Country

9.5.4.4. United Arab Emirates (UAE)

9.5.4.2. Saudi Arabia

9.5.4.3. Qatar

9.5.4.4. Israel

9.5.4.5. South Africa

9.5.4.6. Nigeria

9.5.4.7. Kenya

9.5.4.8. Egypt

9.5.4.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Source

9.5.4. By Function

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL LACTOFERRIN MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 Fonterra Co-operative Group Limited

10.2. Glanbia plc

10.3. APS BioGroup

10.4. Synlait Milk Limited

10.5. MP Biomedicals

10.6. Tatura Milk Industries Ltd.

10.7. Farbest Brands

10.8. Milei GmbH

10.9. InVitria

10.10. Hilmar Cheese Company

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

The global lactoferrin market was valued at USD 253.33 million in 2023 and is projected to reach a market size of USD 436.98 million by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 8.1%.

Growing demand for nutritional supplements and the advantages of lactoferrin for skin are the main factors propelling the Global Lactoferrin Market.

Based on Application, the Global Lactoferrin Market is segmented into Food and Beverages, Infant Formula, Sports and Functional Foods, Pharmaceuticals, Personal Care Products, and Animal Feed.

Asia-Pacific is the most dominant region for the Global Lactoferrin Market.

Fonterra Co-operative Group Limited, Glanbia plc, and APS BioGroup are the key players operating in the Global Lactoferrin Market.