Middle East and Africa Food Packaging Market Size (2024-2030)

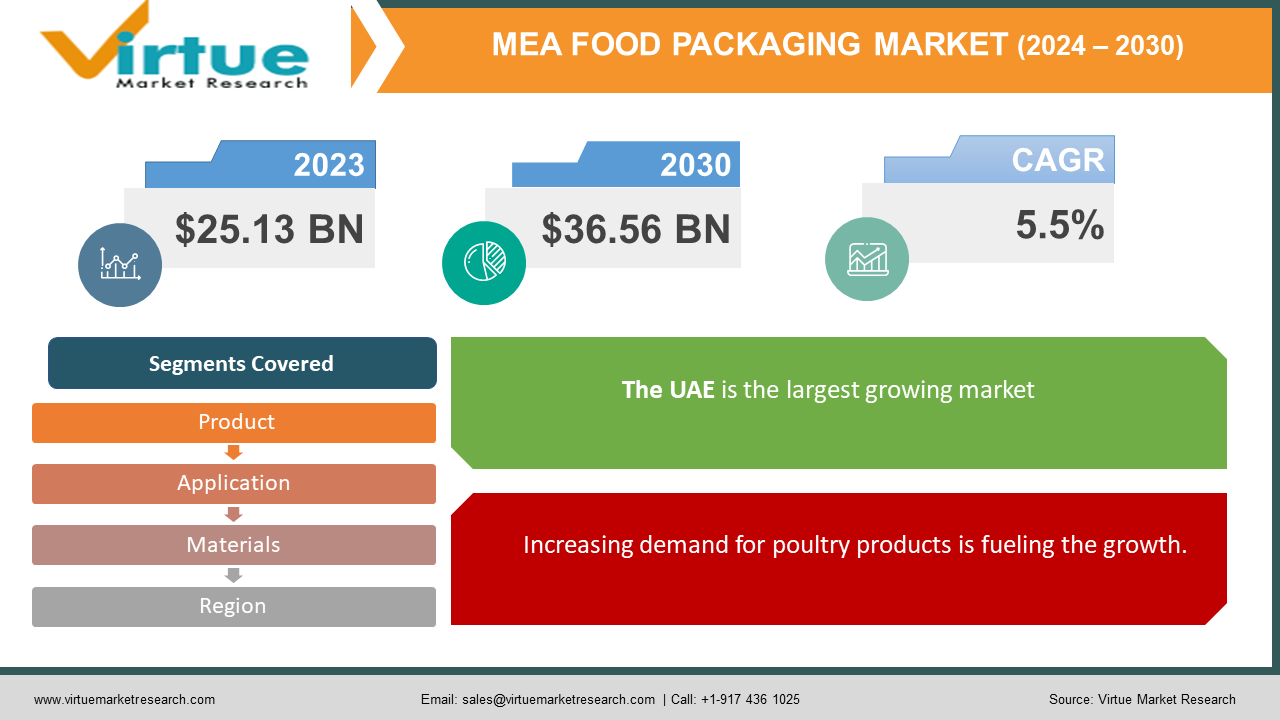

In 2023, the Middle East and African food packaging market reached a valuation of USD 25.13 billion. Projections indicate that by the conclusion of 2030, it is poised to expand to USD 36.56 billion. Throughout the forecast period from 2024 to 2030, the market is expected to register a compound annual growth rate (CAGR) of 5.5%.

A food packaging system guards against contamination, deterioration, and damage to food while it's being transported, stored, or sold. It's a sophisticated system designed to get food ready for consumption, distribute it to customers securely, and provide them with nutritional information. The market for food packaging has seen tremendous growth over the years. In the past, this market had a notable presence due to demand and need. Presently, the industry is focusing on recyclable and barrier properties to retain freshness. In the future, with a growing focus on technological advancements and customization, a significant augmentation is anticipated.

Key Market Insights:

The packaging industry is working towards 100% recyclable, reusable, or biodegradable packaging in the future, especially in the food packaging sector. In food service packaging, businesses are putting more and more emphasis on recycling and environmentally friendly options. For goods like wine, pet food, and protein powders, environmentally friendly alternatives like paper bottles produced from recycled newspapers and corrugated cardboard are becoming more and more popular. Furthermore, eco-friendly packaging options include insulated packaging produced by Temperpack and other businesses using jute and recycled hessian bag material. This focus on sustainability saves natural resources in addition to safeguarding public health and the environment. Growing disposable incomes and urbanization in the Middle East and North Africa are driving up demand for poultry products, which in turn is driving up the need for sustainable packaging.

Middle East and Africa Food Packaging Market Drivers:

Increasing demand for poultry products is fueling the growth.

The growing demand for poultry products, particularly eggs, is driving the growth of the fresh food packaging market in the Middle East and Africa (MEA). This boom is being driven by increased domestic production of eggs as a result of the rising demand for them. Market expansion is supported by the fact that customers in Middle Eastern countries continue to favor chicken meat as their protein source, regardless of their economic status. Demand for domestic chicken products is also being driven by customers' high discretionary expenditures and a growing belief that the meat complies with Halal regulations. Additionally, the demand for fresh food items is rising due to the fast-developing tourist industry in nations like the United Arab Emirates, which is also propelling the growth of the fresh food packaging market in the area.

Economic growth has been facilitating the expansion.

Africa's and the Middle East's economies have grown considerably throughout the years. Urbanization has led to an increase in income for the middle class. As a result, dine-in and takeout have increased. People have more options since there are more lodging options, eateries, and other dining places. Furthermore, a larger percentage of people are willing to try new foods. The benefits of online retail are substantial. As a result, product packaging is currently in high demand.

Middle East and Africa Food Packaging Market Restraints and Challenges:

Challenges due to environmental concerns surrounding packaging waste are a concern.

The MEA food packaging market encounters obstacles due to environmental worries regarding packaging waste, notably plastics. Concerns about environmental sustainability and waste management have escalated, with the accumulation of packaging waste in landfills posing significant environmental challenges. Addressing these issues is vital for fostering the growth of the MEA food packaging market in a sustainable manner.

Complexities are faced in the growth of the food packaging market due to a lack of cold chain infrastructure.

The development of the food packaging sector is hampered in some parts of the Middle East and Africa by a lackluster cold chain infrastructure. Well-established cold chain networks are essential for the efficient delivery and storage of food goods, but their absence might impede market development. For the food packaging business in the area to reach its full potential, this infrastructural gap must be closed.

Challenges to maintaining the guidelines from packaging to storing.

Guidelines on food packaging and materials in contact with food can limit the development of the food packaging market in the short term. Compliance with stringent regulations and standards may pose challenges for manufacturers and impact innovation and product development.

Middle East and Africa Food Packaging Opportunities:

Online retail has been providing the market with numerous opportunities.

The growing e-commerce and online grocery trends present significant opportunities for the food packaging market. With the increasing popularity of online shopping and the rise of e-commerce platforms, there is a growing demand for proper packaging to ensure the safe and efficient delivery of food products. Online grocery platforms offer consumers a convenient avenue to purchase food items, and effective packaging solutions play a crucial role in maintaining product quality and freshness during transportation. As e-commerce continues to expand, the food packaging industry has the opportunity to innovate and develop packaging solutions tailored to the needs of online retailers and consumers, driving further growth and development in the market.

Increasing awareness and concerns about environmental sustainability are driving the demand for sustainable packaging solutions.

The demand for sustainable packaging solutions is on the rise, driven by increasing awareness and concerns about environmental sustainability. This presents manufacturers with opportunities to develop and offer eco-friendly packaging options. By investing in sustainable packaging materials and technologies, companies can meet the growing demand from environmentally conscious consumers. Embracing sustainability not only aligns with consumer preferences but also demonstrates corporate responsibility, ultimately leading to long-term growth and success in the market.

MIDDLE EAST AND AFRICA FOOD PACKAGING MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

5.5% |

|

Segments Covered |

By Product, PRODUCT, APPLICATION, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Iran, UAE, Qatar, Oman, Iraq, Bahrain, Kuwait, Rest of Middle East |

|

Key Companies Profiled |

Mondi Group, Crown Holdings Inc, DS Smith Plc, Amcor plc, Berry Global Inc., Orora Ltd, Owens-Illinois Inc., Ardagh Group S.A., Ball Corporation, International Paper Co., Sealed Air Corp |

Middle East and Africa Food Packaging Market Segmentation:

Middle East and Africa Food Packaging Market Segmentation: By Materials:

- Glass

- Metal

- Paper & Paperboard

- Wood

- Plastics

The plastic segment stands out as the largest and fastest-growing category based on its material properties. Plastic's characteristics, such as its lightweight nature, affordability, durability, and versatility, make it highly favored among consumers worldwide. These attributes enable easy handling, lower production expenses, and improved product safeguarding, which consequently fuel its extensive utilization across numerous industries, including packaging.

Because paper and paperboard are increasingly being used to package a variety of food products, including fruits, vegetables, and drinks, they also control a sizable portion of the fresh food packaging industry. This market is expected to increase significantly throughout the forecast period due to the widespread use of boards and paper as environmentally friendly packaging options. Paper and paperboard materials are used because of their adaptability and eco-friendliness. They also support environmental sustainability objectives by preserving product freshness. The glass segment is witnessing significant growth due to its ability to provide prolonged protection to food products compared to other packaging materials. Glass packaging offers superior barrier properties, ensuring the freshness and quality of food products over an extended period. Its inert nature prevents interactions with the contents, making it suitable for various food and beverage applications.

Middle East and Africa Food Packaging Market Segmentation: By Product

- Rigid

- Semi-Rigid

- Flexible

The largest and fastest-expanding product category is flexible packaging, which is predicted to continue to have strong demand because of technological breakthroughs and creative product packaging solutions. Manufacturers can develop flexible packaging materials with enhanced sustainability, convenience, and utility as technology advances. Because of its adaptability, flexible packaging is favored by a wide range of sectors, which guarantees its continued demand in the market.

Middle East and Africa Food Packaging Market Segmentation: By Application

- Fruits & Vegetables

- Bakery & Confectionery

- Dairy Products

- Meat

- Poultry & Seafood

- Sauces

- Dressings and Condiments

- Others

The application that is most dominant is bakeries and confections in the Middle East and African food packaging markets. To extend their shelf life, high-moisture-barrier packaging is frequently required. Flexible packaging is becoming more common for a variety of applications because of its advantages over paper tins and cartons, including printability, low cost, and lightweight design. Moreover, the investigation revealed a positive association between the growth of the confectionery product sector and its packaging. Owing to shrinking properties and consumer preferences for smaller pack sizes, the food packaging industry's dairy products market is predicted to grow at the fastest rate. It is expected that producers would employ visually striking packaging strategies to expedite this increase. The rising demand for dairy products like yogurt and ice cream is also anticipated to have a significant effect on the market's expansion. Meat and poultry products also make up a sizable portion of the industry. This can be explained by the Middle East and North Africa's ongoing rise in demand for chicken products. The MEA is changing as a result of customers' increasing need for easy-to-use, sanitary packaging options when buying meat and poultry.

Middle East and Africa Food Packaging Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- The rest of MEA

The UAE is the largest growing market in the Middle East and African food packaging markets. This is due to the widespread consumption of canned beverages and processed foods, as well as the increasing demand for sustainable products in the region. This is also attributed to high disposable incomes and rapid growth in the tourism sector. Due to a variety of factors, including shifting consumer preferences, a rise in the number of foreign immigrants, and government campaigns to raise awareness of food safety and hygiene regulations, Saudi Arabia's food packaging industry is expanding at the fastest rate. The nation's sophisticated grocery stores, hypermarkets, and internet shopping portals have raised demand for packaged items and creative packaging designs.

COVID-19 Impact Analysis on the Middle East and Africa Food Packaging Market:

The COVID-19 pandemic has had a positive impact on overall market growth, driven by increased investments by manufacturers in flexible packaging production, particularly for fast-moving consumer goods like food & beverages. Additionally, the growing preference among millennials for fast food and convenience products has led to a rise in the adoption of flexible packaging formats such as small bags and pouches. Furthermore, in line with sustainable development goals, there has been a surge in the adoption of paper-based flexible packaging products, further driving market expansion.

Latest Trends/ Developments:

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Businesses are spending a lot of money to develop techniques to retain competitive pricing. Further growth has resulted from this.

Key Players:

- Mondi Group

- Crown Holdings Inc

- DS Smith Plc

- Amcor plc

- Berry Global Inc.

- Orora Ltd

- Owens-Illinois Inc.

- Ardagh Group S.A.

- Ball Corporation

- International Paper Co.

- Sealed Air Corp

Chapter 1. Middle East and Africa Food Packaging Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Food Packaging Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Food Packaging Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Food Packaging Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Food Packaging Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Food Packaging Market– By Product

6.1. Introduction/Key Findings

6.2. Rigid

6.3. Semi-Rigid

6.4. Flexible

6.5. Y-O-Y Growth trend Analysis By Product

6.6. Absolute $ Opportunity Analysis By Product, 2024-2030

Chapter 7. Middle East and Africa Food Packaging Market– By Application

7.1. Introduction/Key Findings

7.2. Fruits & Vegetables

7.3. Bakery & Confectionery

7.4. Dairy Products

7.5. Meat

7.6. Poultry & Seafood

7.7. Sauces

7.8. Dressings and Condiments

7.9. Others

7.10. Y-O-Y Growth trend Analysis By Application

7.11. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Middle East and Africa Food Packaging Market– By Materials

8.1. Introduction/Key Findings

8.2. Glass

8.3. Metal

8.4. Paper & Paperboard

8.5. Wood

8.6. Plastics

8.7. Y-O-Y Growth trend Analysis By Materials

8.8. Absolute $ Opportunity Analysis By Materials , 2024-2030

Chapter 9 . Middle East and Africa Food Packaging Market, By Geography – Market Size, Forecast, Trends & Insights

9 .1. Middle East and Africa

9 .1.1. By Country

9 .1.1.1. Saudi Arabia

9 .1.1.2. Qatar

9 .1.1.3. UAE

9 .1.1.4. Israel

9 .1.1.5. South Africa

9 .1.1.6. Nigeria

9 .1.1.7. Kenya

9 .1.1.9 . Egypt

9 .1.1.9 . Rest of the Middle East

9.1.2. By Product

9.1.3. By application

9.1.4. Materials

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Middle East and Africa Food Packaging Market– Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

10.1. Mondi Group

10.2. Crown Holdings Inc

10.3. DS Smith Plc

10.4. Amcor plc

10.5. Berry Global Inc.

10.6. Orora Ltd

10.7. Owens-Illinois Inc.

10.8. Ardagh Group S.A.

10.9. Ball Corporation

10.10. International Paper Co.

10.11. Sealed Air Corp

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

In 2023, the Middle East and African food packaging market reached a valuation of USD 25.13 billion. Projections indicate that by the conclusion of 2030, it is poised to expand to USD 36.56 billion. Throughout the forecast period from 2024 to 2030, the market is expected to register a compound annual growth rate (CAGR) of 5.5%.

Increased demand for poultry products and economic growth are propelling the Middle Eastern and African food packaging markets

Based on product, the Middle East and Africa food packaging market is segmented into rigid, semi-rigid, and flexible

The United Arab Emirates is the most dominant region for the Middle East and African food packaging markets

Mondi Group, Crown Holdings Inc., DS Smith Plc, Amcor Plc, Berry Global Inc., Orora Ltd., Owens-Illinois Inc., Ardagh Group S.A., Ball Corporation, International Paper Co., and Sealed Air Corp. are the key players operating in the Middle East and Africa food packaging market