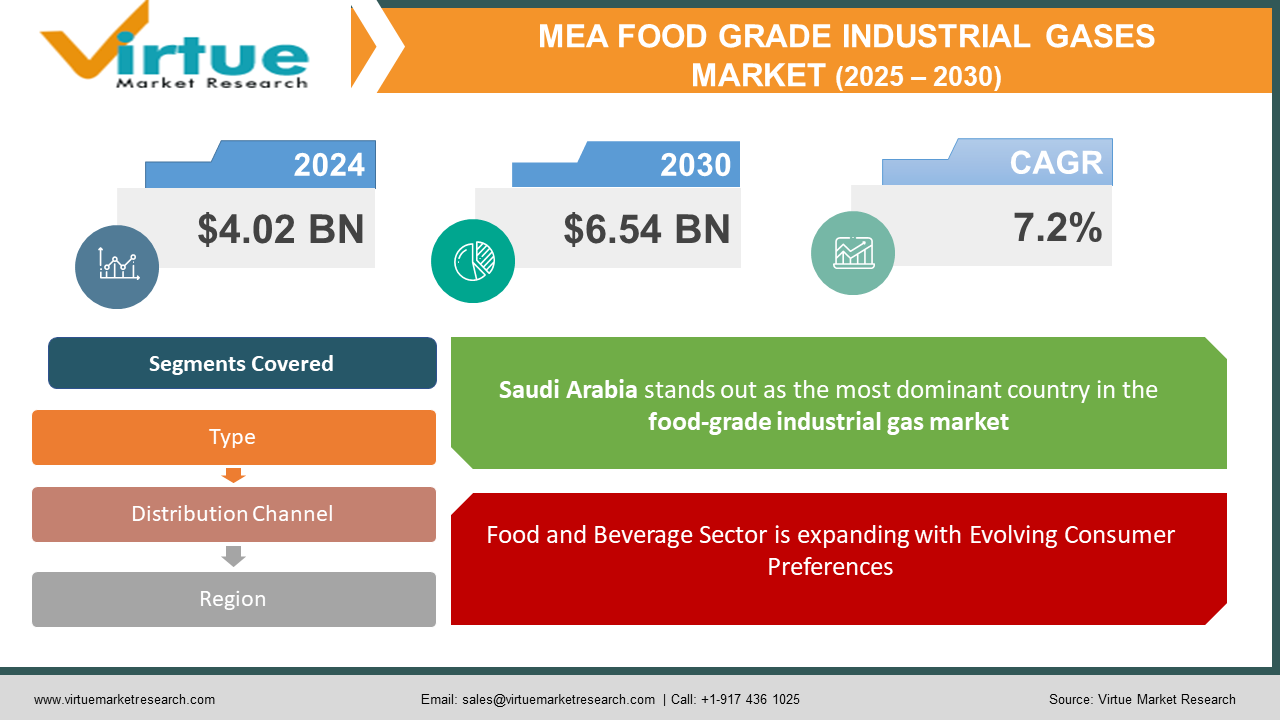

Middle East and Africa Food Grade Industrial Gases Market Size (2024-2030)

The Middle East and Africa Food Grade Industrial Gases Market was valued at USD 4.02 Billion in 2023 and is projected to reach a market size of USD 6.54 Billion by the end of 2030. Over the forecast period of 2024-2030, the market is projected to grow at a CAGR of 7.2%.

The Middle East and Africa (MEA) food-grade industrial gases market is an essential yet often overlooked segment of the industrial gas industry. These gases are critical in ensuring food safety, extending shelf life, and enhancing the overall quality of food products consumed across the region. Consumers across the MEA region are increasingly concerned about food safety and hygiene. Food-grade industrial gases like carbon dioxide (CO2) and nitrogen (N2) are crucial for processes like modified atmosphere packaging (MAP) and inerting, which prevent spoilage and microbial growth, extending the shelf life of food products. The food processing sector in the MEA region is witnessing significant growth, fueled by urbanization, rising disposable incomes, and a growing demand for convenient and packaged food items. This translates to a heightened demand for food-grade industrial gases used in various stages of food processing.

Key Market Insights:

- With about 45% of the Middle East and Africa Food Grade Industrial Gases Market, nitrogen had the largest market share of any gas type.

- With a 32% market share, carbon dioxide is predicted to rise at a 10.2% annual rate. The segment's extensive use of carbonated drinks and packaging for changed atmospheres is what will be responsible for this expansion.

- The United Arab Emirates emerged as the primary contributor to the Middle East and African Food Grade Industrial Gases market, with a market share of 18%.

- Due to the growing demand for modified atmosphere packaging in the meat and poultry industry, the segment that accounted for 15% of the market share is predicted to grow at a compound annual growth rate (CAGR) of 11.2% throughout the projected period.

- The food processing sector in South Africa is predicted to propel the market, which was valued at $180 million, to rise at a growth rate of 10.8%.

- The growing need for large-scale food processing applications is predicted to propel the bulk category, which held a 38% market share in 2023, to a CAGR of 12.4% throughout the forecast period.

Middle East and Africa Food Grade Industrial Gases Market Drivers:

Across the MEA region, the Food and Beverage Sector is expanding with Evolving Consumer Preferences

As disposable incomes increase across the region, consumers have more money to spend on packaged and processed food items. This fuels the demand for convenient and ready-to-eat options with longer shelf lives. The rapid pace of urbanization in the MEA region is leading to busier lifestyles. Consumers are increasingly seeking convenient food options that can be easily prepared or consumed on the go. Packaged and processed foods often rely on food-grade industrial gases for preservation and extended shelf life. Consumer preferences in the MEA region are evolving. There's a growing interest in healthy and convenient food options, with a rise in demand for minimally processed, fresh-like packaged foods. Food-grade industrial gases can play a vital role in Modified Atmosphere Packaging (MAP) and Controlled Atmosphere Packaging (CAP) techniques, which preserve freshness and inhibit the growth of bacteria. The growing popularity of convenience foods like frozen meals, pre-cut vegetables, and packaged salads is driving the demand for nitrogen and carbon dioxide used in their preservation and packaging.

Food safety concerns are a top priority for consumers and regulatory bodies alike. This focus on food safety is another key driver propelling the food-grade industrial gases market in the MEA region.

Food-grade industrial gases like carbon dioxide can inhibit the growth of foodborne pathogens like E. coli and Salmonella, contributing to safer food products. Food spoilage is a significant concern in the MEA region due to climatic factors. Industrial gases like nitrogen can help extend shelf life, reducing food waste and ensuring consumers have access to safe and healthy food options. Modified and Controlled Atmosphere Packaging (MAP & CAP) techniques, utilizing food grade gases, help preserve the texture, flavor, and nutritional value of food products, ensuring consumers get a high-quality eating experience. Governments in the MEA region are implementing stricter food safety regulations. Food-grade industrial gases offer a reliable and safe method to preserve food and comply with these regulations. Consumers are becoming increasingly aware of the importance of food safety and are willing to pay a premium for products that prioritize safety and hygiene. Food processing companies utilize food-grade industrial gases to cater to this growing demand.

Middle East and Africa Food Grade Industrial Gases Market Restraints and Challenges:

In some parts of the MEA region, particularly remote areas, the infrastructure for transporting and distributing food-grade industrial gases can be limited. This lack of robust pipeline networks can restrict access to these essential gases for food and beverage producers, hindering their operations and potentially limiting market reach for gas suppliers. With limited pipeline networks, road transportation becomes the primary method for distributing food-grade industrial gases. However, this reliance on trucks can be hampered by factors like poor road conditions, long distances, and inefficient logistics. These challenges can lead to delays in delivery, increased transportation costs, and potential product spoilage, impacting both suppliers and food producers. The availability of adequate and appropriate storage facilities for food-grade industrial gases can be an issue in certain regions. This can create logistical challenges for both suppliers and food producers, leading to concerns about maintaining gas purity and pressure during storage, potentially compromising product quality and safety.

Middle East and Africa Food Grade Industrial Gases Market Opportunities:

The MEA region's population is projected to climb significantly in the coming years. This necessitates increased food production to cater to growing demand. Additionally, rising disposable incomes are leading to a shift towards processed and packaged foods, further driving the need for these gases for preservation purposes. Consumers in the MEA region are becoming increasingly aware of food safety issues. The use of food-grade industrial gases for inhibiting spoilage and maintaining food hygiene aligns with this growing concern, creating a demand for reliable gas suppliers and innovative solutions. The demand for organic and minimally processed foods is gaining traction in the MEA region. Modified atmosphere packaging (MAP) with food-grade gases like CO2 can help extend the shelf life of these products without compromising on quality, creating an opportunity for market players. Investing in localized production facilities or partnerships with regional gas suppliers can help overcome logistical challenges and ensure efficient delivery to remote areas within the MEA region. Developing and promoting eco-friendly solutions like using recycled gas cylinders or offering carbon capture and utilization technologies can resonate with environmentally conscious consumers and businesses.

MIDDLE EAST AND AFRICA FOOD GRADE INDUSTRIAL GASES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

|

Market Size Available |

2023 - 2030 |

|

|

Base Year |

2023 |

|

|

Forecast Period |

2024 - 2030 |

|

|

CAGR |

7.2% |

|

|

Segments Covered |

By Type, Distribution Channel and Region |

|

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

|

Regional Scope |

|

|

|

Key Companies Profiled |

Linde plc, Air Products & Chemicals, Inc., Air Liquide SA, The National Industrial Gases Company, Linde Arabia, Afrox Limited, Egypt Oxygen & Acetylene Company (EOAC) |

Middle East and Africa Food Grade Industrial Gases Market Segmentation:

Middle East and Africa Food Grade Industrial Gases Market Segmentation: By Type:

- Carbon Dioxide (CO2)

- Nitrogen (N2)

- Oxygen (O2)

- Other Gases

Carbon Dioxide (CO2) Holds the largest market share within the MEA food-grade industrial gases market. Modified Atmosphere Packaging (MAP) technique involves replacing air in food packaging with a controlled mixture of gases, often including CO2. This extends shelf life by inhibiting the growth of bacteria that thrive in oxygen-rich environments. CO2 finds application in the packaging of various products like meat, poultry, seafood, fruits, vegetables, and bakery goods. CO2 is instrumental in creating the fizz and refreshing taste of soft drinks, beers, and other carbonated beverages.

While the current market share might be smaller compared to CO2, nitrogen is experiencing the fastest growth. Nitrogen is used to prevent oxidation, a process that degrades fats and oils in processed foods like nuts, snacks, and coffee. It slows down this process, extending shelf life and preserving quality. Nitrogen can be used to purge air (which contains oxygen) from storage tanks and pipelines used for food processing. This minimizes the risk of oxidation or contamination during storage and transportation.

Middle East and Africa Food Grade Industrial Gases Market Segmentation: By Distribution Channel:

- Bulk Gas Suppliers

- Packaged Gas Suppliers

- Online Distribution Platforms

Bulk Gas Suppliers hold the largest market share, catering to large-scale food processing facilities and beverage companies. Bulk gas suppliers deliver food-grade industrial gases in large quantities, typically through cryogenic tankers or pipelines directly to on-site storage tanks at customer facilities. These tanks are continuously monitored and refilled as needed.

While the current market share might be smaller compared to bulk suppliers, packaged gas is experiencing the fastest growth. Packaged gas suppliers provide food-grade industrial gases in high-pressure cylinders of various sizes. These cylinders can be delivered to customer locations and replaced as needed. Packaged gas requires minimal upfront investment from the customer, making it accessible to smaller players. This method offers greater flexibility in terms of gas type, quantity, and delivery schedule.

Middle East and Africa Food Grade Industrial Gases Market Segmentation: Regional Analysis:

- United Arab Emirates

- Saudi Arabia

- Qatar

- Israel

- South Africa

- Nigeria

- Kenya

- Egypt

- Rest of MEA

Saudi Arabia stands out as the most dominant country in the food-grade industrial gas market. With a market share of approximately 28%, Saudi Arabia's position can be attributed to its robust food and beverage industry, driven by a large and growing population, as well as significant investments in infrastructure and advanced food processing facilities. Saudi Arabia's dominance in the food-grade industrial gases market is underpinned by several key factors. Firstly, the country's thriving oil and gas industry has facilitated the development of a strong industrial gas production and distribution infrastructure. Major international gas companies have established a significant presence in Saudi Arabia, leveraging the availability of raw materials and the country's strategic location as a regional hub for trade and distribution.

With an approximate market share of 12% in the MEA food-grade industrial gases market, Nigeria is the nation with the quickest rate of growth. Numerous factors, such as the growing population, increased urbanization, and growing uptake of contemporary food processing technologies, are responsible for this rapid expansion. Nigeria has a sizable and young population, and this, together with increased disposable incomes, has caused demand for packaged and processed goods to soar. Food-grade gases are increasingly needed in packing, preservation, and transportation processes as customer preferences shift towards convenience and longer shelf lives. Furthermore, multinational gas firms now have the potential to establish operations and grow thanks to Nigeria's government's attempts to support industrialization and draw foreign direct investment (FDI) in the food and beverage sector.

COVID-19 Impact Analysis on the Middle East and Africa Food Grade Industrial Gases Market:

Lockdowns and border restrictions hampered the movement of raw materials and finished products. This led to shortages of food-grade gases in some regions, particularly for smaller players who relied on just-in-time deliveries. The closure of restaurants, hotels, and catering businesses caused a sharp decline in demand for food-grade gases used in these sectors. This impacted the revenue stream of gas suppliers, particularly those heavily reliant on the hospitality industry. Social distancing measures and lockdowns disrupted production and distribution processes. Manpower shortages and limitations on the movement of personnel created logistical hurdles, impacting the smooth functioning of the market. The pandemic accelerated the adoption of e-commerce platforms for ordering food-grade gases. This provided a lifeline to smaller players and those in remote locations, offering greater accessibility and potentially reducing reliance on traditional distribution channels. The heightened focus on hygiene and food safety during COVID-19 propelled the demand for food-grade gases used in sanitation and sterilization processes within food production facilities. This created a new area of opportunity for market players.

Latest Trends/ Developments:

Environmental concerns are prompting a shift towards sustainable practices. CCU technologies can capture CO2 emissions from food processing facilities and convert them into valuable products like biofuels or building materials. This not only reduces a company's environmental footprint but also creates potential revenue streams from captured CO2. Research and development efforts are underway to explore the production of food-grade gases using bio-based feedstocks. This could involve fermenting organic matter to generate CO2 or using renewable energy sources to power nitrogen separation processes. Bio-based production aligns with the growing focus on sustainability within the food and beverage industry. The rise of the Internet of Things (IoT) is paving the way for smart gas management systems. These systems can remotely monitor gas levels in storage tanks, predict consumption patterns, and trigger automatic reordering when supplies are low. This optimizes inventory management, minimizes downtime risks, and improves overall operational efficiency for both gas suppliers and food producers.

Key Players:

- Linde plc

- Air Products & Chemicals, Inc.

- Air Liquide SA

- The National Industrial Gases Company

- Linde Arabia

- Afrox Limited

- Egypt Oxygen & Acetylene Company (EOAC)

Chapter 1. Middle East and Africa Food Grade Industrial Gases Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Middle East and Africa Food Grade Industrial Gases Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Middle East and Africa Food Grade Industrial Gases Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Middle East and Africa Food Grade Industrial Gases Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Middle East and Africa Food Grade Industrial Gases Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Middle East and Africa Food Grade Industrial Gases Market– By Type

6.1. Introduction/Key Findings

6.2. Carbon Dioxide (CO2)

6.3. Nitrogen (N2)

6.4. Oxygen (O2)

6.5. Other Gases

6.6. Y-O-Y Growth trend Analysis By Type

6.7. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Middle East and Africa Food Grade Industrial Gases Market– By Distribution Channel

7.1. Introduction/Key Findings

7.2. Bulk Gas Suppliers

7.3. Packaged Gas Suppliers

7.4. Online Distribution Platforms

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel, 2024-2030

Chapter 8. Middle East and Africa Food Grade Industrial Gases Market, By Geography – Market Size, Forecast, Trends & Insights

8.1. Middle East & Africa

8.1.1. By Country

8.1.1.1. United Arab Emirates (UAE)

8.1.1.2. Saudi Arabia

8.1.1.3. Qatar

8.1.1.4. Israel

8.1.1.5. South Africa

8.1.1.6. Nigeria

8.1.1.7. Kenya

8.1.1.8. Egypt

8.1.1.9. Rest of MEA

8.1.2. By Type

8.1.3. By Distribution Channel

8.1.4. Countries & Segments - Market Attractiveness Analysis

Chapter 9. Middle East and Africa Food Grade Industrial Gases Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

9.1 Linde plc

9.2 . Air Products & Chemicals, Inc.

9.3. Air Liquide SA

9.4. The National Industrial Gases Company

9.5. Linde Arabia

9.6. Afrox Limited

9.7. Egypt Oxygen & Acetylene Company (EOAC)

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The MEA region's population is projected to rise steadily in the coming years. This growing population necessitates increased food production to cater to the demand. Additionally, rising disposable incomes are leading to a shift towards processed and packaged foods, driving the need for these gases for preservation purposes.

The MEA region is vast and geographically diverse. Food processing facilities might be located in remote areas with limited access to bulk gas delivery infrastructure. This can create logistical hurdles and increase costs for gas suppliers, particularly for those focusing on packaged gas distribution.

Linde plc, Air Products & Chemicals, Inc., Air Liquide SA, The National

Industrial Gases Company, Linde Arabia, Afrox Limited, Egypt Oxygen &

Acetylene Company (EOAC).

With a market share of approximately 28%, Saudi Arabia's position can be attributed to its robust food and beverage industry, driven by a large and growing population, as well as significant investments in infrastructure and advanced food processing facilities. Saudi Arabia

With an approximate market share of 12% in the MEA food-grade industrial gases market, Nigeria is the nation with the quickest rate of growth