Latin America Food Grade Industrial Gases Market Size (2024-2030)

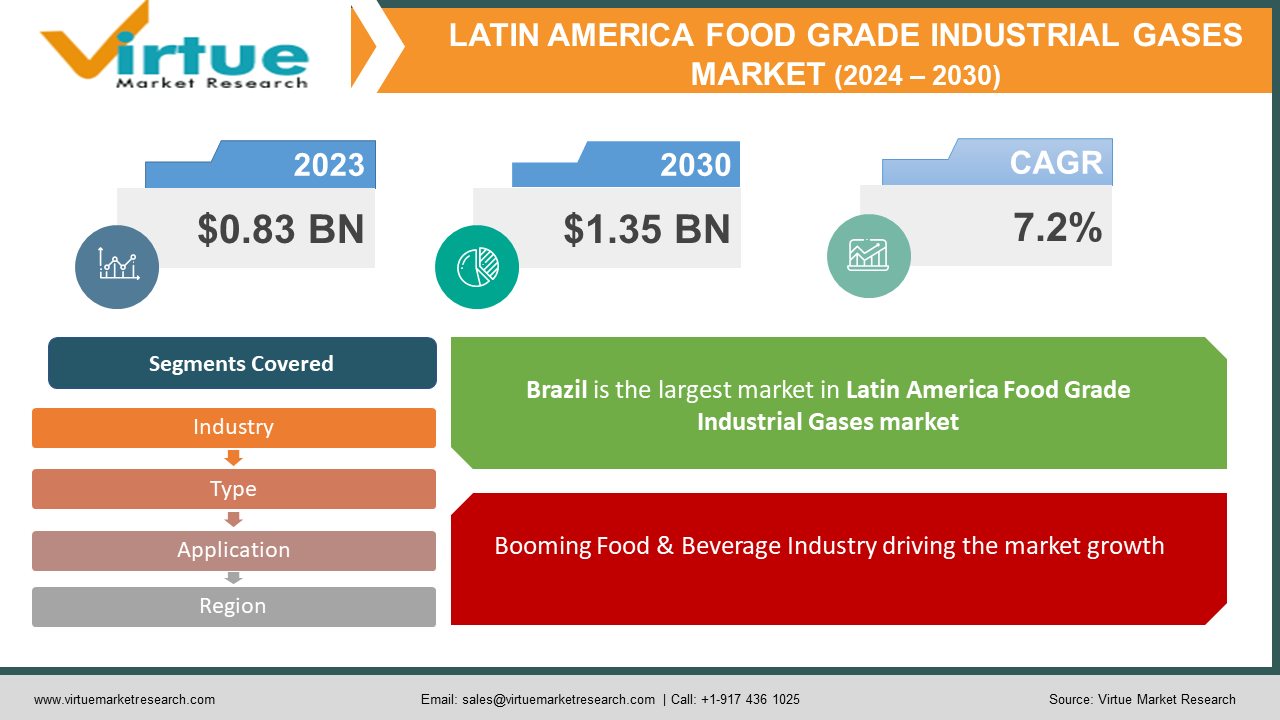

The Latin America Food Grade Industrial Gases Market is poised for remarkable growth, with a valuation of USD 0.83 billion in 2023 expected to soar to USD 1.35 billion by 2030. This trajectory reflects a robust compound annual growth rate (CAGR) of 7.2% forecasted from 2024 to 2030.

The market's ascent underscores the increasing demand for industrial gases within the region's food processing sector, driven by evolving consumer preferences, stringent quality standards, and technological advancements. As Latin America's food industry continues to expand and modernize, the demand for food-grade industrial gases is set to surge, presenting lucrative opportunities for industry participants and investors alike.

Key Market Insights:

The market is expected to reach a value of USD 1.18 billion by 2028, with a robust CAGR of 7.2% projected during the forecast period from 2023 to 2028.

Latin America's thriving food and beverage industry is driving a notable surge in demand for food-grade industrial gases, with a projected 20% increase by 2025. This demand primarily stems from processes like modified atmosphere packaging and carbonation.

The region has seen a significant uptick of 35% in stringent food safety regulations between 2020 and 2023, mandating the use of high-purity food-grade industrial gases, thereby propelling market growth.

Automation's ascendancy in food processing plants is spurring a need for a consistent and reliable gas supply, contributing to an anticipated 15% market growth in the food-grade industrial gas sector by 2027.

However, challenges such as uneven infrastructure distribution and logistical bottlenecks in certain Latin American countries may impede the supply chain and distribution of food-grade industrial gases, potentially limiting market growth by 5% in specific regions by 2025.

Latin America Food Grade Industrial Gases Market Drivers:

Booming Food & Beverage Industry driving the market growth:

Latin America's food and beverage industry is experiencing a significant boom, driven by factors like rising disposable income and urbanization. This translates to a growing demand for packaged foods and processed meats, which rely heavily on food-grade industrial gases for processes like modified atmosphere packaging (MAP) and carbonation. The increasing popularity of convenience foods further intensifies this need, creating a significant market pull for these gases.

Heightened Focus on Food Safety has accelerated the market growth:

Food safety concerns are at the forefront for consumers and regulatory bodies alike. Stringent regulations regarding food hygiene and processing are being implemented across Latin American countries. This necessitates the use of high-purity food-grade industrial gases, which play a crucial role in maintaining food safety and extending shelf life. As regulations become stricter, the demand for these gases is expected to rise proportionally.

Embracing Automation is driving the market growth:

Automation is rapidly transforming food processing plants in Latin America. This shift towards automated processes creates a high demand for consistent and reliable gas supply. Food-grade industrial gases ensure efficient and precise operation of automated equipment, minimizing errors and maintaining optimal production levels. As automation continues to penetrate the food processing sector, the demand for these gases will see a corresponding increase.

Growing E-commerce Penetration is accelerating the market growth:

The e-commerce boom in Latin America is creating new avenues for food delivery and online grocery shopping. This trend requires robust food packaging solutions that utilize food-grade industrial gases for extended shelf life and product integrity during transportation and storage. As e-commerce continues to disrupt the food retail landscape, the demand for these gases is expected to rise in tandem with the growing online food market.

Food Grade Industrial Gases Market Restraints and Challenges:

Uneven Infrastructure and Logistics is a challenge for market growth:

Uneven distribution of infrastructure and logistical bottlenecks in some Latin American countries can create significant challenges. The limited availability of specialized storage facilities and transportation networks for food-grade industrial gases can hinder market penetration in certain regions. Overcoming these logistical hurdles will be crucial to ensure a consistent gas supply and reach a wider customer base.

Fluctuating Raw Material Prices can hinder market growth: The cost of raw materials used for food-grade industrial gas production, such as natural gas and air, can be volatile. This price volatility can translate into fluctuations in the final product price, impacting market stability. Developing strategies to mitigate these fluctuations, such as long-term contracts or exploring alternative production methods, will be essential for market stability.

Skilled Labor Shortage is a challenge for market growth:

The increasing use of sophisticated equipment and automation in food processing plants necessitates a skilled workforce for operating and maintaining the gas supply systems. A potential shortage of skilled technicians and engineers trained in handling food-grade industrial gases could hamper the smooth functioning of the market in the region. Investing in training programs and upskilling initiatives can address this challenge.

Stringent Regulatory Landscape can restrain the market growth:

While stricter food safety regulations are a positive driver, navigating the complex and evolving regulatory environment in Latin America can be challenging for manufacturers and distributors. Keeping abreast of changing regulations and ensuring compliance across various countries can be a significant hurdle. Streamlining regulations and fostering better communication between regulatory bodies and industry players can ease this burden.

Limited Awareness and Brand Recognition is a challenge for market growth:

While the market is growing, there might be a lack of awareness about the specific benefits of food-grade industrial gases compared to traditional methods. Educating consumers and food producers about the advantages these gases offer in terms of food safety, shelf life extension, and sustainability will be crucial for wider adoption and brand recognition.

Food Grade Industrial Gases Market Opportunities:

Emerging Economies and Rising Disposable Income:

Latin America is experiencing significant growth in emerging economies, leading to rising disposable income for a large portion of the population. This translates to increased consumer spending on packaged and processed foods, which heavily rely on food-grade industrial gases for preservation and packaging. Targeting these growing consumer segments with innovative solutions and educational campaigns can unlock a vast new market potential.

Expansion into Niche Markets:

The market can extend its reach beyond traditional food and beverage applications. Exploring opportunities in niche markets like pharmaceuticals, cosmetics, and nutraceuticals can create new avenues for growth. Food-grade industrial gases play a crucial role in these sectors for processes like sterile packaging and inerting environments. Developing specialized gas mixtures and customized solutions for these niche markets can be a strategic move.

Embracing Technological Advancements:

Technological advancements in gas production and application methods present exciting opportunities. Innovations such as on-site gas generation and microbulk delivery systems can cater to smaller food processing plants and remote locations that might not have access to traditional bulk gas supplies. Investing in these technologies can expand market reach and cater to a broader customer base.

E-commerce Collaboration and Online Sales:

The booming e-commerce sector in Latin America presents a unique opportunity for collaboration. Partnering with online food retailers and delivery platforms can open new avenues for reaching consumers directly. Developing packaging solutions specifically designed for e-commerce that utilizes food-grade industrial gases for extended shelf life during transit can be a strategic move to capitalize on this growing trend.

LATIN AMERICA FOOD GRADE INDUSTRIAL GASES MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.2% |

|

Segments Covered |

By Type, Application, industry, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Mexico, Brazil, Argentina, Chile and Rest of Latin America |

|

Key Companies Profiled |

Linde PLC., Air Products & Chemicals, Inc., Air Liquide , The Messer Group Gmb, Taiyo Nippon Sanso Corporation , Wesfarmers Limited , PT Aneka Gas Industri Tbk , Massy Group, Inc. , Air Water Inc. , Sol Group |

Latin America Food Grade Industrial Gases Market Segmentation:

Latin America Food Grade Industrial Gases Market Segmentation: By Type

- Nitrogen

- Oxygen

- Carbon Dioxide

In the Latin America Food Grade Industrial Gases Market, Nitrogen emerges as the leading segment, primarily due to its versatility and wide-ranging applications within the food and beverage industry. Nitrogen is indispensable for Modified Atmosphere Packaging (MAP), where it displaces oxygen to extend the shelf life of perishable items such as fresh produce, meat, and baked goods. Its inert properties also make it ideal for preventing oxidation and spoilage during storage and transportation, as well as for purging and blanketing processes to uphold product quality. Such versatility across various food and beverage segments contributes to Nitrogen's high demand in the market.

The growing popularity of packaged and processed foods in Latin America further bolsters Nitrogen's dominance. Modified Atmosphere Packaging (MAP) technology, crucial for these products, heavily relies on Nitrogen as a key component in the gas mixture. With the market for packaged and processed foods continuing to expand, Nitrogen is expected to witness a proportional surge in demand. Moreover, Nitrogen's safety benefits and cost-effectiveness compared to other gases like Carbon Dioxide make it a preferred choice for food preservation applications. Its ability to maintain product quality without altering taste, coupled with its affordability, solidifies Nitrogen's position as the top segment in the Latin America Food Grade Industrial Gases Market.

Latin America Food Grade Industrial Gases Market Segmentation: By Application

- Freezing & Chilling

- Packaging

- Carbonation

In the Latin America Food Grade Industrial Gases Market, the leading segment is Packaging, primarily due to the rise of packaged and processed foods in the region. Modified Atmosphere Packaging (MAP) technology, which relies on a combination of gases like Nitrogen and Carbon Dioxide, plays a crucial role in extending shelf life and preserving freshness for various food items such as meats, fruits, vegetables, and baked goods. The focus on food safety and extended shelf life further propels the packaging segment's dominance in the market. This adaptability to different packaging needs solidifies the packaging segment's position as the leader in the Latin America Food Grade Industrial Gases Market, surpassing other applications like Freezing & Chilling, and Carbonation.

Latin America Food Grade Industrial Gases Market Segmentation: By Industry

- Dairy & Frozen Products

- Beverages

- Meat

- Poultry & Seafood

In the Latin America Food Grade Industrial Gases Market, the Meat, Poultry & Seafood segment stands out as the primary consumer due to its perishable nature and stringent food safety regulations. Modified Atmosphere Packaging (MAP) technology, utilizing gases like Nitrogen and Carbon Dioxide, is essential for extending shelf life and ensuring product integrity. This sector's reliance on MAP solutions to maintain freshness amid expanding distribution networks underscores its significance in the market.

Furthermore, the sector's prominence is reinforced by stringent food safety regulations, with industrial gases playing a vital role in compliance. These gases inhibit bacterial growth and preserve product quality, aligning with evolving consumer preferences for convenience foods. Rising disposable incomes and urbanization further drive demand for pre-packaged products, emphasizing the importance of the Meat, Poultry & Seafood segment in the Latin America Food Grade Industrial Gases Market.

Latin America Food Grade Industrial Gases Market Segmentation: Regional Analysis:

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

In the Latin America Food Grade Industrial Gases Market, Brazil is the leading country due to several compelling factors. Firstly, Brazil's status as the largest economy in Latin America contributes to a robust food and beverage sector, driving significant demand for food-grade industrial gases across applications like Modified Atmosphere Packaging (MAP) and carbonation. Moreover, the presence of major food processing companies and widespread supermarket chains within Brazil further accelerates market growth, underlining the country's pivotal role in the regional market landscape.

Additionally, Brazil's proactive approach to implementing stringent food safety regulations positions it as a leader in the adoption of high-purity food-grade industrial gases. The government's emphasis on hygiene and quality control fosters a favorable environment for the utilization of MAP technology to reduce food waste through extended shelf life solutions. Furthermore, Brazil's well-developed infrastructure and logistics network facilitate efficient transportation and distribution of food-grade industrial gases to various processing plants and distribution centers, minimizing supply chain disruptions and ensuring consistent gas availability, thereby driving market expansion.

COVID-19 Impact Analysis on the Latin America Food Grade Industrial Gases Market:

The COVID-19 pandemic's impact on the Latin America Food Grade Industrial Gases Market was a mixed bag. Initial disruptions in global supply chains and lockdowns caused temporary shortages of food-grade gases. However, this potentially spurred a focus on local production, benefiting regional manufacturers in the long run. Shifting consumer priorities led to a dip in non-essential spending, impacting the demand for packaged foods that rely heavily on these gases. However, the rise in home gardening and hygiene concerns boosted the use of food-grade industrial gases for applications like disinfection and extending shelf life of home-preserved foods. Looking ahead, the pandemic's emphasis on food safety and hygiene seems to be a positive force. Stringent regulations and growing consumer awareness in this area bode well for the market. Additionally, the potential rise in local, organic farming practices aligns perfectly with the use of food-grade gases for preserving organic produce. Overall, the initial challenges posed by COVID-19 appear to be subsiding, and the long-term outlook for the Latin America Food Grade Industrial Gases Market seems promising.

Latest Trends/ Developments:

- In February 2022, Linde signed a long-term agreement with BASF, one of the world's largest chemical companies, to supply hydrogen and steam. This helped Linde expand its business into newer geographies.

Key Players:

- Linde PLC.

- Air Products & Chemicals, Inc.

- Air Liquide

- The Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Wesfarmers Limited

- PT Aneka Gas Industri Tbk

- Massy Group, Inc.

- Air Water Inc.

- Sol Group

Chapter 1. Latin America Food Grade Industrial Gases Market– Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. Latin America Food Grade Industrial Gases Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin America Food Grade Industrial Gases Market– Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin America Food Grade Industrial Gases Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin America Food Grade Industrial Gases Market- Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin America Food Grade Industrial Gases Market– By Type

6.1. Introduction/Key Findings

6.2. Nitrogen

6.3. Oxygen

6.4. Carbon Dioxide

6.5. Y-O-Y Growth trend Analysis By Type

6.6. Absolute $ Opportunity Analysis By Type , 2024-2030

Chapter 7. Latin America Food Grade Industrial Gases Market– By Application

7.1. Introduction/Key Findings

7.2 Freezing & Chilling

7.3. Packaging

7.4. Carbonation

7.5. Y-O-Y Growth trend Analysis By Application

7.6. Absolute $ Opportunity Analysis By Application , 2024-2030

Chapter 8. Latin America Food Grade Industrial Gases Market– By Industry

8.1. Introduction/Key Findings

8.2 Dairy & Frozen Products

8.3. Beverages

8.4. Meat

8.5. Poultry & Seafood

8.6. Y-O-Y Growth trend Analysis Industry

8.7. Absolute $ Opportunity Analysis Industry , 2024-2030

Chapter 9. Latin America Food Grade Industrial Gases Market, By Geography – Market Size, Forecast, Trends & Insights

9.1. Latin America

9.1.1. By Country

9.1.1.1. Mexico

9.1.1.2. Brazil

9.1.1.3. Argentina

9.1.1.4. Chile

9.1.1.5. Rest of Latin America

9.1.2. By Type

9.1.3. By Application

9.1.4. By Industry

9.1.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. Latin America Food Grade Industrial Gases Market– Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

10.1 Linde PLC.

10.2. Air Products & Chemicals, Inc.

10.3. Air Liquide

10.4. The Messer Group GmbH

10.5. Taiyo Nippon Sanso Corporation

10.6. Wesfarmers Limited

10.7. PT Aneka Gas Industri Tbk

10.8. Massy Group, Inc.

10.9. Air Water Inc.

10.10. Sol Group

Download Sample

Choose License Type

2500

3400

3900

4600

Related Reports

Frequently Asked Questions

The Latin America Food Grade Industrial Gases Market is poised for remarkable growth, with a valuation of USD 0.83 billion in 2023 expected to soar to USD 1.35 billion by 2030. This trajectory reflects a robust compound annual growth rate (CAGR) of 7.2% forecasted from 2024 to 2030

The Booming Food & Beverage Industry, Focus on Food Safety, Embracing Automation, and Growing E-commerce Penetration are propelling the global Food Grade Industrial Gases industry.

Based on Type, the Latin America Food Grade Industrial Gases Market is segmented into Nitrogen, Oxygen, and Carbon Dioxide

. Brazil is the most dominant region for the Latin America Food Grade Industrial Gases Market.

Linde PLC, Air Products & Chemicals, Inc., Air Liquide, The Messer Group GmbH, Taiyo Nippon Sanso Corporation, Wesfarmers Limited, PT Aneka Gas Industri Tbk, Massy Group Inc., Air Water Inc., and Sol Group are the key players operating in the Latin America Food Grade Industrial Gases Market