Location Analytics Market Size (2024-2030)

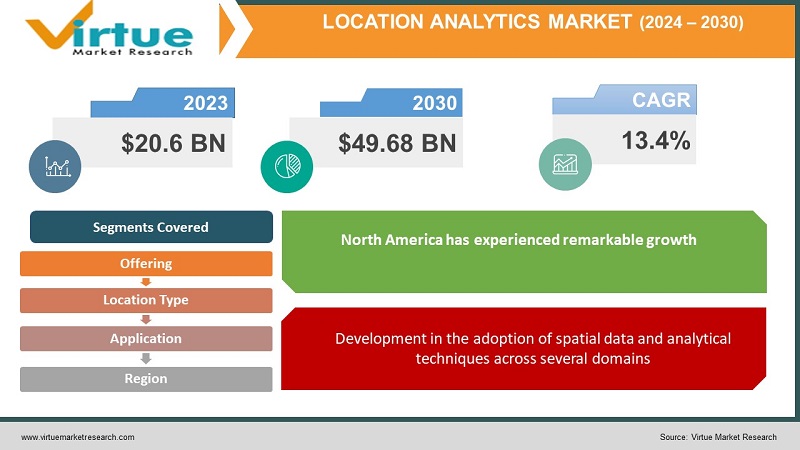

The Location Analytics Market was approximately valued at USD 20.6 billion in 2023 and is anticipated to achieve a market size of USD 49.68 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 13.4%.

Location analytics integrates geographic data constituting assets, infrastructure, transportation, and the environment with an organization's operational and customer information. This convergence ensures the discovery of potent solutions for a wide range of business challenges. The end insights are then seamlessly shared across the organization, leading to informed decision-making and operational enhancements. By connecting spatial context with functional information, location analytics uncovers patterns, trends, and correlations that might otherwise remain concealed. This holistic approach not only assists in streamlining processes and resource allocation but also provides valuable insights into customer behaviour, market trends, and efficiency enhancements. To summarize, location analytics serves as a strategic technique that strengthens organizations to make use of the power of geospatial data for informed, efficient, and powerful business strategies.

Key Market Insights:

· The rapidly developing positioning techniques are based on a network of mobile positioning and satellite-based GPS. With more widespread techniques, like global cell identity (CGICTA) and increased observed time difference (E-OTD), the practical precision falls within the limits of 50-1000 m. These technologies offer opportunities for the end-users based on the precision needed for accurate applications' location identification.

· With the emergence of cloud and IoT systems, companies are now automating the majority of their operations. The healthcare sector is also expected to experience a more significant number of applications. The enhancing IoT applications, equipped with healthcare requirements, are supposed to be dedicated to the development of the market study for the healthcare department. For example, Texas Health saved USD 412,000 applying the real-time location-based system, as medical devices are now readily set up and maintained.

Location Analytics Market Drivers:

- Development in the adoption of spatial data and analytical techniques across several domains

The demand for digitalization has amplified the role of data in enhancing customer service and revenue development for businesses. To direct this landscape, spatial data visualization has come up as a powerful driver. It facilitates effective business planning by unveiling regional priorities, the right pricing strategies, and peak purchase periods. However, the extensive volume of fragmented location-based data has posed threats to conventional BI tools, necessitating innovative solutions like location analytics. This is particularly important across various industries, where spatial data helps in understanding evolving trends and geographical dynamics. By rightly processing and analysing vast spatial data sets, location analytics solutions strengthen businesses with real-time insights into transforming customer choices, market trends, and regulatory landscapes. This transformative capacity is especially evident in sectors such as retail, where spatial insights optimize store-product correlations, increase supply chain coordination, and ultimately enrich business strategies and customer experiences.

Location Analytics Market Restraints and Challenges:

- Legal issues related to geoprivacy and confidential data

The potential misuse of location data, whether intentional or by mistake, holds significant legal implications for both companies and consumers. Integrating location data with personal information increases privacy concerns, resulting in concerns over data leaks. Addressing consumer privacy apprehensions is critical in handling location data owing to stringent regulatory laws that need user consent for approaching such data. Individuals anxious about their location information's security may choose to withhold critical data collection, as made compulsory by certain location analytics apps. Government regulations restrict data processing, location sharing, usage, and storage. The European Union's General Data Protection Regulation (GDPR) stands as a collective effort to protect citizens' Personally Identifiable Information (PII). Companies gathering data must stick to regional laws and secure explicit consent from each customer. Restrictions on consumer location data accessibility curtail organizations' options, restricting the utilization of location data analytics solutions. This mounting individual issue regarding geo privacy and sensitive data affects the estimated growth of the global location analytics market in the future years.

- Lack of uniform regulatory regulations

The fastest advancement of technology has undeniably ushered in a multitude of positive alterations, leading to innovations such as cloud computing, the internet, software-as-a-service, big data, and analytics. This technological surge has made revolutionary changes across versatile sectors, spanning retail, healthcare, government, defence, and BFSI. Within this scenario, location analytics services are garnering important traction as service providers realise their potential for security and promotional endeavours. Despite this escalated adoption, there exists a shortage of universal protocols for location analytics. Multiple legal landscapes across nations impede the development of standardized answers applicable globally, offering vendors challenges in providing their services and solutions across diverse regions.

Location Analytics Market Opportunities:

- Development in the launch of advanced technologies

The catalyst influencing the growth trajectory of the location analytics market is the surging employment of advanced technologies. The prolific proliferation of the Internet of Things (IoT), combined with the maturation of Artificial Intelligence (AI) and Machine Learning (ML) frameworks, influences fervent interest among companies. This confluence of technologies empowers organizations to make use of the complex data ecosystems and gain actionable insights. The ubiquitous existence of IoT devices engenders an unprecedented influx of real-time, geospatially-tagged data, adopting a deeper understanding of consumer behaviour, operational dynamics, and right decision-making. AI and ML set up predictive analytics abilities, facilitating strategic imperatives like market widening, risk mitigation, and precise asset management through intricate integration with location intelligence. As companies progressively head towards these technologies for competitive advantage, location analytics solutions play a pivotal role in becoming huge in unraveling nuanced trends and extracting actionable intelligence from large datasets.

LOCATION ANALYTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

13.4% |

|

Segments Covered |

By Offering, location type, application, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

IBM (US), Google (US), Oracle (US), Microsoft (US), Esri (US), SAS (US), Precisely (US), SAP (Germany), Cisco (US), TomTom (Netherlands), Hexagon (Sweden), Lepton Software (India) |

Location Analytics Market Segmentation

Location Analytics Market Segmentation:

- By Offering:

- Solutions

- By Type

- Geocoding & Reverse Geocoding

- Data Integration & ETL

- Reporting & Visualization

- Thematic Mapping & Spatial Analysis

- Others

- By Deployment

- Cloud

- On-premises

- Services

- Professional Service

- Consulting Services

- Deployment & Integration

- Training, Support, and Maintenance

- Managed Service

By Deployment, Cloud is expected to hold the largest market size during the estimated period.

The employment of cloud deployment in location analytics is reshaping the landscape by offering scalable and efficient solutions. Leveraging cloud infrastructure, organizations process a wide range of geospatial data, earn actionable insights, and enable real-time decision-making. This method ensures seamless integration, collaborative data sharing, and lowered infrastructure costs. Cloud providers handle security and updates, permitting businesses to highlight strategic goals. The escalating demand for dynamic geospatial insights goes hand in hand with cloud deployment's capabilities, driving its adoption as a transformative force in the location analytics domain.

Location Analytics Market Segmentation By Location Type

- Indoor Location

- Outdoor Location

By Location Type, outdoor location is anticipated to hold the biggest market size during the future period.

The usage of geospatial data in outdoor locations facilitates businesses to comprehend foot traffic patterns, formulate advertising strategies, and increase customer experiences. Urban planners leverage outdoor location analytics to design smarter cities, while retailers harness it to figure out optimal store placements. In the layer of tourism, outdoor location analytics helps in understanding visitor choices and crafting customized experiences. However, challenges include data accuracy and privacy issues in outdoor settings. Despite these restraints, outdoor location analytics remains significant, shaping smarter urban planning, customized marketing, and informed decision-making across diverse sectors.

Location Analytics Market Segmentation By Application:

- Risk Management

- Emergency & Response Management

- Customer Experience Management

- Remote Location Analytics

- Supply Chain Planning & Optimization

- Sales & Marketing Optimization

- Others

By Application, Risk Management to account for the higher market size during the estimated period. The imperative to proactively address significant pitfalls becomes evident as businesses enormously leverage location-based insights to revise their strategies. Effective risk management in this market involves meticulous assessment of data accuracy, privacy weaknesses, and technological restrictions. By pre-emptively observing and reducing these risks, enterprises fortify the integrity of their analytical outputs and facilitate compliance with data protection regulations. Such prudence not only impacts decision-making confidence but also strengthens the creation of resilient business models. In the ever-evolving landscape of location analytics, adept risk management arrives as an indispensable technique, enabling companies to harness the full capacity of geospatial data and chart a secure path to success across versatile industries.

Location Analytics Market Segmentation By Region:

- North America

- Asia-Pacific

- Europe

- South America

- Middle East and Africa

The location analytics market in North America has experienced remarkable growth, propelled by technological advancements and a robust business landscape. With the proliferation of IoT, AI, and big data, businesses across markets such as retail, transportation, and urban planning have impacted location-based insights to increase decision-making and operational efficiency. The region's well-established infrastructure, greater mobile penetration, and data-driven culture have ensured the rapid adoption of location analytics solutions. Furthermore, the rising demand for customized experiences and targeted marketing has fuelled the market's widening. As North American organizations continue to value the impact of spatial data in gaining a competitive edge, the location analytics market is anticipated to survive its growth trajectory, dedicating majorly to the region's digital transformation and economic development.

COVID-19 Impact Analysis on the Location Analytics Market:

Location information played a significant role in the administration of community emergency services during the pandemic. The health infrastructure industry has been dealing with several problems, involving overcrowding in hospitals and a shortage of ventilators, gloves, and other necessary supplies. Location data has become a crucial tool to overcome these restraints and offer insightful information about planning and saving resources across the healthcare industry. Governments of India, Germany, and others developed smartphone apps based on location systems to locate the movement of COVID-19-positive citizens in their emergency vicinity. Hence, the accelerating adoption of smart wearables, robotics, and drones helps the growth of location analytics solutions during the pandemic.

Latest Trends:

- Major role of Artificial Intelligence (AI) and Machine Learning (ML)

In recent years, there has been combined growth of Artificial Intelligence (AI) and ML technologies. Location data set up with AI and ML technologies are utilized to create pattern recognition and position signatures from the data it receives. Additionally, the technologies are utilized in generating high-definition (HD) maps and practical simulators to picturise the information. Tier 1 companies are deploying strategically in AI and machine learning to accomplish competitive advantages. Drone and satellite imagery equipment have been applied widely in past years, thus making it comfortable to process all data using conventional computational techniques. By completing image recognition and object identification activities, AI and ML technology save a huge amount of time and energy. Location analytics service vendors will offer creative tools to consumers and install them even more effectively as AI and machine learning advance. The market is anticipated to develop majorly with technological advancements in AI and ML.

Key Players:

- IBM (US)

- Google (US)

- Oracle (US)

- Microsoft (US)

- Esri (US)

- SAS (US)

- Precisely (US)

- SAP (Germany)

- Cisco (US)

- TomTom (Netherlands)

- Hexagon (Sweden)

- Lepton Software (India)

Recent Developments

- In June 2023, IBM purchased Agyla SAS to bolster IBM Consulting's potential in offering localized cloud solutions to clients in France. By connecting Agyla's skills, IBM will increase its portfolio of hybrid multi-cloud services and empower its commitment to advancing hybrid cloud and AI strategies within the location.

- In May 2023, there was a launch of TomTom’s Maps APIs into Alteryx items and location insights packages as a result of collaboration between TomTom and Alteryx. This network extends to Alteryx Designer and the recently launched Location Intelligence given on the Alteryx Analytics Cloud Platform.

- TerraStar-X Enterprise correction service began in Japan post agreement under a contract between Hexagon AB and Hitachi Zosen Corporation in May 2023. Under the contract, Hexagon will get GNSS data from Nippon GPS Data Service (NGDS), a subsidiary company of Hitachi Zosen.

- In January 2023, Precisely bought Transerve to increase businesses’ capacity to make faster and more confident decisions by offering them SaaS visualization, data enrichment, and analysis capacities that offer valuable spatial context.

Chapter 1. GLOBAL LOCATION ANALYTICS MARKET– SCOPE & METHODOLOGY

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Sources

1.5. Secondary Sources

Chapter 2. GLOBAL LOCATION ANALYTICS MARKET – EXECUTIVE SUMMARY

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. GLOBAL LOCATION ANALYTICS MARKET– COMPETITION SCENARIO

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. GLOBAL LOCATION ANALYTICS MARKET - ENTRY SCENARIO

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. GLOBAL LOCATION ANALYTICS MARKET- LANDSCAPE

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. GLOBAL LOCATION ANALYTICS MARKET– BY Offering

6.1. Introduction/Key Findings

6.2. Solutions

6.2.1. By Type

6.2.1.1. Geocoding & Reverse Geocoding

6.2.1.2. Data Integration & ETL

6.2.1.3. Reporting & Visualization

6.2.1.4. Thematic Mapping & Spatial Analysis

6.2.1.5. Others

6.2.2. By Deployment

6.2.2.1. Cloud

6.2.2.2. On-premises

6.3. Services

6.3.1. Professional Service

6.3.1.1. Consulting Services

6.3.1.2. Deployment & Integration

6.3.1.3. Training, Support, and Maintenance

6.3.2. Managed Service

6.4. Y-O-Y Growth trend Analysis By Offering

6.5. Absolute $ Opportunity Analysis By Offering , 2024-2030

Chapter 7. GLOBAL LOCATION ANALYTICS MARKET– BY APPLICATION

7.1. Introduction/Key Findings

7.2. Risk Management

7.3. Emergency & Response Management

7.4. Customer Experience Management

7.5. Remote Location Analytics

7.6. Supply Chain Planning & Optimization

7.7. Sales & Marketing Optimization

7.8. Others

7.9. Y-O-Y Growth trend Analysis By APPLICATION

7.10. Absolute $ Opportunity Analysis By APPLICATION , 2024-2030

Chapter 8. GLOBAL LOCATION ANALYTICS MARKET– BY Location Type

8.1. Introduction/Key Findings

8.2. Indoor Location

8.3. Outdoor Location

8.4. Y-O-Y Growth trend Analysis Location Type

8.5. Absolute $ Opportunity Analysis Location Type , 2024-2030

Chapter 9. GLOBAL LOCATION ANALYTICS MARKET, BY GEOGRAPHY – MARKET SIZE, FORECAST, TRENDS & INSIGHTS

9.1. North America

9.1.1. By Country

9.1.1.1. U.S.A.

9.1.1.2. Canada

9.1.1.3. Mexico

9.1.2. By APPLICATION

9.1.3. By Offering

9.1.4. By Location Type

9.1.5. Countries & Segments - Market Attractiveness Analysis

9.2. Europe

9.2.1. By Country

9.2.1.1. U.K.

9.2.1.2. Germany

9.2.1.3. France

9.2.1.4. Italy

9.2.1.5. Spain

9.2.1.6. Rest of Europe

9.2.2. By APPLICATION

9.2.3. By Location Type

9.2.4. By Offering

9.2.5. Countries & Segments - Market Attractiveness Analysis

9.3. Asia Pacific

9.3.1. By Country

9.3.1.2. China

9.3.1.2. Japan

9.3.1.3. South Korea

9.3.1.4. India

9.3.1.5. Australia & New Zealand

9.3.1.6. Rest of Asia-Pacific

9.3.2. By APPLICATION

9.3.3. By Offering

9.3.4. By Location Type

9.3.5. Countries & Segments - Market Attractiveness Analysis

9.4. South America

9.4.1. By Country

9.4.1.1. Brazil

9.4.1.2. Argentina

9.4.1.3. Colombia

9.4.1.4. Chile

9.4.1.5. Rest of South America

9.4.2. By APPLICATION

9.4.3. By Offering

9.4.4. By Location Type

9.4.5. Countries & Segments - Market Attractiveness Analysis

9.5. Middle East & Africa

9.5.1. By Country

9.5.1.1. United Arab Emirates (UAE)

9.5.1.2. Saudi Arabia

9.5.1.3. Qatar

9.5.1.4. Israel

9.5.1.5. South Africa

9.5.1.6. Nigeria

9.5.1.7. Kenya

9.5.1.8. Egypt

9.5.1.9. Rest of MEA

9.5.2. By APPLICATION

9.5.3. By Offering

9.5.4. By Location Type

9.5.5. Countries & Segments - Market Attractiveness Analysis

Chapter 10. GLOBAL LOCATION ANALYTICS MARKET– COMPANY PROFILES – (OVERVIEW, PRODUCT PORTFOLIO, FINANCIALS, STRATEGIES & DEVELOPMENTS)

10.1 IBM (US)

10.2. Google (US)

10.3. Oracle (US)

10.4. Microsoft (US)

10.5. Esri (US)

10.6. SAS (US)

10.7. Precisely (US)

10.8. SAP (Germany)

10.9. Cisco (US)

10.10. TomTom (Netherlands)

10.11. Hexagon (Sweden)

10.12. Lepton Software (India)

Download Sample

Choose License Type

2500

4250

5250

6900

Related Reports

Frequently Asked Questions

The Location Analytics Market was approximately valued at USD 20.6 billion in 2023 and is anticipated to achieve a market size of USD 49.68 billion by the end of 2030. Over the forecast period of 2024-2030, the market is estimated to grow at a CAGR of 13.4%.

Development in the adoption of spatial data and analytical techniques is propelling the Location Analytics Market.

. Location Analytics Market is segmented based on Offering, Location Type, Application, and Region.

North America is the most dominant region for the Location Analytics Market.

SAP (Germany), Cisco (US), TomTom (Netherlands), Hexagon (Sweden), and Lepton Software (India) are a few of the key players operating in the Location Analytics Market.