Location Intelligence and Location Analytics Market Size (2025 – 2030)

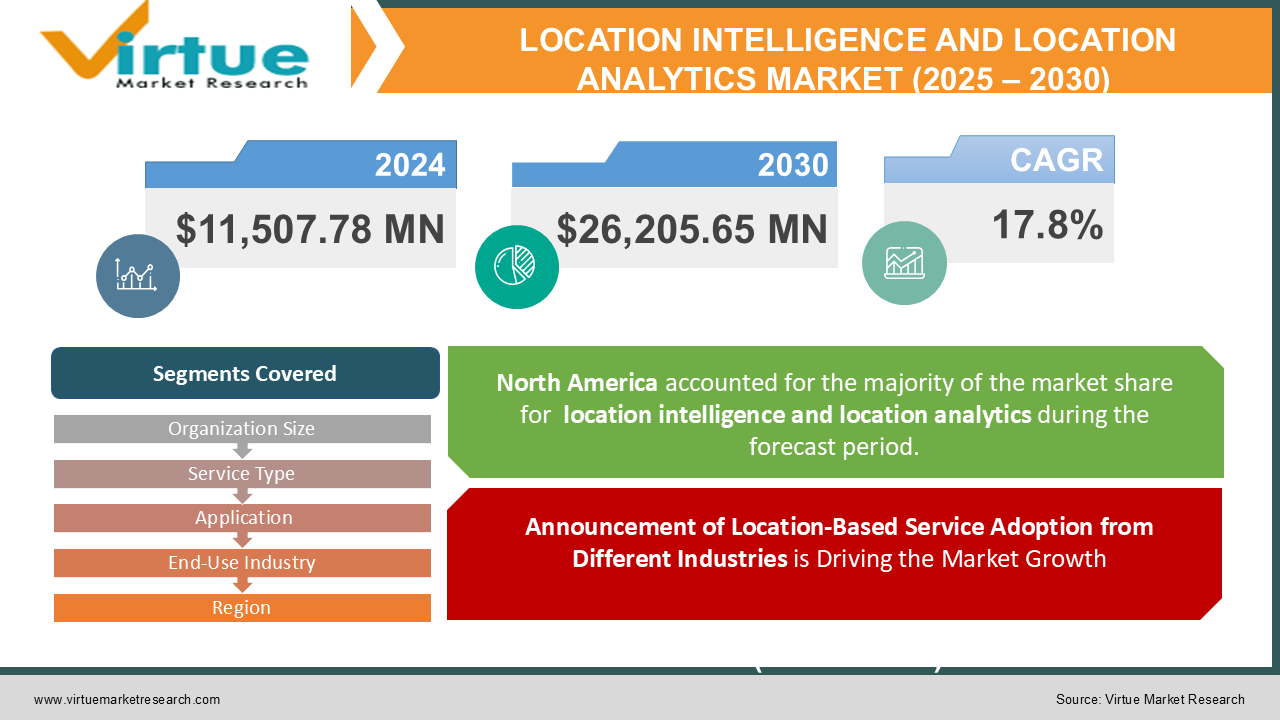

The Global Location Intelligence & Location Analytics Market was valued at USD 11,507.78 million in 2024 and is projected to reap around USD 26,205.65 million by 2030, growing at a CAGR of 17.8% during the forecast period 2025 – 2030.

The integration of geospatial data with business intelligence which can allow organizations to obtain meaningful insights with advanced cartographic tools is the reason for the growth.

Key Market Insights:

-

More than 60% of retail enterprises are using location intelligence to analyze customer footstep traffic to optimize store locations and tailor marketing.

-

Governments across the world are investing exuberantly in smart city projects—using geospatial analytics to navigate traffic, urban planning, and emergency response.

-

Cloud-based location analytics platforms are becoming increasingly popular as organizations are able to gain geospatial insights from any location with greater scalability.

Market Drivers:

Announcement of Location-Based Service Adoption from Different Industries is Driving the Market Growth:

Organizations from different industries are implementing location data for better decision-making, optimized operations, and improved customer engagement.

Geospatial Analytics is evolving and is Integrated with BI Platforms:

The essence of geospatial data with BI tools allows for more in-depth analysis and results in actionable insights and competitive advantage.

Demand for Real-Time Data:

The demand for real-time data for Strategic Decision-making Role Data collection has grown far and away from its earlier form to something referred to as spatial data.

Market Restrains and Challenges:

As the usage of geospatial data is on the rise, concern regarding user privacy and data security is also soaring. GDPR (General Data Protection Regulation) in Europe and CCPA (California Consumer Privacy Act) impose clear-cut regulations on how businesses not only collect but also store & use location data. As such, compliance with these laws comes with substantial investments by companies in data protection frameworks, encryption technologies, and anonymization methods. Moreover, consumers are becoming more mindful of data privacy, causing more users to opt out of location tracking, which makes location-based services less effective and leads to less good location data for analytics.

Location intelligence solutions involve a high-cost investment in terms of software, hardware, cloud storage, and data analytics platforms. Advanced location analytics tools are not only expensive but also require training personnel, so companies need to invest time and energy into this. In addition to this, routine software updates, upkeep, and scaling of infrastructure also add to the operational costs, making it hard for SMEs to invest in these solutions.

Many businesses continue to work with legacy IT infrastructure and traditional business intelligence (BI) systems that can be challenging to integrate with modern location analytics platforms. Integrating location intelligence solutions with other applications such as CRM, ERP, and supply chain solutions is tricky and time-consuming, sometimes requiring custom APIs and middleware. Companies often fail to capitalize on the value of location-based insights without seamless integration across various departments, leading to a lag in decision-making, inefficient operations, and missed occasions for expansion into new markets.

Market Opportunities:

The Power of AI Geospatial Analytics on the Future of Predictive Modeling, Traffic Forecasting & Personalized Location-Based Marketing. Machine learning algorithms can be used by businesses to analyze customer movement patterns, optimize supply chain routes, or improve urban planning. Expect Artificial Intelligence-led real-time location tracking to drive further innovation around smart cities, autonomous vehicles, and precision farming.

Urbanization across the globe has lent itself to the growth of smart cities and infrastructure. Urban planning, traffic management, and emergency response are some of the areas of focus in the smart cities governments across the world are investing in, with geospatial analytics being crucial for the functioning of these projects. The rise of IoT and 5G networks enables improved, real-time monitoring of infrastructure that enables cities to become more agile and sustainable. There will be huge opportunities for companies providing location data-based solutions in areas such as public safety and security, waste management, and transportation optimization.

Retail giants and e-commerce platforms are investing massively in location-based marketing strategies by leveraging geospatial data for hyper-personalized customer promotion. Proximity marketing, geofencing, and beacon technology are on the rise, allowing businesses to target users based on where they are in real-time and what they are purchasing. With this trend, we can expect higher customer engagement and conversion rates, which will accelerate the adoption of location analytics in the marketing domain as well.

ROBOTICS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2024 - 2030 |

|

Base Year |

2024 |

|

Forecast Period |

2025 - 2030 |

|

CAGR |

17.8% |

|

Segments Covered |

By Organization Size, Service Type, Application, End-Use Industry, and Region |

|

Various Analyses Covered |

Global, Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

North America, Europe, APAC, Latin America, Middle East & Africa |

|

Key Companies Profiled |

ESRI, Oracle Corporation, IBM Corporation, Google LLC, Microsoft Corporation, SAS Institute Inc., SAP SE, Hexagon AB, Pitney Bowes Inc., TIBCO Software Inc. |

Location Intelligence and Location Analytics Market Segmentation: By Organization Size

-

Small and Medium-sized enterprises (SMEs)

-

Large Enterprises

There is a growing demand for cost-effective cloud-based location intelligence platforms. Utilized geospatial analytics for customer engagement, store location analysis, and logistics tracking.

A company making heavy investments in AI location analytics, spatial data warehouse, and IoT-based solutions. Location intelligence is embedded in business intelligence (BI) systems in large enterprises for market expansion and risk management.

Location Intelligence and Location Analytics Market Segmentation: By Service Type

-

Consulting Services

-

Managed Services

Services advise on site-based strategy, deployment planning, and analytics integration. The integration of GIS mapping, geospatial data processing, and predictive analytics with existing IT infrastructure. Comprehensive solutions such as real-time monitoring, cloud hosting, and analytics software maintenance.

Location Intelligence and Location Analytics Market Segmentation: By Application

-

Risk Management

-

Facility Management

-

Customer & Market Management

-

Optimization of Supply Chain and Logistics

-

Remote Monitoring

Risk Management pinpoints areas of high risk for insurance and financial services, and disaster preparedness.Facility Management enhances real estate, warehouse placements, and corporate asset tracking.Customer and Market Management improves retail store planning, marketing campaigns, and customer engagement strategies.Remote Monitoring is used on the farm, in the oil & gas fields, and utilities monitor environmental conditions and assets.Optimization of Supply Chain and Logistics delivers fleet tracking, last-mile delivery improvements, and warehouse automation.

Location Intelligence and Location Analytics Market Segmentation: By End-Use Industry

-

Transportation & Logistics

-

Retail & Consumer Goods

-

Government & Defense

-

Energy & Utilities

-

Healthcare & Life Sciences

-

BFSI — Banking, Financial Services & Insurance

Supply chain efficiency through fleet management, route optimization, and cargo tracking.Tracking customer movement, forecasting demand, and improving in-store experiences.National security, urban planning, emergency response systems.Management of Power Grid, Resource Allocation, and Renewable Energy Site Selection Hospital resource optimization, outbreak tracking, and telemedicine advancementsFraud detection, risk assessment based on location, strategy of ATM placement.

Location Intelligence and Location Analytics Market Segmentation: By Region

-

North America

-

Europe

-

Asia-Pacific

-

Latin America

-

Middle East & Africa

North America is the market leader as early adopters of technology in geospatial analytics with substantial investment. In Europe, the demand was pushed forward by several smart city initiatives and forceful data privacy regulations. Asia–Pacific is Emerging as the fastest-growing region owing to urbanization, e-commerce growth, and a rise in IoT adoption. Latin America is a growing market with a rising need for location-based business intelligence. Middle East & Africa have increased Infrastructure Development and National Security Initiatives Drive Adoption.

COVID-19 Impact on Local Intelligence and Location Analytics Market Report:

The Location Intelligence & Location Analytics Market with the immense potential of the close positive impact of the COVID-19 pandemic on businesses, costs, usages, and needs was also analyzed under the following categories. The worldwide lockdowns, supply chain hiccups, and workforce restrictions spurred demand for real-time location-based insights for companies, governments, and healthcare institutions.

Geospatial analytics used for contact tracing, outbreak tracking, and predictive modeling of virus spread were all accelerated by the pandemic. Governments and health organizations used location intelligence platforms to track hotspots, hospital capacities, and vaccine distribution. Similarly, GIS Suited with AI plays an important part in predicting how many people might be infected and where should they be kept in quarantine.

The subsequent lockdowns triggered a massive migration to online shopping, requiring retailers and logistics providers to utilize location analytics to optimize delivery routes, placement of inventory, and last-mile logistics. Proximity marketing and geofencing enabled businesses to reach local customers with relevant, contactless shopping experiences. Retailers used heatmaps and foot traffic analysis to change store locations based on evolving consumer habits.

Increased supply chain disruptions during the pandemic also made real-time fleet tracking, route planning, and inventory forecasting more desirable. Integrating geospatial intelligence with AI and IoT, companies managed warehouses, optimized deliveries, and minimized transportation costs. Predictive analytics has been very indispensable in sectors like food, drugs, and essential commodities for demand forecasting.

Location-based data for improving urban mobility, traffic management, and enhancing responsiveness in emergency situations prompted governments to accelerate smart city initiatives. Managing remote workforce became necessary for organizations in handling the productivity of employees, field operations, and COVID-19 compliance. Observing business activities from multiple locations became smooth due to 5G and cloud-based GIS platforms.

Latest Trends/Developments:

The innovation and continuous business requirement evolution are accountable for the dramatic changes seen in the Location Intelligence & Location Analytics Market. Indicates Key Trends/Highlights the Following

Over the years, the trend has been to incorporate Artificial Intelligence (AI) and Machine Learning (ML) into location-based analytics for business use. This can analyze enormous location data and identify complex patterns and trends. These capabilities improve predictive analytics-allowing the company to forecast demand correctly, provide personalized marketing, and generate operational efficiencies. This, in turn, is strongly influential in sectors like retail for decisions that are based on knowing customer behavior.

For example, parts of Europe are more focused on sustainability and environmental responsibility. Organizations use location intelligence to upgrade their supply chain, minimize their carbon footprint, and make choices that are more sustainable. At the same time, it has become a measure of the kind of preferences among consumers and compliance with regulatory standards, as organizations seek to sustain themselves within specific industries.

Key Players:

-

ESRI

-

Oracle Corporation

-

IBM Corporation

-

Google LLC

-

Microsoft Corporation

-

SAS Institute Inc.

-

SAP SE

-

Hexagon AB

-

Pitney Bowes Inc.

-

TIBCO Software Inc.

Chapter 1. Location Intelligence and Location Analytics Market – Scope & Methodology

1.1 Market Segmentation

1.2 Scope, Assumptions & Limitations

1.3 Research Methodology

1.4 Primary Sources

1.5 Secondary Sources

Chapter 2. Location Intelligence and Location Analytics Market – Executive Summary

2.1 Market Size & Forecast – (2025 – 2030) ($M/$Bn)

2.2 Key Trends & Insights

2.2.1 Demand Side

2.2.2 Supply Side

2.3 Attractive Investment Propositions

2.4 COVID-19 Impact Analysis

Chapter 3. Location Intelligence and Location Analytics Market – Competition Scenario

3.1 Market Share Analysis & Company Benchmarking

3.2 Competitive Strategy & Development Scenario

3.3 Competitive Pricing Analysis

3.4 Supplier-Distributor Analysis

Chapter 4. Location Intelligence and Location Analytics Market Entry Scenario

4.1 Regulatory Scenario

4.2 Case Studies – Key Start-ups

4.3 Customer Analysis

4.4 PESTLE Analysis

4.5 Porters Five Force Model

4.5.1 Bargaining Power of Suppliers

4.5.2 Bargaining Powers of Customers

4.5.3 Threat of New Entrants

4.5.4 Rivalry among Existing Players

4.5.5 Threat of Substitutes

Chapter 5. Location Intelligence and Location Analytics Market – Landscape

5.1 Value Chain Analysis – Key Stakeholders Impact Analysis

5.2 Market Drivers

5.3 Market Restraints/Challenges

5.4 Market Opportunities

Chapter 6. Location Intelligence and Location Analytics Market – BY ORGANIZATION SIZE

6.1 Introduction/Key Findings

6.2 Small and Medium-sized enterprises (SMEs)

6.3 Large Enterprises

6.4 Y-O-Y Growth trend Analysis BY ORGANIZATION SIZE

6.5 Absolute $ Opportunity Analysis BY ORGANIZATION SIZE, 2025-2030

Chapter 7. Location Intelligence and Location Analytics Market – BY SERVICE TYPE

7.1 Introduction/Key Findings

7.2 Consulting Services

7.3 Managed Services

7.4 Y-O-Y Growth trend Analysis BY SERVICE TYPE

7.5 Absolute $ Opportunity Analysis BY SERVICE TYPE, 2025-2030

Chapter 8. Location Intelligence and Location Analytics Market – BY APPLICATION

8.1 Introduction/Key Findings

8.2 Risk Management

8.3 Facility Management

8.4 Customer & Market Management

8.5 Optimization of Supply Chain and Logistics

8.6 Remote Monitoring

8.7 Y-O-Y Growth trend Analysis BY APPLICATION

8.8 Absolute $ Opportunity Analysis BY APPLICATION, 2025-2030

Chapter 9. Location Intelligence and Location Analytics Market – By End-User

9.1 Introduction/Key Findings

9.2 Transportation & Logistics

9.3 Retail & Consumer Goods

9.4 Government & Defense

9.5 Energy & Utilities

9.6 Healthcare & Life Sciences

9.7 BFSI — Banking, Financial Services & Insurance

9.8 Y-O-Y Growth trend Analysis By End-User

9.9 Absolute $ Opportunity Analysis By End-User, 2025-2030

Chapter 10. Location Intelligence and Location Analytics Market , By Geography – Market Size, Forecast, Trends & Insights

10.1 North America

10.1.1 By Country

10.1.1.1 U.S.A.

10.1.1.2 Canada

10.1.1.3 Mexico

10.1.2 By Service Type

10.1.2.1 By Light Type

10.1.3 By Power System

10.1.4 Countries & Segments - Market Attractiveness Analysis

10.2 Europe

10.2.1 By Country

10.2.1.1 U.K

10.2.1.2 Germany

10.2.1.3 France

10.2.1.4 Italy

10.2.1.5 Spain

10.2.1.6 Rest of Europe

10.2.2 By Service Type

10.2.3 By Light Type

10.2.4 By Power System

10.2.5 By By End-User

10.2.6 Countries & Segments - Market Attractiveness Analysis

10.3 Asia Pacific

10.3.1 By Country

10.3.1.1 China

10.3.1.2 Japan

10.3.1.3 South Korea

10.3.1.4 India

10.3.1.5 Australia & New Zealand

10.3.1.6 Rest of Asia-Pacific

10.3.2 By Service Type

10.3.3 By Light Type

10.3.4 By Power System

10.3.5 By By End-User

10.3.6 Countries & Segments - Market Attractiveness Analysis

10.4 South America

10.4.1 By Country

10.4.1.1 Brazil

10.4.1.2 Argentina

10.4.1.3 Colombia

10.4.1.4 Chile

10.4.1.5 Rest of South America

10.4.2 By Service Type

10.4.3 By Light Type

10.4.4 By Power System

10.4.5 By By End-User

10.4.6 Countries & Segments - Market Attractiveness Analysis

10.5 Middle East & Africa

10.5.1 By Country

10.5.1.1 United Arab Emirates (UAE)

10.5.1.2 Saudi Arabia

10.5.1.3 Qatar

10.5.1.4 Israel

10.5.1.5 South Africa

10.5.1.6 Nigeria

10.5.1.7 Kenya

10.5.1.8 Egypt

10.5.1.9 Rest of MEA

10.5.2 By Service Type

10.5.3 By Light Type

10.5.4 By Power System

10.5.5 By By End-User

10.5.6 Countries & Segments - Market Attractiveness Analysis

Chapter 11. Location Intelligence and Location Analytics Market – Company Profiles – (Overview, Product Portfolio, Financials, Strategies & Developments)

11.1 ESRI

11.2 Oracle Corporation

11.3 IBM Corporation

11.4 Google LLC

11.5 Microsoft Corporation

11.6 SAS Institute Inc.

11.7 SAP SE

11.8 Hexagon AB

11.9 Pitney Bowes Inc.

11.10 TIBCO Software Inc.

Download Sample

Choose License Type

2500

4250

5250

6900

Frequently Asked Questions

Location Intelligence (LI) and Location Analytics (LA) are ways to use geospatial data and mapping technologies to describe and analyze business trends, consumer behaviors, and overall efficiencies across an organization's operations.

The Global Location Intelligence & Location Analytics Market is expected to reach USD 26.2 billion in 2030, growing at a CAGR of 17.8% from 2025-2030.

The increasing demand for location-based services across industries, Advancement in geospatial analytics and business intelligence consolidation, and Growing demand for real-time data for decision-making

Top Industries that use Location Intelligence:

- Transport & Logistics (routing, vehicle tracking)

- Retail & Consumer Goods(customer behavior analysis, site selection)

- Govt and Defense (security, disaster management)

- Energy & Utilities (grid management, asset monitoring).

- Health Care & Life Sciences (virus and disease tracking, patient locations services).

Issues surrounding data privacy and security in tracking users.High-cost geospatial analytics tools and Integration Issues.