Latin American Power Tools Market Size (2024-2030)

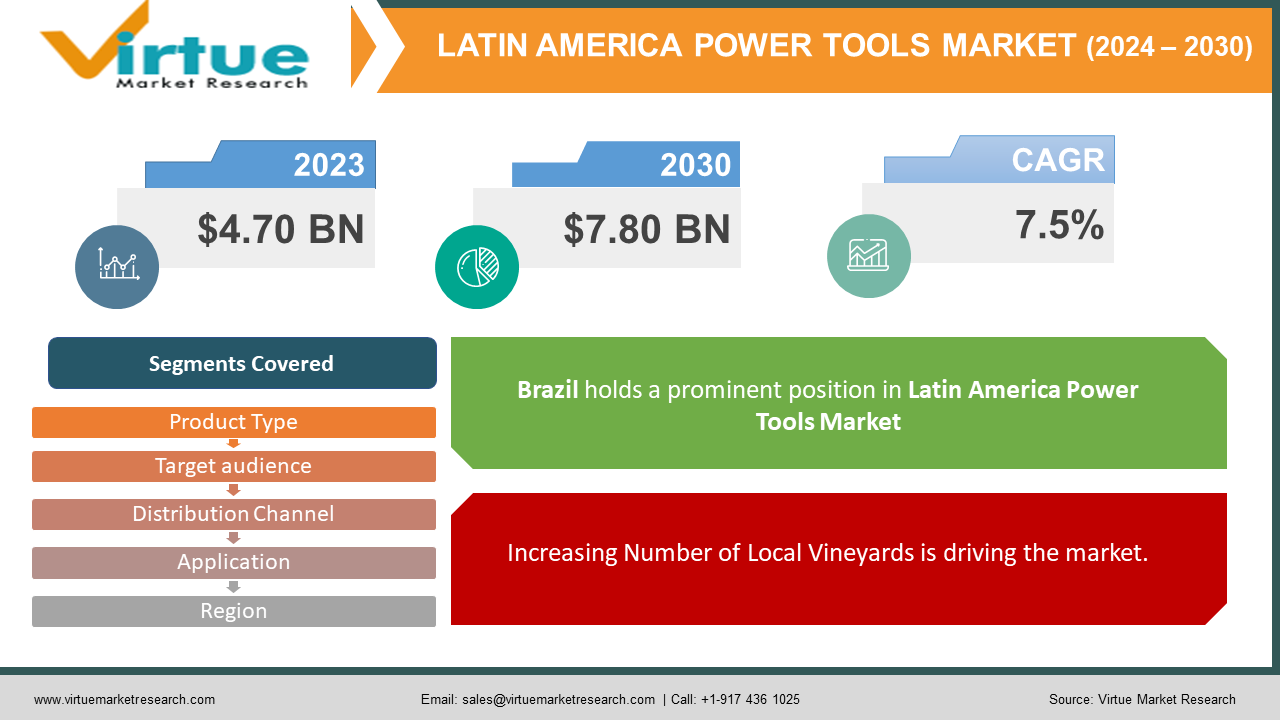

The Latin American Power Tools Market was valued at USD 4.70 billion in 2023 and is projected to reach a market size of USD 7.80 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.5%.

A power tool is not only operated by human labor but also by an extra power source and mechanism. The market for power tools has witnessed a lot of changes over the years. Latin America's power tool market is buzzing! Imagine Latin America buzzing with construction cranes, growing cities, and DIY projects galore! Convenience reigns supreme, with cordless tools and online shopping leading the charge. But it's not just about muscle; sustainability is all the rage, with eco-friendly options sparking a green revolution. Keep your eyes peeled; this market's going to be a real powerhouse!

Key Market Insights:

- Imagine a landscape buzzing with construction cranes, newly paved roads snaking through burgeoning cities, and homes echoing with the satisfying hum of DIY projects. That's the stage for the Latin American power tools market, a dynamic space experiencing a thrilling growth spurt.

- Look no further than the region's infrastructure ambitions. Governments and investors are pouring concrete and steel into roads, bridges, and buildings, creating an insatiable demand for all types of power tools, from heavy-duty drills to delicate sanders. This construction boom isn't limited to mega-projects, though. Rising urban populations are driving a thirst for home improvement and renovation, with DIY enthusiasts snapping up tools to personalize their spaces. Convenience reigns supreme in this arena, with cordless options leading the charge for their portability and user-friendliness. Online platforms are also key players, expanding their reach and democratizing access to tools across the region.

- Of course, this vibrant landscape isn't without its challenges. Uneven infrastructure across regions can hinder distribution and reach, while established global players and ambitious startups compete fiercely for market share. Navigating these hurdles requires innovation, adaptability, and a focus on catering to diverse regional needs and preferences.

- In essence, the Latin American power tool market is a microcosm of the region itself—vibrant, diverse, and brimming with potential. While challenges exist, the opportunities for growth and innovation are undeniable.

Latin American Power Tools Market Drivers:

Infrastructure Investments and Urban Expansion in LATAM Fueling Power Tool Demand:

Infrastructure projects: Governments and private players are pouring investments into infrastructure development, from roads and bridges to power plants and airports. This translates to a skyrocketing demand for heavy-duty power tools for professionals and specialized equipment for specific sectors.

Urban expansion: Rapidly growing cities require constant construction and maintenance, boosting the need for tools for residential construction, renovation, and home improvement projects.

The rising disposable income is fueling market growth:

Improved economic conditions across the region are leading to higher disposable incomes. This allows consumers to spend more on home improvement projects and DIY activities, fuelling the demand for smaller, portable power tools for personal use.

The technological advancements in the industry are propelling power tools market growth:

Cordless revolution: Battery technology advancements and user-friendly features are making cordless power tools the preferred choice for their convenience and portability. This caters to a mobile workforce and a tech-savvy generation.

Specialized solutions: Manufacturers are increasingly catering to specific industry needs and DIY projects with tools built for purpose, from heavy-duty industrial options to delicate woodworking equipment.

The expansion of e-commerce across the industry verticals are driving market growth:

Online platforms are revolutionizing access to power tools, reaching previously underserved regions, and expanding product variety. Competitive pricing and convenient delivery options further boost the market.

Latin American Power Tools Market Restraints and Challenges:

Fluctuations in Raw Material Costs largely hamper the market:

Prices of essential materials like steel, plastic, and copper can fluctuate due to global market factors and local economic conditions. This impacts production costs and can lead to price instability for consumers.

Uneven Infrastructure and Distribution and Competition from Global Giants slowdown the growth:

The region's infrastructure varies significantly across countries, making distribution and market reach challenging in remote areas. This can hinder market expansion and limit access to certain consumer segments.

Established international brands like Bosch and Stanley Black & Decker hold significant market share and brand recognition. Local manufacturers and newer entrants face fierce competition in terms of pricing, product features, and distribution networks.

Counterfeiting and Quality Concerns:

The presence of counterfeit power tools poses a safety risk and undermines consumer trust. Additionally, some lower-quality tools may not meet performance expectations, further impacting market reputation.

Latin American Power Tools Market Opportunities:

The Latin American power tools market is a vibrant fiesta of opportunity, but finding the perfect rhythm for your business requires the right steps. Construction crews across the continent are dancing to the tune of infrastructure projects, demanding high-performance cordless tools and specialty equipment. For smaller contractors and DIY enthusiasts, affordability and durability are the key factors—robust drills and saws at accessible prices. In the urban salsa of the growing middle class, convenience and innovation take center stage. Cordless and lithium-ion options cater to the desire for easy home improvement projects, while user-friendly designs and niche tools for gardening and repairs add flavor to the mix.

But the rhythm varies across the region. In Brazil, the construction boom demands heavy-duty professional tools, while Argentina's tango sways toward cost-effective solutions for DIY enthusiasts. Colombia's construction and mining sectors crave specialty tools, and Chile's tech-savvy users groove to advanced features and digital solutions. The rest of South America offers a diverse ensemble of opportunities, from mining and agriculture in the Andes to infrastructure projects in the Amazon.

To truly succeed, it is necessary to embrace the local beat. Partnering with regional distributors and manufacturers, adapting the existing offerings to voltage preferences and material habits, and investing in after-sales service and training is beneficial. By understanding diverse needs, embracing innovation, and catering to specific niches, enormous opportunities are created and greater revenue is achieved.

LATIN AMERICA POWER TOOLS MARKET REPORT COVERAGE:

|

REPORT METRIC |

DETAILS |

|

Market Size Available |

2023 - 2030 |

|

Base Year |

2023 |

|

Forecast Period |

2024 - 2030 |

|

CAGR |

7.5% |

|

Segments Covered |

By Product Type, Target audience, Distribution Channel, Application, and Region |

|

Various Analyses Covered |

Regional & Country Level Analysis, Segment-Level Analysis, DROC, PESTLE Analysis, Porter’s Five Forces Analysis, Competitive Landscape, Analyst Overview on Investment Opportunities |

|

Regional Scope |

Brazil, Argentina, Colombia, Chile,Rest of South America |

|

Key Companies Profiled |

Stanley Black & Decker, Robert Bosch, Techtronic Industries (TTI), Grupo Rotoplas, Makita, Tramontina, Wacker Neuson, Husqvarna |

Latin American Power Tools Market Segmentation:

Latin American Power Tools Market Segmentation: By Product Type

- Corded

- Electric

- Specialized Tools

Electric drills, the undisputed lords, hold the largest share in Latin America's power tool area. But nimble cordless options charge ahead, fuelled by convenience and mobility, poised to steal the crown as the swift-growing member! Rigidity is crucial in this stimulating geography where tools dance to the tune of invention.

Latin American Power Tools Market Segmentation: By Distribution Channel

- Pharmacies and Hardware Store

- Online Retailers

- Direct-to-Consumer Brands

Traditional slip-and-mortar titans like apothecaries and tackle stores hold the stronghold! They have supreme control over Latin America's power tool distribution, thanks to convenience and familiarity. But watch out, the digital revolution is charging forward! Online retailers swell, fuelled by wider reach and competitive pricing, poised to steal the crown as the swift-growing member.

Latin American Power Tools Market Segmentation: By Target Audience

- Professionals

- DIY Enthusiasts

- First-Time Buyers

Professionals, the construction crew, and mechanics apply the power in Latin America's tool scene! Their demand for high-performance gear keeps them the dominant member. But DIY suckers, weekend soldiers, and home improvers are the stimulating future! Fueled by creativity and affordability, they charge ahead as a swift-growing member.

Latin American Power Tools Market Segmentation: By Application

- Construction

- Home Improvement and Renovation

- Woodworking and Metalworking

- Gardening and Maintenance

Construction, erecting conglomerates of steel and concrete, dominates Latin America's power tool operation! Structure systems and structure conditioning fuel the demand for heavy-duty tools. But watch out! Home enhancement is on the rise! Emendations and DIY systems, driven by growing civic populations and disposable inflows, swell as the swift-growing members.

Latin American Power Tools Market Segmentation: Regional Analysis

- Brazil

- Argentina

- Colombia

- Chile

- Rest of South America

Brazil, the undisputed heavyweight, holds around 55% of the market share. Booming construction, government investments, and a large middle-class fuel demand for both professional and consumer tools. Expect strong growth in the cordless and lithium-ion segments.

Argentina, the tango challenger, captured roughly 15% of the market. A mature market with a focus on DIY and home improvement but facing economic challenges. Opportunities lie in affordable, durable tools and niche applications.

Colombia, the salsa stepper, claims approximately 10% of the market. Rapid economic growth and infrastructure projects drive demand, particularly for professional tools. Look for cordless solutions and specialty tools for construction.

Chile, the Andean innovator, holds around 8% of the market. High adoption of technology and a focus on efficiency create demand for advanced features and digital tools. Opportunities in automation and smart power tools.

The rest of South America is a diverse ensemble with a 12% share, with each country showcasing unique potential. Peru's mining industry, Ecuador's agricultural sector, and Bolivia's infrastructure projects offer niche opportunities.

COVID-19 Impact Analysis on the Latin American Power Tools Market:

The shadow of COVID-19 impended large over the Latin American power tool request, but this flexible geography survived the storm with both scars and unanticipated blooms. Lockdowns choked products and transferred prices haywire, while profitable straits dampened consumer spirits, especially in DIY havens. But amidst the dislocation, a digital phoenix rose! E-commerce surged, carrying tools to every corner, and homebound folk, hankering for DIY solace, fueled a smash in lower tools and handy accessories. Safety enterprises, too, set up their voice, amplifying demand for cleaning and conservation tools.

This was not all doom and dusk, however. The request is on track to reclaim its pre-pandemic glory by 2024–2025, propelled by urbanization's grim march, rising inflows, and a thirst for technological sensations in tools. So, how can you power up in this converted geography? Embrace the digital surge, offer budget-friendly options, cater to niche needs like hygiene and sustainability, and build trust through expert advice.

Latest Trends/ Developments:

The Latin American power tool request is not just about forging nails; it's a factory bursting with invention! Sustainability steals the limelight with eco-friendly techniques, solar-powered charging, and indeed reclaimed tool options. But that is not all; AI is bruiting to drills, optimizing settings like a genie in a toolbox. And get these 3D printers churning out custom handles, spare corridors, and indeed entire tools on-demand! Gamification, the new power grid, is titillating the scene with points, challenges, and a vibrant online community. Affordability? No problem! Micro-loans, settlements, and pay-per-use models are making high-quality tools accessible to all. Indeed, those gravel tools are getting an alternate life; upcycling shops and repurposing enterprises are turning trash into treasure.

Companies in this industry are motivated to increase their market share by using a range of strategies, including acquisitions, joint ventures, and investments. Companies are spending a lot of money to develop new technologies to retain competitive pricing. Further growth has resulted from this.

Key Players:

- Stanley Black & Decker

- Robert Bosch

- Techtronic Industries (TTI)

- Grupo Rotoplas

- Makita

- Tramontina

- Wacker Neuson

- Husqvarna

Chapter 1. Latin American Power Tools Market – Scope & Methodology

1.1. Market Segmentation

1.2. Scope, Assumptions & Limitations

1.3. Research Methodology

1.4. Primary Target Audience s

1.5. Secondary Target Audience s

Chapter 2. Latin American Power Tools Market – Executive Summary

2.1. Market Size & Forecast – (2024 – 2030) ($M/$Bn)

2.2. Key Trends & Insights

2.2.1. Demand Side

2.2.2. Supply Side

2.3. Attractive Investment Propositions

2.4. COVID-19 Impact Analysis

Chapter 3. Latin American Power Tools Market – Competition Scenario

3.1. Market Share Analysis & Company Benchmarking

3.2. Competitive Strategy & Development Scenario

3.3. Competitive Pricing Analysis

3.4. Supplier-Distributor Analysis

Chapter 4. Latin American Power Tools Market - Entry Scenario

4.1. Regulatory Scenario

4.2. Case Studies – Key Start-ups

4.3. Customer Analysis

4.4. PESTLE Analysis

4.5. Porters Five Force Model

4.5.1. Bargaining Power of Suppliers

4.5.2. Bargaining Powers of Customers

4.5.3. Threat of New Entrants

4.5.4. Rivalry among Existing Players

4.5.5. Threat of Substitutes

Chapter 5. Latin American Power Tools Market - Landscape

5.1. Value Chain Analysis – Key Stakeholders Impact Analysis

5.2. Market Drivers

5.3. Market Restraints/Challenges

5.4. Market Opportunities

Chapter 6. Latin American Power Tools Market – By Product Type

6.1. Introduction/Key Findings

6.2. Corded

6.3. Electric

6.4. Specialized Tools

6.5. Y-O-Y Growth trend Analysis By Product Type

6.6. Absolute $ Opportunity Analysis By Product Type , 2024-2030

Chapter 7. Latin American Power Tools Market – By Distribution Channel

7.1. Introduction/Key Findings

7.2 Pharmacies and Hardware Stores

7.3. Online Retailers

7.4. Direct-to-Consumer Brands

7.5. Y-O-Y Growth trend Analysis By Distribution Channel

7.6. Absolute $ Opportunity Analysis By Distribution Channel , 2024-2030

Chapter 8. Latin American Power Tools Market – By Target Audience

8.1. Introduction/Key Findings

8.2 Professionals

8.3. DIY Enthusiasts

8.4. First-Time Buyers

8.5. Y-O-Y Growth trend Analysis Target Audience

8.6. Absolute $ Opportunity Analysis Target Audience , 2024-2030

Chapter 9. Latin American Power Tools Market – By Application

9.1. Introduction/Key Findings

9.2 Construction

9.3. Home Improvement and Renovation

9.4. Woodworking and Metalworking

9.5. Gardening and Maintenance

9.6. Y-O-Y Growth trend Analysis Application

9.7. Absolute $ Opportunity Analysis Application , 2024-2030

Chapter 10. Latin American Power Tools Market , By Geography – Market Size, Forecast, Trends & Insights

10.1. Latin America

10.1.1. By Country

10.1.1.1. Mexico

10.1.1.2. Brazil

10.1.1.3. Argentina

10.1.1.4. Chile

10.1.1.5. Colombia

10.1.1.6. Rest of Latin America

10.1.2. By Target Audience

10.1.3. By Distribution Channel

10.1.4. By product Type

10.1.5. BY Application

10.1.6. Countries & Segments - Market Attractiveness Analysis

Chapter 11. Latin American Power Tools Market – Company Profiles – (Overview, Product Type Portfolio, Financials, Strategies & Developments)

11.1 Stanley Black & Decker

11.2. Robert Bosch

11.3. Techtronic Industries (TTI)

11.4. Grupo Rotoplas

11.5. Makita

11.6. Tramontina

11.7. Wacker Neuson

11.8. Husqvarna

Download Sample

Choose License Type

2500

3400

3900

4600

Frequently Asked Questions

The Latin American Power Tools Market was valued at USD 4.70 billion in 2023 and is projected to reach a market size of USD 7.80 billion by the end of 2030. Over the forecast period of 2024–2030, the market is projected to grow at a CAGR of 7.5%.

Construction Boom, Rising Disposable Income, Technological Advancements, E-commerce Expansion, Shifting Consumer Preferences

Corded, Electric, and Specialized Tools are the segments by Product Type.

Brazil holds the title of the most dominant region for the Latin American power tools market.

Stanley Black & Decker, Robert Bosch, Techtronic Industries (TTI), Grupo Rotoplas, Makita, Tramontina, Wacker Neuson, Husqvarna